Process Instrumentation Market Size, Share, Growth, Trends, and Forecast 2034

Process Instrumentation Market By Instrument (Field Instruments and Process Analyzers), By Solution (PLC, DCS, SCADA, HMI, Functional Safety, and MES), By Industry (Oil & Gas, Chemicals, Pulp & Paper, Pharmaceuticals, Metals & Mining, Food & Beverages, Energy & Power, Water & Wastewater Treatment, and Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

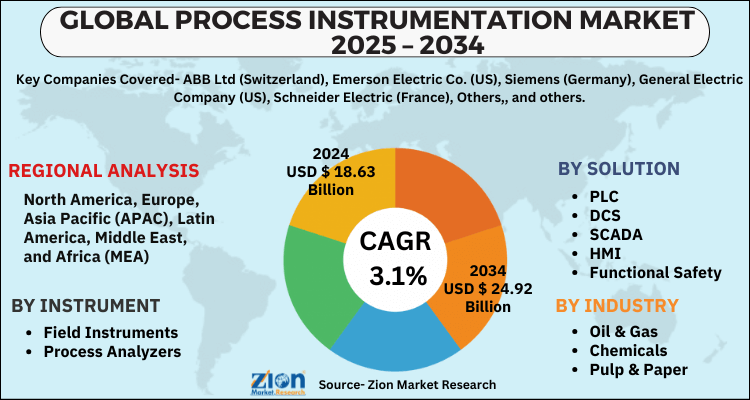

| USD 18.63 Billion | USD 24.92 Billion | 3.1% | 2024 |

Process Instrumentation Market Size And Forecast

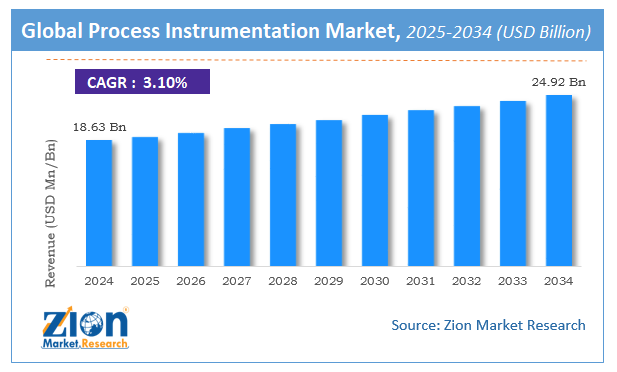

The global process instrumentation market size was worth around USD 18.63 Billion in 2024 and is predicted to grow to around USD 24.92 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 3.1% between 2025 and 2034. The report analyzes the global process instrumentation market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the process instrumentation industry.

Process Instrumentation Market: Overview

Process Instrumentation is a collective term for sensors incorporated into measuring instruments used for indicating, measuring, and recording physical quantities. It is used in several applications including industrial manufacturing facilities and water & wastewater treatment to measure several variables such as pressure, flow, pH, level, conductivity, temperature, turbidity, force, speed, humidity, and other variables in process plants. In the process instrumentation market, the major parameters like recording, positioning, measuring, and controlling are fueling the growth of the market as they are vital for the smooth functioning of a manufacturing unit and are top priorities for process instruments for attaining great levels of absolute reliability, accuracy, and precision.

Process instrumentation is used to measure temperature, turbidity, humidity, speed, pressure, level, pH, force, flow, and other variables. Process instrumentation tools are needed in several end-user industries. Process instrumentation offers several benefits, such as decreases human errors, improves product quality, reduces plant emissions and operating costs. Measuring, recording, controlling, and positioning are the key parameters required for trouble-free operations of a manufacturing unit. Therefore, process instruments prioritize delivering complete consistency, exactness, and accurateness. Thus, process instrumentation gadget majorly offers proficient means to enhance plant efficiency and increase product quality.

Key Insights

- As per the analysis shared by our research analyst, the global process instrumentation market is estimated to grow annually at a CAGR of around 3.1% over the forecast period (2025-2034).

- Regarding revenue, the global process instrumentation market size was valued at around USD 18.63 Billion in 2024 and is projected to reach USD 24.92 Billion by 2034.

- The process instrumentation market is projected to grow at a significant rate due to rising demand for real-time data monitoring, increasing industrial automation, stringent regulatory requirements, advancements in sensor technology, and growing adoption in sectors like oil & gas, pharmaceuticals, and water treatment.

- Based on Instrument, the Field Instruments segment is expected to lead the global market.

- On the basis of Solution, the PLC segment is growing at a high rate and will continue to dominate the global market.

- Based on the Industry, the Oil & Gas segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Process Instrumentation Market: Growth Drivers

Increasing focus of manufacturing firms on attaining cost-saving and better efficiency

Process automation can help in achieving the efficiency of a production site that is assessed by its ability to respond quickly to rapid and unexpected changes in demand, preferences, and resource availability. Instrumentation products help to measure and analyze process parameters such as pressure, temperature, level, and humidity, while process automation solutions help monitor and control processes to lower rework costs, minimize inspection costs, and reduce system failures. Thus, process instrumentation helps manufacturing firms cut costs and increase revenue. Industries are vigorously adopting process automation and instrumentation solutions across their production sites to streamline industry operations, achieve enhanced productivity, and reduce costs.

Increase in technological advancements and innovation are the major factors primarily driving this market’s growth. Increasing demand for automated processes and instruments by producers is the key factor bolstering the expansion of process instrumentation market. Moreover, rising adoption of IoT-based processing instruments across various industries and the shift of production approach from traditional practices to digitalized methods is anticipated to boost the development of the process instrumentation market in the upcoming years. Furthermore, developments made in drilling technologies, like microseismic imaging, stacked laterals, and fracking, leads to onshore exceptional oil and gas analysis. In addition, cost efficiency, asset utilization, and reduction in engineering time and energy efficiency with the help of process instruments are some of the considerable factors positively influencing the growth of process instrumentation market.

Process Instrumentation Market: Restraints

High implementation and maintenance costs related to process instrumentation

There is a need for high initial investments to set up an automated production plant which is one of the most significant factors limiting the growth of the process instrumentation market. Huge capital is required to deploy automation solutions, as well as instrumentation devices such as process analyzers and transmitters. Moreover, automation software solutions require recurrent upgrades owing to ongoing technological advancements. It is not feasible for small businesses to bear such expenditures. Thus, system installation, maintenance, and upgrade require huge capital investment, confining market growth to a certain extent.

Process Instrumentation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Process Instrumentation Market |

| Market Size in 2024 | USD 18.63 Billion |

| Market Forecast in 2034 | USD 24.92 Billion |

| Growth Rate | CAGR of 3.1% |

| Number of Pages | 177 |

| Key Companies Covered | ABB Ltd (Switzerland), Emerson Electric Co. (US), Siemens (Germany), General Electric Company (US), Schneider Electric (France), Others,, and others. |

| Segments Covered | By Instrument, By Solution, By Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Process Instrumentation Market: Segmentation

The global process instrumentation market is segregated based on instrument, solution, and industry.

By instrument, the market is classified into Field Instruments and Process Analyzers. Field instruments dominated the global process instrumentation market in 2021. Field instruments assist in managing plant assets, enhancing plant safety, and optimizing overall production processes through data acquisition, control, and measurement. It is necessary to obtain significant information regarding major parameters, including temperature, pressure, and level, to monitor and control processes quickly, smoothly, securely, and accurately, as well as to achieve optimum productivity.

By solution, the global market is classified into PLC, DCS, SCADA, HMI, Functional Safety, and MES. Among them, the PLC segment is estimated to dominate the overall process instrumentation market, owing to the increasing deployment of various enterprise solutions. They are used to lower power consumption, handle complicated logic operations and offer better dependability since they have no moving parts.

Recent developments

- In June 2020, Emerson Electric Co. launched ASCO Series 353 pulse valves. These valves are expected to help end-users achieve effective, efficient, and convenient bag cleaning. These valves can be used in different applications in agriculture, pharmaceuticals, mining, rubber, metals, cement, and power industries

- In February 2019, General Electric Company launched the sixth version of iFIX, an HMI/SCADA software designed to improve operational productivity by providing plant operators with high performance to give users the most informed view of the problem or task and secure visualization from anywhere at any time.

- In September 2019, Siemens and Grundfos signed a digital partnership framework for their strategic collaboration with the two companies. The new partnership focuses on the complementary products and solutions provided by both parties in three main areas: water and wastewater applications, industrial automation, and building technology.

Process Instrumentation Market: Regional Landscape

The Asia Pacific is anticipated to have the fastest growth during the forecast period, followed by North America. In the Asia Pacific, the demand for process instrumentation solutions is growing from the oil & gas and food & beverages industries due to the ever-increasing population in the Asia Pacific. Development in technologies such as using autonomous underwater vehicles and unmanned aerial vehicles, onshore and offshore pipelines is being done to protect against terrorist attacks, criminal activities, and even repair damages. These factors lead to the growth of the instrumentation market in this region. Additionally, the provision of IoT platform capabilities is expected to propel the process automation and instrumentation market in North America.

Process Instrumentation Market: Competitive Landscape

Some of the main competitors dominating the global process instrumentation market include -

- ABB Ltd (Switzerland)

- Emerson Electric Co. (US)

- Siemens (Germany)

- General Electric Company (US)

- Schneider Electric (France)

- Others

Global process instrumentation market is segmented as follows:

By Instrument

- Field Instruments

- Process Analyzers

By Solution

- PLC

- DCS

- SCADA

- HMI

- Functional Safety

- MES

By Industry

- Oil & Gas

- Chemicals

- Pulp & Paper

- Pharmaceuticals

- Metals & Mining

- Food & Beverages

- Energy & Power

- Water & Wastewater Treatment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global process instrumentation market is expected to grow due to increasing industrial automation, demand for precision in manufacturing, stringent regulatory standards, growth in oil & gas and chemical industries, and advancements in smart sensor technologies.

According to a study, the global process instrumentation market size was worth around USD 18.63 Billion in 2024 and is expected to reach USD 24.92 Billion by 2034.

The global process instrumentation market is expected to grow at a CAGR of 3.1% during the forecast period.

Asia-Pacific is expected to dominate the process instrumentation market over the forecast period.

Leading players in the global process instrumentation market include ABB Ltd (Switzerland), Emerson Electric Co. (US), Siemens (Germany), General Electric Company (US), Schneider Electric (France), Others,, among others.

The report explores crucial aspects of the process instrumentation market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed