Precious Metals Market Size, Share, And Growth Report 2032

Precious Metals Market By Type (Platinum, Gold, Ruthenium, Palladium, Silver, and Others), By End-Use Industry (Automotive, Electronics, Jewelry, Chemicals, Investment, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

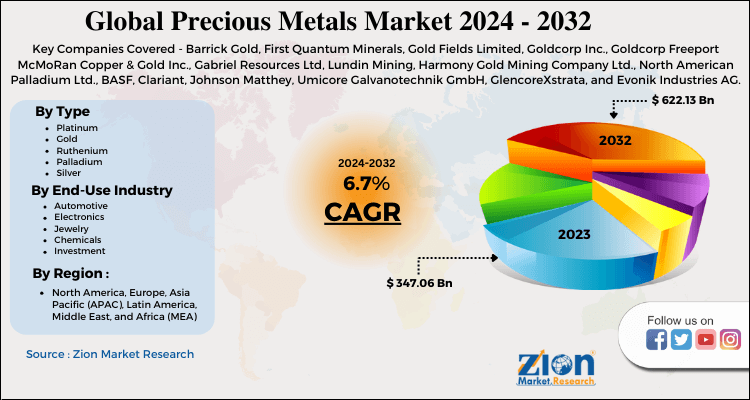

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 347.06 Billion | USD 622.13 Billion | 6.7% | 2023 |

Precious Metals Market Size

According to Zion Market Research, the global Precious Metals Market was worth USD 347.06 Billion in 2023. The market is forecast to reach USD 622.13 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.7% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Precious Metals Market industry over the next decade.

Precious Metals Market Overview

Gold and silver have been envied for a long time owing to their value. Even today, investors are investing in a portfolio of these precious metals. The global precious metals market can be a good portfolio to invest in as it diversifies and hedge the risk against inflation. Gold isn’t the only metal out there in which investors are willing to invest. Platinum, Silver, and palladium can be added to the portfolio as each metal has its own opportunities and unique risks.

COVID-19 Impact Analysis

COVID-19 severely impacted the demand and supply of the precious metal market. The Petrochemical and automobile industry which are the major consumers of the market is negatively affected by the pandemic owing to lockdown rules and regulations on transportation. Several countries went into lockdown due to the pandemic, which led to minimal use of personal vehicles, thus affecting negatively the demand for automotive catalysts which are used in the vehicle exhaust streams. This resulted in a decrease in the demand for precious metal catalysts.

Precious Metals Market: Growth Factors

Gold and silver, specifically in the jewelry market, are estimated to witness steady growth over the forecast period. Gold and silver have played an important part in marriages, especially in China and India. A significant amount of gold and silver is used in the form of ornaments and jewelry. The wedding market segment of India and China is likely to show numerous growth opportunities for the gold and silver jewelry market over the coming years.

Precious metals like gold are also used for investment purposes. It is usually traded in the stock exchange market associated with decreasing share prices attributed to its intensifying high prices.

Precious Metals Market: Segmentation

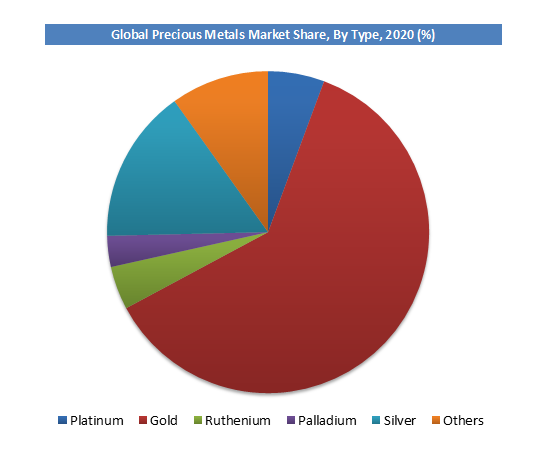

Type Segment Analysis Preview

Platinum is projected to grow at a CAGR of around 6.5% over the forecast period. Platinum catalyst helps in reducing carbon dioxide (CO2) emission. It is widely used in the automobile sector to lower the harmful effect of pollutants released by industrial processing units. It can also be validated by an increase in the sale of diesel-consuming vehicles. Platinum is also used as one of the important emission control catalysts. The auto-catalysts help in reducing emissions from diesel and gasoline engines and enhance energy efficiency.

Moreover, Platinum is used to improve medical technology to enhance health care. Platinum is also used in the pharmaceutical sector as many catalysts rely on palladium, platinum, ruthenium, iridium, rhodium, and osmium. Sources like refinery & petrochemical complexes, automobiles, chemical industries, natural gas processing plants, oil, and pharmaceutical industries, among others, are getting familiar with an increased number of applications for platinum-based emission catalysts and thus increasing the market.

End-Use Industry Segment Analysis Preview

The investment segment is projected to grow at a CAGR of around 7% from 2024 to 2032. The ongoing declining prices of gold and platinum have generated a greater attraction from investors and are likely to continue in the future. The industrial segment held a substantial share in the market owing to the growth in the electrical industry wherein silver is one of the main metals used.

The jewelry segment has also contributed majorly to the overall market growth. Gold and silver have played an important part in marriages, especially in China and India. The wedding market of both countries offers round-the-year opportunities for the vendors, thereby driving the demand for precious metals, mainly gold and silver.

Precious Metals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Precious Metals Market |

| Market Size in 2023 | USD 347.06 Billion |

| Market Forecast in 2032 | USD 622.13 Billion |

| Growth Rate | CAGR of 6.7% |

| Number of Pages | 110 |

| Key Companies Covered | Barrick Gold, First Quantum Minerals, Gold Fields Limited, Goldcorp Inc., Goldcorp Freeport McMoRan Copper & Gold Inc., Gabriel Resources Ltd, Lundin Mining, Harmony Gold Mining Company Ltd., North American Palladium Ltd., BASF, Clariant, Johnson Matthey, Umicore Galvanotechnik GmbH, GlencoreXstrata, and Evonik Industries AG, among others |

| Segments Covered | By Type, By End-Use Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

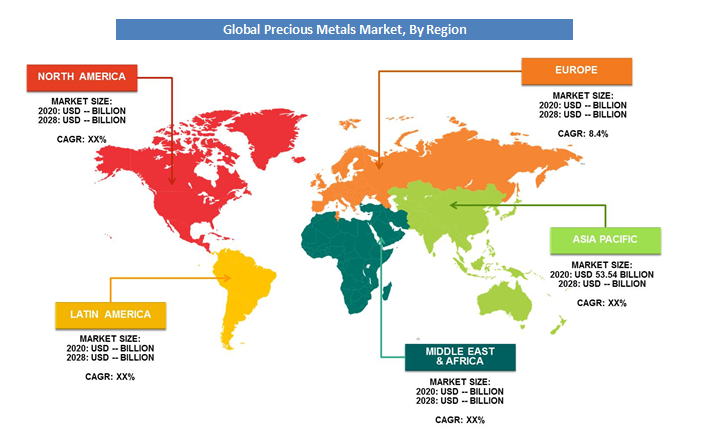

Precious Metals Market: Regional Analysis

The Asia Pacific accounted for a share of around 35% in 2020. China has an extensive influence on the precious metals market. The country is leading in the consumption of gold and PGM. The strong manufacturing sector of China is the main factor spurring the demand in the country. India is an alternative powerhouse in the region. India is the second largest consumer of gold in the Asia Pacific. India also has a strong jewelry market due to the wedding industry. Similarly, the country is also evolving its capabilities in the manufacturing industry by attracting foreign investors in the field of energy, construction, automotive, chemical, and many more.

Precious Metals Market: Competitive Players

Some of the key players in the Precious Metals Market are

- Barrick Gold

- First Quantum Minerals

- Gold Fields Limited

- Goldcorp Inc.

- Goldcorp Freeport McMoRan Copper & Gold Inc.

- Gabriel Resources Ltd

- Lundin Mining

- Harmony Gold Mining Company Ltd.

- North American Palladium Ltd.

- BASF

- Clariant

- Johnson Matthey

- Umicore Galvanotechnik GmbH

- GlencoreXstrata

- Evonik Industries AG

- Among others.

The Global Precious Metals Market is segmented as follows:

By Type

- Platinum

- Gold

- Ruthenium

- Palladium

- Silver

- Others

By End-Use Industry

- Automotive

- Electronics

- Jewelry

- Chemicals

- Investment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Precious metals are rare, naturally occurring metallic elements with high economic value due to their rarity, durability, and aesthetic appeal. Examples include gold, silver, platinum, and palladium, often used in jewelry, investment, and industrial applications like electronics and catalysts.

According to study, the Precious Metals Market size was worth around USD 347.06 billion in 2023 and is predicted to grow to around USD 622.13 billion by 2032.

The CAGR value of Precious Metals Market is expected to be around 6.7% during 2024-2032.

Asia Pacific has been leading the Precious Metals Market and is anticipated to continue on the dominant position in the years to come.

The Precious Metals Market is led by players like Barrick Gold, First Quantum Minerals, Gold Fields Limited, Goldcorp Inc., Goldcorp Freeport McMoRan Copper & Gold Inc., Gabriel Resources Ltd, Lundin Mining, Harmony Gold Mining Company Ltd., North American Palladium Ltd., BASF, Clariant, Johnson Matthey, Umicore Galvanotechnik GmbH, GlencoreXstrata, and Evonik Industries AG, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed