Positron Emission Tomography Market Size, Share, Trends, Growth 2034

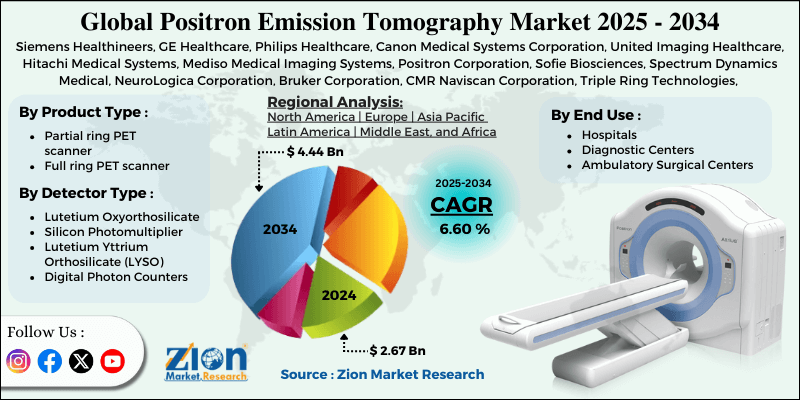

Positron Emission Tomography Market By Product Type (Partial ring PET scanner, Full ring PET scanner), By Detector Type (Lutetium Oxyorthosilicate [LSO], Silicon Photomultiplier [SiPM], Lutetium Yttrium Orthosilicate [LYSO], Digital Photon Counters [DPC], and Others), By End Use (Hospitals, Diagnostic Centers, Ambulatory Surgical Centers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

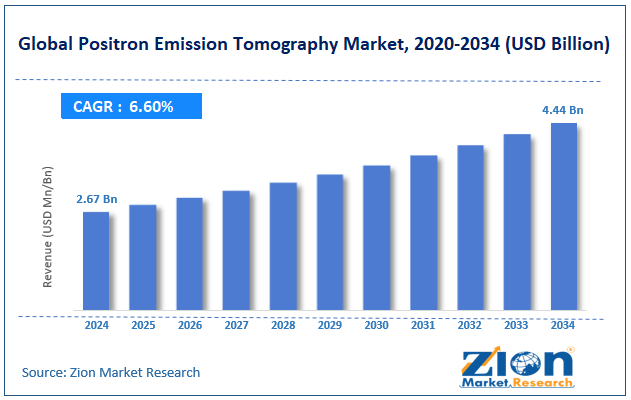

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.67 Billion | USD 4.44 Billion | 6.60% | 2024 |

Positron Emission Tomography Industry Perspective:

The global positron emission tomography market size was worth around USD 2.67 billion in 2024 and is predicted to grow to around USD 4.44 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.60% between 2025 and 2034.

Positron Emission Tomography Market: Overview

Positron emission tomography is a painless imaging technique that uses radioactive tracers to envisage and measure changes in metabolic processes, chemical activity, and blood flow in the body. It is extensively used in cardiology, oncology, and neurology to detect cancers, assess heart conditions, and monitor brain disorders. The global positron emission tomography market is likely to expand rapidly, driven by advancements in PET imaging technology, integration with hybrid imaging systems, and the growing applications in neurology. Continuous advancements like time-of-flight (TOF) technology, digital PET, and AI integration are lessening scan times and enhancing image quality. These improvements improve patient comfort and diagnostic precision, motivating clinical adoption.

Moreover, the blend of PET with MRI or CT offers functional and anatomical imaging, increasing its significance for accurate disease detection. Hybrid systems have gained massive traction in cardiology, neurology, and oncology, enhancing patient outcomes. The improved diagnostic precision is fueling diagnostic centers and hospitals to invest heavily in such systems. Additionally, PET is largely used in detecting Parkinson’s disease, Alzheimer’s disease, epilepsy, and other neurological illnesses. The rising research in neurodegenerative illnesses and early detection biomarkers is propelling adoption.

Despite the growth, the global market is impeded by factors such as low availability of skilled professionals and the short half-life of radiotracers. The scarcity of proficient radiologists, PET technologists, and nuclear medicine experts negatively impacts service availability. Several regions lack sufficient training facilities for managing advanced positron emission tomography systems. This scarcity results in underutilization of installed equipment. Also, the radioactive tracers used in PET imaging deteriorate faster, needing on-site cyclotrons or nearby radiopharmacies. This logistical intricacy raises operational costs and restricts adoption in underdeveloped and remote regions. Supply chain problems may delay patient scans.

Nonetheless, the global positron emission tomography industry stands to gain from a few key opportunities. Research in novel radiotracers may increase PET applications beyond neurology and oncology. Advanced tracers for infectious, inflammatory, and cardiovascular diseases may offer fresh industry segments. This may diversify revenue sources for radiopharmaceutical and PET machine producers.

Furthermore, AI-based PET analysis solutions can enhance accuracy, improve predictive diagnostics, and reduce interpretation time. Companies developing AI-based PET solutions can enter the growing demand for high-precision and automated imaging. This technology can also assist less experienced radiologists.

Key Insights:

- As per the analysis shared by our research analyst, the global positron emission tomography market is estimated to grow annually at a CAGR of around 6.60% over the forecast period (2025-2034)

- In terms of revenue, the global positron emission tomography market size was valued at around USD 2.67 billion in 2024 and is projected to reach USD 4.44 billion by 2034.

- The positron emission tomography market is projected to grow significantly owing to expanding applications in cardiology and neurology, rising availability of radiopharmaceuticals, and increasing incidences of cardiovascular and cancer diseases.

- Based on product type, the full ring PET scanner segment is expected to lead the market, while the partial ring PET scanner segment is expected to grow considerably.

- Based on detector type, the Lutetium Yttrium Orthosilicate (LYSO) segment is the dominating segment, while the Silicon Photomultiplier (SiPM) segment is projected to witness sizeable revenue over the forecast period.

- Based on end use, the hospitals segment is expected to lead the market compared to the diagnostic centers segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Positron Emission Tomography Market: Growth Drivers

How is surging adoption by the cardiology and neurology domains propelling the positron emission tomography market?

Cardiac PET continues to gain substantial share for myocardial perfusion imaging with ^82Rb and ^13N-ammonia, offering lower radiation and enhanced diagnostic accuracy than SPECT – the United States procedure numbers have surged since 2020, with societies reporting rising lab conversions.

In neurology, tau PET, and amyloid support differential diagnosis in cognitive impairment, alongside 2023-24 progresses in anti-amyloid therapies, centers cited higher interest in biomarker-guided care pathways, which usually comprise PET for appropriate patients. Wider recognition of FDG PET in inflammatory neurologic and neuro-oncology conditions also diversifies demand beyond oncology, simplifying utilization in departments.

How are the expanding reimbursement improvements and guideline endorsements impacting the growth of the positron emission tomography market?

Key oncology guidelines have increasingly integrated PET for lymphoma, head & neck, prostate, melanoma, lung cancer, and specific gynecologic cancers. This widens medically necessary use cases and facilitates payer coverage. Between 2021 and 2024, several health payers and systems increased reimbursement for PSMA PET in prostate cancer and for SSTR PET in neuroendocrine tumors.

Conversely, some regions also recognized PET’s role in treatment response evaluation – collectively decreasing out-of-pocket barriers and steadying provider economics. Hospital procurement and country-level tender activity reports since 2022 indicate steady PET-CT fleet upgrades, reflecting administrators' confidence that regulations-based volumes will continue, which in turn fuels the positron emission tomography market.

Positron Emission Tomography Market: Restraints

Training gaps and workforce shortages create barriers to market progress

PET imaging requires a highly trained workforce, including nuclear medicine physicians, technologists, radiopharmacists, and radiologists. Worldwide workforce reports indicate an unstable distribution of expert personnel, with a few regions having fewer than 1 nuclear medicine physician per 1 million individuals.

In 2023, the Society of Nuclear Medicine and Molecular Imaging and the European Association of Nuclear Medicine underscored technician scarcity as a barrier for service expansion. Even in technologically developed centers, a shortage of a PET-expert workforce restricts the ability to increase operational hours or expand patient throughput. This notably decreases profit potential and delays care.

Positron Emission Tomography Market: Opportunities

How is the positron emission tomography market opportunistic to technology innovations?

The introduction of total-body PET allows 40x higher sensitivity, which facilitates ultra-low-dose protocols, novel research, and rapid scanning in systemic diseases.

Since 2022, installments have surged in China, Europe, and the United States, with more academic centers publishing on dynamic imaging in infectious diseases, immunology, and pharmacokinetics. These advancements open PET to novel clinical markets beyond cancer. This is expected to add 10-15% to the positron emission tomography industry growth over the next 7 years.

Positron Emission Tomography Market: Challenges

Growing competition from other imaging modalities limits the growth of the market

Though PET delivers impeccable molecular imaging detail, it competes with cost-efficient and more accessible modalities like SPECT, CT, and MRI, which are highly preferred as primary diagnostic choices. MRI and CT are currently selected for cancer staging in most regions, while SPECT dominates cardiac imaging due to its simpler logistics and lower costs. The newest advances in MRI and CT technologies have further lowered the performance gap in most applications. Therefore, PET should consistently prove its clinical value and cost-efficiency to gain reimbursement and broader adoption.

Positron Emission Tomography Market: Segmentation

The global positron emission tomography market is segmented based on product type, detector type, end use, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on product type, the global positron emission tomography industry is divided into partial ring PET scanner and full ring PET scanner. The full ring PET scanner segment holds leadership in the global market due to the high-quality of images, ability to capture complete data in one rotation, and high sensitivity. Their exhaustiveness detector arrangement enables fast scan times and higher precision diagnosis, which is vital in neurology, oncology, and cardiology. These systems are extensively used in advanced diagnostic centers, hospitals, and research institutes across the globe.

Based on detector type, the global positron emission tomography market is segmented as Lutetium Oxyorthosilicate (LSO), Silicon Photomultiplier (SiPM), Lutetium Yttrium Orthosilicate (LYSO), Digital Photon Counters (DPC), and others. The Lutetium Yttrium Orthosilicate (LYSO) segment dominates the market due to its optimal light output, superior timing resolution, and high-density, increasing its suitability for TOF PET imaging. They offer improved image clarity and faster signal detection, which are essential for accurate diagnosis in different domains. LYSO crystals are also less sensitive to temperature changes, assuring consistent performance in various environments.

Based on end use, the global market is segmented into hospitals, diagnostic centers, ambulatory surgical centers, and others. The hospital segment holds the maximum market share due to its extensive infrastructure, ability to manage a high volume of complex diagnoses, and access to advanced imaging technologies. They usually integrate PET with MRI or CT, allowing precise treatment and diagnosis planning, especially in neurology, oncology, and cardiology. Hospitals benefit from government support, direct funding, and strong referral networks that sustain high patient volumes.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Positron Emission Tomography Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Positron Emission Tomography Market |

| Market Size in 2024 | USD 2.67 Billion |

| Market Forecast in 2034 | USD 4.44 Billion |

| Growth Rate | CAGR of 6.60% |

| Number of Pages | 214 |

| Key Companies Covered | Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems Corporation, United Imaging Healthcare, Hitachi Medical Systems, Mediso Medical Imaging Systems, Positron Corporation, Sofie Biosciences, Spectrum Dynamics Medical, NeuroLogica Corporation, Bruker Corporation, CMR Naviscan Corporation, Triple Ring Technologies, Positronic Imaging Technologies, and others. |

| Segments Covered | By Product Type,By Detector Type, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Positron Emission Tomography Market: Regional Analysis

Why does North America hold a dominant position in the global Positron Emission Tomography Market?

North America is anticipated to retain its leading role in the global positron emission tomography market as a result of the high prevalence of chronic diseases, strong healthcare infrastructure, and technological dominance. North America holds the leading rates of cardiovascular disease and cancer worldwide, fueling primary demand for PET scans. The United States alone registered nearly 1.9 million fresh cases in 2024, according to the American Cancer Society. PET's competency to detect diseases early increases its significance as a vital diagnostic tool in North America. The region benefits from advanced research, hospitals, and diagnostic networks equipped with superior PET systems.

According to the CMS, in 2023, the United States spent nearly USD 4.5 trillion yearly on healthcare, allowing constant investment in high-end imaging technology. This infrastructure backs large-scale clinical adoption of PET scanners. Furthermore, North America houses major PET technology developers like Siemens Healthineers' U.S. division and GE Healthcare. Continuous advancements like TOF and digital PET scanning have enhanced efficacy and accuracy. These improvements give the region a technological advantage over other areas.

Europe ranks as the second-leading region in the global positron emission tomography industry as a result of high cancer burden, strong adoption of hybrid imaging solutions, and substantial healthcare funding. Europe holds the leading number of cancer patients across the globe, creating significant demand for PET scans. According to ECIS, there were more than 3.7 million fresh cases in the region in 2024. PET's ability to detect tumors early and guide treatment plans increases its significance in the regional healthcare.

Moreover, European healthcare facilities have broadly embraced PET/MRI and PET/CT systems to improve diagnostic accuracy. The pressure for high-resolution and integrated diagnostics fuels this adoption. Additionally, several European nations offer universal healthcare systems that subsidize or fund PET scans for eligible individuals. For instance, in France and Germany, government healthcare programs cover the majority of PET scan costs. This policy assures wider patient access to advanced imaging solutions.

Positron Emission Tomography Market: Competitive Analysis

The leading players in the global positron emission tomography market are:

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Canon Medical Systems Corporation

- United Imaging Healthcare

- Hitachi Medical Systems

- Mediso Medical Imaging Systems

- Positron Corporation

- Sofie Biosciences

- Spectrum Dynamics Medical

- NeuroLogica Corporation

- Bruker Corporation

- CMR Naviscan Corporation

- Triple Ring Technologies

- Positronic Imaging Technologies

Positron Emission Tomography Market: Key Market Trends

Development of novel radiotracers:

The industry is progressing beyond the conventional FDG (Fluorodeoxyglucose) tracer, with novel agents targeting some cancers, cardiovascular conditions, and neurodegenerative conditions. These advancements are offering improved diagnostic specificity and new clinical applications. The pharma companies and research institutions are heavily investing in the development of tracers.

Rising demand for mobile and portable PET solutions:

Mobile and portable PET units are emerging to enhance accessibility in the underserved and rural regions. These systems facilitate advanced imaging without needing patients to travel long distances. This trend is progressing in some parts of North America and APAC, backed by public and private health initiatives.

The global positron emission tomography market is segmented as follows:

By Product Type

- Partial ring PET scanner

- Full ring PET scanner

By Detector Type

- Lutetium Oxyorthosilicate (LSO)

- Silicon Photomultiplier (SiPM)

- Lutetium Yttrium Orthosilicate (LYSO)

- Digital Photon Counters (DPC)

- Others

By End Use

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Positron emission tomography is a painless imaging technique that uses radioactive tracers to envisage and measure changes in metabolic processes, chemical activity, and blood flow in the body. It is extensively used in cardiology, oncology, and neurology to detect cancers, assess heart conditions, and monitor brain disorders.

The global positron emission tomography market is projected to grow due to rising demand for accurate and early disease diagnosis, increasing adoption of hybrid imaging modalities, and improvements in PET imaging systems.

According to study, the global positron emission tomography market size was worth around USD 2.67 billion in 2024 and is predicted to grow to around USD 4.44 billion by 2034.

The CAGR value of the positron emission tomography market is expected to be around 6.60% during 2025-2034.

North America is expected to lead the global positron emission tomography market during the forecast period.

The key players profiled in the global positron emission tomography market include Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems Corporation, United Imaging Healthcare, Hitachi Medical Systems, Mediso Medical Imaging Systems, Positron Corporation, Sofie Biosciences, Spectrum Dynamics Medical, NeuroLogica Corporation, Bruker Corporation, CMR Naviscan Corporation, Triple Ring Technologies, and Positronic Imaging Technologies.

The competitive landscape of the global market is moderately consolidated, with major players like Siemens Healthineers, GE HealthCare, and Philips dominating scanner production, while radiopharmaceutical companies and specialized firms focus on supply chains and tracers. Product innovations, strategic collaborations, and geographic expansion are leading strategies fueling competition.

Leading players are focusing on expanding tracer production, launching advanced PET technologies, and forming partnerships with healthcare providers to increase adoption. They are also targeting emerging markets through service support and localized operations.

The PET market is witnessing stable to slightly declining scanner prices due to competitive pressures and technological advancements, while specialized tracers like PSMA agents command premium pricing. Emerging markets usually face higher per-scan costs because of lower equipment density and limited supply chains.

The report examines key aspects of the positron emission tomography market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed