Medical Imaging Reagents Market Size, Share, Trends, Growth and Forecast 2034

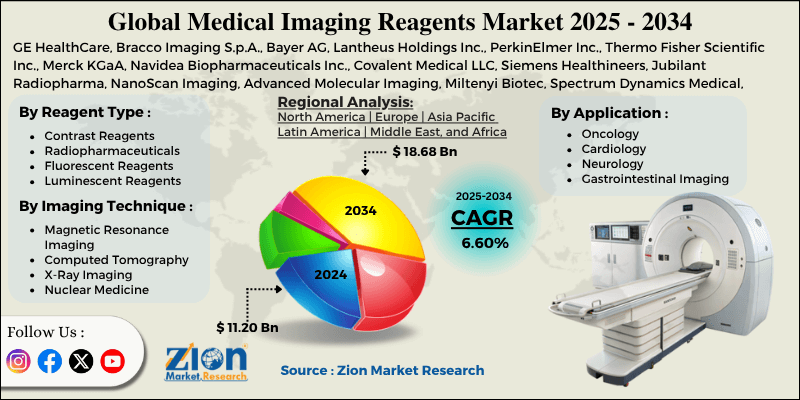

Medical Imaging Reagents Market By Reagent Type (Contrast Reagents, Radiopharmaceuticals, Fluorescent Reagents, Luminescent Reagents), By Imaging Technique (Magnetic Resonance Imaging, Computed Tomography, X-Ray Imaging, Nuclear Medicine), By Application (Oncology, Cardiology, Neurology, Gastrointestinal Imaging), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

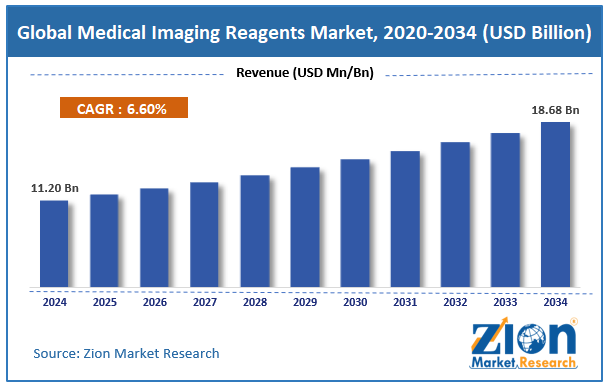

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.20 Billion | USD 18.68 Billion | 6.60% | 2024 |

Medical Imaging Reagents Industry Perspective:

The global medical imaging reagents market size was worth around USD 11.20 billion in 2024 and is predicted to grow to around USD 18.68 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.60% between 2025 and 2034.

Medical Imaging Reagents Market: Overview

Medical imaging reagents are specialized chemical substances that enhance the visibility of internal body structures during imaging procedures, such as CT scans, MRI, nuclear imaging, and ultrasound. These reagents enhance clarity and contrast, allowing physicians to detect, monitor, and diagnose diseases such as cardiovascular illnesses, cancer, and neurological disorders.

The global medical imaging reagents market is driven by the increasing demand for non-invasive diagnostic methods, advancements in imaging modalities, and the growth of theranostics and personalized medicine. Healthcare providers and patients are increasingly preferring non-invasive procedures. Imaging methods, such as CT and MRI, backed by contrast agents, often eliminate the need for surgical biopsies, thereby offering greater comfort and safety.

Moreover, constant advances in PET, MRI, and hybrid systems with dedicated imaging capabilities, such as disease-specific or nanoparticle-based markers, are gaining popularity.

Additionally, imaging reagents play a vital role in personalized medicine, primarily for monitoring treatment responses and identifying biomarkers. Theranostics imaging enables targeted therapy and diagnosis, advancing the field of oncology.

However, the global market faces hindrances such as high-priced reagents and imaging procedures, as well as risks of toxicity and adverse reactions. Advanced reagents used in molecular imaging or PET are high-priced. In emerging economies, expensive treatments reduce hospital utilization rates and restrict patient affordability.

A few imaging reagents, such as gadolinium-based contrast agents, are associated with nephrogenic systemic fibrosis (NSF) in patients with renal disease. These issues have led to lower usage and increased scrutiny.

Nonetheless, the global medical imaging reagents industry is well-positioned for the growth of targeted molecular imaging agents and the integration of AI in imaging. Companies are actively investing in reagents that bind to disease-specific biomarkers, such as HER2, in breast cancer. These support personalized treatment planning and offer accurate diagnostics.

Artificial intelligence is improving reagent efficiency monitoring and image interpretation. AI tools also help identify the optimal timing and doses of reagents, thereby reducing adverse effects and enhancing outcomes.

Furthermore, the rising awareness and spending on animal healthcare open doors for imaging reagents in veterinary diagnostics, mainly in developed countries.

Key Insights:

- As per the analysis shared by our research analyst, the global medical imaging reagents market is estimated to grow annually at a CAGR of around 6.60% over the forecast period (2025-2034)

- In terms of revenue, the global medical imaging reagents market size was valued at around USD 11.20 billion in 2024 and is projected to reach USD 18.68 billion by 2034.

- The medical imaging reagents market is projected to grow significantly due to the increasing prevalence of chronic illnesses, rising demand for non-invasive diagnostic techniques, and the expansion of theranostics and personalized medicine.

- Based on reagent type, the contrast reagents segment is expected to lead the market, while the radiopharmaceuticals segment is expected to grow considerably.

- Based on imaging technique, the nuclear medicine segment is the dominant one, while the magnetic resonance imaging segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the oncology segment is expected to lead the market, followed by the cardiology segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Medical Imaging Reagents Market: Growth Drivers

Heavy investment in precision medicine and molecular imaging spurs market growth

The global inclination towards precision medicine has increased the demand for molecular imaging methods that utilize specific reagents, such as antibodies, radiolabeled peptides, and nanoparticles. These reagents facilitate the visualization of disease mechanisms at the molecular and cellular levels, aiding in the development of personalized treatment strategies. This inclination and support notably propel the growth of the global medical imaging reagents market.

In addition, radiopharmaceutical companies such as Lantheus and Telix Pharmaceuticals have expanded their imaging portfolios with novel FDA approvals for PSMA PET reagents used in the detection of prostate cancer, thereby strengthening the significance of these reagents in personalized medicine.

The growing adoption of automation and AI in imaging considerably fuels the market growth

AI has enhanced the interpretability and quantity of diagnostic imaging, thereby increasing utilization rates in healthcare systems. As AI systems need high-resolution and high-quality images for precise interpretation, the need for effective imaging reagents has increased consistently.

Siemens Healthineers launched an AI-improved CT imaging solution in 2024. It automatically adjusts contrast dosing according to diagnostic requirements and patient physiology, enhancing efficacy while minimizing adverse effects. This is particularly beneficial in the extensive hospital infrastructure found in Europe and North America.

Medical Imaging Reagents Market: Restraints

Logistics and the short half-life of radiopharmaceuticals adversely impact market progress

Radiopharmaceutical imaging reagents, such as FDG (fluorodeoxyglucose), used in PET scans, are short-lived (for example, 110 minutes for FDG), requiring highly coordinated delivery logistics or on-site cyclotrons for their administration. These operational difficulties limit the availability of nuclear imaging reagents to academic institutions or hospitals with specialized facilities for nuclear imaging.

Many PET imaging centers in rural regions of Asia and Europe reported canceled or delayed procedures due to transportation disturbances and reagent shortages, mainly in remote areas. These logistical issues are a key barrier to the industry's expansion beyond Tier 2 and Tier 1 cities.

Medical Imaging Reagents Market: Opportunities

The development of personalized and targeted imaging agents positively impacts the market growth

The growth of precision medicine has created opportunities for targeted reagents that are well-matched to specific biomarkers, thereby enhancing diagnostic precision in cardiology, oncology, and neurology. These agents are essential for monitoring therapeutic response and identifying disease at the molecular level. The growth of these agents is a key opportunity, ultimately impacting the progress of the medical imaging reagents industry.

Recent progress includes the 2024 FDA approval of Piflufolastat F 18, a prostate-specific membrane antigen (PSMA) imaging agent, which notably improves the detection of prostate cancer.

Medical Imaging Reagents Market: Challenges

Competition from alternative diagnostic technologies restricts the growth of the market

Improvements in liquid biopsy, AI-based predictive tools, and wearable diagnostics offer non-imaging alternatives that aim to reduce dependence on imaging procedures in specific diagnostic pathways. Liquid biopsies, for instance, can identify cancer-specific biomarkers from blood samples without needing imaging confirmation in the early stages.

The FDA approved multiple blood-based screening tests for colorectal cancer detection in 2024, which may reduce the demand for imaging in early diagnosis. With the growing prominence and improvements in precision diagnostics, medical imaging reagents may need to shift towards a more confirmatory and specialized role, thereby decreasing overall procedure time.

Medical Imaging Reagents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Imaging Reagents Market |

| Market Size in 2024 | USD 11.20 Billion |

| Market Forecast in 2034 | USD 18.68 Billion |

| Growth Rate | CAGR of 6.60% |

| Number of Pages | 213 |

| Key Companies Covered | GE HealthCare, Bracco Imaging S.p.A., Bayer AG, Lantheus Holdings Inc., PerkinElmer Inc., Thermo Fisher Scientific Inc., Merck KGaA, Navidea Biopharmaceuticals Inc., Covalent Medical LLC, Siemens Healthineers, Jubilant Radiopharma, NanoScan Imaging, Advanced Molecular Imaging, Miltenyi Biotec, Spectrum Dynamics Medical, and others. |

| Segments Covered | By Reagent Type, By Imaging Technique, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Imaging Reagents Market: Segmentation

The global medical imaging reagents market is segmented based on reagent type, imaging technique, application, and region.

Based on reagent type, the global medical imaging reagents industry is divided into contrast reagents, radiopharmaceuticals, fluorescent reagents, and luminescent reagents. The contrast reagents segment registered the largest share of the market due to their high volume of use in emergency and routine diagnostics. These agents are widely used in imaging modalities such as ultrasound, MRI, and CT, where they enhance the visibility of organs, blood vessels, and soft tissues. Their extensive use in a broad spectrum of procedures, mainly in gastrointestinal, cardiovascular, and neurological imaging, fuels the segment.

Based on imaging technique, the global medical imaging reagents market is segmented into magnetic resonance imaging, computed tomography, x-ray imaging, and nuclear medicine. The nuclear medicine segment captured a significant share of the market, driven by the increasing use of targeted molecular imaging, rising investment in radiopharmaceutical research and development, and the growth of theranostic applications.

Techniques like SPECT and PET are majorly dependent on radiopharmaceutical reagents, which hold greater diagnostic value for cancer, cardiac diseases, and neurological disorders. Its accuracy in identifying cellular-level changes before anatomical changes occur offers a crucial benefit over other techniques.

Based on application, the global market is segmented into oncology, cardiology, neurology, and gastrointestinal imaging. The oncology segment holds a leading share of the worldwide market. Cancer monitoring and diagnosis are primarily dependent on advanced imaging modalities, such as MRI, PET, and CT, which require radiopharmaceuticals and specialized contrast agents.

With the growing burden of cancer, over 20 million fresh cases are expected yearly by 2025, thus fueling the need for precise and early tumor staging, location, and treatment monitoring. The incorporation of theranostics and molecular imaging in cancer care notably drives reagent utilization in this domain.

Medical Imaging Reagents Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is expected to remain the leading region in the global medical imaging reagents market, driven by improved healthcare infrastructure, strong investment in radiopharmaceuticals and nuclear medicine, and dominance in research and development and innovation.

North America, especially the United States, boasts a developed healthcare systems, which offer enhanced access to advanced diagnostic facilities. The U.S. holds over 43 CT scanners and 40 MRI units per million people, notably more than the global average. This robust infrastructure supports the broader use of imaging reagents in complex procedures and routine diagnostics.

Additionally, the region is a leader in nuclear imaging, particularly in SPECT and PET, due to both private and public investment. The United States is home to radiopharmaceutical production and numerous cyclotron facilities and leads the PET radiotracer supply chain. The United States performs over 20 million nuclear medicine procedures yearly, demanding large volumes of specialized reagents, according to the SNMMI.

Furthermore, North America is home to leading players such as Bracco Diagnostics, GE Healthcare, and Lantheus, which heavily invest in the R&D of new reagents. The region leads in advancements in targeted tracers, molecular imaging, and hybrid agents. Frequent FDA approvals of radiopharmaceuticals and novel contrast agents propel regional industry dominance.

Europe is projected to grow significantly in the global medical imaging reagents industry due to the surging cases of an aging population and chronic diseases, as well as major clinical trials and research activities, and the increasing adoption of hybrid imaging. Europe has the largest geriatric population, with over 22% of its population aged 65 years or older, according to Eurostat.

The geriatric demographic experiences a higher risk of cardiovascular, neurodegenerative diseases, and cancer, which need repetitive imaging. This growing patient pool results in increased demand for radiopharmaceuticals and contrast agents in diagnostic imaging procedures.

Moreover, the region is a prominent center for clinical trials, comprising new imaging agents backed by several institutions. The European Medicines Agency (EMA) also supports simplified processes for novel imaging reagents. European Union-funded programs, such as Horizon Europe, are increasingly financing imaging modernization and development.

Additionally, the adoption of SPECT-CT, PET-MRI, and PET-CT is expanding in the region, particularly in the fields of neurology and oncology. Radiopharmaceuticals used in these systems are gaining traction due to their accuracy. Over 8 million nuclear medicine procedures are performed in the region, according to the European Association of Nuclear Medicine (EANM).

Medical Imaging Reagents Market: Competitive Analysis

The leading players in the global medical imaging reagents market are:

- GE HealthCare

- Bracco Imaging S.p.A.

- Bayer AG

- Lantheus Holdings Inc.

- PerkinElmer Inc.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Navidea Biopharmaceuticals Inc.

- Covalent Medical LLC

- Siemens Healthineers

- Jubilant Radiopharma

- NanoScan Imaging

- Advanced Molecular Imaging

- Miltenyi Biotec

- Spectrum Dynamics Medical

Medical Imaging Reagents Market: Key Market Trends

Surging adoption of hybrid imaging techniques:

Methods like SPECT-CT and PET-MRI are largely adopted for their superior anatomical-functional imaging and diagnostic accuracy. These modalities require specialized reagents that are well-matched with dual systems, driving the demand for hybrid-compatible agents. Hybrid imaging procedures are progressing at over 8% CAGR, mainly in cardiology and oncology.

Regulatory drive for environmentally friendly and safer agents:

There is an increasing focus on lowering ecological impact and toxicity, mainly for gadolinium-based contrast agents. The EMA and FDA are motivating the development of low-dose and macrocyclic formulations with enhanced safety profiles. This trend is driving manufacturers to invest in next-gen biodegradable imaging reagents and reformulate older agents.

The global medical imaging reagents market is segmented as follows:

By Reagent Type

- Contrast Reagents

- Radiopharmaceuticals

- Fluorescent Reagents

- Luminescent Reagents

By Imaging Technique

- Magnetic Resonance Imaging

- Computed Tomography

- X-Ray Imaging

- Nuclear Medicine

By Application

- Oncology

- Cardiology

- Neurology

- Gastrointestinal Imaging

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Medical imaging reagents are specialized chemical substances that enhance the visibility of internal body structures during various imaging procedures. These reagents enhance clarity and contrast, enabling physicians to detect, monitor, and diagnose diseases such as cardiovascular illnesses, cancer, and neurological disorders.

What key factors will influence the growth of the medical imaging reagents market from 2025 to 2034?

The global medical imaging reagents market is projected to grow due to the increasing demand for diagnosis among the growing geriatric population, the mounting adoption of hybrid imaging techniques, and investments from the private sector and government.

According to study, the global medical imaging reagents market size was worth around USD 11.20 billion in 2024 and is predicted to grow to around USD 18.68 billion by 2034.

The CAGR value of the medical imaging reagents market is expected to be approximately 6.60% from 2025 to 2034.

North America is expected to lead the global medical imaging reagents market during the forecast period.

The key players profiled in the global medical imaging reagents market include GE HealthCare, Bracco Imaging S.p.A., Bayer AG, Lantheus Holdings, Inc., PerkinElmer Inc., Thermo Fisher Scientific Inc., Merck KGaA, Navidea Biopharmaceuticals, Inc., Covalent Medical, LLC, Siemens Healthineers, Jubilant Radiopharma, NanoScan Imaging, Advanced Molecular Imaging, Miltenyi Biotec, and Spectrum Dynamics Medical.

The report examines key aspects of the medical imaging reagents market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed