Global Poly (Vinylphosphonic Acid) (CAS 27754-99-0) Market Report Forecast 2034

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market By Application (Fuel Cells, Chemical and Biological Sensors, Biocomposite Materials, Surface Modification and Adhesives, Water Treatment, Coating, Others), By Application (Fuel Cells, Chemical and Biological Sensors, Biocomposite Materials, Surface Modification and Adhesives, Water Treatment, Coating, Others), By End-User Industry (Chemical Industry, Pharmaceutical Industry, Construction Industry, Textile Industry, Electronics Industry), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

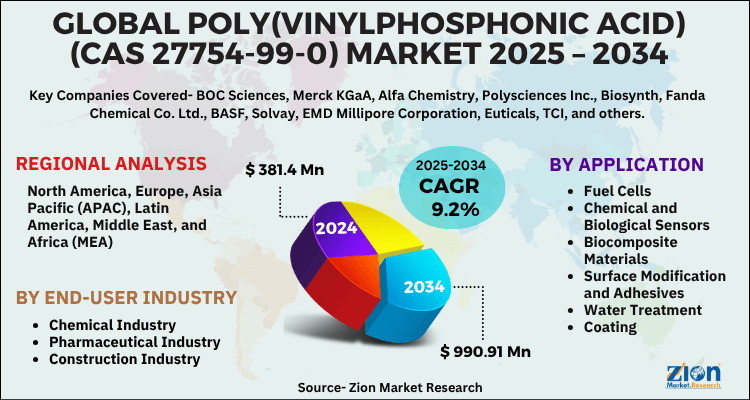

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 381.4 Million | USD 990.91 Million | 9.2% | 2024 |

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Industry Perspective

The global poly (vinylphosphonic acid) (CAS 27754-99-0) market size was worth around USD 381.4 Million in 2024 and is predicted to grow to around USD 990.91 Million by 2034 with a compound annual growth rate (CAGR) of roughly 9.2% between 2025 and 2034.

The report analyzes the global poly (vinylphosphonic acid) (CAS 27754-99-0) market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the poly (vinylphosphonic acid) (CAS 27754-99-0) industry.

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Overview

With a linear formula of (C2H5O3P)n, poly(vinylphosphonic acid), usually referred to as PVPA or polyethenylphosphonic acid, is a very useful chemical (CAS Number: 27754-99-0). It is perfect for a variety of sectors because of its exceptional adhesive powers, outstanding chemical stability, and film-forming qualities. Main applications include water treatment, coatings, adhesives, and polymer synthesis. Its exceptional binding capabilities increase the range of applications it may be used in both industry and scientific research.

Key Insights

- As per the analysis shared by our research analyst, the global poly (vinylphosphonic acid) (CAS 27754-99-0) market is estimated to grow annually at a CAGR of around 9.2% over the forecast period (2025-2034).

- Regarding revenue, the global poly (vinylphosphonic acid) (CAS 27754-99-0) market size was valued at around USD 381.4 Million in 2024 and is projected to reach USD 990.91 Million by 2034.

- The poly (vinylphosphonic acid) (CAS 27754-99-0) market is projected to grow at a significant rate due to increasing demand in water treatment, rising applications in coatings and adhesives, and growing interest in biomedical and sustainable materials.

- Based on Application, the Fuel Cells segment is expected to lead the global market.

- On the basis of Application, the Fuel Cells segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User Industry, the Chemical Industry segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Growth Drivers

The growing water treatment industry drives market growth

The growing water treatment industry is expected to drive the Poly(Vinylphosphonic Acid) market during the forecast period. PVPA is useful in water treatment applications because of its strong metal ion chelating capabilities. PVPA demand may be driven by rising water quality concerns as well as a growing need for efficient water treatment options. For instance, India will have severe water scarcity by 2030, according to Financial Express, with demand for water exceeding supply by a factor of two. Long-term demand for these water purification systems is predicted to rise in response to the scarcity of water for residential and commercial usage. Moreover, the anticipated overall implementation cost of Swachh Bharat Mission-Urban 2.0 for all of its components in the fiscal year 2021–2022 is USD 18.998 billion. Of which the Government of India will provide USD 4.892 billion; the remaining amount will come from various funding sources, such as grants from outside organizations and the public and private sectors, CSR, etc. It covers the country's funding allotment for the treatment of wastewater and water.

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Restraints

The cost of PVPA hampers market growth

The dynamics of the Poly(Vinylphosphonic Acid) market may be significantly impacted by the cost of production. In comparison to competing materials, PVPA's overall competitiveness may be impacted by high manufacturing costs. Additionally, the price and accessibility of the raw materials needed to synthesize PVPA might affect the cost of manufacturing. Manufacturers may face difficulties due to fluctuations in the cost of essential raw materials. Thus, acting as a major restraint for the industry expansion.

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Opportunities

Biomedical advances and green chemistry offer a lucrative opportunity

PVPA could find use in drug delivery systems, biomaterials, and other medical applications as the biomedical sector develops. Investigating fresh medical materials and technologies might lead to new applications for PVPA. Furthermore, prospects for ecologically friendly materials like PVPA are created by the increased focus on sustainability and green chemical methods. By promoting PVPA as a sustainable and environmentally beneficial choice, businesses and customers who care about the environment may get interested. Thus, this is expected to offer a lucrative opportunity for the Poly(Vinylphosphonic Acid) (CAS 27754-99-0) market development during the forecast period.

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Challenges

Regulatory compliance and alternatives pose a major challenge to market growth

Manufacturers of PVPAs may face difficulties due to strict chemical industry environmental and safety laws. It might be necessary to make more investments in R&D and manufacturing processes to comply with requirements. Furthermore, the creation of substitute materials with better qualities can result from the quick advances in polymer chemistry and technology, which might make PVPA less appealing in some applications.

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Segmentation

The global Poly(Vinylphosphonic Acid) (CAS 27754-99-0) industry is segmented based on the application, End-User and region.

Based on the application, the global tamarind market is bifurcated into fuel cells, chemical and biological sensors, biocomposite materials, surface modification and adhesives, water treatment, coating and others. The fuel cells segment is expected to dominate the market growth during the forecast period. Fuel cells are electrochemical devices that convert chemical energy directly into electrical energy. They consist of an electrolyte, an anode, and a cathode. Proton-exchange membrane fuel cells (PEMFCs) are a type of fuel cell that uses a polymer electrolyte membrane to conduct protons and separate the anode and cathode compartments. Proton conductivity, which is essential in proton-exchange membrane fuel cells, is a property of PVPA. To produce electrical current, protons must flow through the membrane with efficiency.

Furthermore, PVPA's chemical stability may be advantageous in the challenging working circumstances of fuel cells. For the fuel cell to remain stable over time, the polymer's capacity to withstand deterioration in the presence of reactive chemicals is crucial. On the other hand, the water treatment segment is expected to grow at the fastest rate over the forecast period. The ability of PVPA to sequester metal ions is one of its main uses in the treatment of water. This characteristic is essential for eliminating heavy metals and other impurities from water, aiding in the stream purification of wastewater and industrial effluent. Additionally, in boiler water treatment, PVPA is frequently used to address corrosion and scale development problems. Because the polymer minimizes corrosion and inhibits scale development, it has chelating qualities that extend the life and efficiency of boilers. Thus, this is expected to drive the market growth.

By End-User Industry, the global poly (vinylphosphonic acid) (CAS 27754-99-0) market is split into Chemical Industry, Pharmaceutical Industry, Construction Industry, Textile Industry, Electronics Industry.

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market |

| Market Size in 2024 | USD 381.4 Million |

| Market Forecast in 2034 | USD 990.91 Million |

| Growth Rate | CAGR of 9.2% |

| Number of Pages | 223 |

| Key Companies Covered | BOC Sciences, Merck KGaA, Alfa Chemistry, Polysciences Inc., Biosynth, Fanda Chemical Co. Ltd., BASF, Solvay, EMD Millipore Corporation, Euticals, TCI, and others. |

| Segments Covered | By Application, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Regional Analysis

The Asia Pacific is expected to hold a significant market share during the forecast period

The Asia Pacific is expected to hold a significant market share during the forecast period. The area is known for its quick industrialization, especially in nations like China and India. The usage of PVPA in industries including adhesives, coatings, water treatment, and others may rise as a result of industrial expansion. The Asia-Pacific area is seeing a rise in the need for efficient water treatment technologies due to rising industrial activity and population growth. PVPA's ability to chelate metal ions makes it a promising tool for treating problems related to water quality. For instance, according to secondary sources, India has 1,428,627,663 people living there as of 2023, a rise of 0.81% from 2022. India's population increased by 0.68% from 2021 to 1,417,173,173 in 2022. India's population increased by 0.8% from 2020 to 1,407,563,842 in 2021. Consequently, according to the International Trade Administration, in India, the demand for advanced treatment methods is rising. The Indian market for water and wastewater treatment is expected to increase at a compound annual growth rate (CAGR) of 9.7%, from $1.31 billion in 2020 to $2.08 billion by 2025.

Furthermore, governments in the Asia-Pacific region may enact more stringent environmental laws as public awareness of environmental issues grows. Due to its environmental friendliness in some applications, PVPA may become more in demand as the industry looks to comply with legislation. Therefore, this is expected to propel the market expansion in the region.

Poly(Vinylphosphonic Acid) (CAS 27754-99-0) Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the poly (vinylphosphonic acid) (CAS 27754-99-0) market on a global and regional basis.

The global poly (vinylphosphonic acid) (CAS 27754-99-0) market is dominated by players like:

- BOC Sciences

- Merck KGaA

- Alfa Chemistry

- Polysciences Inc.

- Biosynth

- Fanda Chemical Co. Ltd.

- BASF

- Solvay

- EMD Millipore Corporation

- Euticals

- TCI

The global Poly(Vinylphosphonic Acid) (CAS 27754-99-0) market is segmented as follows:

By Application

- Fuel Cells

- Chemical and Biological Sensors

- Biocomposite Materials

- Surface Modification and Adhesives

- Water Treatment

- Coating

- Others

By End-User Industry

- Chemical Industry

- Pharmaceutical Industry

- Construction Industry

- Textile Industry

- Electronics Industry

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global poly (vinylphosphonic acid) (CAS 27754-99-0) market is expected to grow due to rising adoption in fuel cells and other high-performance materials, increasing demand for its use in water treatment and coatings, and growing focus on its potential in biomedical applications and as an adhesion promoter.

According to a study, the global poly (vinylphosphonic acid) (CAS 27754-99-0) market size was worth around USD 381.4 Million in 2024 and is expected to reach USD 990.91 Million by 2034.

The global poly (vinylphosphonic acid) (CAS 27754-99-0) market is expected to grow at a CAGR of 9.2% during the forecast period.

Asia-Pacific is expected to dominate the poly (vinylphosphonic acid) (CAS 27754-99-0) market over the forecast period.

Leading players in the global poly (vinylphosphonic acid) (CAS 27754-99-0) market include BOC Sciences, Merck KGaA, Alfa Chemistry, Polysciences Inc., Biosynth, Fanda Chemical Co. Ltd., BASF, Solvay, EMD Millipore Corporation, Euticals, TCI, among others.

The report explores crucial aspects of the poly (vinylphosphonic acid) (CAS 27754-99-0) market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-(cas-27754-99-0)-market-size.png)