Polytetrafluoroethylene (PTFE) Coatings Market Size, Share, Trend Analysis Report 2034

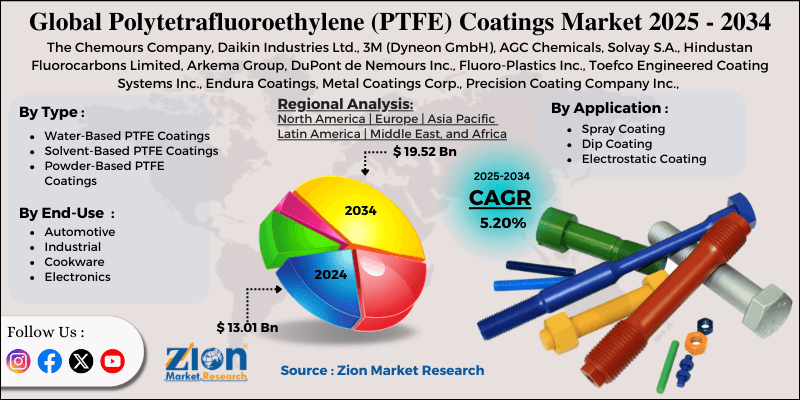

Polytetrafluoroethylene (PTFE) Coatings Market By Type (Water-Based PTFE Coatings, Solvent-Based PTFE Coatings, Powder-Based PTFE Coatings), By Application (Spray Coating, Dip Coating, Electrostatic Coating), By End-Use Industry (Automotive, Industrial, Cookware, Electronics), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

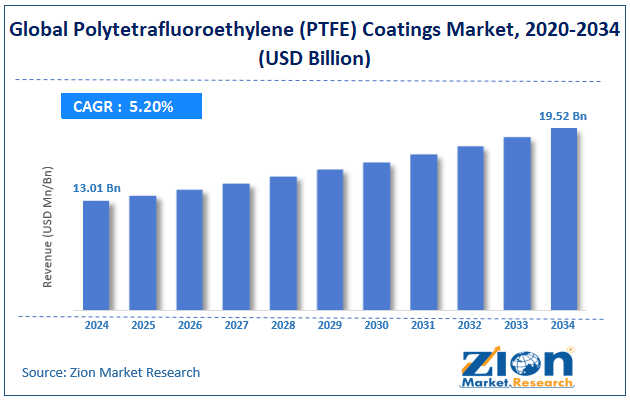

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 13.01 Billion | USD 19.52 Billion | 5.20% | 2024 |

Polytetrafluoroethylene PTFE Coatings Industry Perspective:

The global polytetrafluoroethylene PTFE coatings market size was worth approximately USD 13.01 billion in 2024 and is projected to grow to around USD 19.52 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.20% between 2025 and 2034.

Polytetrafluoroethylene PTFE Coatings Market: Overview

Polytetrafluoroethylene PTFE coatings are highly effective fluoropolymer coatings known for their exceptional low-friction, non-stick, and chemical-resistant properties. They are widely used in various industries, including aerospace, automotive, cookware, chemical processing, and electronics. PTFE coatings provide durability in harsh chemical environments and extreme temperatures. The global polytetrafluoroethylene PTFE coatings market is poised for significant growth, driven by the increasing use in chemical processing equipment, the development of the non-stick cookware sector, and the rising demand for medical device applications. PTFE's chemical inertness increases its suitability for coating tanks, valves, and pipes in chemical plants.

The global chemical market is actively adopting PTFE coatings to improve corrosion resistance and increase equipment life in extreme processing environments. The commercial and household cookware industries are highly dependent on PTFE for non-stick features. With the rising demand for convenient cooking solutions among consumers, the global non-stick cookware industry is expected to experience significant growth. This rise directly backs the development of the worldwide market.

Additionally, PTFE coatings are widely used in catheters, guidewires, and surgical instruments due to their lubricity and biocompatibility. The global medical device sector is projected to exceed $670 billion by 2030, driven by surging demand for high-performance coatings, particularly in minimally invasive surgeries.

Nevertheless, the global market faces limitations due to factors such as high processing and production costs, as well as the availability of low-priced alternatives. PTFE coatings are expensive to produce due to their high energy requirements and complex manufacturing process. This limits their adoption in price-sensitive and small-scale industries, particularly in emerging nations where budget substitutes are preferred.

Additionally, materials such as epoxy-based polymers and silicone coatings offer similar functionality at a lower price. In markets where budget is a key concern, these substitutes are highly preferred, thus limiting the reach of PTFE coatings. Still, the global polytetrafluoroethylene PTFE coatings industry benefits from several favorable factors, including the rise in additive manufacturing and modernization in the aerospace sector. With the growth of additive manufacturing, PTFE coatings are also explored and used for coating printed components that need chemical or thermal protection. This offers a niche market, but speedily progressing use cases.

Moreover, the aerospace industry is highly preferring PTFE for lessening friction in actuators, hydraulic parts, and cable systems. With the global aerospace industry recovering post-pandemic and orders of new airplanes rising, the domain offers lucrative opportunities for PTFE coatings.

Key Insights:

- As per the analysis shared by our research analyst, the global polytetrafluoroethylene PTFE coatings market is estimated to grow annually at a CAGR of around 5.20% over the forecast period (2025-2034)

- In terms of revenue, the global polytetrafluoroethylene PTFE coatings market size was valued at around USD 13.01 billion in 2024 and is projected to reach USD 19.52 billion by 2034.

- The polytetrafluoroethylene PTFE coatings market is projected to grow significantly due to surging demand in the automotive industry, advancements in healthcare and medical fields, and industrial growth in developing economies.

- Based on type, the water-based PTFE coatings segment is expected to lead the market, while the powder-based PTFE coatings segment is expected to grow considerably.

- Based on application, the spray coating segment is the largest, while the electrostatic coating segment is projected to experience substantial revenue growth over the forecast period.

- Based on end-use industry, the industrial segment is expected to lead the market, followed by the automotive segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Polytetrafluoroethylene PTFE Coatings Market: Growth Drivers

Growth in industrial equipment and chemical processing propels the market growth

PTFE coatings are crucial in the chemical processing market due to their exceptional inertness to most bases, acids, and solvents. They are highly preferred in pipelines, tanks, reactors, and other process equipment to enhance longevity and improve corrosion resistance. The global chemical processing equipment industry is expected to exceed USD 85 billion by 2030, driven by growing demand for specialty chemicals and industrialization, according to reports.

The 3M company increased its PTFE-based linings in its fluoropolymer segment in March 2024 to meet the rising demand from APAC chemical manufacturers, primarily in China and India.

Mounting demand for pharmaceutical and medical devices substantially impels the market growth

The healthcare sector is actively utilizing PTFE coatings for medical tools due to their non-stick properties, resistance to chemical sterilization, and biocompatibility. Catheters, surgical instruments, and guidewires benefit from PTFE coatings that enhance patient safety and decrease friction during procedures. The worldwide medical device industry exceeded USD 570 billion in the previous year and is expected to progress at a 5.8% CAGR by 2030, creating new possibilities for PTFE. Thus, this has notably impacted the progress of the global polytetrafluoroethylene PTFE coatings market.

Boston Scientific announced a new line of coated catheter systems using polytetrafluoroethylene to reduce patient trauma and procedural friction, further validating its growing role in the medical technology field.

Polytetrafluoroethylene PTFE Coatings Market: Restraints

Challenges in the disposal and recycling of PTFE coatings negatively impact market progress

PTFE coatings are chemically inert and thermally stable, making them highly difficult to reuse. Their disposal typically involves high-temperature incineration, which is both environmentally sensitive and expensive. This restriction is prompting producers and end-users to seek substitute coating solutions with low ecological disposal costs.

Germany's Federal Environmental Agency expressed concern about the high volume of landfill waste from PTFE-based industrial waste in May 2024, recommending strict waste management and compliance practices for users of fluoropolymers.

Polytetrafluoroethylene PTFE Coatings Market: Opportunities

Improvements in water-based and eco-friendly PTFE coatings positively impact market growth

Environmental regulations are driving the development of new-generation, water-based, and low-VOC PTFE coatings that meet compliance requirements while maintaining performance. Advances in PTFE dispersion technologies have enabled novel applications in the electronics, food processing, and packaging domains, positively impacting the growth of the polytetrafluoroethylene PTFE coatings industry.

Chemours launched a water-based PTFE coating line with reduced PFOA content in February 2025, aiming to serve industrial and cookware users in Europe in compliance with evolving REACH protocols.

Polytetrafluoroethylene PTFE Coatings Market: Challenges

Growing global regulatory pressure on fluoropolymers restricts the growth of market

PTFE, categorized under the PFAS category, is experiencing increasing regulatory scrutiny owing to its ecological persistence. Governments in Canada, the United States, and the European Union are assessing usage limits, possible bans, and labeling requirements.

The European Union REACH committee initiated a 6-month assessment period on PFAS limitations, explicitly focusing on PTFE-based coatings used in electronics and cookware. If passed, the rule is expected to take effect in early 2026, limiting the use of PTFE in consumer applications.

Polytetrafluoroethylene (PTFE) Coatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polytetrafluoroethylene (PTFE) Coatings Market |

| Market Size in 2024 | USD 13.01 Billion |

| Market Forecast in 2034 | USD 19.52 Billion |

| Growth Rate | CAGR of 5.20% |

| Number of Pages | 214 |

| Key Companies Covered | The Chemours Company, Daikin Industries Ltd., 3M (Dyneon GmbH), AGC Chemicals, Solvay S.A., Hindustan Fluorocarbons Limited, Arkema Group, DuPont de Nemours Inc., Fluoro-Plastics Inc., Toefco Engineered Coating Systems Inc., Endura Coatings, Metal Coatings Corp., Precision Coating Company Inc., Surface Solutions Group LLC, Intech Services Inc., and others. |

| Segments Covered | By Type, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polytetrafluoroethylene PTFE Coatings Market: Segmentation

The global polytetrafluoroethylene PTFE coatings market is segmented based on type, application, end-use industry, and region.

Based on type, the global polytetrafluoroethylene PTFE coatings industry is divided into water-based PTFE coatings, solvent-based PTFE coatings, and powder-based PTFE coatings. The water-based PTFE coatings segment accounted for a considerable share of the market due to the increasing environmental regulations on solvent emissions and VOCs. These coatings are highly eco-friendly, safer, and comply with the global sustainable manufacturing trends. With the growing demand from the food processing, consumer goods, and cookware industries, water-based PTFE is gaining traction and adoption, primarily in North America and Europe.

Based on application, the global polytetrafluoroethylene PTFE coatings market is segmented into spray coating, dip coating, and electrostatic coating. The spray coating segment held a substantial industry share owing to its ability to coat complex geometries, precision, and versatility. It facilitates uniform coating thickness and is highly suitable for the cookware, automotive, and electronics industries. Its compatibility and scalability with water-based PTFE constructions increase its global adoption.

Based on end-use industry, the global market is segmented into automotive, industrial, cookware, and electronics. The industrial segment accounted for a larger market share owing to its widespread use in valves, pumps, heat exchangers, chemical processing equipment, and machinery. PTFE's unique resistance to high temperatures, corrosion, and aggressive chemicals propels its adoption for harsh environments. Heavy investments in manufacturing and infrastructure, as well as rapid industrialization in the APAC region, support this dominance.

Polytetrafluoroethylene PTFE Coatings Market: Regional Analysis

Asia Pacific to witness significant growth over the forecast period

The Asia Pacific is projected to maintain its dominant position in the global polytetrafluoroethylene PTFE coatings market, driven by its strong manufacturing and industrial base, booming automotive production, and competitive advantages, as well as low-cost production. The Asia Pacific is a key hub for manufacturing, with countries such as South Korea, Japan, China, and India, which primarily rely on PTFE coatings for their equipment and machinery. The regional manufacturing accounted for more than 27% of China's GDP in 2024, according to the World Bank. This broader industrial activity propels strong demand for PTFE in machinery, processing plants, and structural components.

Moreover, the region leads the world in global automotive production, with China manufacturing over 26 million vehicles in 2024, accounting for more than 30% of the total output. APAC's automotive progress, which includes the expansion of electric cars, directly fuels the demand for advanced coatings.

Similarly, the APAC region offers raw materials, cost-effective labor, and manufacturing infrastructure, thereby increasing its prominence for PTFE coating manufacturers. Key players have expanded their production capacities in India and China due to the favorable economic conditions prevailing in these regions. This localized manufacturing enables efficient meeting of both export and domestic demand.

North America maintains its position as the second-leading region in the global polytetrafluoroethylene PTFE coatings industry due to the strong presence of industrial and advanced manufacturing sectors, a developed automotive industry, and dominance in aerospace and defense applications. North America, primarily the United States, is home to a large number of advanced manufacturing facilities in defense, aerospace, heavy machinery, and chemical processing.

The United States manufacturing sector accounted for USD 2.9 trillion of GDP in 2024, representing more than 11% of the country's overall GDP. High demand for chemical-resistant and durable coatings in industrial applications fuels the demand for PTFE. Furthermore, the United States produced over 10.5 million vehicles in the previous year, with a rising emphasis on fuel-efficient systems and EVs. PTFE coatings are utilized in battery systems, fuel lines, and engine components due to their low friction and high heat resistance.

R&D spending and automotive innovation in North America are driving the demand for coherent coating solutions, such as PTFE. Moreover, North America leads the overall aerospace and defense sector, where PTFE coatings are used for corrosion resistance, friction reduction, and thermal protection. The U.S defense budget hit USD 886 billion in 2024, with significant investments in coated parts for missiles, aircraft, and space technologies. This sector sustains itself as a key consumer of specialty coatings.

Polytetrafluoroethylene PTFE Coatings Market: Competitive Analysis

The leading players in the global polytetrafluoroethylene PTFE coatings market are:

- The Chemours Company

- Daikin Industries Ltd.

- 3M (Dyneon GmbH)

- AGC Chemicals

- Solvay S.A.

- Hindustan Fluorocarbons Limited

- Arkema Group

- DuPont de Nemours Inc.

- Fluoro-Plastics Inc.

- Toefco Engineered Coating Systems Inc.

- Endura Coatings

- Metal Coatings Corp.

- Precision Coating Company Inc.

- Surface Solutions Group LLC

- Intech Services Inc.

Polytetrafluoroethylene PTFE Coatings Market: Key Market Trends

Move toward PFOA-free and eco-friendly formulations:

Environmental regulations in the United States, Asia, and the European Union are forcing manufacturers to eliminate PFOA from PTFE coatings. This is boosting the adoption and development of low-VOC PTFE and water-based coatings that meet ecological and safety standards. Companies are investing in sustainable substitutes to capitalize on regulatory-compliant opportunities across various industries.

Growing demand in FDA-compliant and food-safe applications:

PTFE coatings used in bakeware, cookware, and food processing equipment are reformulated to meet stringent EU and FDA food safety regulations. The trend toward long-lasting and non-toxic surfaces is driving the growth of food-grade and premium PTFE coatings, primarily in Europe and North America.

The global polytetrafluoroethylene PTFE coatings market is segmented as follows:

By Type

- Water-Based PTFE Coatings

- Solvent-Based PTFE Coatings

- Powder-Based PTFE Coatings

By Application

- Spray Coating

- Dip Coating

- Electrostatic Coating

By End-Use Industry

- Automotive

- Industrial

- Cookware

- Electronics

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polytetrafluoroethylene PTFE coatings are highly effective fluoropolymer coatings known for their exceptional low-friction, non-stick, and chemical-resistant properties. They are widely used in various industries, including aerospace, automotive, cookware, chemical processing, and electronics. PTFE coatings provide durability in harsh chemical environments and extreme temperatures.

The global polytetrafluoroethylene PTFE coatings market is projected to grow due to strong demand in the energy and oil & gas sectors, high adoption in chemical equipment processing, and the rise of the semiconductor and electronics industry.

According to study, the global polytetrafluoroethylene PTFE coatings market size was worth around USD 13.01 billion in 2024 and is predicted to grow to around USD 19.52 billion by 2034.

The CAGR value of the polytetrafluoroethylene PTFE coatings market is expected to be around 5.20% during 2025-2034.

The Asia Pacific is expected to lead the global polytetrafluoroethylene PTFE coatings market during the forecast period.

The key players profiled in the global polytetrafluoroethylene PTFE coatings market include The Chemours Company, Daikin Industries Ltd., 3M (Dyneon GmbH), AGC Chemicals, Solvay S.A., Hindustan Fluorocarbons Limited, Arkema Group, DuPont de Nemours, Inc., Fluoro-Plastics, Inc., Toefco Engineered Coating Systems, Inc., Endura Coatings, Metal Coatings Corp., Precision Coating Company, Inc., Surface Solutions Group, LLC, and Intech Services, Inc.

The report examines key aspects of the polytetrafluoroethylene PTFE coatings market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

List of Contents

Polytetrafluoroethylene PTFE CoatingsIndustry Perspective:Polytetrafluoroethylene PTFE Coatings OverviewKey Insights:Polytetrafluoroethylene PTFE Coatings Growth DriversPolytetrafluoroethylene PTFE Coatings RestraintsPolytetrafluoroethylene PTFE Coatings OpportunitiesPolytetrafluoroethylene PTFE Coatings ChallengesReport ScopePolytetrafluoroethylene PTFE Coatings SegmentationPolytetrafluoroethylene PTFE Coatings Regional AnalysisPolytetrafluoroethylene PTFE Coatings Competitive AnalysisPolytetrafluoroethylene PTFE Coatings Key Market TrendsThe global polytetrafluoroethylene PTFE coatings market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed