Polyimide (PI) Market Size, Share, Growth Report 2034

Polyimide (PI) Market By Product Type (Thermosetting PI and Thermoplastic PI), By Form (Film, Fiber, Resin, Coating, and Foam), By Application (Electrical & Electronics, Automotive, Aerospace, Industrial, Medical, and Consumer Goods), By End-user (Semiconductors, OEMs, Industrial Manufacturing, Research Institutions), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

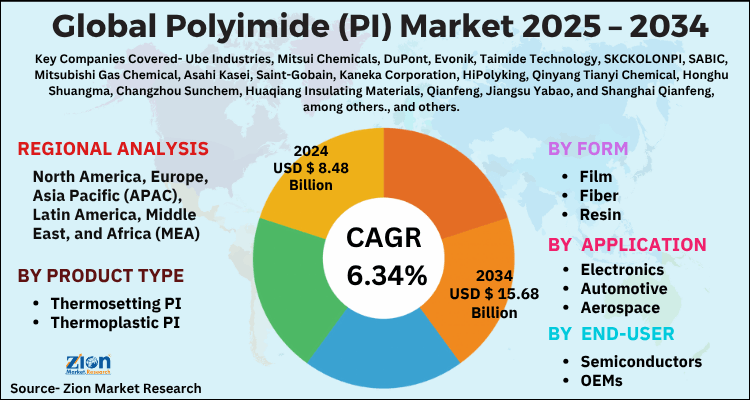

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.48 Billion | USD 15.68 Billion | 6.34% | 2024 |

Polyimide (PI) Market: Industry Perspective

The global polyimide (PI) market size was worth around USD 8.48 Billion in 2024 and is predicted to grow to around USD 15.68 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.34% between 2025 and 2034. The report analyzes the global polyimide (PI) market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the polyimide (PI) industry.

Polyimide (PI) Market: Overview

A polymer of imide monomers called polyimide (PI) has two acyl groups attached to nitrogen. Both thermosetting and thermoplastic materials are possible. In some applications, it takes the place of materials like glass, metals, and even steel. It displays good dielectric characteristics, an intrinsic low coefficient of thermal expansion, and extremely high thermal stability (>500°C). Polyimide is a popular dielectric material that has been extensively utilized in the fields of electronics, aerospace, and automotive to meet the growing need for materials that can perform well in challenging environments, such as high temperatures. Due to their excellent chemical resistance, high-temperature stability, and mechanical qualities, polyimides are a significant family of step-growth polymers.

Key Insights

- As per the analysis shared by our research analyst, the global polyimide (PI) market is estimated to grow annually at a CAGR of around 6.34% over the forecast period (2025-2034).

- Regarding revenue, the global polyimide (PI) market size was valued at around USD 8.48 billion in 2024 and is projected to reach USD 15.68 billion by 2034.

- The global Polyimide (PI) market is being driven by the increasing demand from various end-use industries, including automotive, aerospace, and others, due to the growing need for materials that can perform well in challenging circumstances, such as high temperatures.

- Based on the form, the film segment is expected to dominate the market during the forecast period.

- Based on the application, the electrical & electronics segment is expected to capture the largest market share over the forecast period.

- Based on region, the Asia Pacific is expected to hold the largest market share over the forecast period.

Polyimide (PI) Market: Growth Drivers

The increasing electronics sector drives the market growth

A thermoplastic polymer known as a polyimide film is a dielectric material that can tolerate high temperatures. Polyimide films provide several advantages over glass, metals, and even steel in the electronics industry and other industrial applications, including great temperature stability, tensile characteristics, and superior chemical resistance. Due to its reasonable thermal expansion and strong high-temperature resistance, polyimide film is also well-suited for flexible printed circuits. Polyimide sheets are therefore often employed in the electronics industry.

The German electronics sector's turnover will almost reach 200 billion euros in 2021, predicts ZVEI. Nominal sales growth from January to November 2021 was roughly 10%. The business association anticipates a 4% increase in production in 2022. The Department for Promotion of Industry and Internal Trade estimates that India exported $11.1 billion worth of electronic goods from April 2020 to March 2021 (FY21). Between April 2000 and December 2021, US$3.19 billion in FDI was attracted to the electronic products industry. Since Polyimide Film is often employed in the electronics sector, the sector's strong expansion is propelling the polyimide market's expansion.

Polyimide (PI) Market: Restraints

Processing concerns and high costs hamper the market growth

Processing polyimides is challenging since it requires a high level of technological proficiency, which poses a significant obstacle for the polyimide industry growth. The improved heat and chemical resistance cause processing issues such as poor solubility, poor adhesion, and non-uniformity. Additionally, there is a significant influence from the high production costs and the scarce commercial availability of the monomers needed for synthesis. The need for the cost of specialist equipment and technological know-how are additional difficult obstacles. As a result of these difficulties, the market for polyimides is severely hampered and slowing down.

Polyimide (PI) Market: Opportunities

Increasing collaboration provides a lucrative opportunity for the market growth

The increasing collaboration among the key market players operating in these industries is expected to offer a lucrative opportunity for polyimide market growth over the forecast period. For instance, in June 2023, the 54% investment Glenwood Private Equity currently has in the publicly traded South Korean business PI Advanced Materials (PIAM) will be acquired by Arkema, a world leader in specialty materials. Polyimide films, a high-performance polymer with excellent qualities including heat resistance, electrical insulation, mechanical strength, and flexibility, are dominated by PIAM, a worldwide industry leader. With its acquisition of PIAM, Arkema will have a unique chance to expand its polymer line with ultra-high performance and cutting-edge technology, enhancing its current portfolio of specialized materials.

Polyimide (PI) Market: Challenges

Regulatory and environmental issue act as a major challenge to the market growth

Regulatory standards and restrictions in certain industries, such as healthcare and food packaging, can impact the use of polyimides due to concerns about potential chemical migration and safety. In addition, traditional methods of polyimide production may involve the use of solvents and chemicals that can be harmful to the environment. There's a growing demand for more environmentally friendly production processes and materials. Therefore, the regulatory and environmental issues act as a major challenge to the market growth during the forecast period.

Polyimide (PI) Market: Segmentation

The global Polyimide (PI) industry is segmented based on product type, form, application, end-user, and region.

Based on product type, the global polyimide (PI) market is divided into thermosetting PI and thermoplastic PI.

Based on the form, the global polyimide market is bifurcated into film, fiber, resin, coating, and foam. The film segment is expected to dominate the market during the forecast period. Polyimide films are widely used in the electronics industry for manufacturing flexible printed circuits (FPCs), which are critical components in flexible electronic devices. The films' thermal stability, mechanical flexibility, and electrical insulation properties make them ideal for this application. Moreover, polyimide films find use in aerospace applications, including insulation for spacecraft components and thermal barriers for sensitive instruments. Their lightweight nature and thermal stability are advantageous in these environments. Therefore, the numerous application in different industries is expected to propel the segment growth over the forecast period.

Based on the application, the market is segmented into electronics, automotive, aerospace, industrial, medical, and consumer goods. The electrical & electronics segment is expected to capture the largest market share over the forecast period, as businesses started implementing work-from-home policies and individuals started setting up home offices. There was a dramatic change in consumer preferences toward consumer electronics like laptops, mobile phones, and smart gadgets, which raised the use of polyimides. On the other hand, the aerospace segment is expected to grow at the fastest rate over the projected period. The expanded global manufacturing of aerospace components is responsible for this expansion. For instance, aerospace product sales increased from 430 billion to 466 billion dollars in 2022. The greatest market for polyimides in Europe is the aerospace industry, with France having the largest volume market share in 2022, which is more than 30% of the total market. Manufacturers of worldwide aerospace parts and aircraft, such as Dassault Aviation and Airbus, have their headquarters in France. The need for polyimides has also been bolstered by the industry's stability.

Polyimide (PI) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polyimide (PI) Market |

| Market Size in 2024 | USD 8.48 Billion |

| Market Forecast in 2034 | USD 15.68 Billion |

| Growth Rate | CAGR of 6.34% |

| Number of Pages | 214 |

| Key Companies Covered | Ube Industries, Mitsui Chemicals, DuPont, Evonik, Taimide Technology, SKCKOLONPI, SABIC, Mitsubishi Gas Chemical, Asahi Kasei, Saint-Gobain, Kaneka Corporation, HiPolyking, Qinyang Tianyi Chemical, Honghu Shuangma, Changzhou Sunchem, Huaqiang Insulating Materials, Qianfeng, Jiangsu Yabao, and Shanghai Qianfeng, among others., and others. |

| Segments Covered | By Product Type, By Form, By Application, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyimide (PI) Market: Regional Analysis

The Asia Pacific is expected to hold the largest market share over the forecast period

The Asia Pacific is expected to hold the largest polyimide market share during the forecast period. The strong expansion of polyimide under the trade names Kevlar or nylon in this region is influenced by expanding electronics manufacturing, a foundation for automobile and urbanization trends. Due to factors including strong consumer electronics device demand, a growing manufacturing base, and urbanization, the electronics sector is rapidly expanding in APAC. Japan's manufacturing of consumer electronics climbed from US$215 million in January 2022 to US$230 million in March 2022, according to the Japan Electronics and Information Technology Industries Association (JEITA).

Consumer electronics, insulating films, integrated circuits, and other products are all seeing an increase in demand for polyimide due to APAC’s strong potential for growth in the electronics industry. In addition, the market is also driven by the growth in the automotive sector especially in the countries like India and China. For instance, as per the figure given by SIAM, with high-level double-digit growth over the previous few years, the passenger car category is the only one that has continued on a solid growth trajectory. That can be attributed to the increasing demand for Uvs, SUVs, and MPVs. The UV sub-segment represented slightly more than 2 million units, or 51.50% of all PV sales in FY2023, representing a 35% YoY rise. There were 3.89 million units sold in total in FY2023. Thus, this is expected to drive the market growth in the region.

Polyimide (PI) Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the polyimide (PI) market on a global and regional basis.

The global polyimide (PI) market is dominated by players like:

- Ube Industries

- Mitsui Chemicals

- DuPont

- Evonik

- Taimide Technology

- SKCKOLONPI

- SABIC

- Mitsubishi Gas Chemical

- Asahi Kasei

- Saint-Gobain

- Kaneka Corporation

- HiPolyking

- Qinyang Tianyi Chemical

- Honghu Shuangma

- Changzhou Sunchem

- Huaqiang Insulating Materials

- Qianfeng

- Jiangsu Yabao

- and Shanghai Qianfeng

- among others.

The global polyimide (PI) market is segmented as follows;

By Product Type

- Thermosetting PI

- Thermoplastic PI

By Form

- Film

- Fiber

- Resin

- Coating

- Foam

By Application

- Electronics

- Automotive

- Aerospace

- Industrial

- Medical

- Consumer Goods

By End-user

- Semiconductors

- OEMs

- Industrial Manufacturing

- Research Institutions

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A polymer of imide monomers called polyimide (PI) has two acyl groups attached to nitrogen. Both thermosetting and thermoplastic materials are possible. In some applications, it takes the place of materials like glass, metals, and even steel. It displays good dielectric characteristics, an intrinsic low coefficient of thermal expansion, and extremely high thermal stability (>500°C).

The rising demand for polyimides from several end-use sectors, including aerospace applications, medical/healthcare applications, and others, is the primary factor driving the growth of the worldwide polyimide (PI) market. Additionally, the worldwide polyimide (PI) market is expanding due to the rising need for lightweight, high-performance materials.

According to a study, the global polyimide (PI) market size was worth around USD 8.48 Billion in 2024 and is expected to reach USD 15.68 Billion by 2034.

The global polyimide (PI) market is expected to grow at a CAGR of 6.34% during the forecast period.

Asia-Pacific is expected to dominate the polyimide (PI) market over the forecast period. It is currently the world’s highest revenue-generating market due to the growing consumer electronics and automotive industries.

Leading players in the global polyimide (PI) market include Ube Industries, Mitsui Chemicals, DuPont, Evonik, Taimide Technology, SKCKOLONPI, SABIC, Mitsubishi Gas Chemical, Asahi Kasei, Saint-Gobain, Kaneka Corporation, HiPolyking, Qinyang Tianyi Chemical, Honghu Shuangma, Changzhou Sunchem, Huaqiang Insulating Materials, Qianfeng, Jiangsu Yabao, and Shanghai Qianfeng, among others., among others.

The report explores crucial aspects of the polyimide (PI) market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed

-market-size.png)