Plant Phenotyping Market Size, Share, And Growth Report 2032

Plant Phenotyping Market Size- By Product (Equipment, Software, and Sensors), By Application (Plant Research, Breeding, Product Development, and Quality Assessments), and By Region - Global and Regional Industry Overview, Comprehensive Analysis, Historical Data, and Forecasts 2024-2032

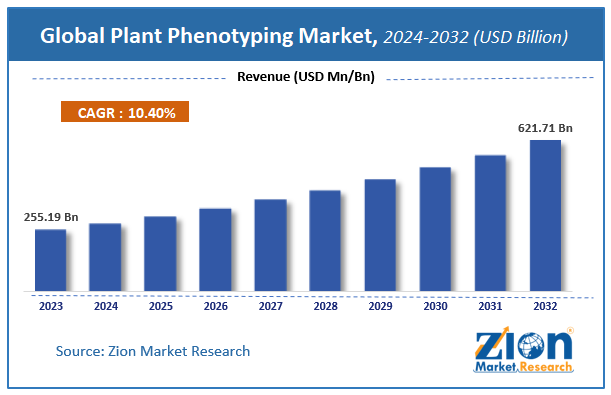

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 255.19 Billion | USD 621.71 Billion | 10.4% | 2023 |

Plant Phenotyping Market Size

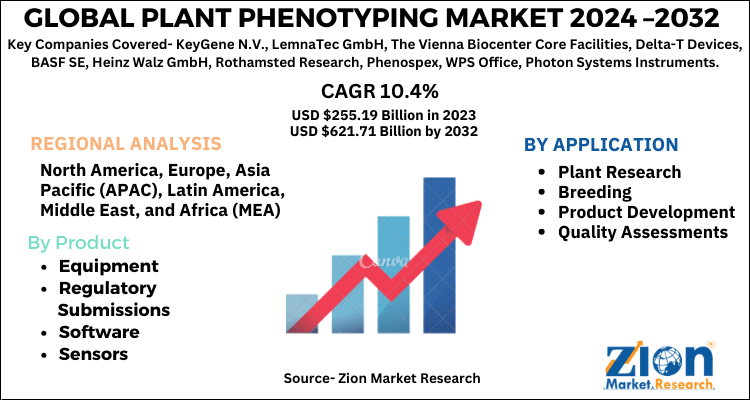

Zion Market Research has published a report on the global Plant Phenotyping Market, estimating its value at USD 255.19 Billion in 2023, with projections indicating that it will reach USD 621.71 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 10.4% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Plant Phenotyping Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Plant Phenotyping Market: Overview

Plant phenotyping is an evolving science and gives key information on how environmental pressures, genetics, crop management, and epigenetics can guide in selecting productive plants & herbs. Reportedly, plant phenotyping is predicted to lead to future plant breeding activities. Moreover, phenotyping is key to any breeding selection procedure and modern plant phenotyping measures complicated features pertaining to growth & yield as well as the adaption of plants to stress. Plant phenotyping also helps in improving accuracy and precision at various scales of organs & canopies. Precisely, plant phenotyping is defined as features of plants resulting from the interaction between crop management, genotype, and environment. It establishes a relationship between plants & their environment such as soil microbes' effect on plant growth.

Plant phenotyping is used to describe the quantitative characteristics of a plant which includes physiological, ontological, anatomical, and biochemical properties. The phenotypic data helps in detecting the quantitative trait locus (QTL). They give the insight on plants, how they react to the light, CO2, and also how the pathogens and pests influence the phenotypes. In addition to this, phenotypic data act as the indicators in the toxicology studies, for instance, soil salinity, and in dedicated duckweed assays. Moreover, they also give the insight on how the plants cope with the limitation of water and nutrients. Phenotyping methods used for plants benefits the breeders and gene banks by addressing the seed germination for seed viability.

Global Plant Phenotyping Market: Growth Drivers

The growth of the plant phenotyping market can be credited to its ability of plant phenotyping in understanding the interaction of plants with their surroundings. Additionally, phenotyping helps plants in improving crop management activities, effectively measuring the biostimulant effect and the effect of microbes on plant growth. Furthermore, the plant breeding process is one of the key applications of plant phenotyping. In the last few years, plant phenotyping has been a key research topic in basic & applied plant research. Apparently, the launching of new sensor technologies for plant phenotyping has opened new growth avenues for the plant phenotyping market in recent years.

The major factors driving the market are innovations in the technologies for high-throughput screening and increasing significance for the sustainable crop production by better crop varieties. In addition to this, rising investments in the plant phenotyping research in urban regions are the major factor anticipated to drive the market during the forecast period. Therefore, such strong factors are considered to positively influence the market growth during the upcoming years. However, lack of the technical awareness coupled with the lesser adoption in the developing countries due to lack of funds is hampering the market growth.

Furthermore, an increase in focus on sustainable crop yield is set to boost the growth of the plant phenotyping industry. In addition to this, the surge in acceptance of automation methods for plant development will create novel vistas of expansion for the plant phenotyping market in near future. Nonetheless, less availability of experts operating these tools & huge costs associated with these systems will impede business space.

Plant Phenotyping Market: Segmentation

On the basis of the product, the plant phenotyping market is fragmented into equipment, software, and sensors. Furthermore, equipment is classified into the site, platform, and level of automation.

Based on the application, the market is categorized into a high-throughput screening, trait identification, photosynthetic performance, morphology and growth assessment, and others.

Plant Phenotyping Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plant Phenotyping Market |

| Market Size in 2023 | USD 255.19 Billion |

| Market Forecast in 2032 | USD 621.71 Billion |

| Growth Rate | CAGR of 10.4% |

| Number of Pages | 154 |

| Key Companies Covered | KeyGene N.V., LemnaTec GmbH, The Vienna Biocenter Core Facilities, Delta-T Devices, BASF SE, Heinz Walz GmbH, Rothamsted Research, Phenospex, WPS Office, Photon Systems Instruments, Qubit Systems, and Phenomix Corporation |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plant Phenotyping Market: Regional Landscape

Europe To Account Majorly Towards Regional Market Size By 2032

The growth of the plant phenotyping industry in Europe over the assessment period is due to the large-scale presence of key participants such as BASF SE, Heinz Walz, KeyGene, Rothamsted, and LemnaTec in European countries. Apart from this, the rise in plant phenotyping initiatives and programs by firms has helped the latter establish a strong position in the European plant phenotyping market. This will also account notably for the growth of the regional market over the coming years. For the record, Europe had launched ventures such as European Plant Phenotyping Project. Reportedly, other kinds of ventures introduced in Europe include UK Plant Phenomics Network, Plant Phenotyping Network, and Phenome French Plant Phenotyping Network. All these aforementioned aspects will drive regional market trends.

Plant Phenotyping Market: Competitive Players

Key players profiled in the study and influencing industry growth are:

- KeyGene N.V.

- LemnaTec GmbH

- The Vienna Biocenter Core Facilities

- Delta-T Devices

- BASF SE

- Heinz Walz GmbH

- Rothamsted Research

- Phenospex

- WPS Office

- Photon Systems Instruments

- Qubit Systems

- Phenomix Corporation

The global Plant Phenotyping Market is segmented as follows:

By Product

- Equipment

- Regulatory Submissions

- Software

- Sensors

By Application

- Plant Research

- Breeding

- Product Development

- Quality Assessments

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Plant phenotyping is the process of measuring and analyzing observable traits of plants, such as growth, morphology, physiology, and productivity. It helps researchers and breeders understand plant performance under various environmental conditions and aids in improving crop yield, resilience, and efficiency.

According to study, the Plant Phenotyping Market size was worth around USD 255.19 billion in 2023 and is predicted to grow to around USD 621.71 billion by 2032.

The CAGR value of Plant Phenotyping Market is expected to be around 10.4% during 2024-2032.

Europe has been leading the Plant Phenotyping Market and is anticipated to continue on the dominant position in the years to come.

The Plant Phenotyping Market is led by players like KeyGene N.V., LemnaTec GmbH, The Vienna Biocenter Core Facilities, Delta-T Devices, BASF SE, Heinz Walz GmbH, Rothamsted Research, Phenospex, WPS Office, Photon Systems Instruments, Qubit Systems, and Phenomix Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed