Plant Milk Market Size, Share, Growth Analysis Report, 2032

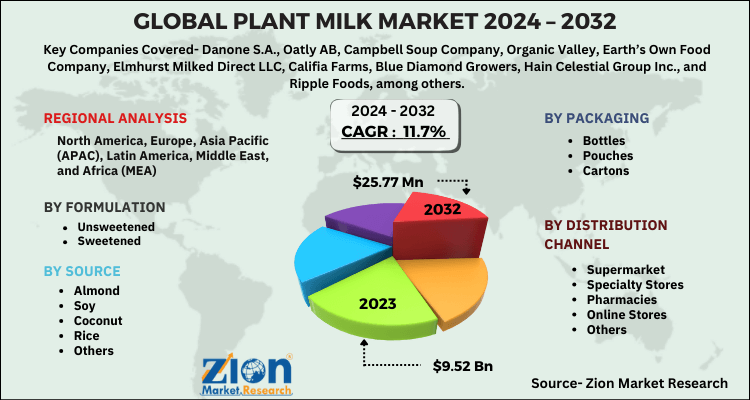

Plant Milk Market By Source (Almond, Soy, Coconut, Rice, and Others), By Distribution Channel (Supermarket, Specialty Stores, Pharmacies, Online Stores, and Others), By Formulation (Unsweetened and Sweetened), By Packaging (Bottles, Pouches, and Cartons), By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

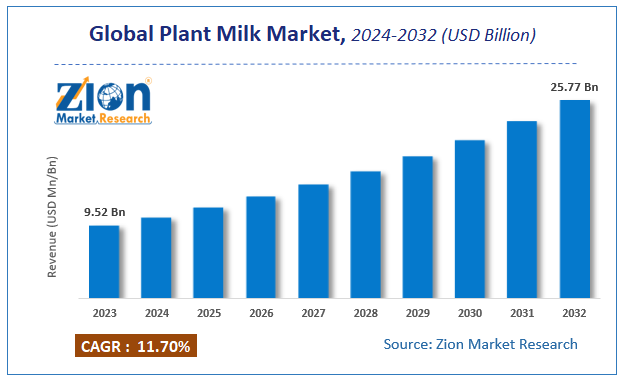

| USD 9.52 Billion | USD 25.77 Billion | 11.7% | 2023 |

Plant Milk Market Insights

Zion Market Research has published a report on the global Plant Milk Market, estimating its value at USD 9.52 Billion in 2023, with projections indicating that it will reach USD 25.77 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 11.7% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Plant Milk Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Plant Milk Market: Overview

Plant milk, also known as Non-Dairy or Milk Alternative Beverage, is prepared from water-based plant extract. It is extracted from sources like Almonds, Soy, Coconut, and Rice, among others, as an alternative to dairy milk and other animal milk. The beverage is consumed as a vegan product and adds up many nutritional values along with proteins, vitamins, and minerals. Products prepared from Plant Milk are vegan cheese, soy yogurt, and ice cream, among others.

The market is primarily driven by the growing number of consumers preferring vegan food, their awareness about health, and high nutritional values. The market that started with only Soy and Almond Milk is now expanded to various options, and consumers are looking for better products for Planet Earth. In addition to this, new technologies and manufacturing processes have been adopted by brands and companies to explore new bases to find more alternatives. This trend is expected to continue over the forecast period.

COVID-19 Impact Analysis

The unprecedented interruptions caused by COVID-19 affected the Plant Milk Market negatively. With production lines paused, the supply chain disrupted, and the demand from consumers abridged, the market saw very slow growth. The order for these alternative dairy products in places like hotels and restaurants was declined.

However, some people, since it is high in nutritional value, purchase through e-commerce services. Manufacturing operations have been allowed to start in the latter half of 2020 and are likely to boost the market.

Plant Milk Market: Growth Factors

The Global Plant Milk Market is generating a lot of demand because of the surge in consumer preference for lactose-free food products. Due to rising lactose intolerance and dairy milk allergies among consumers, there has been significant growth in dairy alternative milk. Lactose, which is the main carbohydrate in dairy products, causes bloating, diarrhea, and abdominal cramps. Consumers are now more aware of having healthy eatable food products, which will boost the market during the forecasted period.

The increasing demand for organic foods and beverages has boosted the Plant Milk Market There has been a change in consumer preference, owing to rich and healthy benefits like boosting metabolism and strengthening immunity. Additionally, these products have anti-oxidants and omega-3 fatty acids, making them superior to conventional dairy milk.

Plant Milk Market: Segmentation Analysis

By Source Segment Analysis

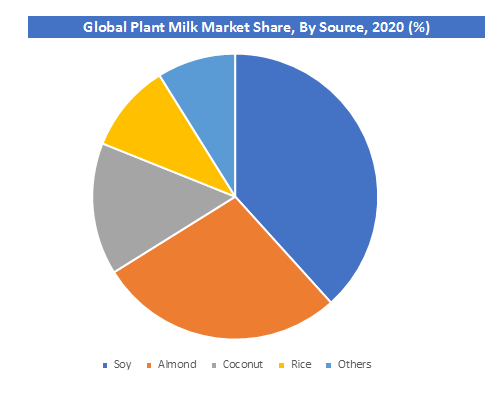

Almond Milk Segment held a share of 29.82% in 2023. It has been widely accepted due to its creamy texture and health benefits, as it helps against weight control, acts as a substitute for milk for lactose intolerant people, and strengthens the bones and joints. Currently, new-age consumers are demanding healthy alternatives to dairy products and meats, which has allowed this segment to grow immensely. Many manufacturers in countries like the U.S. and Canada have started offering people looking for healthy drinks, and high-quality rich almond milk. People adhering to vegan foods will drive the overall segment.

Soy Milk Segment is expected to grow at a CAGR of 12.41% during the year 2024 to 2032. It contains a high amount of proteins and has low calories. Soy Milk is mainly preferred by people having cholesterol and heart problems. It also reduces inflammation in the body, as it contains isoflavones. Coconut, Rice, and Others form the Source type segment.

By Distribution Channel Segment Analysis

The Supermarkets Segment held a significant share of the Global Plant Milk Market. This is attributed to the rising convenience offered by the stores. Supermarkets and Hypermarkets are preferred due to their high range of variety available at the stores. Consumers see the distribution of all the nutrients and other vitamins on the pack, favoring a lot to shop from the supermarkets. These mainstream stores had significant shares due to the increasing income of the consumers in the developed regions.

Online Stores are expected to generate significant revenue over the forecasting period. It will also be the fastest-growing segment in the Plant Milk Market. This is attributed to easy accessibility and low cost as compared to other segments. Online stores offer a discounted rate as their marketing strategy, and the increasing consumer trend of buying all appliances in one touch will drive the segment.

Specialty Stores, Pharmacies, and Others form the Distribution Channel type segment.

Plant Milk Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plant Milk Market |

| Market Size in 2023 | USD 9.52 Billion |

| Market Forecast in 2032 | USD 25.77 Billion |

| Growth Rate | CAGR of 11.7% |

| Number of Pages | 205 |

| Key Companies Covered | Danone S.A., Oatly AB, Campbell Soup Company, Organic Valley, Earth’s Own Food Company, Elmhurst Milked Direct LLC, Califia Farms, Blue Diamond Growers, Hain Celestial Group Inc., and Ripple Foods, among others. |

| Segments Covered | By Source, By Distribution Channel, By Formulation, By Packaging, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

By Formulation Segment Analysis

The unsweetened Milk Segment is projected to grow at a CAGR of around 12.70% from 2024 to 2032. It is attributed to rising consumer awareness towards sugar-free and gluten-free products. It also provides more calcium than other types of milk.

Sugar-free milk lessens the chances of getting diabetes and heart diseases with the same or more nutrients and vitamins as compared to other conventional dairy. It can blend with various foods and other beverages. Hence, it is expected to dominate the market over the forecasted period.

By Packaging Segment Analysis

Cartons Packaging Segment held a significant share in the Global Plant Milk Market. The rise in urbanization and its trends of packed food products will drive the market significantly. Consumers are attracted to the design of packaging with new fancy packaging in the industry. The packed food or beverage is at times easy to carry while traveling, and the new-age consumers prefer having it. Many manufacturers have turned up for packaging of cartons having significant recycling properties.

The bottles segment will grow over the forecasted period due to increased awareness of green and sustainable initiatives. The government is coming up with many initiatives towards sustainable packaging products. This trend is supposed to drive the market. Also, awareness among the manufacturers to manufacture recyclable and reusable bottle packaging will propel the segment, keeping in mind the environmental concerns. Pouches form the last packaging segment for this market.

Plant Milk Market: Regional Analysis

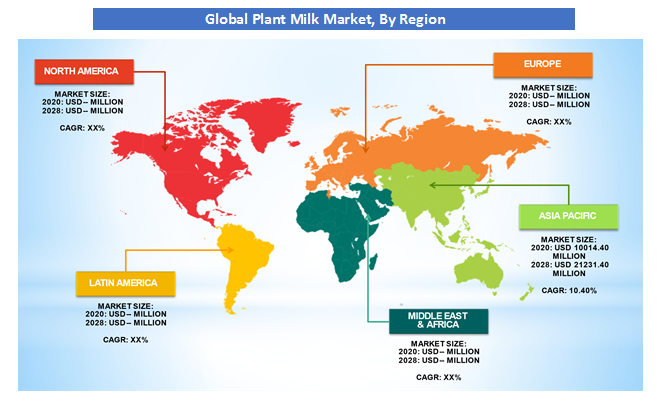

Asia Pacific is projected to grow at a CAGR of 12.4% during the forecast period. The Asia Pacific is likely to witness a significant increase in demand because of the increasing shift towards plant-based food, increasing urbanization, and awareness of healthy food. More and more consumers prefer healthy lifestyles and thereby choose healthy food alternatives. There has been an increase in awareness of sustainability over the years in APAC regions. These regions are also the source of many raw materials used in Plant milk, which propels the market significantly.

North America is expected to hold a significant share of the global Plant Milk Market due to the rising trend of Vegan Food. The U.S. and Canada are among many countries where there is rising awareness about having a healthy life with nutrient-rich food. Many countries in North America have lactose intolerant and diabetic populations, and these people are a significant contributor to the Plant Milk Market. These are essential factors to boost the market demand.

Plant Milk Market: Competitive Analysis

Some of the key players in the Plant Milk Market include:

- Danone S.A.

- Oatly AB

- Campbell Soup Company

- Organic Valley

- Earth’s Own Food Company

- Elmhurst Milked Direct LLC

- Califia Farms

- Blue Diamond Growers

- Hain Celestial Group Inc.

- Ripple Foods

These key players are focusing on business expansion to grow their footprints in other countries. Other strategies like improvement in quality and new product development are likely to boost and capture the market significantly. Companies like Earth’s Own Food Company are coming up with new flavored products in their beverage segment to meet the rising demand of consumers.

The Global Plant Milk Market is segmented as follows:

By Source

- Almond

- Soy

- Coconut

- Rice

- Others

By Distribution Channel

- Supermarket

- Specialty Stores

- Pharmacies

- Online Stores

- Others

By Formulation

- Unsweetened

- Sweetened

By Packaging

- Bottles

- Pouches

- Cartons

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global Plant Milk market size was worth around USD 9.52 billion in 2023 and is expected to reach USD 25.77 billion by 2032.

The global Plant Milk market is expected to grow at a CAGR of 11.7% during the forecast period.

Some of the key factors driving the Global Plant Milk Market growth are a heavy surge in consumer preference for lactose-free food products and increasing demand for organic foods and beverages.

Asia Pacific is expected to dominate the Plant Milk market over the forecast period.

Some of the key players in the Plant Milk Market include Danone S.A., Oatly AB, Campbell Soup Company, Organic Valley, Earth’s Own Food Company, Elmhurst Milked Direct LLC, Califia Farms, Blue Diamond Growers, Hain Celestial Group Inc., and Ripple Foods, among the others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed