Pharmaceutical Pouches Market Size, Share, And Growth Report 2032

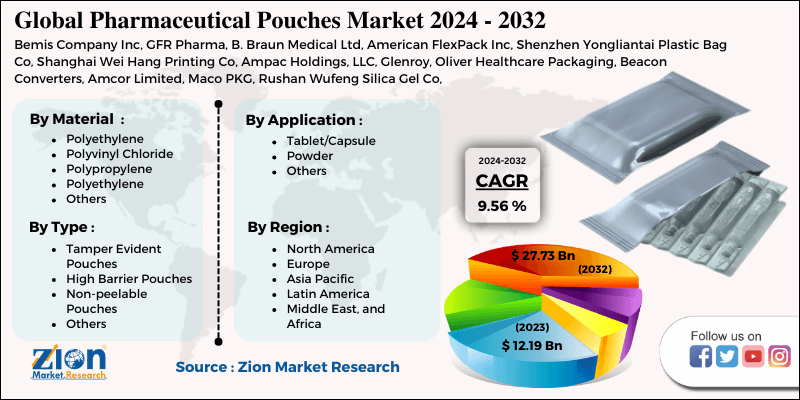

Pharmaceutical Pouches Market By Material (Polyethylene, Polyvinyl Chloride, Polypropylene, Polyethylene, and Others), By Type (Tamper Evident Pouches, High Barrier Pouches, Non-peelable Pouches, and Others), By Application (Tablet/Capsule, Powder, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

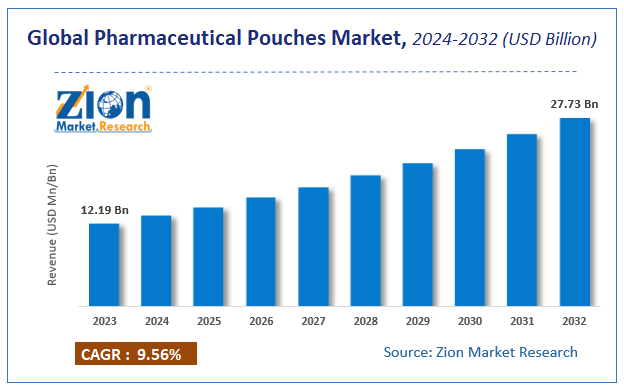

| USD 12.19 Billion | USD 27.73 Billion | 9.56% | 2023 |

Pharmaceutical Pouches Market Size

Zion Market Research has published a report on the global Pharmaceutical Pouches Market, estimating its value at USD 12.19 Billion in 2023, with projections indicating that it will reach USD 27.73 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 9.56% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Pharmaceutical Pouches Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Global Pharmaceutical Pouches Market Overview

Pharmaceutical pouches are the packages and packaging processes for pharmaceutical products. The pouch can be made of several materials such as Polyethylene, Polyvinyl Chloride, Polypropylene, and Polyethylene. , Its application is based on the responsiveness of the pharmaceutical products to be packaged. The pouch must ensure that the pharmaceutical product remains firm throughout its shelf life. Well-organized packaging of medicines is important in maintaining sterility and free from any kind of infection which may otherwise be harmful for the patients. Proper pharmaceutical packaging also provides the medicines a protection from physical damage and is crucial to maintain the functionality of them.

Rising awareness of environmental issues due to old-age packaging material, increasing safety concerns and the adoption of new regulatory standards for packaging recycling is also driving the pharmaceutical pouches industry worldwide.

COVID-19 Impact Analysis

The COVID-19 pandemic has brought loud focus on the need for health care reforms to endorse universal availability to affordable care and bridge geographic, economic, and social divisions. Most countries may have experienced disruption in pharma supply chain because of their dependency on China for APIs and excipients but countries and companies do have supply chain resilience as one of the near-term priorities. COVID-19 has highlighted issues like re-shoring, near-shoring and shortening supply chains. COVID-19 has clearly highlighted the importance of a strong health care system, the lack of which can put the global pharmaceutical pouches market and society at risk. Industry players need to learn from the challenged faced during pandemic and promptly develop the required healthcare infrastructure and make it available to the entire population. The consumers have become more aware and demanding of proper and safe packaging due to the pandemic. The supply chain may have been hampered because of the lockdown situation in many countries but the smooth and steady supply is still the focus and market has seen a sharp increase than before.

Pharmaceutical Pouches Market: Growth Factors

There has been a growth in the pharmaceutical industry and in demand of healthcare products in emerging economies like India, China, and Brazil with an increase in population, disposable income and growing focus on increasing life expectancy. With the increase in pharmaceutical industry, proper packaging in pharmaceutical is on the rise with focus on sustainability by adoption of biodegradable and recyclable materials. Also, the growing demand or convenient packaging is expected to create new growth opportunities for the manufacturers. The busy schedule and rapidly changing lifestyle will lead to increasing consumers’ adoption of easy-to-swallow medicines, leading to the growth in demand for the powdered and liquid form of medicine, which will give rise to those pouches used for powdered and liquid medicines such as sachets. However, because of non-biodegradable features plastic packaging is expected to face a hindrance in growth. The rise in diseases such as cancer, diabetes, obesity, and spread of sudden COVID-19 has opened an opportunity for new healthcare initiatives.

Pharmaceutical Pouches Market: Segmentation

Material Segment Analysis Preview

The global market for the pharmaceuticals pouch is fragmented into its material type, product type, and application. On the basis of the type of the material, the segment is sub-segmented into polyethylene, polyvinyl chloride, polypropylene, polyethylene terephthalate, and others which include coated paper, aluminum, and plastic

Type Segment Analysis Preview

On the basis of the type of the product, the market is categorized into tamper evident pouches, high barrier pouches, and non-peelable pouches and some others like breathable plastic pouches.

Pharmaceutical Pouches Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical Pouches Market |

| Market Size in 2023 | USD 12.19 Billion |

| Market Forecast in 2032 | USD 27.73 Billion |

| Growth Rate | CAGR of 9.56% |

| Number of Pages | 155 |

| Key Companies Covered | Bemis Company Inc, GFR Pharma, B. Braun Medical Ltd, American FlexPack Inc, Shenzhen Yongliantai Plastic Bag Co, Shanghai Wei Hang Printing Co, Ampac Holdings, LLC, Glenroy, Oliver Healthcare Packaging, Beacon Converters, Amcor Limited, Maco PKG, Rushan Wufeng Silica Gel Co, Qingdao Huakang Plastic Packaging Co, Shandong Mingda Packing Product Co, and Dongguan Hehui Packaging Materials |

| Segments Covered | By Material, By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

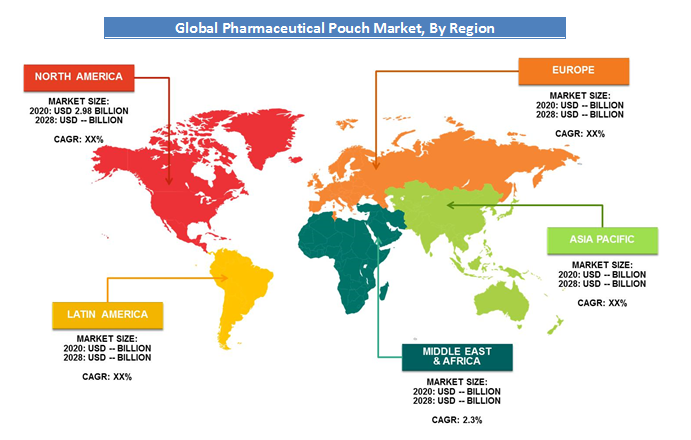

Pharmaceutical Pouches Market: Regional Analysis

European region held a share of over 20% in 2020. This is attributed to the presence of major market players and dominance in the market such as Amcor PLC. Growing demand in the pharmaceutical sector is anticipated to propel the market growth from 2024 to 2032.

Asia Pacific region is projected to grow at a CAGR of over 4% during the forecast period. This surge is due to the increasing concern in safe and proper packaging in the region. This is attributed to the increasing demand from China and India.

In the Middle-East region, Saudi Arabia is the largest economy both by GDP and population, it has one of the largest pharmaceuticals market in the Gulf Cooperation Council (GCC) region. There is a positive impact on Saudi Arabia pharmaceutical pouch market. Opportunities for pharmaceutical pouch manufacturers are expected to grow significantly in Asia Pacific because of untapped market and rising demand in pharmaceutical products.

Pharmaceutical Pouches Market: Competitive Players

The key market players that are involved in the pharmaceuticals pouch market include:

- Bemis Company Inc.

- GFR Pharma

- B. Braun Medical Ltd.

- American FlexPack Inc.

- Shenzhen Yongliantai Plastic Bag Co.

- Shanghai Wei Hang Printing Co.

- Ampac Holdings LLC

- Glenroy

- Oliver Healthcare Packaging

- Beacon Converters

- Amcor Limited

- Maco PKG

- Rushan Wufeng Silica Gel Co.

- Qingdao Huakang Plastic Packaging Co.

- Shandong Mingda Packing Product Co.

- Dongguan Hehui Packaging Materials

- Among others

The companies are engaged in several growth and expansion strategies to gain a competitive advantage. Industry players also follow value chain integration with business operations in multiple stages of the value chain. The market players are benefiting from innovation, primarily due to the presence of semi-differentiated offerings among the players in the different regions.

The global pharmaceutical pouch market is segmented as follows:

By Material

- Polyethylene

- Polyvinyl Chloride

- Polypropylene

- Polyethylene

- Others

By Type

- Tamper Evident Pouches

- High Barrier Pouches

- Non-peelable Pouches

- Others

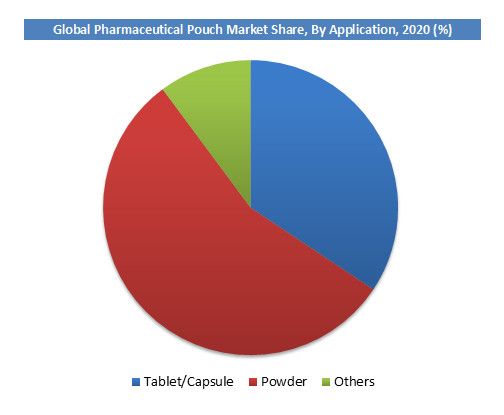

By Application

- Tablet/Capsule

- Powder

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pharmaceutical pouches are specialized packaging solutions designed to store and protect medications, ensuring their stability, safety, and efficacy. Made from materials like foil, plastic, or laminates, they provide a barrier against moisture, light, and contaminants, commonly used for powders, tablets, and liquid drugs.

According to study, the Pharmaceutical Pouches Market size was worth around USD 12.19 billion in 2023 and is predicted to grow to around USD 27.73 billion by 2032.

The CAGR value of Pharmaceutical Pouches Market is expected to be around 9.56% during 2024-2032.

North America has been leading the Pharmaceutical Pouches Market and is anticipated to continue on the dominant position in the years to come.

The Pharmaceutical Pouches Market is led by players like Bemis Company Inc, GFR Pharma, B. Braun Medical Ltd, American FlexPack Inc, Shenzhen Yongliantai Plastic Bag Co, Shanghai Wei Hang Printing Co, Ampac Holdings, LLC, Glenroy, Oliver Healthcare Packaging, Beacon Converters, Amcor Limited, Maco PKG, Rushan Wufeng Silica Gel Co, Qingdao Huakang Plastic Packaging Co, Shandong Mingda Packing Product Co, and Dongguan Hehui Packaging Materials.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed