Pharmaceutical Water Market Size, Share, Trends, Growth and Forecast 2034

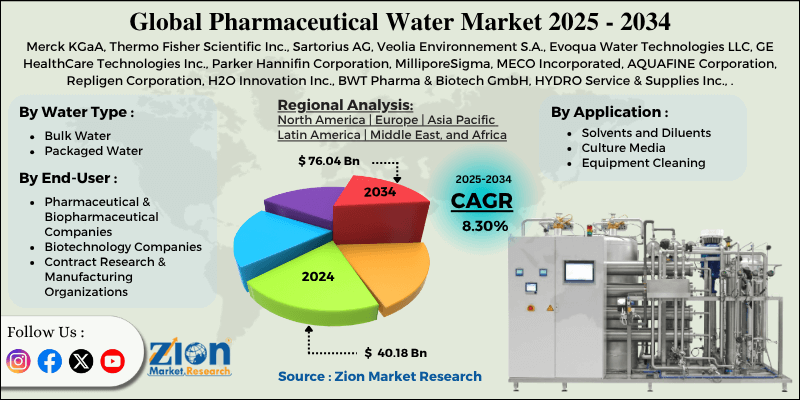

Pharmaceutical Water Market By Water Type (Bulk Water, Packaged Water), By Application (Solvents and Diluents, Culture Media, Equipment Cleaning, and Others), By End-User (Pharmaceutical & Biopharmaceutical Companies, Biotechnology Companies, Contract Research & Manufacturing Organizations, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

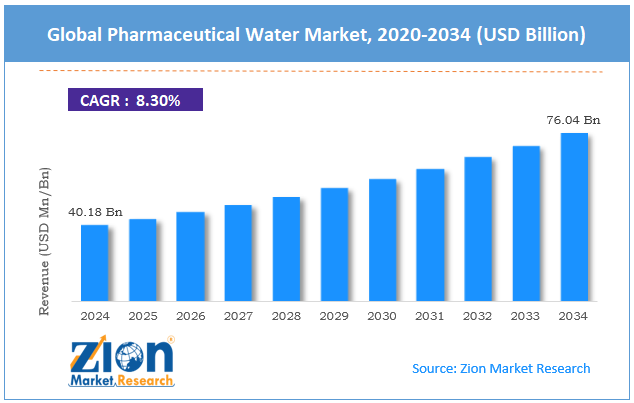

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 40.18 Billion | USD 76.04 Billion | 8.30% | 2024 |

Pharmaceutical Water Industry Perspective:

The global pharmaceutical water market size was worth around USD 40.18 billion in 2024 and is predicted to grow to around USD 76.04 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.30% between 2025 and 2034.

Pharmaceutical Water Market: Overview

Pharmaceutical water refers to highly purified water used in the manufacturing and formulation of pharmaceutical products. It serves as a vital element and cleaning agent in processes that require stringent chemical and microbial quality standards. Every water type is modified for specific applications, such as drug synthesis, equipment rinsing, and the preparation of intravenous solutions.

The global pharmaceutical water market is projected to experience momentum driven by the growing demand for Injectables and biologics, the expansion of pharmaceutical manufacturing facilities, and advancements in water purification. The growth of injectable drugs and biologics needs WFI-grade water with optimal purity standards. This trend notably drives the demand for high-grade pharmaceutical water systems.

Additionally, the proliferation of pharmaceutical production plants, primarily in developing nations such as Brazil and India, is increasing the demand for localized pharmaceutical-grade water production. Moreover, advancements in ozonation, membrane filtration, vapor compression distillation, and electrodeionization (EDI) have enhanced energy efficiency, water purity, and reliability, motivating pharmaceutical companies to upgrade older machines.

Nevertheless, the global market is hindered by complex documentation and validation, as well as technological obsolescence. Regulatory bodies require a strict system validation process comprising operational qualification (OQ), installation qualification (IQ), and performance qualification (PQ). This procedure is lengthy and may delay implementation. Rapid advances in water purification may render existing systems obsolete, pressuring companies to reinvest in new technologies to comply with updated rules and efficiency standards.

Nonetheless, the pharmaceutical water industry is anticipated to experience substantial growth over the coming years due to the adoption of mobile and modular water systems, integration with IoT and Industry 4.0, and the development of energy-efficient and environmentally friendly water systems.

Modular, mobile, and pre-validated pharmaceutical water systems are gaining prominence due to their speed of deployment, scalability, and flexibility in contract manufacturing settings. Advanced monitoring systems that utilize predictive analytics, IoT sensors, and real-time compliance tracking can enhance efficacy, ensure consistent water quality, and minimize downtime, thereby offering a technological edge.

Additionally, there is a growing demand for sustainable pharmaceutical water systems that utilize less energy, reduce carbon footprints, and recycle water. This creates opportunities for advancements in eco-friendly models.

Key Insights:

- As per the analysis shared by our research analyst, the global pharmaceutical water market is estimated to grow annually at a CAGR of around 8.30% over the forecast period (2025-2034)

- In terms of revenue, the global pharmaceutical water market size was valued at around USD 40.18 billion in 2024 and is projected to reach USD 76.04 billion by 2034.

- The pharmaceutical water market is projected to grow significantly due to the increasing demand for biopharmaceuticals, expanding global manufacturing capacities, and growth in Contract Development and Manufacturing Organizations (CDMOs) and contract manufacturing.

- Based on water type, the bulk water segment is expected to lead the market, while the packaged water segment is expected to grow considerably.

- Based on application, the solvents and diluents is the largest segment, while the equipment cleaning segment is projected to witness substantial revenue growth over the forecast period.

- Based on end-user, the pharmaceutical & biopharmaceutical companies segment is expected to lead the market compared to the contract research & manufacturing organizations segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Pharmaceutical Water Market: Growth Drivers

Expansion of production facilities and a rise in global pharmaceutical manufacturing propel market growth

The global pharmaceutical production capacity is expanding, particularly in developing regions such as Vietnam, Brazil, India, and China, resulting in increased demand for high-quality process water. Several global pharmaceutical companies are either building new facilities in Latin America and Asia Pacific or outsourcing to enhance scalability and reduce costs.

With India leading as the key supplier of generic medicines on a global scale, the development of novel production lines innately fuels the demand for purified water systems. Lupin, Sun Pharma, and Dr. Reddy’s have stated capacity growth to meet the ever-increasing demand from Europe and the United States.

Stringent regulatory frameworks stimulating high-purity water standards notably fuel the market growth

Strict water quality protocols mandated by agencies such as EMA, FDA, ICH, JP, and USP are driving investments in compliant distribution networks and advanced water purification systems. Regulations mandate defined chemical and microbiological limits for diverse water grades. Hence, heavy investments ultimately drive the growth of the global pharmaceutical water market.

For example, the USP monograph for water for injection now permits non-distillation techniques, such as reverse osmosis (RO), making system upgrades essential. The (Ph. Eur.) The European Pharmacopoeia also reviewed its WFI standards in 2024 to address the removal of endotoxin in closed-loop systems, which impacts the design of water systems in the European Union.

Pharmaceutical Water Market: Restraints

Water scarcity concerns and environmental impact negatively impact market progress

Pharmaceutical water systems consume substantial quantities of energy and water, particularly in multi-step processes such as deionization and distillation. This raises ecological sustainability concerns, primarily in Water-stressed regions such as India, the Middle East, and certain parts of the United States.

An analysis by the Environmental Protection Agency revealed that pharmaceutical manufacturing facilities account for approximately 10% of industrial water waste in the United States, contributing to water scarcity. In addition, the WHO highlighted the risks of pharmaceutical waste contaminating natural water sources due to ineffective wastewater treatment in a few developing economies.

Pharmaceutical Water Market: Opportunities

Integration of automation and IoT in water system monitoring is opportune for market growth

The incorporation of AI, IoT, and cloud-based automation in pharmaceutical water systems is offering opportunities for more predictive and smarter operations in the pharmaceutical water industry. Real-time monitoring of TOC, microbial loads, conductivity, and flow rates enhances regulatory compliance, reduces costs, and improves uptime by minimizing downtime and manual testing.

Companies like Bosch, Suez, and Grundfos have built smart water management platforms using SCADA, machine learning, and edge computing. For example, Grundfos iSOLUTIONS enables flow control and predictive pump management in pharmaceutical loops, resulting in an 18% decrease in energy consumption, as demonstrated in a 2024 pilot with a Germany-based Contract Development and Manufacturing Organization (CDMO).

Pharmaceutical Water Market: Challenges

Repeated supply chain disturbances in water system components restrict the market growth

The global market relies on a stable supply of specialized components, including UV lights, membranes, ozone generators, and stainless steel piping. Worldwide supply chain barriers, particularly following the COVID-19 pandemic and during periods of geopolitical stress, have delayed replacements and installations.

A BioProcess International report for 2024 states that lead times for pharmaceutical-grade reverse osmosis (RO) membranes have increased from 1 to 3 months. For distribution units, delays may range from 6 to 9 months due to international shipping delays and component shortages.

Pharmaceutical Water Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Pharmaceutical Water Market |

| Market Size in 2024 | USD 40.18 Billion |

| Market Forecast in 2034 | USD 76.04 Billion |

| Growth Rate | CAGR of 8.30% |

| Number of Pages | 212 |

| Key Companies Covered | Merck KGaA, Thermo Fisher Scientific Inc., Sartorius AG, Veolia Environnement S.A., Evoqua Water Technologies LLC, GE HealthCare Technologies Inc., Parker Hannifin Corporation, MilliporeSigma, MECO Incorporated, AQUAFINE Corporation, Repligen Corporation, H2O Innovation Inc., BWT Pharma & Biotech GmbH, HYDRO Service & Supplies Inc., Aquatech International LLC., and others. |

| Segments Covered | By Water Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Pharmaceutical Water Market: Segmentation

The global pharmaceutical water market is segmented based on water type, application, end-user, and region.

Based on water type, the global pharmaceutical water industry is divided into bulk water and packaged water. The bulk water segment holds a considerable market share. It comprises water for injection and purified water produced on-site, which is distributed via piping systems. Bulk water is broadly used in cleaning equipment, formulation processes, and large-scale drug manufacturing. Its prominence stems from its continuous availability, cost-effectiveness, biopharmaceutical, and high-volume pharmaceutical production.

Based on application, the global pharmaceutical water market is segmented into solvents and diluents, culture media, equipment cleaning, and others. The solvents and diluents segment leads the global market, accounting for a leading revenue share. High-purity water is a crucial component in the formulation of liquid pharmaceuticals, including ophthalmics, oral solutions, and injectables. It is essential as a diluent in parenteral vaccines and drugs, as well as a core solvent for active pharmaceutical ingredients (APIs). With the growing production of injectable biologics, vaccines, and generics, the segment leads the market, registering for over 50 percent of the overall application-based industry share.

Based on end-user, the global market is segmented into pharmaceutical & biopharmaceutical companies, biotechnology companies, contract research & manufacturing organizations, and others. Pharmaceutical and biopharmaceutical companies held a dominant share in the global market. These organizations require larger volumes of purified water for production, formulation, sterile processing, quality control, and cleaning purposes. The growth of injectable drug pipelines, oral solid dosage drugs, and monoclonal antibodies (mAbs) drives continuous demand for purified water and water for injection.

Pharmaceutical Water Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is expected to continue its leadership in the global pharmaceutical water market due to a strong biopharmaceutical and pharmaceutical industry base, improved manufacturing facilities and compliance network, and rising outsourcing and CDMO industry.

North America, particularly the United States, is home to prominent pharmaceutical companies, including Johnson & Johnson, Pfizer, and Merck. These companies drive significant demand for injectable-grade and purified water in pharmaceutical production and formulation. The United States alone contributes over 40% of the global pharmaceutical output, thereby increasing its regional dominance.

Moreover, the region leads in terms of FDA-regulated and GMP-compliant facilities, which must maintain high-purity water quality measures through validated procedures. The United States Food and Drug Administration (FDA) strictly mandates water quality principles under 21 CFR Part 211. This fuels companies to invest in well-developed purification technologies, such as ultrafiltration, reverse osmosis, and distillation.

North America boasts a strong presence of contract development and manufacturing organizations (CDMOs), including Thermo Fisher Scientific, Lonza, and Catalent. These businesses manufacture drugs for various pharmaceutical companies, requiring high-capacity and robust water storage and purification systems.

The Asia Pacific region holds a second-leading share in the global pharmaceutical water industry, driven by low-cost manufacturing, stringent regulatory reforms that fuel quality compliance, and growth in biosimilar and biologics production. APAC is home to the leading contract manufacturing organizations and active pharmaceutical ingredient producers.

Over 60% of global vaccines are produced by China and India, which primarily rely on ultra-pure water systems for the manufacture of injectable biologics and drugs. Rising outsourcing by Western pharma firms amplifies investments in local water purification infrastructure.

Moreover, regulatory bodies in the APAC region are streamlining GMP rules to comply with EU EMA and US FDA standards. China's NMPA and India's CDSCO (Central Drugs Standards Control Organization) have imposed fresh rules for water-for-injection and cleanroom systems. This pressure for regulatory compliance propels the demand for high-quality and validated pharmaceutical water technologies.

Additionally, the APAC region is a leading player in global biosimilar manufacturing, with a strong presence in countries such as India and South Korea. Biosimilars need highly purified water for final product formulation and cell culture media. Asia's biologics industry is projected to reach USD 100 billion by 2026, according to BioSpectrum Asia.

Pharmaceutical Water Market: Competitive Analysis

The key operating players in the global pharmaceutical water market include:

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Veolia Environnement S.A.

- Evoqua Water Technologies LLC

- GE HealthCare Technologies Inc.

- Parker Hannifin Corporation

- MilliporeSigma

- MECO Incorporated

- AQUAFINE Corporation

- Repligen Corporation

- H2O Innovation Inc.

- BWT Pharma & Biotech GmbH

- HYDRO Service & Supplies Inc.

- Aquatech International LLC.

Pharmaceutical Water Market: Key Market Trends

Growing adoption of membrane-based purification technologies:

Pharmaceutical companies are increasingly preferring membrane-based purification systems, such as ultrafiltration (UF), reverse osmosis (RO), and nanofiltration (NF). These systems offer reduced chemical use, high efficiency, and compliance with strict water quality standards.

Move toward modular and multi-use water systems:

Pharmaceutical companies are increasingly favoring multi-use and modular water systems to support rapid facility expansion and flexible manufacturing. The trend complies with the market’s move towards cost-effective, decentralized, and agile production.

The global pharmaceutical water market is segmented as follows:

By Water Type

- Bulk Water

- Packaged Water

By Application

- Solvents and Diluents

- Culture Media

- Equipment Cleaning

- Others

By End-User

- Pharmaceutical & Biopharmaceutical Companies

- Biotechnology Companies

- Contract Research & Manufacturing Organizations

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Pharmaceutical water refers to highly purified water used in the manufacturing and formulation of pharmaceutical products. It serves as a vital element and cleaning agent in processes that require stringent chemical and microbial quality standards.

The global pharmaceutical water market is projected to grow due to increasing demand for injectables and biologics, a rising focus on sterile manufacturing, and the growth of cell therapies and personalized medicine.

According to study, the global pharmaceutical water market size was worth around USD 40.18 billion in 2024 and is predicted to grow to around USD 76.04 billion by 2034.

The CAGR value of the pharmaceutical water market is expected to be approximately 8.30% from 2025 to 2034.

North America is expected to lead the global pharmaceutical water market during the forecast period.

The key players profiled in the global pharmaceutical water market include Merck KGaA, Thermo Fisher Scientific Inc., Sartorius AG, Veolia Environnement S.A., Evoqua Water Technologies LLC, GE HealthCare Technologies Inc., Parker Hannifin Corporation, MilliporeSigma, MECO Incorporated, AQUAFINE Corporation, Repligen Corporation, H2O Innovation Inc., BWT Pharma & Biotech GmbH, HYDRO Service & Supplies, Inc., and Aquatech International LLC.

The report examines key aspects of the venous stents market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that influence the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed