Global Permanent Magnet Motor Market Size, Share, Growth Analysis Report - Forecast 2034

Permanent Magnet Motor Market By Type (AC Motor, DC Motor), By Power Rating (Up to 25 kW, 25–100 kW, Above 100 kW), End-Use Industry (Automotive, Industrial, Consumer Electronics, Aerospace & Defense, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034 -

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 47.91 Billion | USD 133.40 Billion | 10.78% | 2024 |

Permanent Magnet Motor Industry Perspective:

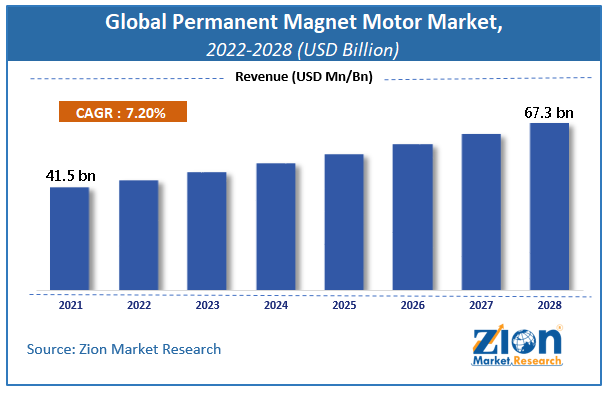

The global permanent magnet motor market size was worth around USD 47.91 Billion in 2024 and is predicted to grow to around USD 133.40 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 10.78% between 2025 and 2034. The report analyzes the global permanent magnet motor market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the permanent magnet motor industry.

The report analyzes the permanent magnet motor market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the permanent magnet motor market.

Permanent Magnet Motor Market: Overview

A permanent magnet motor is an electric motor with permanent magnets as well as windings on its field, rather than only windings. The basic operation of a permanent magnet motor is similar to that of other electric motors, the outer stator houses windings of coils fed by a power source, and the rotor revolves freely thanks to the forces given by the stator coils. Permanent magnet motors come in bigger sizes, have more horsepower, and may compete with induction motors in terms of strength, efficiency, and a number of applications.

Key Insights

- As per the analysis shared by our research analyst, the global permanent magnet motor market is estimated to grow annually at a CAGR of around 10.78% over the forecast period (2025-2034).

- Regarding revenue, the global permanent magnet motor market size was valued at around USD 47.91 Billion in 2024 and is projected to reach USD 133.40 Billion by 2034.

- The permanent magnet motor market is projected to grow at a significant rate due to increasing demand for energy-efficient motors, rising electric vehicle adoption, advancements in magnetic materials, and industrial automation trends.

- Based on Type, the AC Motor segment is expected to lead the global market.

- On the basis of Power Rating, the Up to 25 kW segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-Use Industry, the Automotive segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

COVID-19 Impact:

Due to the COVID-19 pandemic, supply chains may feel the most substantial near-term consequences on permanent magnet motors that are already contracted or in the production process. Industry leaders expect supply and construction delays, either as a result of industry closures to prevent the spread of the coronavirus or as a result of workers being ill. Many of the components and parts used in the manufacture of permanent magnet motors are sourced from Europe, China, Asia Pacific, and portions of Europe.

Manufacturing interruptions in China and the United States may cause the permanent magnet motor industry to see a severe short-term drop. Furthermore, several nations' domestic currencies have declined as a result of the COVID-19 pandemic. There is a mismatch of supply and demand, which results in financial losses for metal manufacturers; also, critical components required in the construction of permanent magnet motors are often acquired in US dollars, which might result in higher component costs.

Permanent Magnet Motor Market: Growth Drivers

Increasing demand for energy-efficient and low-cost maintenance synchronized motors across different industries is likely to drive market growth.

Permanent magnet synchronized motors are significantly more efficient than induction motors, and they are the most power-dense traction motors on the market. As a result, the growing need for higher-efficiency motors is projected to fuel the demand for permanent magnet synchronous motors in a variety of sectors. Permanent magnet motors are used in most sectors, including electronics, textiles, and pulp & paper, to provide higher-functioning goods with more functionality (for instance, silent washing machines & fans, and improved low voltage to allow solar water pumps and deliver better performance on overcast days).

Permanent magnet motors are also being considered for HVAC applications in the residential and commercial sectors. Permanent magnet synchronous motors are predicted to be used in the majority of electric cars in the future (about 80 percent). Appliances with efficient permanent magnet motors consume 20-40 percent less energy than those with traditional alternating current motors. PM motors are also more dependable than traditional motors, which is a critical feature for appliances built for usage in off-grid or rural settings. These distinct qualities boost customer satisfaction in off-grid and weak-grid markets, encouraging them to spend more for higher-performing appliances.

Permanent Magnet Motor Market: Restraints

The high cost of permanent magnet motors may hinder the growth of the market

The increased cost of permanent magnet motors is one of the key constraints limiting their expansion. Permanent magnet motors are highly efficient, although they are expensive due to the usage of rare-earth magnets. Although some industrial and commercial electronics manufacturers are hesitant to invest in permanent magnet motors, this trend is expected to alter in the future period, as permanent magnet motors reduce maintenance costs, improving operations in both the industrial & commercial sectors and resulting in increased productivity.

Permanent Magnet Motor Market: Opportunities

The adoption of cost-effective ferrite permanent magnets offers significant opportunities for the market expansion

Permanent magnets made of rare-earth materials, which are extensively employed in permanent magnet motors, are costly. This is because pricey neodymium or samarium-cobalt magnets are used. As a result, ferrite magnets are employed to make low-cost permanent magnet motors. In addition, to be cost-effective, these ferrite permanent magnets are readily accessible in China and offer minimal current losses in low-frequency applications like motor drives. A motor using ferrite magnets, on the other hand, is expected to have roughly 30-50 percent of the power density of a rare-earth motor. Due to the high expense of rare-earth magnets, several industries are looking for ways to employ ferrites instead. The demand for ferrite permanent magnet motors is projected to increase as a result of this reason.

Permanent Magnet Motor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Permanent Magnet Motor Market |

| Market Size in 2024 | USD 47.91 Billion |

| Market Forecast in 2034 | USD 133.40 Billion |

| Growth Rate | CAGR of 10.78% |

| Number of Pages | 166 |

| Key Companies Covered | ABB Ltd., Siemens AG, Nidec Corporation, Mitsubishi Electric Corporation, Toshiba Corporation, Rockwell Automation, WEG S.A., Franklin Electric Co. Inc., Allied Motion Technologies Inc., Robert Bosch GmbH, Ametek Inc., Johnson Electric Holdings Ltd., YASA Limited, Traktionssysteme Austria, Hinetics, and others. |

| Segments Covered | By Type, By Power Rating, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Permanent Magnet Motor Market: Challenges.

Availability of inexpensive and low-quality electric motors in local markets poses a great challenge to the market.

With a large number of local and foreign companies, the permanent magnet motors industry is extremely fragmented. The regulated market mostly caters to industrial clients and maintains high product quality, whereas the unorganized market provides low-cost options for tapping local markets. In most countries, local makers of electric motors target the unorganized sector and fight fiercely with global suppliers in their marketplaces. Unorganized competitors offering low-cost, low-quality electric motors are presently posing a significant threat to industry leaders. This poses a significant impediment to the global permanent magnet motor market's expansion.

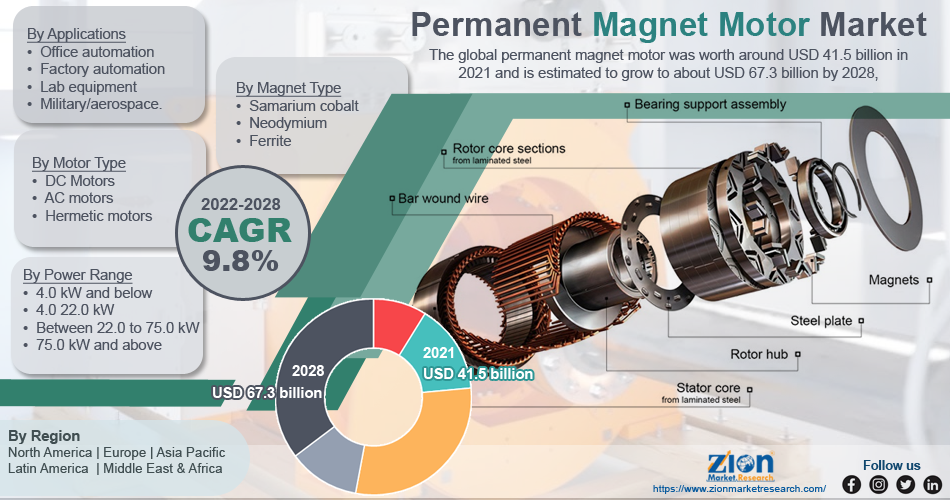

Permanent Magnet Motor Market: Segmentation

The global permanent magnet motor market is categorized into motor type, magnet type, power range, applications, and region. Based on motor type, the market is bifurcated into DC Motors, AC motors, and Hermetic motors. The magnet-type segment of the market is categorized into samarium cobalt, neodymium, and ferrite. By power range, the global permanent magnet motor market is divided into 4.0 22.0 kW, 4.0 kW & below, between 22.0 75.0 kW, and 75.0 kW and above. The application segment of the market comprised office automation, factory automation, lab equipment, and military/aerospace.

Recent Developments

- In December 2019, Rockwell Automation has introduced control of permanent magnet motors to its Powerflex 755T Drives series, extending the power ranges and functionalities of its TotalFORCE technology for industrial drives.

- In May 2020, Nidec Leroy-Somer launches Dyneo+, its new series of ultra-premium performance permanent magnet-assisted synchronous reluctance motors.

Permanent Magnet Motor Market: Regional Landscape

During the projection period of 2022 to 2028, Asia Pacific is expected to be the biggest share in the global permanent magnet motor market. The permanent magnet motor market in the Asia Pacific is growing as a result of increased investments in the automotive industry, particularly electric cars, and increased electronics production in the area. Furthermore, nations like China, Japan, and India are propelling the region's permanent magnet motor market forward. North America and Europe combinedly hold more than 55 percent of the market share.

Permanent Magnet Motor Market: Competitive Landscape

Key players functioning in the global permanent magnet motor market include

- ABB

- Siemens

- Rockwell Automation

- Nidec Corporation

- Johnson Electric

- Wolong Electric

- WEG

- Allied Motion

- AMETEK

- Toshiba

- Regal Beloit

- Yaskawa

- Liebherr

- Faulhaber

- TECO

- Dumore

- Kolmorgen

- Electrocraft

- Cartermotor Company

- Mark Elektriks

The global permanent magnet motor market is segmented as follows:

By Motor Type

- DC Motors

- AC motors

- Hermetic motors

By Magnet Type

- Samarium cobalt

- Neodymium

- Ferrite

By Power Range

- 4.0 kW and below

- 4.0 22.0 kW

- Between 22.0 to 75.0 kW

- 75.0 kW and above

By Applications

- Office automation

- Factory automation

- Lab equipment

- Military/aerospace.

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global permanent magnet motor market is expected to grow due to demand for energy-efficient motors in EVs, industrial automation, and renewable energy applications.

According to a study, the global permanent magnet motor market size was worth around USD 47.91 Billion in 2024 and is expected to reach USD 133.40 Billion by 2034.

The global permanent magnet motor market is expected to grow at a CAGR of 10.78% during the forecast period.

Asia-Pacific is expected to dominate the permanent magnet motor market over the forecast period.

Leading players in the global permanent magnet motor market include ABB Ltd., Siemens AG, Nidec Corporation, Mitsubishi Electric Corporation, Toshiba Corporation, Rockwell Automation, WEG S.A., Franklin Electric Co. Inc., Allied Motion Technologies Inc., Robert Bosch GmbH, Ametek Inc., Johnson Electric Holdings Ltd., YASA Limited, Traktionssysteme Austria, Hinetics, among others.

The report explores crucial aspects of the permanent magnet motor market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed