PCBN Cutting Tool Market Size, Share, Trends, Growth & Forecast 2034

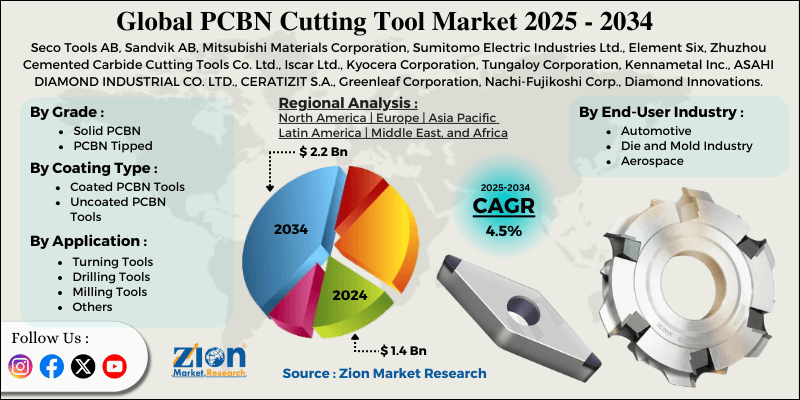

PCBN Cutting Tool Market By Grade (Solid PCBN and PCBN Tipped), By Coating Type (Coated PCBN Tools and Uncoated PCBN Tools), By Application (Turning Tools, Drilling Tools, Milling Tools, and Others), By End-User Industry (Automotive, Die and Mold Industry, Aerospace, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.4 Billion | USD 2.2 Billion | 4.5% | 2024 |

PCBN Cutting Tool Industry Perspective:

What will be the size of the global PCBN cutting tool market during the forecast period?

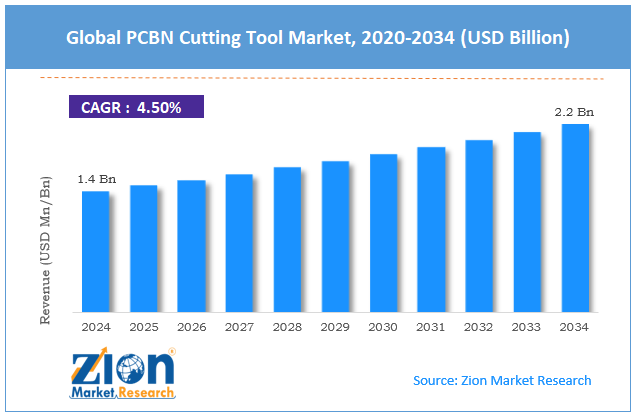

The global PCBN cutting tool market size was worth around USD 1.4 billion in 2024 and is predicted to grow to around USD 2.2 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global PCBN cutting tool market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2025-2034).

- In terms of revenue, the global PCBN cutting tool market size was valued at around USD 1.4 billion in 2024 and is projected to reach USD 2.2 billion by 2034.

- Rising demand for precision machining is expected to drive the PCBN cutting tool market.

- Based on the grade, in 2024, the Solid PCBN segment dominates the market.

- Based on the coating type, the coated PCBN tools captured the largest share of revenue in 2024.

- Based on the application, the milling tools dominate the market in 2024 and are expected to continue the same pattern over the projected period.

- Based on the end-user industry, the automotive segment captures a significant market share in 2024.

- Based on region, the Asia Pacific is expected to lead the PCBN cutting tool market over the projected period.

PCBN Cutting Tool Market: Overview

A PCBN cutting tool is a high-performance machining tool created by sintering tiny cubic boron nitride grains with ceramic or metallic binders at high pressure and temperature. PCBN tools are tough, stable at high temperatures, and wear-resistant. This means they can mill hardened ferrous materials, such as hardened steels and cast irons, as well as some superalloys, at high cutting speeds with perfect dimensional precision. PCBN cutting tools are used by manufacturers for hard turning, finishing, and semi-finishing since they can substitute grinding processes. At the same time, they improve surface finish, reduce machining time, and extend tool life in demanding industrial settings, including automotive, aerospace, die-and-mold, and precision engineering.

PCBN Cutting Tool Market: Dynamics

Growth Drivers

Why does the expansion of the automotive and aerospace industries drive the development of the PCBN cutting tool market?

The automotive and aerospace industries are growing rapidly, which is suitable for the PCBN cutting tool market, as these industries require high-precision machining of hard, heat-resistant materials. In the automotive industry, the growing production of electric vehicles, lightweight parts, and high-performance engines has led to more use of hardened steels and cast irons for gears, bearings, and transmission parts. PCBN tools are better at resisting wear and maintaining consistent surface quality.

In the aerospace industry, the need for more fuel-efficient planes and new propulsion systems requires that high-strength alloys and critical components be machined to very tight tolerances. PCBN cutting tools enable the machine to work quickly and steadily, resulting in extended tool life. This enables manufacturers to reduce cycle times, increase productivity, and maintain quality standards, thereby supporting market growth.

For instance, according to ACEA data, new EU car registrations increased by 1.8% in 2025 compared to the same period last year.

Restraints

High material & production costs impede the market growth

The PCBN cutting tool market isn't growing because the materials and production costs are too high. This is because the manufacturing process requires high pressures and temperatures, as well as expensive cubic boron nitride raw materials. Because of these factors, PCBN cutting tools cost a lot more than typical tools like coated carbide or ceramic tools. Because of this, end customers sensitive to pricing, especially small- and medium-sized machining firms, are sometimes unwilling to buy PCBN machines unless the performance advantages justify the initial cost. The high initial cost also increases the likelihood that tools will break or be misused, which can reduce adoption and limit market penetration, especially in production settings where cost is essential.

Opportunities

Will integration with Industry 4.0 and automation offer opportunities for expansion of the PCBN cutting tool market?

Integration with Industry 4.0 and automation will open up many new business opportunities, notably in the PCBN cutting tool sector. As manufacturers build smart factories and adopt CNC automation, robotics, and digital process control, they need cutting tools that can operate at high speeds with minimal human intervention. Because they are highly wear-resistant, thermally stable, and always perform well, PCBN cutting tools are ideal for automated, computer-controlled applications. These are all the things needed for unattended machining and lights-out manufacturing.

PCBN tools help prevent unexpected tool failures, reduce downtime, and boost overall equipment effectiveness (OEE) when used with Industry 4.0 technologies such as real-time tool condition monitoring, predictive maintenance, and data-driven optimization. Automation also likes tools that last longer and cut consistently, since fewer tool replacements and manual adjustments mean more output. As a result, the drive toward Industry 4.0 in the automotive, aerospace, and precision manufacturing industries is projected to create significant opportunities for PCBN tools, enabling the market to grow over the long term, even though the tools initially cost more.

Challenges

How do intense competition & price pressure pose a significant threat to the growth of the PCBN cutting tool industry?

The PCBN cutting tool industry is struggling to grow because better, cheaper options are available. For instance, coated carbide, ceramic, and PCD tools, which are less expensive, can perform several machining operations effectively. These other options typically provide a reasonable balance of performance and cost, particularly when PCBN’s high hardness or heat stability isn't required.

Businesses that are concerned about price value these solutions more because they require less upfront capital, can be used in more ways, and are less likely to fail. Because of this, PCBN instruments are only utilized for highly particular or very accurate tasks. This makes them less popular and puts more pressure on PCBN tool suppliers to do well. Therefore, the PCBN cutting tool market is hampered by intense competition.

PCBN Cutting Tool Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | PCBN Cutting Tool Market |

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2034 | USD 2.2 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 216 |

| Key Companies Covered | Seco Tools AB, Sandvik AB, Mitsubishi Materials Corporation, Sumitomo Electric Industries Ltd., Element Six, Zhuzhou Cemented Carbide Cutting Tools Co. Ltd., Iscar Ltd., Kyocera Corporation, Tungaloy Corporation, Kennametal Inc., ASAHI DIAMOND INDUSTRIAL CO. LTD., CERATIZIT S.A., Greenleaf Corporation, Nachi-Fujikoshi Corp., Diamond Innovations, and others. |

| Segments Covered | By Grade, By Coating Type, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

PCBN Cutting Tool Market: Segmentation

Grade Insights

Why do solid PCBN dominate the PCBN Cutting Tool market in 2024?

In 2024, the Solid PCBN segment dominates the market. It is growing because it does a great job of cutting hardened materials with high precision and high volume. Solid PCBN tools are made entirely of polycrystalline cubic boron nitride, not just PCBN tips. They are very hard, stable at high temperatures, and wear evenly, making them perfect for continuous cutting operations such as hard turning hardened steels, cast iron, and powder-metallurgy parts. In automated, CNC-intensive manufacturing setups, maintaining dimensional accuracy and surface finish at high cutting rates is essential, as it reduces cycle times and subsequent finishing procedures.

Although these solid PCBN tools initially cost more, industries such as automotive, aerospace, and precision engineering are rapidly adopting them because they reduce total cost of ownership, extend tool life, and increase productivity, thereby driving greater revenue growth in this category.

Coating Type Insights

Do the coated PCBN tools hold the largest market share in 2024?

The coated PCBN tools captured the largest share of revenue in 2024. The primary driver of growth is the increasing need for extended tool life and process stability when cutting hardened ferrous materials at high speeds. Coated PCBN tools feature surface coatings that reduce friction, increase heat resistance, and protect the cutting edge from chemical and diffusion wear. This means they work better in tough cutting situations. These benefits are especially useful in the automotive and aerospace industries, where high production volumes, stringent tolerances, and automated CNC operations require tools that are reliable and durable. Coated PCBN tools are also a better value than solid PCBN tools, as they last longer and require less frequent replacement. This increases total machining productivity and drives revenue growth in this area.

Application Insights

Will the milling tools hold the largest share in the PCBN cutting tool market over the projected period?

The milling tools dominate the market in 2024 and are expected to continue the same pattern over the projected period. The rise is attributable to the increasing demand for high-precision machining of toughened materials in sophisticated, high-value parts. The increasing use of PCBN milling tools is enabling the finishing and semi-finishing of hardened steels, cast irons, and sintered materials. This is especially true in the automotive, aerospace, and die-and-mold industries. Producers can cut cycle times and boost productivity by keeping cutting edges sharp, giving surfaces a fantastic polish, and working at high cutting speeds.

Also, the growing use of CNC machining centers and automated milling operations is good for PCBN milling tools, as they perform consistently and last longer. This means less downtime and more revenue for this type of tool, even though the tools cost more initially.

End-User Industry Insights

Why automotive segment dominate the PCBN cutting tool industry?

The automotive segment captures a significant market share in 2024. The growth is being driven by increased manufacturing of high-performance, high-precision vehicle parts. Automotive manufacturers use PCBN cutting tools extensively to machine hardened steel and cast-iron parts, such as gears, transmission components, camshafts, brake discs, and bearing seats, that require very tight tolerances and a very smooth surface finish. The transition to electric vehicles, lighter designs, and improved powertrain efficiency has increased the need for modern machining systems capable of operating quickly and automatically. PCBN tools help car manufacturers lower their overall production costs and boost efficiency. This leads to continued sales growth in this segment.

Regional Insights

Why does the Asia Pacific hold the largest market share in the PCBN Cutting Tool market?

Asia Pacific holds the largest market share in 2024 and is expected to maintain this pattern over the analysis period. Revenue growth is driven by rapid industrialization, increased manufacturing capacity, and the greater use of advanced machining technologies in the region. China, Japan, South Korea, and India are big players in the automotive, aerospace, heavy machinery, and precision engineering industries. PCBN cutting tools are often used to cut hardened steels and cast iron. Demand for long-lasting, high-performance cutting tools is rising due to the growth of mass production, increased spending on CNC and automated manufacturing systems, and a move toward higher-quality, higher-precision parts.

Also, large-scale producers in the Asia Pacific region use PCBN tools because they help them save money by extending equipment lifespans and increasing productivity. This leads to ongoing income growth in the area.

PCBN Cutting Tool Market: Competitive Analysis

The global PCBN cutting tool market is dominated by players like:

- Seco Tools AB

- Sandvik AB

- Mitsubishi Materials Corporation

- Sumitomo Electric Industries Ltd.

- Element Six

- Zhuzhou Cemented Carbide Cutting Tools Co. Ltd.

- Iscar Ltd.

- Kyocera Corporation

- Tungaloy Corporation

- Kennametal Inc.

- ASAHI DIAMOND INDUSTRIAL CO. LTD.

- CERATIZIT S.A.

- Greenleaf Corporation

- Nachi-Fujikoshi Corp.

- Diamond Innovations

The global PCBN cutting tool market is segmented as follows:

By Grade

- Solid PCBN

- PCBN Tipped

By Coating Type

- Coated PCBN Tools

- Uncoated PCBN Tools

By Application

- Turning Tools

- Drilling Tools

- Milling Tools

- Others

By End-User Industry

- Automotive

- Die and Mold Industry

- Aerospace

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed