Passive Authentication Market Size, Share, Trends, Growth 2032

Passive Authentication Market By Industry (Media & Entertainment, Healthcare, Retail, Consumer, Telecom & IT, Government Financial Services, and Insurance), By Organization Size (Large and Small & Medium Enterprises), By Deployment Type (Cloud and On-Premise), By Business Function (Tourism Management, Marketing Management, Compliance Management, and Others), By Component (Services and Solutions), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.57 Billion | USD 12.64 Billion | 26.08% | 2023 |

Description

Global Passive Authentication Market: Insights

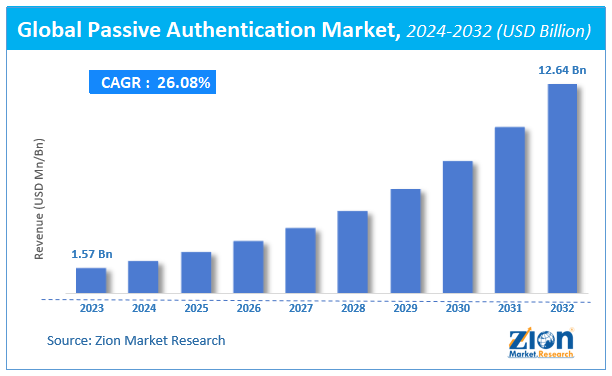

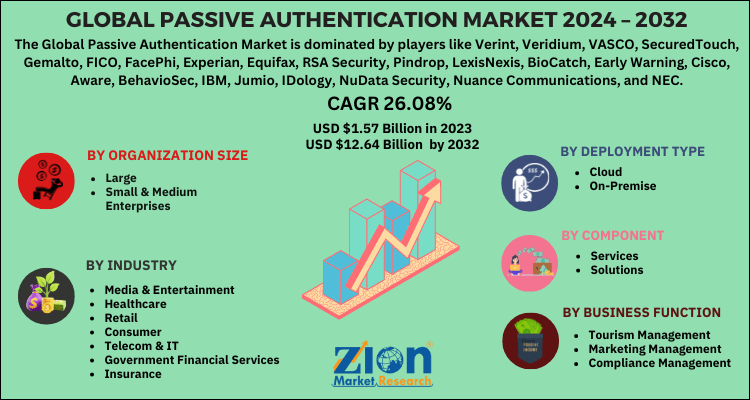

According to the report published by Zion Market Research, the global Passive Authentication Market size was valued at USD 1.57 Billion in 2023 and is predicted to reach USD 12.64 Billion by the end of 2032. The market is expected to grow with a CAGR of 26.08% during the forecast period. The report analyzes the global Passive Authentication Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Passive Authentication industry.

Key Insights

- As per the analysis shared by our research analyst, the passive authentication market is anticipated to grow at a CAGR of 26.08% during the forecast period (2024-2032).

- The global passive authentication market was estimated to be worth approximately USD 1.57 billion in 2023 and is projected to reach a value of USD 12.64 billion by 2032.

- The growth of the passive authentication market is being driven by increasing need for seamless, secure, and user-friendly identity verification across digital platforms.

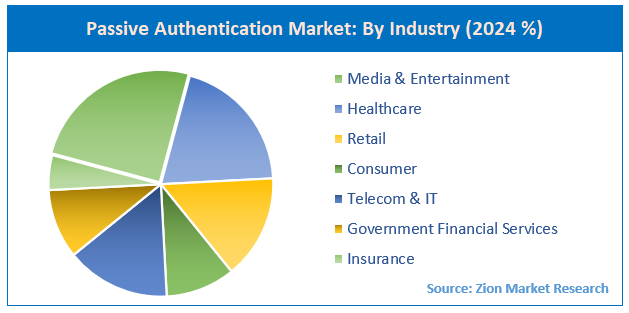

- Based on the industry, the media & entertainment segment is growing at a high rate and is projected to dominate the market.

- On the basis of organization size, the large segment is projected to swipe the largest market share.

- In terms of deployment type, the cloud segment is expected to dominate the market.

- Based on the business function, the tourism management segment is expected to dominate the market.

- In terms of component, the services segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Global Passive Authentication Market: Overview

Authentication is the act of verifying the identity of an individual user. Authentication can be passive as well as active. Passive authentication is a process where the identity of an individual user is verified without the need for any specific additional actions for the authentication purpose. Passive authentication needs users to authenticate with the help of a web browser where the user is redirected to an identity provider. The passive authentication process involves the use of behavioral patterns which includes contextual and biometric authentication along with device identification process.

It also includes the multi-factor authentication that offers enhanced control and security to assist organizations discard the requirement for password-based security method.

Global Passive Authentication Market: Growth Factors

One of the major factors driving the growth of the global passive authentication market is the growing replacement for traditional and outdated security ways like password and security questions with the voice biometric which offer a friction-free and most secure method to verify the identity of users in the digital transaction and telephone calls. This process needs a more extended period of speech for establishing a high-security verification method. The passive verification process does not need a user to remember their phone numbers or account numbers. Moreover, the significant spike in the demand for the multi-factor authentication process in an organization will boost the growth of the global passive authentication market during the forecast period.

Also, the growing incidences of cybercrimes all across the globe along with the data security issues are likely to positively shape the trajectory of the global market during the forecast period. The growing demand for secure and quick online transactions is also promoting the growth of the global passive authentication market during the forecast period.

The emergence of the coronavirus pandemic has significantly boosted the growth of the global market. The ongoing trend of the adoption of collaboration tools like Cisco Connect and Zoom is propelling the demand for passive authentication in the market globally due to the ongoing cyber-attacks amid the pandemic. The growing utilization of smartphones for payment services and smart working from one’s own device has induced companies to initiate biometric technology in order to secure the user's devices from hackers. Thus, biometric authentication that includes iris recognition, facial recognition, and fingerprint recognition emerged as a preferable way to secure the identity of the users.

Request Free Sample

Request Free Sample

Recent Development

- In May 2022, LexisNexis Risk Solutions acquired BehavioSec, a behavioral biometrics firm, to strengthen its passive and continuous authentication capabilities. The integration enhances fraud detection across digital channels by leveraging user behavior patterns for seamless identity verification.

- In November 2022, Gemalto NV launched its “Identity Check Passive Biometrics” solution, combining behavioral biometrics with machine learning to enable frictionless, continuous authentication during online interactions — minimizing user friction while maintaining robust security.

- In March 2022, Jumio introduced Passive Liveness Detection, a facial biometric solution powered by AI that detects spoofing attempts without requiring active user participation. The technology improves the security and user experience of remote identity verification processes.

- In August 2023, ID R&D demonstrated its leadership in voice biometrics by winning the VoxCeleb Speaker Recognition Challenge with its IDVoice technology. The achievement highlights advancements in passive voice-based authentication — including speaker verification and liveness detection — particularly for voice assistants and conversational AI applications.

- Around 2023, NEC Corporation unveiled a multimodal biometric authentication solution that integrates facial and iris recognition. Designed for high-security environments, the system enhances passive and continuous identity verification by combining multiple biometric modalities for greater accuracy and resilience.

Global Passive Authentication Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Passive Authentication Market |

| Market Size in 2023 | USD 1.57 Billion |

| Market Forecast in 2032 | USD 12.64 Billion |

| Growth Rate | CAGR of 26.08% |

| Number of Pages | 207 |

| Key Companies Covered | Verint, Veridium, VASCO, SecuredTouch, Gemalto, FICO, FacePhi, Experian, Equifax, RSA Security, Pindrop, LexisNexis, BioCatch, Early Warning, Cisco, Aware, BehavioSec, IBM, Jumio, IDology, NuData Security, Nuance Communications, and NEC |

| Segments Covered | By Industry, By Organization Size, By Deployment Type, By Business Function, By Component And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Passive Authentication Market: Segmentation

The global passive authentication market can be segmented into the industry, organization size, deployment type, business function, component, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By Industry, the market can be segmented into media & entertainment, healthcare, retail, consumer, telecom & IT, government financial services, and insurance.

By Organization Size, the market can be segmented into large and small & medium enterprises.

By Deployment Type, the market can be segmented into cloud and on-premise.

By Business Function, the market can be segmented into tourism management, marketing management, compliance management, and others.

By Component, the market can be segmented into services and solutions. The service segment can be further bifurcated into managed and professional services.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Passive Authentication Market Dynamics

Key Growth Drivers

The passive authentication market is primarily driven by the escalating demand for enhanced cybersecurity in the face of increasingly sophisticated cyber threats, such as identity theft and data breaches. Traditional authentication methods like passwords are no longer sufficient, leading organizations to seek more robust and dynamic security solutions. Concurrently, there is a strong consumer and business desire for a seamless and frictionless user experience. Passive authentication, which verifies identity through continuous, background monitoring of behavioral and biometric patterns, eliminates the need for intrusive login prompts and passwords, thereby improving user satisfaction and reducing abandonment rates. The proliferation of smartphones and other personal devices equipped with advanced sensors further facilitates the collection of necessary data, while strict regulatory requirements in sectors like banking and healthcare are also compelling organizations to adopt stronger and more compliant authentication measures.

Restraints

Despite its benefits, the passive authentication market is restrained by significant privacy concerns. Since the technology relies on the continuous collection and analysis of user data—including biometrics, keystroke dynamics, and device usage patterns—it raises questions about data privacy and potential misuse. This is particularly challenging in regions with stringent data protection laws like GDPR. The high initial implementation costs and complexity of integrating passive authentication systems with existing legacy IT infrastructure can also deter small and medium-sized enterprises (SMEs). Furthermore, a lack of professional expertise and a need for specialized skills in deploying and managing these complex systems can hinder adoption. There are also inherent technological limitations, as the systems are not yet perfect and can suffer from issues like false positives or negatives, which can negatively impact the user experience.

Opportunities

The passive authentication market presents several key opportunities for growth and innovation. The integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) can significantly enhance the accuracy and effectiveness of behavioral biometrics, enabling the detection of even the most subtle anomalies that may indicate fraud. There is also a major opportunity for market expansion into new and emerging industry verticals. While the Banking, Financial Services, and Insurance (BFSI) sector has been a primary adopter, healthcare (for securing patient records), e-commerce (for fraud prevention), and government services are increasingly recognizing the value of passive authentication. The growing trend toward cloud-based solutions also provides an opportunity to offer more scalable, cost-effective, and easily deployable services, making the technology more accessible to a wider range of businesses.

Challenges

The challenges facing the passive authentication market are complex and multifaceted. One of the most significant is the need to build consumer trust and ensure transparency regarding data collection and usage. Organizations must navigate the delicate balance between robust security and user privacy, clearly communicating how data is being used and protected. Another challenge is the continuous evolution of cyber threats, which requires constant updates and improvements to algorithms to stay ahead of sophisticated fraudulent activities. Moreover, the technical complexity of integrating a wide variety of data sources and sensors while maintaining high accuracy is a persistent hurdle. Lastly, the potential for algorithmic bias, where the system may incorrectly authenticate certain user demographics, and the risk of model drift over time, which can lead to a decrease in accuracy, are critical challenges that require ongoing research and development to overcome.

Global Passive Authentication Market: Regional analysis

North America accounts for the largest share in the global passive authentication market due to the growing awareness of people regarding passive authentication solutions. Moreover, the high adoption of advanced technology in the region further boosts the growth of the regional market during the forecast period.

Asia Pacific is expected to witness huge growth during the forecast period due to the growing prevalence of cyber-attacks in the region.

Global Passive Authentication Market: Competitive Analysis

The global passive authentication market is dominated by players like:

- Verint

- Veridium

- VASCO

- SecuredTouch

- Gemalto

- FICO

- FacePhi

- Experian

- Equifax

- RSA Security

- Pindrop

- LexisNexis

- BioCatch

- Early Warning

- Cisco

- Aware

- BehavioSec

- IBM

- Jumio

- IDology

- NuData Security

- Nuance Communications

- NEC

Global Passive Authentication Market: Segmentation

The global passive authentication market is segmented as follows:

By Industry

- Media & Entertainment

- Healthcare

- Retail

- Consumer

- Telecom & IT

- Government Financial Services

- Insurance

By Organization Size

- Large

- Small & Medium Enterprises

By Deployment Type

- Cloud

- On-Premise

By Business Function

- Tourism Management

- Marketing Management

- Compliance Management

- Others

By Component

- Services

- Solutions

Global Passive Authentication Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed