Global Paper Bags Packaging Market Size, Share, Growth Analysis Report - Forecast 2034

Paper Bags Packaging Market By Material (Brown Kraft, White Kraft), By Type (Sewn Open Mouth, Pinch Bottom Open Mouth, Pasted Valve, Self-Opening Sacks, Others), By End Use (Food & Beverages, E-commerce, Chemicals, Agriculture, Retail, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

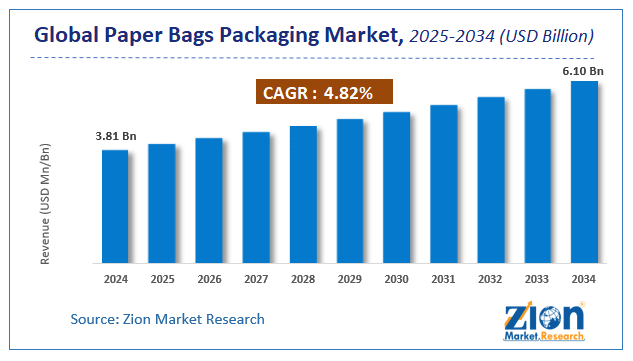

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.81 Billion | USD 6.10 Billion | 4.82% | 2024 |

Global Paper Bags Packaging Market: Industry Perspective

The global paper bags packaging market size was worth around USD 3.81 Billion in 2024 and is predicted to grow to around USD 6.10 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.82% between 2025 and 2034. The report analyzes the global paper bags packaging market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the paper bags packaging industry.

The report analyzes the global paper bags packaging market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the paper bags packaging industry.

Global Paper Bags Packing Market: Overview

A paper bag is a carrier made of paper which is generally in the form of kraft paper. It is also known as paperboard and is produced from chemical pulp that is manufactured in a krafting process. The main source of paper bags can either be recycled fibers or virgin fibers depending on the requirement of the customer. They are most commonly used as shopping bags and in certain cases, have found applications for the packaging of consumer items. The paper bag packaging is produced in a way that allows them to carry all kinds of consumer goods including electronics, glass bottles, groceries, and clothing items.

Paper bag packaging has several benefits that are applicable not only to the consumer and the seller but to the environment as well thus encouraging sustainable and eco-friendly growth which is a major reason why these products continue to stay in demand and as per market trends, paper bag packaging may gain higher momentum during the growth period. Several end-user verticals including cosmetics, stationery products, food & beverages along with other sectors are focusing on utilizing the benefits provided by paper packaging.

Key Insights

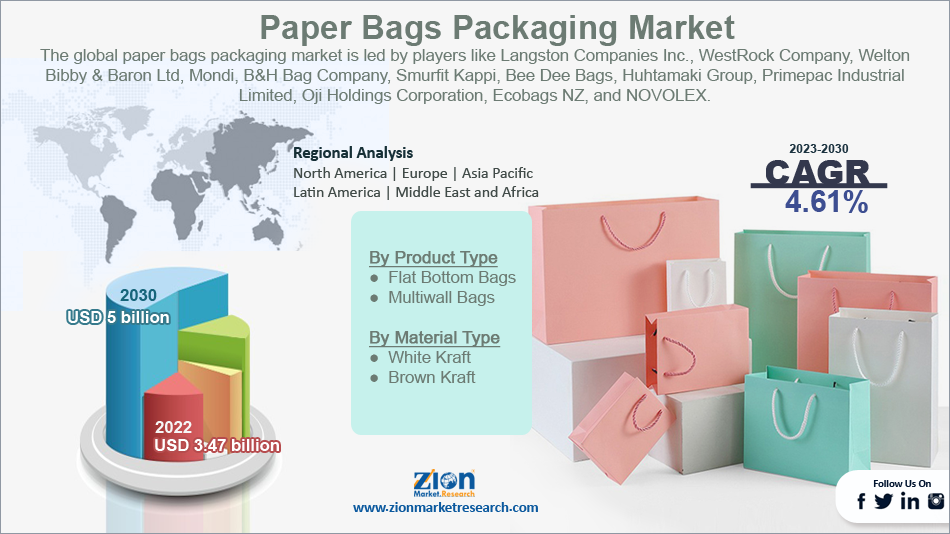

- As per the analysis shared by our research analyst, the global paper bags packaging market is estimated to grow annually at a CAGR of around 4.61% over the forecast period (2023-2030)

- In terms of revenue, the global paper bags packaging testing market size was valued at around USD 3.47 billion in 2022 and is projected to reach USD 5 billion, by 2030.

- The paper bags packaging industry is projected to grow at a significant rate due to the growing awareness of sustainable growth

- Based on material type segmentation, white kraft was predicted to show maximum market share in the year 2022

- Based on product type segmentation, multiwall bags was the leading type in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Global Paper Bags Packing Market: Growth Drivers

Increasing awareness about sustainable growth to propel market demand

The global paper bags packaging market is projected to grow owing to the increased awareness amongst the population and world leaders about the importance of environmental sustainability and growth. This has led to more consumers becoming smart in their choices and preferring ways to reduce or eliminate the use of materials that can be harmful to the environment.

The packaging industry has long been one of the largest environmental polluters and has recently come onto the radar of environment regulatory bodies which have started holding them responsible for the irreparable damage that occurs in the environment due to irresponsible packaging measures. Almost 85.1% of plastic packaging is unregulated and ends up in landfills, polluting the environment. Paper bags are excellent substitutes for plastic packaging which is currently witnessing a decline in its popularity.

On the contrary, paper bags can help the packaging industry change its image since these bags are made from renewable sources of energy along with being recyclable and biodegradable.

Restraints:

Presence of substitute material to restrict market expansion

While the paper bags packaging industry continues to grow and has true potential for expansion, it could register certain hindrances in terms of the large-scale presence and adoption of the substitute materials available for consumption.

The greatest competitor for paper bag packaging is plastic packaging, which is the most common type of packaging. For instance, as per data from the US Environmental Protection Agency (EPA), more than 14.5 million tons of plastic packaging and containers were used in the commercial market in 2022. Since they offer higher performance, product acceptance, versatility, and better flexibility, plastic packaging continues to dominate a large part of the packaging industry.

Opportunities:

Increasing innovation to open higher growth opportunities

The global sales volume is expected to reach new heights owing to the increasing investments in the innovation of new and better-performing paper bag packaging. Businesses and consumers understand the potential that paper packaging holds but at the same time, are aware of the drawbacks held by the packaging material. There are consistent activities and programs undertaken by various product providers to ensure that the disadvantages or areas of improvement around paper bags are well taken care of. For instance, paper bags come in different ranges of strength, sizes, and shapes that provide them with better durability.

Challenges:

Raw material supply to pose a major challenge

The paper bags packaging industry players face challenges in terms of a consistent and balanced supply of raw materials. The price of the basic resources is extremely sensitive to various issues including the political and economical state of the exporting or importing countries. This leads to changing prices and availability of the products making it difficult for businesses to carry out their operations smoothly. This causes consumers to question the cost-effectiveness of the product in comparison to other easily available substitutes.

Recent Developments:

- In October 2024, Reckitt and Mondi announced the launch of a new packaging made of paper which is made of 75% less plastic and will be used for packaging Finish dishwater tablets. The move is expected to eliminate the use of almost 2,000 tonnes of plastic annually once it is completely in action

- In September 2024, Seal Packaging, a Luton-based packaging solutions provider, announced the acquisition and launch of a new range of paper bags called Itsnotpaper. The company aims to help consumers in achieving net zero by ascertaining that the product's usage, raw material, and end-life are sustainable

- In January 2024, Adeera Packaging, an India-based producer of recycled paper bags for the food industry, stated that they are working on generating innovative solutions that will allow paper bags to manage the spillage caused due to liquid food items

Key Insights

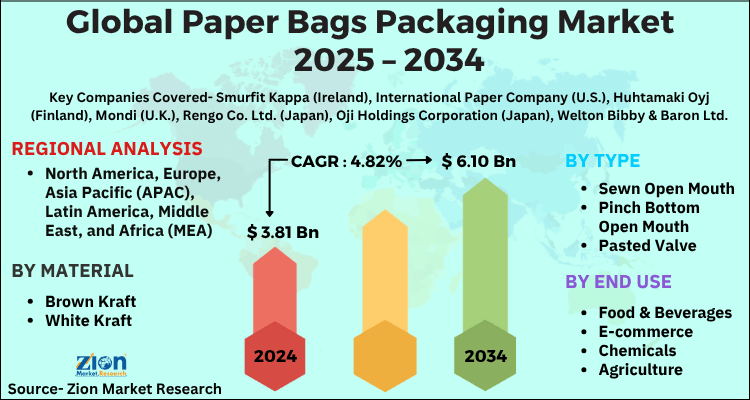

- As per the analysis shared by our research analyst, the global paper bags packaging market is estimated to grow annually at a CAGR of around 4.82% over the forecast period (2025-2034).

- Regarding revenue, the global paper bags packaging market size was valued at around USD 3.81 Billion in 2024 and is projected to reach USD 6.10 Billion by 2034.

- The paper bags packaging market is projected to grow at a significant rate due to increasing environmental concerns and consumer preference for sustainable packaging, stringent government regulations and bans on single-use plastics, and the rapid expansion of the e-commerce and food delivery sectors.

- Based on Material, the Brown Kraft segment is expected to lead the global market.

- On the basis of Type, the Sewn Open Mouth segment is growing at a high rate and will continue to dominate the global market.

- Based on the End Use, the Food & Beverages segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Global Paper Bags Packing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Paper Bags Packaging Market |

| Market Size in 2024 | USD 3.81 Billion |

| Market Forecast in 2034 | USD 6.10 Billion |

| Growth Rate | CAGR of 4.82% |

| Number of Pages | 210 |

| Key Companies Covered | Smurfit Kappa (Ireland), International Paper Company (U.S.), Huhtamaki Oyj (Finland), Mondi (U.K.), Rengo Co. Ltd. (Japan), Oji Holdings Corporation (Japan), Welton Bibby & Baron Ltd (U.K.), Novolex Holdings Inc. (U.S.), ProAmpac (U.S.), United Bags (U.S.), Global-Pak (U.S.), Ronpack (U.S.), Packman Packaging (India), Gelpac (Canada), Southern Packaging, LP (U.S.), and others. |

| Segments Covered | By Material, By Type, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Paper Bags Packaging Market: Segmentation Analysis

The global paper bags packaging market is segmented based on Material, Type, End Use, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on Material, the global paper bags packaging market is divided into Brown Kraft, White Kraft.

On the basis of Type, the global paper bags packaging market is bifurcated into Sewn Open Mouth, Pinch Bottom Open Mouth, Pasted Valve, Self-Opening Sacks, Others.

By End Use, the global paper bags packaging market is split into Food & Beverages, E-commerce, Chemicals, Agriculture, Retail, Others.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Global Paper Bags Packing Market: Regional Analysis

The paper bags packing market shows distinct regional trends, driven by environmental regulations, consumer preferences, and industrial growth. In North America and Europe, stringent bans on single-use plastics and rising eco-consciousness have significantly boosted demand for paper bags across retail, food service, and e-commerce sectors. Asia-Pacific is witnessing rapid market growth due to expanding retail infrastructure, urbanization, and increasing awareness about sustainable packaging, particularly in countries like China and India. Meanwhile, Latin America and the Middle East & Africa are experiencing steady growth, propelled by shifting regulatory landscapes and growing adoption of eco-friendly packaging solutions, although market penetration remains moderate compared to more developed regions. Overall, global momentum toward sustainability and circular economy principles continues to fuel regional market expansion for paper bags.

Global Paper Bags Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the paper bags packaging market on a global and regional basis.

The global paper bags packaging market is dominated by players like:

- Smurfit Kappa (Ireland)

- International Paper Company (U.S.)

- Huhtamaki Oyj (Finland)

- Mondi (U.K.)

- Rengo Co. Ltd. (Japan)

- Oji Holdings Corporation (Japan)

- Welton Bibby & Baron Ltd (U.K.)

- Novolex Holdings Inc. (U.S.)

- ProAmpac (U.S.)

- United Bags (U.S.)

- Global-Pak (U.S.)

- Ronpack (U.S.)

- Packman Packaging (India)

- Gelpac (Canada)

- Southern Packaging

- LP (U.S.)

Global Paper Bags Packaging Market: Segmentation Analysis

The global paper bags packaging market is segmented as follows;

By Material

- Brown Kraft

- White Kraft

By Type

- Sewn Open Mouth

- Pinch Bottom Open Mouth

- Pasted Valve

- Self-Opening Sacks

- Others

By End Use

- Food & Beverages

- E-commerce

- Chemicals

- Agriculture

- Retail

- Others

Global Paper Bags Packaging Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

A paper bag is a carrier made of paper which is generally in the form of kraft paper. It is also known as paperboard and is produced from chemical pulp that is manufactured in a krafting process. The main source of paper bags can either be recycled fibers or virgin fibers depending on the requirement of the customer. They are most commonly used as shopping bags and in certain cases, have found applications for the packaging of consumer items.

The global paper bags packaging market is expected to grow due to rising environmental concerns, government bans on plastic bags, increasing demand for sustainable packaging, and growth in retail and food industries.

According to study, the global paper bags packaging market size was worth around USD 3.47 billion in 2022 and is predicted to grow to around USD 5 billion by 2030.

The global paper bags packaging market is expected to grow at a CAGR of 4.82% during the forecast period.

North America is expected to dominate the paper bags packaging market over the forecast period.

Leading players in the global paper bags packaging market include Smurfit Kappa (Ireland), International Paper Company (U.S.), Huhtamaki Oyj (Finland), Mondi (U.K.), Rengo Co. Ltd. (Japan), Oji Holdings Corporation (Japan), Welton Bibby & Baron Ltd (U.K.), Novolex Holdings Inc. (U.S.), ProAmpac (U.S.), United Bags (U.S.), Global-Pak (U.S.), Ronpack (U.S.), Packman Packaging (India), Gelpac (Canada), Southern Packaging, LP (U.S.), among others.

The report explores crucial aspects of the paper bags packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Industry PerspectiveGlobal Paper Bags Packing OverviewKey InsightsGlobal Paper Bags Packing Growth DriversRestraints:Opportunities:Challenges:Recent Developments:Key InsightsGlobal Paper Bags Packing Report ScopeSegmentation AnalysisGlobal Paper Bags Packing Regional AnalysisCompetitive AnalysisSegmentation AnalysisGlobal Market:Regional Segment AnalysisRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed