Paper And Forest Products Market Size, Share, Trends, Growth 2034

Paper And Forest Products Market By Product Type (Pulp, Paper, Lumber, Wood Panels, and Others), By Application (Construction, Packaging, Printing, Furniture, and Others), By End-User (Residential, Commercial, Industrial, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

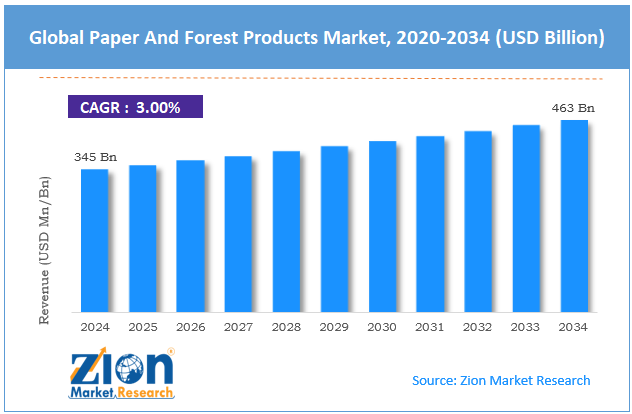

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 345 Billion | USD 463 Billion | 3.0% | 2024 |

Paper And Forest Products Industry Perspective:

What will be the size of the global paper and forest products market during the forecast period?

The global paper and forest products market size was worth around USD 345 billion in 2024 and is predicted to grow to around USD 463 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.0% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global paper and forest products market is estimated to grow annually at a CAGR of around 3.0% over the forecast period (2025-2034).

- In terms of revenue, the global paper and forest products market size was valued at around USD 345 billion in 2024 and is projected to reach USD 463 billion by 2034.

- Technological advancements and innovation are expected to drive the paper and forest products market.

- Based on the product type, the paper is expected to capture the highest revenue share over the projected period.

- Based on the application, the packaging application is expected to hold the largest market share over the projected period.

- Based on the end user, the residential segment is expected to capture a prominent revenue share over the analysis period.

- Based on region, the Asia Pacific is expected to lead the paper and forest products market over the projected period.

Paper And Forest Products Market: Overview

The paper and forest products market is the global industry that harvests trees and other forest resources, processes wood fiber and forest biomass, and sells the resulting products. This market includes pulp and paper products, such as tissue, hygiene products, and printing and writing paper, as well as solid wood goods used in buildings, furniture, and factories. It covers the entire value chain, from forest management to logging, pulp production, paper conversion into other products, engineered wood production, and recycling. The industry is very important to the packaging, publishing, building, personal care, and consumer goods sectors. It is also becoming more focused on sustainability, certified forestry practices, and circular-economy activities to protect the environment and ensure that resources remain available for the long term.

Paper And Forest Products Market: Dynamics

Growth Drivers

How is the rising demand for packaging driving the expansion of the paper and forest products market?

The paper and forest products sector has grown significantly as more people need packaging. This is because it is used often and in many crucial ways. The rapid growth of e-commerce, organized retail, food and drink delivery, pharmaceuticals, and fast-moving consumer goods has increased demand for protective packaging materials, including corrugated boxes, paperboard cartons, wrapping paper, and others. More people are buying items online, which means each shipped item requires more packaging. This increases the need for containerboard and corrugated solutions. Also, more people care about the environment, and governments are making it harder to use single-use plastics. This has accelerated the changeover to paper packaging that can be recycled or broken down.

More and more companies are using eco-friendly packaging to achieve their ESG goals and meet their customers' needs. This gives the paper a better chance of winning. The ongoing growth of consumer markets drives consistent, long-term demand for paper and forest-based packaging materials. This is because population growth, urbanization, and rising disposable incomes are all directly tied to package consumption. This makes the whole industry grow.

Restraints

Environmental concerns and sustainability pressures are hindering the industry’s growth

The paper and forest products industry faces difficulties in growth due to environmental issues and sustainability concerns. This means more rules, higher business costs, and a risk to the industry's reputation. The business relies significantly on forest resources, water, and energy, and is often associated with deforestation, loss of biodiversity, carbon emissions, and water pollution from pulp and paper production. To protect forests, regulate pollution, treat wastewater, and reduce waste, governments around the world are implementing stronger restrictions. This means businesses must invest substantial resources in greener technologies and in compliance with regulations.

Environmental groups, customers, and investors also pressure businesses to use approved sustainable forestry methods, such as FSC or PEFC certification. This makes it more expensive to purchase and maintain these methods. One could not sell these goods, have problems with suppliers, or harm the company if one doesn't follow sustainability standards. While sustainability has the potential to endure, adherence to environmental standards may constrain short-term growth, particularly for smaller, less technologically sophisticated businesses.

Opportunities

Why do technological advancements and innovation offer a market development opportunity?

The paper and forest products market has significant opportunities to grow by adopting new technologies, improving efficiency, cutting prices, developing better-for-the-environment products, and creating high-value products. Businesses can follow environmental rules and make more money by adopting modern pulp processing, automation, and digital monitoring systems. These systems make manufacturing more efficient, use less energy and water, and produce less waste. Engineered wood products, lightweight packaging materials, and specialty papers are examples of new technologies that help firms move into faster-growing areas such as sustainable packaging, bio-based materials, and green construction solutions.

Advanced recycling processes also help recover more fibers, supporting circular economy activities and reducing the need for new raw materials. Smart manufacturing and Industry 4.0 integration also make the supply chain more open and the way things work more efficiently. These technical improvements not only make businesses more competitive but also create new areas of application, preparing the industry for long-term market expansion.

Challenges

Does the decline in demand for traditional paper products pose a major challenge to the expansion of the market?

The paper and forest products industry is struggling to grow as fewer consumers prefer traditional paper products, especially in developed countries. The need for newspapers, magazines, office paper, and writing and printing paper has decreased significantly as more and more business, media, and communication activities move online.

As companies shift to electronic documents and people read more on digital news sites and e-books, demand in these areas, which were previously very high, continues to decline. This structural drop makes older paper mills too full, which lowers prices and makes it harder for firms that depend on graphic paper grades to make money. It also requires businesses to pay for changes to their operations, such as shutting down mills or shifting production lines. The loss of traditional paper categories remains a significant challenge, especially for businesses that haven't added new products to their ranges. But some of the losses are offset by growth in the packaging, tissue, and specialty paper categories. Even as the industry is changing, the decline in demand for traditional paper is a major concern for the sector's long-term, balanced growth.

Paper And Forest Products Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Paper And Forest Products Market |

| Market Size in 2024 | USD 345 Billion |

| Market Forecast in 2034 | USD 463 Bllion |

| Growth Rate | CAGR of 3.0% |

| Number of Pages | 219 |

| Key Companies Covered | Packaging Corporation of America, International Paper Company, Sappi Limited, Nippon Paper Industries Co. Ltd., UPM-Kymmene Corporation, Stora Enso Oyj, Resolute Forest Products Inc., Mondi Group, Domtar Corporation, Oji Holdings Corporation, Nine Dragons Paper (Holdings) Limited, WestRock Company, Smurfit Kappa Group, SCA (Svenska Cellulosa Aktiebolaget), CMPC (Compañía Manufacturera de Papeles y Cartones), Suzano S.A., Mercer International Inc., Georgia-Pacific LLC, Weyerhaeuser Company, Canfor Corporation, and others. |

| Segments Covered | By Product Type, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Paper And Forest Products Market: Segmentation

Product Type Insights

What factor drives the paper segment into a dominant position?

The paper is expected to capture the highest revenue share over the projected period. The rapid rise of packaging and hygiene-related applications is what is driving the segment's growth. This has more than made up for the structural loss in traditional printing and writing sheets. As e-commerce, organized retail, food delivery services, and fast-moving consumer goods grow rapidly, demand for containerboard, corrugated boxes, folding cartons, and other paper-based packaging materials has also increased.

At the same time, greater awareness of environmental issues and regulations on single-use plastics has accelerated the shift to paper packaging that can be recycled and biodegraded. This has helped sales expand.

Application Insights

Why packaging application hold the largest market share?

The packaging application is expected to hold the largest market share over the projected period. The rapid growth of e-commerce, retail, and the packaged consumer goods market has been a major driver of the segment's growth. As more people shop online, the need for corrugated boxes, containerboard, folding cartons, and protective paper-based packaging has grown. This is because every shipment of goods needs packaging that is safe and durable.

Also, the growth of the pharmaceutical industry and food and drink delivery services has increased demand for packaging materials that are clean, lightweight, and environmentally friendly. Businesses have also begun using recyclable, biodegradable paper packaging in response to environmental regulations and rising customer demand for eco-friendly alternatives to plastic. This has led to increased demand.

End-User Insights

Why does the residential segment dominate the paper and forest products industry?

The residential segment is expected to capture a prominent revenue share over the analysis period. The growth is primarily due to increased home construction, increased home remodeling, and greater demand for environmentally friendly building materials. As cities expand and populations grow, particularly in developing countries, the need for additional housing increases. This increases demand for wood-based products, including lumber, plywood, engineered wood, fiberboard, and other building materials.

Regional Insights

Why does the Asia Pacific hold the largest market share in the paper and forest products market?

Asia Pacific is expected to drive industry growth. The growth is being driven by rapid industrialization, urbanization, and economic expansion in countries such as China and India. The area's large population and expanding disposable incomes drive up demand for paper and forest products. China is among the largest producers and consumers of paper products and is a major driver of the market's growth. The government is also helping the business by promoting sustainable forest management and the making of eco-friendly products.

Paper And Forest Products Market: Competitive Analysis

The global paper and forest products market is dominated by players like:

- Packaging Corporation of America

- International Paper Company

- Sappi Limited

- Nippon Paper Industries Co. Ltd.

- UPM-Kymmene Corporation

- Stora Enso Oyj

- Resolute Forest Products Inc.

- Mondi Group

- Domtar Corporation

- Oji Holdings Corporation

- Nine Dragons Paper (Holdings) Limited

- WestRock Company

- Smurfit Kappa Group

- SCA (Svenska Cellulosa Aktiebolaget)

- CMPC (Compañía Manufacturera de Papeles y Cartones)

- Suzano S.A.

- Mercer International Inc.

- Georgia-Pacific LLC

- Weyerhaeuser Company

- Canfor Corporation

The global paper and forest products market is segmented as follows:

By Product Type

- Pulp

- Paper

- Lumber

- Wood Panels

- Others

By Application

- Construction

- Packaging

- Printing

- Furniture

- Others

By End User

- Residential

- Commercial

- Industrial

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed