Global P2P Payment Market Size, Share, Growth Analysis Report - Forecast 2034

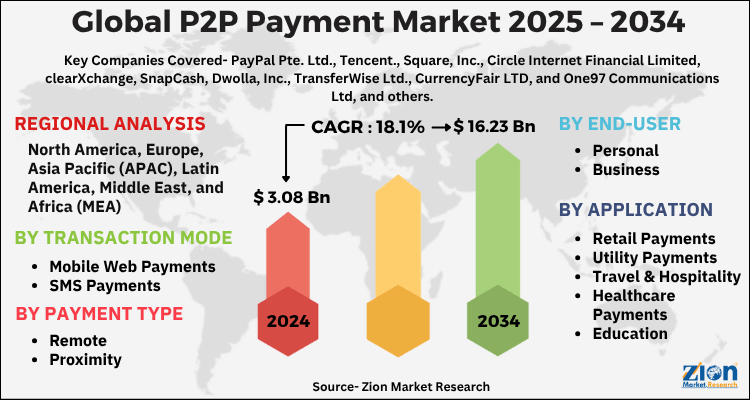

P2P Payment Market By Transaction Mode (Mobile Web Payments, SMS Payments, Mobile Apps, Near Field Communication (NFC), QR Code Payments), By Payment Type (Remote, Proximity), By End-user (Personal, Business), By Application (Retail Payments, Utility Payments, Travel & Hospitality, Healthcare Payments, Education), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

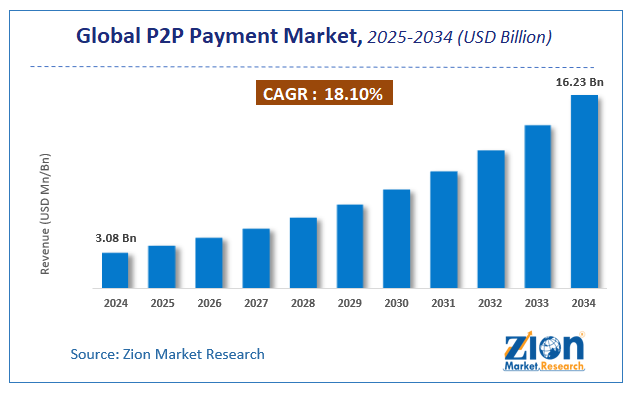

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.08 Billion | USD 16.23 Billion | 18.1% | 2024 |

P2P Payment Market: Industry Perspective

The global p2p payment market size was worth around USD 3.08 Billion in 2024 and is predicted to grow to around USD 16.23 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 18.1% between 2025 and 2034. The report analyzes the global p2p payment market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the p2p payment industry.

Person-to-person payments (P2P) is an online technology that allows customers to send money from their bank account or credit card to another person's account. It's based on Paypal's successful model, in which customers create a secure account connection with a trusted third-party vendor and designate their bank account or credit card information for transferring and accepting funds. Customers can assign the number of funds to be transferred using an online interface or a mobile application as an alternative.

Understanding the customers who use P2P payments necessitates market research. It aids companies in gaining a better understanding of their competitors and how they approach the market. Before launching, new businesses should test P2P payments. They must make certain that it is compatible with their operating system. Market research assists businesses in making the best decisions possible. This applies not only to peer-to-peer and micropayments but to every aspect of a business.

Key Insights

- As per the analysis shared by our research analyst, the global p2p payment market is estimated to grow annually at a CAGR of around 18.1% over the forecast period (2025-2034).

- Regarding revenue, the global p2p payment market size was valued at around USD 3.08 Billion in 2024 and is projected to reach USD 16.23 Billion by 2034.

- The p2p payment market is projected to grow at a significant rate due to Expanding due to smartphone penetration, rise of digital wallets, and increasing preference for quick, contactless financial transactions.

- Based on Transaction Mode, the Mobile Web Payments segment is expected to lead the global market.

- On the basis of Payment Type, the Remote segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user, the Personal segment is projected to swipe the largest market share.

- By Application, the Retail Payments segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

P2P Payment Market: Growth Factors

Consumer acceptance of online banking, mobile banking, and e-commerce is increasing, which means more people will use person-to-person payments. Popular cash payment apps like Venmo and Google Wallet help customers use P2P payments as smartphones and tablets become a more common mode of everyday applications. Because of the increased use of online shopping and banking applications, the P2P payment market is expected to grow. However, the market's growth is being stifled by an increase in cyberattacks and identity theft.

Transaction Mode Segment Analysis Preview

Mobile apps hold a substantial share and are expected to witness the highest CAGR growth during the forecast period. P2P mobile payment solutions, such as Zelle, have gone from a nice-to-have to a must-have for credit unions. Zelle is a mobile-first payment platform that can help credit unions improve member experience while lowering check and cash management costs. Offering Zelle through a native app, as FLEX does, gives members of all ages the assurance that their transaction is being handled by a trusted partner. This year, make sure your credit union is on board with mobile payments so you don't fall behind. NFC/Smartcard and SMS from the other segments of transaction mode.

Location Segment Analysis Preview

Over the next few years, the growth of mobile proximity and in-store payments will far outpace that of m-commerce and mobile peer-to-peer transactions. Consumers can purchase goods and services directly at the point of sale using proximity m-payment, which is based on contactless near-field communications (NFC). The amount purchased is deducted from a pre-paid account, a mobile account, or a bank account when consumers simply hold their phone close to a reader. When you use your mobile phone to make a transaction for a good or service, this is known as remote mobile payment, or m-payment. There are a few different methods for making a remote m-payment. One method allows mobile subscribers to purchase something via their phone or SMS, such as an app, ringtone, or video, and have it charged to their phone account.

Type of purchase segment analysis preview

Money transfers & Payments form the largest portion. The increasing disposable income of the global population, as well as the emergence of low-cost smartphone manufacturers in the Asia region, are credited with this growth. Furthermore, the growing use of internet services has resulted in the widespread adoption of smartphones. Airtime transfer & Top-Ups, Merchandise & Coupons, and Travel & Ticketing form the type pf purchase segment.

Application Segment Analysis Preview

Retail payments form the largest portion. It consists of the online marketplace. Online marketplaces are a network that allows private sellers of goods to connect with potential buyers. Online marketplaces can provide services such as seller promotion, buyer and seller ratings based on previous transactions, payment processing, and escrow services. Travels & Hospitality Payments, Transportation & Logistics Payments, Energy & utility Payments, and others.

P2P Payment Market: Regional Analysis Preview

North America accounted for a share of 34% in 2020. Some of the most significant recent developments in the peer-to-peer (P2P) payments space are taking place in the United States. Consumer interest in digital transfer capabilities has been validated by the success of mobile solutions such as Venmo (acquired by PayPal in 2013) and Square Cash, particularly among millennials—a segment in which US banks have shown only passing interest until recently. Following its purchase by Early Warning Systems, the bank-owned clearXchange network was recently retooled, signaling a renewed focus on a financial institution–led collaborative initiative that will compete head-to-head with non-bank solutions that have shown exponential growth.

Asia Pacific is projected to grow at a CAGR of over 22% during the forecast period. The mobile peer-to-peer (P2P) money transfer market is led by the Asia Pacific. The growth of the market is aided by a large number of smartphone and internet users in emerging economies like China and India. More than half of the world's smartphone users live in the Asia Pacific, and the number is expected to rise significantly in the coming years. The increasing adoption of smartphones in the region is being fueled by the availability of low-cost smartphones and rising disposable income among the region's population. Furthermore, government-backed initiatives to promote digital payments are hastening the adoption of mobile peer-to-peer payments.

P2P Payment Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | P2P Payment Market |

| Market Size in 2024 | USD 3.08 Billion |

| Market Forecast in 2034 | USD 16.23 Billion |

| Growth Rate | CAGR of 18.1% |

| Number of Pages | 120 |

| Key Companies Covered | PayPal Pte. Ltd., Tencent., Square, Inc., Circle Internet Financial Limited, clearXchange, SnapCash, Dwolla, Inc., TransferWise Ltd., CurrencyFair LTD, and One97 Communications Ltd, and others. |

| Segments Covered | By Transaction Mode, By Payment Type, By End-user, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

P2P Payment Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the p2p payment market on a global and regional basis.

The global p2p payment market is dominated by players like:

- PayPal Pte. Ltd.

- Tencent.

- Square Inc.

- Circle Internet Financial Limited

- clearXchange

- SnapCash

- Dwolla Inc.

- TransferWise Ltd.

- CurrencyFair LTD

- and One97 Communications Ltd

The global P2P payment market is segmented as follows:

By Transaction Mode

- NFC/Smartcard

- SMS

- Mobile Apps

By Type of Purchase

- Airtime transfer & Top-Ups

- Money transfers & Payments

- Merchandise & Coupons

- Travel & Ticketing

By Applications

- Retail Payments

- Travels & Hospitality Payments

- Transportation & Logistics Payments

- Energy & Utility Payments

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global p2p payment market is expected to grow due to Expanding due to smartphone penetration, rise of digital wallets, and increasing preference for quick, contactless financial transactions.

According to a study, the global p2p payment market size was worth around USD 3.08 Billion in 2024 and is expected to reach USD 16.23 Billion by 2034.

The global p2p payment market is expected to grow at a CAGR of 18.1% during the forecast period.

North America is expected to dominate the p2p payment market over the forecast period.

Some of key players in P2P payment market are PayPal Pte. Ltd., Tencent., Square, Inc., Circle Internet Financial Limited, clearXchange, SnapCash, Dwolla, Inc., TransferWise Ltd., CurrencyFair LTD, and One97 Communications Ltd, among others.

The report explores crucial aspects of the p2p payment market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed