Out of Home Tea Market Size & Share Report, Growth, Trends, 2032

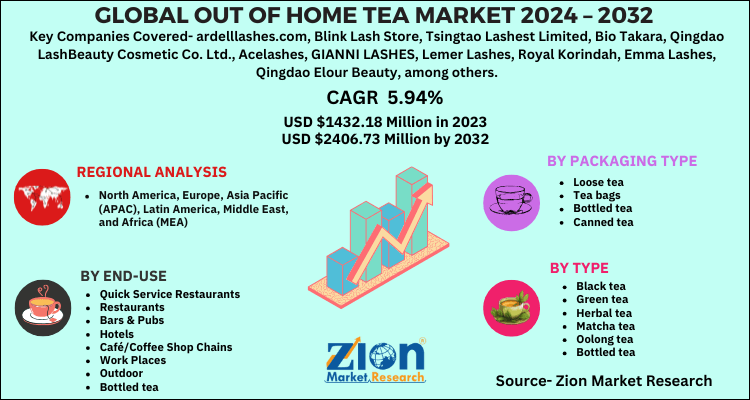

Out of Home Tea Market - by Packaging Type (Tea bags, Loose tea, Canned tea, and Bottled tea), By Type (Green tea, Black tea, Matcha tea, Herbal tea, and Oolong tea), By End use (Restaurants, Quick Service Restaurants, Hotels, Bars and Pubs, Work Places, Café/Coffee Shop Chains, and Outdoor), and By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

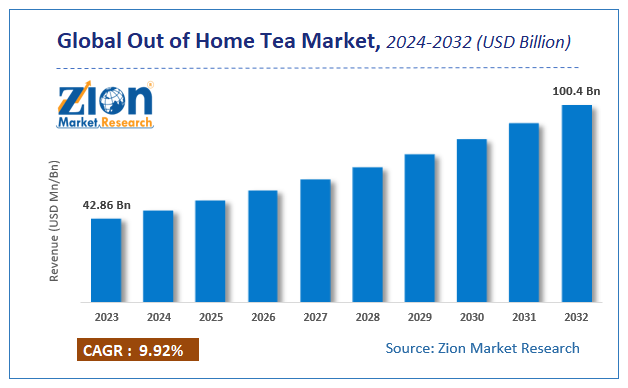

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 42.86 Billion | USD 100.4 Billion | 9.92% | 2023 |

Out of Home Tea Market Insights

Zion Market Research has published a report on the global Out of Home Tea Market, estimating its value at USD 42.86 Billion in 2023, with projections indicating that it will reach USD 100.4 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 9.92% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Out of Home Tea industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Introduction

Out-of-home tea is the tea that is consumed in quick service hotels, pubs, cafes, bars, restaurants, and myriad other outdoor locations. This tea is available in various flavors including matcha tea, black tea, oolong tea, green tea, and herbal tea. Among these out of home teas, black tea is one of the most consumed beverages globally as a result of its antioxidant feature assisting in minimization of body inflammation. Black tea has anti-hyperglycemic effect and its long-term intake helps in reducing the high blood pressure & stoke risk in human beings you can check this also Bubble Tea Market Size.

Reportedly, black tea arrests the growth of breast tumors due to the anti-proliferative activities of its polyphenol. Furthermore, out of home tea helps in avoiding debilitating human ailments encompassing remaining of metabolic as well as cardiovascular health of the human beings.

Furthermore, green tea is consumed on a large-scale in the countries like China and is made up of camellia sinensis and offers lucrative health benefits. It comprises of polyphenols including flavanols, flavonoids, phenolic acids, and flavandiols. These compounds contribute nearly 30% of the dry leaf weight. Green tea also strengthens the immunity of the body system and protects it against free radicals or oxidants. Apart from this, herbal tea is prepared from mixture of herbs, spices, and fruits in heated water. Matcha tea is manufactured after crushing the green leaves into powdered form, while oolong tea is produced through plant crushing under sun & oxidation before twisting & curling the plant.

Apparently, the important chemical ingredients that influence the taste and flavor in out-of-home tea brew include polyphenols, volatile flavor compounds, sugars, caffeine, organic acids, and amino acids. Phenolic compounds of out-of-home tea such as theaflavins and thearubigins have proved to be significant due to their high intrinsic qualities. They are responsible for imparting flavor, color, and brightness to tea. In addition to this, out-of-home tea also helps in reducing obesity in individuals.

Global Out of Home Tea Market: Segmentation

The study provides a decisive view of the out of home tea market by segmenting the market based on by oil type, by fat type, by application, by form and by region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

By type analysis includes black tea, green tea, herbal tea, matcha tea, oolong tea and bottled tea.

On the basis of packaging type analysis includes loose tea, tea bags, bottled tea, canned tea.

On the basis of end-use analysis includes quick service restaurants, restaurants, bars & pubs, hotels, café/coffee shop chain, work places, outdoor and bottled tea.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Out of Home Tea Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Out of Home Tea Market |

| Market Size in 2023 | USD 42.86 Billion |

| Market Forecast in 2032 | USD 100.4 Billion |

| Growth Rate | CAGR of 9.92% |

| Number of Pages | 110 |

| Key Companies Covered | The Coca-Cola Company, Associated British Foods, Tata Global Beverages Ltd., Unilever Group, PepsiCo. Inc., Celestial Seasonings. Inc., Starbucks Corporation, Costa Ltd., The Republic of Tea, Nestle S.A., Bettys and Taylors Group Limited, Tenfu Corporation, Peet’s Coffee & Tea, Kusmi Tea, Dilmah Ceylon Tea Company Plc. |

| Segments Covered | By Type, By Packaging Type, By End-Use And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Market Growth Drivers

With the antioxidating features of black tea and the use of green tea as medicine in countries like China and India for controlling bleeding, providing relief to patients with heart disorders, and healing wounds. This, in turn, will steer the market size over the forecast timeline. Apparently, green tea is also consumed as it offers myriad benefits such as helping in weight reduction, Alzheimer's disease, and type 2 diabetes.

As per NIH researchers, green tea offer numerous health benefits such as cancer chemopreventive effects as well as chemotherapeutic benefits for the patient. Furthermore, green tea catechin help in the inhibition of Helicobacter pylori infection. The health-promoting activity of green tea is credited to the high presence of EGCG in it.

Additionally, empirical studies have exhibited that consuming black tea regularly helps in reducing the probability of heart ailments. Reportedly, the inclusion of black tea in the diet helped in the reduction of low-density lipoprotein cholesterol in hypercholesterolemic humans. Besides these benefits, the intake of black tea also plays a vital part in minimizing body weight while the polyphenols of black tea obstruct obesity through lipid & complex sugar absorption. Apparently, black tea polyphenols also enhance the process of lipolysis and thus plummet lipid accumulation by reducing the multiplication of fats. This, in turn, will embellish the market growth over the years ahead.

Polyphenols in the home tea possess antioxidant, antiviral, and anti-inflammatory features. They control detoxification enzymes, strengthen immune functionalities, and reduce platelet accumulation. A plethora of studies suggests that polyphenolic compounds present in green & black tea are related to the prevention of heart diseases, particularly atherosclerosis and coronary heart disease.

Studies have revealed that green tea offers numerous health advantages owing to the presence of a high proportion of epigallocatechin gallate (EGCG) contents. Some experiments carried out on animals have demonstrated that green tea aids in avoiding degenerative ailments. Clinical trials on animals & humans have also displayed that green tea can help in reducing chronic ailments as well as avoiding neurological disorders and oxidative stress.

Apparently, green tea also benefits the gastrointestinal system along with helping in preventing cancer of the lungs, pancreas, stomach, colon, kidney, mammary glands, and small intestine. For the record, the beneficial impact of green tea on typhoid and diarrhea has been known in the Asian continent long back. It has also been unleashed that green tea consumption offers benefits to an individual suffering from influenza and herpes simplex virus in its initial phase.

Asia Pacific To Maintain Its Dominant Market Position Over 2024-2032

The regional market growth over the forecast timeline is attributed to the large-scale presence of tea manufacturers in the countries like India. Apart from this, India and China contribute a major share in the export of tea as well as there is high tea consumption witnessed in these countries. These factors will steer the growth of the regional market over the years ahead.

Competitive Landscape and Company Market Share Analysis

Key players profiled in the report include

- The Coca-Cola Company

- Associated British Foods

- Tata Global Beverages Ltd.

- Unilever Group

- PepsiCo. Inc.

- Celestial Seasonings. Inc.

- Starbucks Corporation

- Costa Ltd.

- The Republic of Tea

- Nestle S.A.

- Bettys and Taylors Group Limited

- Tenfu Corporation

- Peet’s Coffee & Tea

- Kusmi Tea

- Dilmah Ceylon Tea Company Plc.

The global out-of-home tea market is segmented as follows:

By Type

- Black tea

- Green tea

- Herbal tea

- Matcha tea

- Oolong tea

- Bottled tea

By Packaging Type

- Loose tea

- Tea bags

- Bottled tea

- Canned tea

By End-use

- Quick Service Restaurants

- Restaurants

- Bars & Pubs

- Hotels

- Café/Coffee Shop Chains

- Work Places

- Outdoor

- Bottled tea

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Out Of Home Tea Market was valued at USD 42.86 Billion in 2023.

The Out Of Home Tea Market is expected to reach USD 100.4 Billion by 2032, growing at a CAGR of of 9.92% between 2024 to 2032.

Global Out Of Home Tea Market players such as The Coca-Cola Company, Associated British Foods, Tata Global Beverages Ltd., Unilever Group, PepsiCo. Inc., Celestial Seasonings. Inc., Starbucks Corporation, Costa Ltd., The Republic of Tea, Nestle S.A., Bettys and Taylors Group Limited, Tenfu Corporation, Peet’s Coffee & Tea, Kusmi Tea, Dilmah Ceylon Tea Company Plc.

The key market participants include Associated British Foods, Tata Global Beverages Ltd., Celestial Seasonings, Inc., Costa Ltd., The Republic of Tea, Nestle S.A., Bettys and Taylors Group Limited, Tenfu Corporation, Peet’s Coffee & Tea, Kusmi Tea, Starbucks Corporation, Unilever Group, PepsiCo, Inc., The Coca-Cola Company, and Dilmah Ceylon Tea Company Plc.

Tea that is consumed outside of a private setting, such as a restaurant, a coffee shop, a tea shop, or another public location is referred to as "out of home tea." It may also refer to tea that is purchased from vending machines, food trucks, or other similar mobile shops and eaten while on the move. Tea drinking out from home is becoming increasingly popular as more individuals look for novel and high-quality tea experiences outside of the confines of their own houses. It frequently entails experimenting with novel tea kinds and mixes, as well as a variety of approaches to preparing tea and items related to tea.

The regional market growth over the forecast timeline is attributed to the large-scale presence of tea manufacturers in the countries like India. Apart from this, India and China contribute a major share in the export of tea as well as there is high tea consumption witnessed in these countries. These factors will steer the growth of the regional market over the years ahead.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed