Origami Aeroplane Seat Design Market Size, Share, Trends, Growth 2034

Origami Aeroplane Seat Design Market By Aircraft Type (Commercial, Business Jets, Regional Aircraft, Transport Aircraft), By Class (Economy Class, Premium Economy Class, Business Class, First Class), By Seat Type (9G Seats, 16G Seats, 21G Seats), By Component (Structure, Foams, Actuators, Electric Fittings, and Others), By End Use (OEM, Aftermarket), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

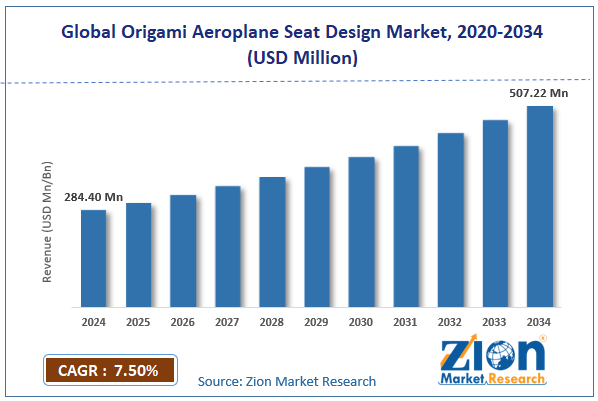

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 284.40 Million | USD 507.22 Million | 7.50% | 2024 |

Origami Aeroplane Seat Design Industry Perspective:

The global origami aeroplane seat design market size was around USD 284.40 million in 2024 and is projected to reach USD 507.22 million by 2034, with a compound annual growth rate (CAGR) of roughly 7.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global origami aeroplane seat design market is estimated to grow annually at a CAGR of around 7.50% over the forecast period (2025-2034)

- In terms of revenue, the global origami aeroplane seat design market was valued at approximately USD 284.40 million in 2024 and is projected to reach USD 507.22 million by 2034.

- The origami aeroplane seat design market is projected to grow significantly, driven by increased focus on lightweight aircraft interiors, rising adoption of premium economy seating, and rising passenger comfort expectations.

- By aircraft type, the commercial segment is expected to lead the market, while the regional aircraft segment is expected to grow

- significantly.

- By class, economy class is the dominant segment, while premium economy class is projected to generate sizeable revenue over the forecast period.

- Based on seat type, the 16G seats segment is expected to lead the market, followed by the 9G seats segment.

- Based on the component, the structure segment is the dominating segment, while the actuators segment is projected to witness sizeable revenue over the forecast period.

- Based on end use, the OEM segment is expected to lead the market, followed by the aftermarket segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Origami Aeroplane Seat Design Market: Overview

The origami aeroplane seat design is an emerging concept in aircraft seating inspired by origami's structural principles. These seats are designed to fold, expand, and compress in a space-efficient manner without compromising passenger comfort, allowing airlines to enhance cabin capacity and layout. The global origami aeroplane seat design market is poised for notable growth, driven by demand for space optimization in densified cabins, rising fuel prices, and post-COVID Flex-Cabin layouts for reconfigurable seating.

Airlines progressively seek to maximize seating density without degrading comfort to counter margin pressure. Origami-based seats allow micro-adjustable layouts while maintaining recline and legroom. This advantage backs LCC growth, dynamic fleet utilization, and premium-flex cabins.

Moreover, fuel accounts for 20-30% of an airline's operating costs, and any weight-saving offers a compounding margin return. Origami designs employ advanced composites and structural minimization to curb seat mass. Lower airframe weight translates into lower burn rates, maintenance costs, and CO2 emissions.

Furthermore, airlines now value speedy conversion between cargo nodes or distancing and high-density without downtime. Origami seats fold flat or have retractable frameworks that allow on-aircraft reconfiguration. This directly reduces the time and inventory required for seat kits.

Although drivers exist, the global market is challenged by factors such as reliability, fatigue concerns, and a cost premium versus traditional high-volume seats. Airline seats experience thousands of cycles with cleaning, temperature swings, and abuse. Movable joints increase concerns regarding squeak, play, jamming over time, and fracture. MRO liability and warranty exposure slow buyer confidence.

Similarly, advanced composites, tooling novelty, and low production volumes increase unit costs. Airlines experiencing thin yields resist capex spikes without fast ROI proof. Procurement inertia favors proven platforms with depreciated tooling.

Even so, the global origami aeroplane seat design industry is well-positioned due to its associations with eVTOL and New-Gen OEMs before the design freeze, as well as dynamic yield management models for seasonal fleet utilization. Entering seat specifications early in clean-sheet platforms secures long, locked-in volumes.

Regional OEMs and eVTOL seek IP-differentiated cabins as selling points. Co-development reduces friction around the anchor roadmap and certification. Origami cabins allow switching density per route, macro shock, or season. Airlines can algorithmically tie layouts to demand curves rather than fixed configs. Revenue science + physical flexibility is a structural benefit.

Origami Aeroplane Seat Design Market Dynamics

Growth Drivers

How is cabin experience reframing the driving the origami aeroplane seat design market?

Cabins are being reframed as experiential assets rather than commodity tubes, with 60% of airline brand equity now tied to the seat experience (APX 2024). Origami seat kinematics allow cradling, privacy, and shock-free recline without pitch theft – creating a premium-like sensation in economy footprint; in 2024, ANA and Singapore Airlines funded 'passenger calmness' R&D with seat geometry as a core lever. With 78% of premium-leisure travelers citing seat comfort as a booking-decisive factor, seat architecture is moving from furniture to a revenue lever—boosting origami adoption.

How do safety, biomechanics & injury reduction fuel the origami aeroplane seat design market?

2023-24 registered a rise in turbulence litigation, with NTSB reporting a 19% YoY growth in severe in-cabin injuries, prompting insurer and regulatory pressure for biomechanically safer seats. Origami-based frameworks redistribute load paths and flexurally absorb energy in place of rigidly transmitting force during g-load spikes.

In August 2024, EASA released papers on 'dynamic deceleration moderation' – directly aligning with origami seat logic. With climate-based turbulence anticipated to grow by 2028, safety has become a structural driver of origami seat adoption, propelling the origami aeroplane seat design market.

Restraints

Supply-chain immaturity for fold-kinematic components negatively impacts the market

The vendor base for precision foldable seat assemblies is still shallower than that of mature suppliers of standard foams, rails, and frames, resulting in longer lead times, QA variability, and higher MOQs. In 2024, two European Tier-2s publicly reported delivery overruns on foldable assemblies due to hinge-forging backlogs, further strengthening reliability issues. Airlines avoid platforms without industrial derisking because downtime costs exceed the benefits of advancement, turning supply risk into a procurement blocker. Without a scaled second-source network, origami seats continue to experience adoption resistance.

Opportunities

How is the premium-economy boom advantageous for the development of the origami aeroplane seat design market?

Premium economy accounted for 21% of long-haul cabins in 2024, creating a high-margin zone that can fund novel seat innovations. Origami kinematics provide non-pitch-steal recline, privacy, and biomechanical comfort that match the mid-tier and premium-leisure demands of corporate customers. Airlines now use PEY as the CAPEX absorber for cabin refreshes – as witnessed in 2024 expansions by Qantas and Air Canada, which used 'comfort-as-revenue-engine' framing to position origami seats to upsell experience without taking more real estate. Such a boom eventually augments the worldwide origami aeroplane seat design industry.

Challenges

Retro-installation complexity restricts the market growth

Older fuselages, mixed-generation rails, and non-standard monuments complicate drop-in origami retrofits. Engineering reintegration contributes to downtime cost – airlines dislike parked metal. In many 2024 retrofit cycles, carriers rejected origami proposals solely because of downtime cost and not performance. Retrofit feasibility should be engineered down before industry scale can materialize. Complexity tax destroys procurement momentum.

Origami Aeroplane Seat Design Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Origami Aeroplane Seat Design Market |

| Market Size in 2024 | USD 284.40 Million |

| Market Forecast in 2034 | USD 507.22 Million |

| Growth Rate | CAGR of 7.50% |

| Number of Pages | 216 |

| Key Companies Covered | Panasonic Avionics (cabin innovation group), Safran Seats, RECARO Aircraft Seating, Collins Aerospace, JAMCO Corporation, PriestmanGoode (concept designer), Acumen Design Associates, Thompson Aero Seating, Airbus Cabin Innovation Studio, Boeing Future Cabin Concepts, Expliseat, HAECO Cabin Solutions, AVIC Cabin Systems, LIFT Aircraft Seating (by Encore), Adient Aerospace, and others. |

| Segments Covered | By Aircraft Type, By Class, By Seat Type, By Component, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Origami Aeroplane Seat Design Market: Segmentation

The global origami aeroplane seat design market is segmented by aircraft type, class, seat type, component, end use, and region.

Based on aircraft type, the global origami aeroplane seat design industry is divided into commercial, business jets, regional aircraft, and transport aircraft. The commercial segment accounted for a significant share of the market, as airlines operating large fleets seek space-optimization and fuel-saving seats at scale to enhance route economics and ESG scores.

Based on class, the global market is segmented into economy class, premium economy class, business class, and first class. The economy class segment holds a dominant share of the market, as airlines primarily use origami-style foldability to flex or densify the largest seat-count zone, unlocking the greatest weight savings and revenue leverage per aircraft.

Based on seat type, the global market is segmented into 9G seats, 16G seats, and 21G seats. 16G seats hold leadership since they are the mainstream certification standard for the majority of commercial narrow-body and wide-body fleets. This makes line-fit and origami-based retrofit adoption more scalable.

Based on component, the global origami aeroplane seat design market is segmented into structure, foams, actuators, electric fittings, and others. The structure segment holds a leading share, as origami advancement is fundamentally frame- and geometry-driven, with foldable load-bearing frameworks forming the core IP, certification baseline, and weight delta.

Based on end use, the global market is segmented into OEM and aftermarket. OEMs hold a substantial share, as origami seat concepts are usually embedded early in cabin and airframe definition, enabling structural integration, fleet-wide standardization, and alignment with certification requirements from day one.

Origami Aeroplane Seat Design Market: Regional Analysis

Asia Pacific to witness significant growth over the forecast period

Asia Pacific is likely to sustain its leadership in the origami aeroplane seat design market due to the fastest fleet expansion, strong pressure on seat-mile economics, and alignment with government and sustainability initiatives that are boosting advanced interiors. Asia Pacific accounts for 40-45% of the worldwide commercial aircraft backlog growth by 2035, led by China, India, and Southeast Asia.

More novel aircraft translate to more OEM-spec seating advancement procurement. Origami seats ride along with new builds rather than the slow retrofit cycles observed in the West. Asia's trunk routes (Delhi–Mumbai, Beijing–Shanghai, Singapore–Jakarta, Tokyo–Osaka) are among the top 10 densest city pairs by RPK. Airlines' flight units achieve economies through space optimization, weight reductions, and uplift flexibility. Origami seating enables revenue-density gains without permanent densification penalties.

Furthermore, the aviation policies of Japan, China, India, and Singapore include efficiency and lightweighting in their growth roadmaps. MRO hubs and OEMs invest in future cabin technologies to capture export share. ESG capital inflows in Asia Pacific aviation progress at 18-20% Year-on-Year post-2021, drawing lightweight origami configurations into funded adoption pipelines.

Europe continues to secure the second-highest share in the origami aeroplane seat design industry, owing to a strong OEM and seat-tier supply base anchored in Europe, rigorous weight-reduction and sustainability mandates from EU policy, and retrofit appetite within cost-disciplined, mature fleets. Europe hosts major seat manufacturers and design houses that feed Airbus' final assembly lines and retrofit programs. European OEM-associated suppliers hold nearly 40% of the worldwide premium aircraft seating supply share. This legacy supply chain benefit augments origami-based adoption inside the current cabin sourcing infrastructure.

Moreover, EU climate architectures pressure airlines to decarbonize by mass and burn cuts. Cabin light-weighting is among the few 'immediate-impact levers', with 2-3% fuel-burn reduction per 100kg removed per flight cycle, as mentioned in operator disclosures. Origami seats deliver structural mass and shipping-volume savings aligned with EU ESG scorekeeping.

Additionally, Europe's fleet is well developed, with high yields on constrained airport slots. European airlines target cabin retrofit programs to unveil economies without novel airframes. Premium-flex zones and retrofit now account for 22-25% of the regional-wide-body interior spend, making origami reconfigurability commercially appealing.

Origami Aeroplane Seat Design Market: Competitive Analysis

The leading players in the global origami aeroplane seat design market are:

- Panasonic Avionics (cabin innovation group)

- Safran Seats

- RECARO Aircraft Seating

- Collins Aerospace

- JAMCO Corporation

- PriestmanGoode (concept designer)

- Acumen Design Associates

- Thompson Aero Seating

- Airbus Cabin Innovation Studio

- Boeing Future Cabin Concepts

- Expliseat

- HAECO Cabin Solutions

- AVIC Cabin Systems

- LIFT Aircraft Seating (by Encore)

- Adient Aerospace

Origami Aeroplane Seat Design Market: Key Market Trends

Lightweighting with advanced composites and topology-minimized frames:

Origami seat frames progressively use carbon-hybrid laminates, topology-optimized ribs, and 3D-focused aluminum. The goal is to remove inert mass while preserving crash compliance. Weight savings compound into carbon dioxide reductions, fuel savings, and ESG finance benefits.

Digital-twin and VR-based cabin validation replacing physical tryouts:

OEMs now virtually mimic fold paths, egress, crash loads, and pinch zones before cutting metal. This slashes prototyping time and derisks layout approvals. Digital verification is augmenting the willingness to assess unconventional and folding architectures.

The global origami aeroplane seat design market is segmented as follows:

By Aircraft Type

- Commercial

- Business Jets

- Regional Aircraft

- Transport Aircraft

By Class

- Economy Class

- Premium Economy Class

- Business Class

- First Class

By Seat Type

- 9G Seats

- 16G Seats

- 21G Seats

By Component

- Structure

- Foams

- Actuators

- Electric Fittings

- Others

By End Use

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The origami aeroplane seat design is an emerging concept in aircraft seating inspired by origami's structural principles. These seats are designed to fold, expand, and compress in a space-efficient manner without compromising passenger comfort, allowing airlines to enhance cabin capacity and layout.

The global origami aeroplane seat design market is projected to grow due to rising demand for cabin space optimization, advances in foldable structural materials, and increasing retrofitting of older aircraft cabins.

According to a study, the global origami aeroplane seat design market size was approximately USD 284.40 million in 2024 and is expected to reach approximately USD 507.22 million by 2034.

The CAGR value of the origami aeroplane seat design market is expected to be around 7.50% during 2025-2034.

The structure segment holds the leading share because the core origami innovation lies in the foldable load-bearing frame that drives both cabin reconfigurability and weight reduction.

Asia Pacific is expected to lead the global origami aeroplane seat design market during the forecast period.

China is a major contributor due to its localized investments in next-generation lightweight cabin interior technologies and rapidly expanding commercial fleet orders.

The key players profiled in the global origami aeroplane seat design market include Panasonic Avionics (cabin innovation group), Safran Seats, RECARO Aircraft Seating, Collins Aerospace, JAMCO Corporation, PriestmanGoode (concept designer), Acumen Design Associates, Thompson Aero Seating, Airbus Cabin Innovation Studio, Boeing Future Cabin Concepts, Expliseat, HAECO Cabin Solutions, AVIC Cabin Systems, LIFT Aircraft Seating (by Encore), and Adient Aerospace.

The competitive landscape is fragmented with a mix of established aircraft seat OEMs partnering with a wave of specialized startups and airframers focused on lightweight modular architectures and patent-driven folding geometries.

The report examines key aspects of the origami aeroplane seat design market, including a detailed analysis of current growth drivers and restraints, as well as future growth opportunities and challenges that will affect the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed