Optical Transmission and Component Market Size, Share Report 2034

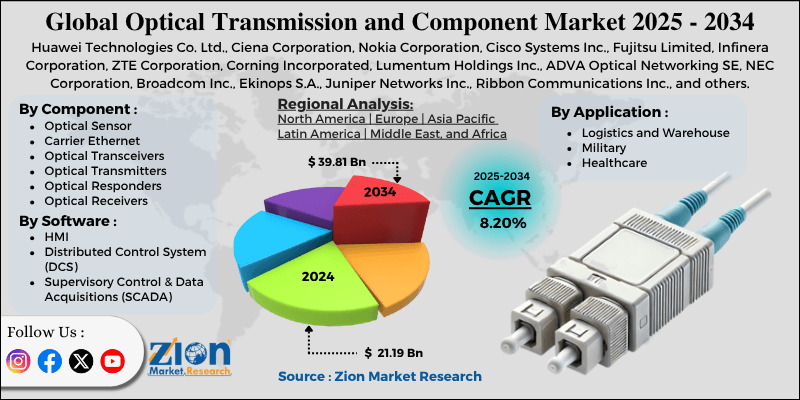

Optical Transmission and Component Market By Component (Optical Sensor, Carrier Ethernet, Optical Transceivers, Optical Transmitters, Optical Responders, Optical Receivers, and Others), By Software (HMI Distributed Control System [DCS], Supervisory Control and Data Acquisitions [SCADA], and Others), By Application (Logistics and Warehouse, Military, Healthcare, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

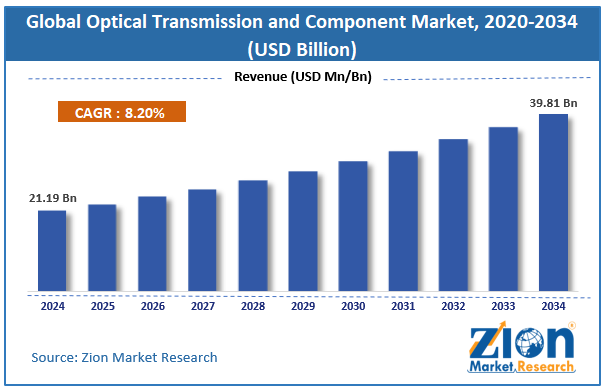

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 21.19 Billion | USD 39.81 Billion | 8.20% | 2024 |

Optical Transmission and Component Industry Perspective:

The global optical transmission and component market size was worth around USD 21.19 billion in 2024 and is predicted to grow to around USD 39.81 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.20% between 2025 and 2034. The report analyzes the global optical transmission and component market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the retail earplugs industry.

Key Insights:

- As per the analysis shared by our research analyst, the global optical transmission and component market is estimated to grow annually at a CAGR of around 8.20% over the forecast period (2025-2034)

- In terms of revenue, the global optical transmission and component market size was valued at around USD 21.19 billion in 2024 and is projected to reach USD 39.81 billion by 2034.

- The optical transmission and component market is projected to grow significantly due to the expansion of 5G network infrastructure, the increasing adoption of smart devices and IoT, and rising investments in broadband infrastructure.

- Based on component, the optical transceivers segment is expected to lead the market, while the optical receivers segment is expected to grow considerably.

- Based on software, the Supervisory Control and Data Acquisitions (SCADA) segment is the dominating segment. In contrast, the Distributed Control System (DCS) segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the military segment is expected to lead the market compared to the healthcare segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Optical Transmission and Component Market: Overview

The optical transmission and component sector focuses on devices and technologies that enable high-speed data transmission via optical fibers. It comprises components like amplifiers, switches, wavelength-division multiplexers, and optical transceivers used in data centers, telecommunications, and enterprise networks. The global optical transmission and component market is poised for notable growth due to the increasing demand for high-speed internet connectivity, the expansion of next-generation and 5G networks, and the rise in data center deployment. The speedy digitalization in industries and the rise in online streaming, cloud services, and IoT devices are increasing the demand for high-speed internet. Optical transmission systems offer the needed bandwidth and low latency for effective data transfer. This rising demand propels the adoption in enterprise and telecom networks.

Moreover, the rollout of 5G networks worldwide needs enhanced fronthaul and backhaul capabilities backed by optical transmission components. Fiber optics promises minimal latency and high data throughput required for 5G infrastructure. Telecom operators and governments are heavily investing in optical networks to meet these requirements. Additionally, the rise of edge data centers and hyperscale to support AI and big data analytics is a key propeller. Data centers depend on optical components to manage huge data flows effectively. The need for energy-efficient and high-performance transmission solutions is boosting the industry growth.

Nevertheless, the global market faces limitations due to factors such as the high initial installation costs and complex network integration and maintenance. Setting up optical transmission networks comprises costly components, skilled labor, and fiber installation. The capital-intensive nature of the technology restricts adoption among medium and small enterprises. Cost concerns continue to be a leading barrier in the emerging economies.

Likewise, optical systems need specialized skills for regular maintenance and integration. Compatibility issues between new and legacy systems may create operational challenges. This may hamper smooth network upgrades. Still, the global optical transmission and component industry benefits from several favorable factors, such as growing investment in submarine cable projects and the development of energy-efficient optical components. Growing international data traffic is propelling the demand for undersea cable systems.

New projects like Google's Equiano and 2Africa are increasing worldwide connectivity. Component manufacturers benefit from these multi-billion-dollar investments. Also, innovation in low-power transceivers and amplifiers can resolve energy concerns in large networks. Sustainable optical solutions comply with the green data center initiatives. This move offers new product development (NPD) opportunities.

Optical Transmission and Component Market Dynamics

Growth Drivers

How is the expansion of IoT connectivity and smart cities boosting the optical transmission and component market?

The ongoing development of smart cities across the globe is creating ample opportunities for optical transmission systems, which form the digital backbone of urban connectivity. From smart traffic management to connected surveillance systems, IoT-based applications demand high-bandwidth and ultra-high optical infrastructure. Governments in economies like India, the UAE, and Japan are adopting large-scale smart city projects with considerable investments in fiber-optic backbone networks. For example, in 2024, India’s Smart Cities Mission declared that more than 100 cities are now leveraging optical components for real-time urban management systems and monitoring, stimulating the industry growth.

How do technological improvements in optical components fuel the optical transmission and component market?

Recent innovations in optical technologies, such as silicon photonics, photonic integrated circuits (PICs), and coherent optics, are transforming the landscape of the optical transmission and component market. These innovations improve bandwidth efficiency, lower the total cost of ownership, and reduce power consumption for telecom operators. The rising trend towards miniaturized and integrated photonic components is also allowing more efficient and compact network designs. As cloud and telecom players aim for high spectral efficiency, constant R&D investments in AI-driven network optimization and quantum-safe optics are boosting the adoption of these technologies worldwide.

Restraints

Shortage of skilled workforce hampers the market progress

The optical transmission sector needs highly skilled technicians and engineers capable of designing, maintaining, and installing complex optical networks. The scarcity is exceptionally high in the developing economies where training programs for fiber optic solutions are low. In 2025, many network operators in Southeast Asia delayed optical backbone upgrades due to a shortage of skilled technical personnel. Without sufficiently skilled labor, operators experience slow deployment schedules, increased risk of network failures, and higher operational costs, which collectively limit the industry's growth.

Opportunities

How does the adoption of edge computing and AI offer advantageous conditions for the optical transmission and component market development?

Edge computing and AI applications require high-bandwidth, low-latency connections, creating opportunities for optical transmission providers. Businesses deploying edge data centers depend on optical switches, photonic integrated circuits, and transceivers to meet the strict performance needs. This trend opens opportunities for innovative optical technologies that can support real-time data processing and distributed AI workloads. With the growing adoption of AI in industries, the demand for robust optical infrastructure is expected to increase significantly, impacting the optical transmission and component industry.

Challenges

Dependence on semiconductor and component supply limits the market growth

The optical industry depends heavily on lasers, semiconductors, and specialty components, which increases its significance in the context of supply chain disturbances. According to the IDC reports, component scarcity delayed nearly 20% of optical equipment deliveries across the globe. Recent geopolitical stresses and semiconductor scarcity impacted product timelines for major vendors. Delays in the availability of vital optical modules may postpone network deployments, majorly affecting revenue streams. Promising a stable supply of critical components is continuously challenging manufacturers.

Optical Transmission and Component Market: Segmentation

The global optical transmission and component market is segmented based on component, software, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on component, the global optical transmission and component industry is divided into optical sensors, carrier ethernet, optical transceivers, optical transmitters, optical responders, optical receivers, and others. The optical transceivers segment has registered a dominating share of the market because they enable high-speed data transfer by converting electrical signals into optical ones and vice versa. Their demand is surging with the rise of data centers, cloud networks, and 5G. The move towards 800G and 400G modules is driving the industry dominance. They are vital for obtaining more efficient and faster communication in modern networks.

Based on software, the global optical transmission and component market is segmented into HMI, distributed control system (DCS), supervisory control and data acquisition (SCADA), and others. The supervisory control and data acquisition (SCADA) segment held leadership in the market. It enables real-time monitoring, data collection, and control in fiber-optic networks. It improves operational efficiency, fault detection, and network reliability in large-scale performance optimization and network management. Its integration with IoT technologies and AI further strengthens its prominence in advanced optical infrastructure.

Based on application, the global market is segmented into logistics and warehouse, military, healthcare, and others. The military segment holds a leading share because of its critical need for high-speed and secure communication networks. Optical transmission systems offer reliable data transfer for defense communication, battlefield management, and surveillance. The adoption of advanced technologies like high-capacity networks and fiber-optic sensors augments operational efficiency. Growing defense budgets and advanced programs across the globe fuel the segmental dominance in the industry.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Optical Transmission and Component Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Optical Transmission and Component Market |

| Market Size in 2024 | USD 21.19 Billion |

| Market Forecast in 2034 | USD 39.81 Billion |

| Growth Rate | CAGR of 8.20% |

| Number of Pages | 215 |

| Key Companies Covered | Huawei Technologies Co. Ltd., Ciena Corporation, Nokia Corporation, Cisco Systems Inc., Fujitsu Limited, Infinera Corporation, ZTE Corporation, Corning Incorporated, Lumentum Holdings Inc., ADVA Optical Networking SE, NEC Corporation, Broadcom Inc., Ekinops S.A., Juniper Networks Inc., Ribbon Communications Inc., and others. |

| Segments Covered | By Component, By Software, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Optical Transmission and Component Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Optical Transmission and Component Market?

Asia Pacific is projected to maintain its dominant position in the global optical transmission and component market due to the rapid deployment of 5G networks, the expansion of data center infrastructure, and strong government initiatives. Asia Pacific economies, mainly Japan, South Korea, and China, are the leaders of 5G network rollouts. China alone has deployed more than 2 million 5G base stations through 2025, needing extensive optical backhaul infrastructure. This large-scale deployment fuels the demand for optical transmission components in the APAC.

Moreover, the region experiences tremendous growth in hyperscale data centers and cloud services, especially in Singapore, China, and India. APAC registers for more than 40% of new worldwide data center capacity in 2024, propelling the need for high-speed optical receivers and transceivers. Optical networks are vital to manage the rising data traffic effectively. Furthermore, governments in the region are heavily investing in digital infrastructure under initiatives like India's 'National Optical Fiber Network' and China's 'Digital Silk Road'. These initiatives aim to increase broadband access, mainly in semi-urban and urban regions. These policies augment the demand for optical transmission components.

North America maintains its position as the second-leading region in the global optical transmission and component industry due to the strong fiber and 5G network growth, high adoption of data centers and cloud services, and R&D and advancements. North America, especially Canada and the United States, is rigorously increasing fiber-optic and 5G networks to meet the rising connectivity demands. The United States alone holds over 2,00,000 miles of new fiber deployed in 2024 to support high-speed broadband and 5G backhaul. This infrastructure growth fuels primary demand for optical transceivers, receivers, and amplifiers. The region also houses leading cloud service providers like Microsoft Azure, Amazon Web Services, and Google Cloud, which require advanced optical transmission solutions.

North America registered for more than 35% of the worldwide hyperscale data center capacity in 2024, driving the need for high-speed optical components. Effective optical networks are vital to support the growing data traffic and low-latency uses. The region also leads in R&D for optical communication technologies, comprising coherent transmission, next-gen transceivers, and WDM. Companies invest billions every year to develop high-capacity and energy-efficient solutions. These advancements improve network performance and maintain intense competition in the worldwide optical markets.

Optical Transmission and Component Market: Competitive Analysis

The leading players in the global optical transmission and component market are:

- Huawei Technologies Co. Ltd.

- Ciena Corporation

- Nokia Corporation

- Cisco Systems Inc.

- Fujitsu Limited

- Infinera Corporation

- ZTE Corporation

- Corning Incorporated

- Lumentum Holdings Inc.

- ADVA Optical Networking SE

- NEC Corporation

- Broadcom Inc.

- Ekinops S.A.

- Juniper Networks Inc.

- Ribbon Communications Inc.

Optical Transmission and Component Market: Key Market Trends

Adoption of high-capacity transmission technologies:

There is a surging move towards 400G, 800G, and beyond optical transmission systems to meet the growing transmission data traffic. Data centers and telecom operators are deploying high-capacity coherent systems and transceivers. This trend fuels more efficient and faster network performance, as well as future-proof infrastructure.

Focus on energy-efficient and sustainable solutions:

With the growing sustainability goals and energy costs, the industry is inclining towards low-power optical transceivers, network components, and amplifiers. Green optical solutions reduce operational expenditure and carbon footprint. This trend is highly seen in telecom and large-scale data center infrastructure projects.

The global optical transmission and component market is segmented as follows:

By Component

- Optical Sensor

- Carrier Ethernet

- Optical Transceivers

- Optical Transmitters

- Optical Responders

- Optical Receivers

- Others

By Software

- HMI

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisitions (SCADA)

- Others

By Application

- Logistics and Warehouse

- Military

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The optical transmission and component sector focuses on devices and technologies that enable high-speed data transmission via optical fibers. It comprises components like amplifiers, switches, wavelength-division multiplexers, and optical transceivers used in data centers, telecommunications, and enterprise networks.

The global optical transmission and component market is projected to grow due to increasing demand for high-speed internet connectivity, energy-efficient and low-latency communication systems, and the expansion of telecommunication networks in developing regions.

According to study, the global optical transmission and component market size was worth around USD 21.19 billion in 2024 and is predicted to grow to around USD 39.81 billion by 2034.

The CAGR value of the optical transmission and component market is expected to be around 8.20% during 2025-2034.

The military application area is expected to offer significant growth opportunities in the optical transmission and component market.

Asia Pacific is expected to lead the global optical transmission and component market during the forecast period.

China is a key contributor to the global optical transmission and component market.

The key players profiled in the global optical transmission and component market include Huawei Technologies Co., Ltd., Ciena Corporation, Nokia Corporation, Cisco Systems, Inc., Fujitsu Limited, Infinera Corporation, ZTE Corporation, Corning Incorporated, Lumentum Holdings Inc., ADVA Optical Networking SE, NEC Corporation, Broadcom Inc., Ekinops S.A., Juniper Networks, Inc., and Ribbon Communications Inc.

What investment or partnership opportunities exist in the optical transmission and component market?

Opportunities exist in data center expansion, 5G infrastructure, R&D collaborations, and advanced photonic components.

The report examines key aspects of the optical transmission and component market, providing a detailed analysis of current growth factors and restraints, as well as future opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed