Online Gambling Market Size, Share, Trends, Growth 2034

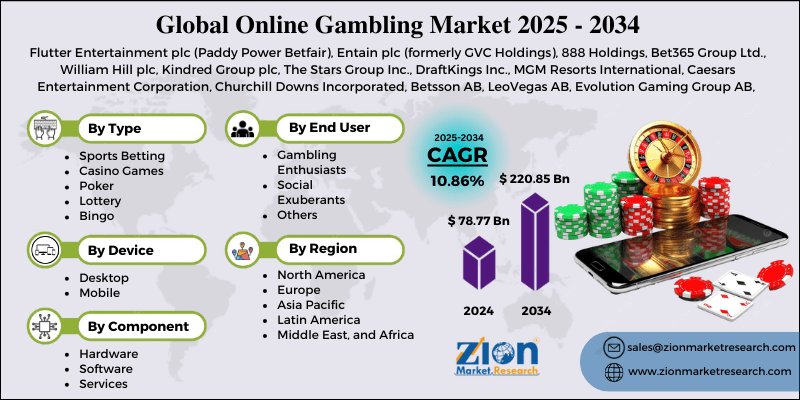

Online Gambling Market By Type (Sports Betting, Casino Games, Poker, Lottery, Bingo, and Others), By Device (Desktop, Mobile, and Others), By Component (Hardware, Software, and Services), By End-User (Gambling Enthusiasts, Social Exuberants, and Others) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 78.77 Billion | USD 220.85 Billion | 10.86% | 2024 |

Online Gambling Industry Perspective:

The global online gambling market was valued at approximately USD 78.77 billion in 2024 and is expected to reach around USD 220.85 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 10.86% between 2025 and 2034.

Online Gambling Market: Overview

Online gambling is a digital platform offering online betting on sports, casino games, poker, lotteries, and other chance-based entertainment, with no geographic restrictions and convenient and accessible gaming. These platforms have multiple game options, secure payment processing, personalized promotions, 24/7 access, and responsible gambling tools.

Online gambling is for recreational players looking for entertainment, dedicated bettors looking for profit, sports fans looking to add excitement to their viewing experience, and technology-savvy adults looking for convenience.

Products range from traditional sportsbooks and virtual casinos to live dealer games, instant lotteries, and specialized betting markets for different types of players, experience levels, and risk tolerance.

The digital transformation of the gambling industry, increasing smartphone penetration, evolving regulatory landscapes across key markets, and technological innovations enhancing user experiences are expected to drive substantial growth in the global online gambling industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global online gambling market is estimated to grow annually at a CAGR of around 10.86% over the forecast period (2025-2034)

- In terms of revenue, the global online gambling market size was valued at around USD 78.77 billion in 2024 and is projected to reach USD 220.85 billion by 2034.

- The online gambling market is projected to grow significantly due to progressive regulation in key jurisdictions, the normalization of online betting through mainstream media coverage, advancements in payment processing technology, and increasing consumer preference for at-home entertainment options.

- Based on type, sports betting leads the segment and will continue to lead the global market.

- Based on the device, the mobile segment is expected to lead the market during the projected period.

- Based on components, software is anticipated to command the largest market share.

- Based on end-user, gambling enthusiasts are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Online Gambling Market: Growth Drivers

Regulatory evolution and market legitimization

The online gambling market is experiencing growth as regulatory frameworks evolve globally, transitioning from prohibition to regulated marketplace models. Jurisdictions are shifting from restriction to licensing and taxation, and previously untapped markets are now open to business.

The recognition of gambling tax revenue has forced regulatory reform in many countries under budget pressure. Mainstream acceptance has grown as major sports leagues and media companies partner with gambling operators.

Responsible gambling frameworks are now part of the regulatory requirements, and consumer protection and industry legitimacy have improved. Moving from the grey market to a fully regulated market will unlock huge growth over the forecast period.

Technological advancement and user experience optimization

Online gambling platforms have evolved dramatically through technological innovation, creating immersive and seamless experiences that drive consumer engagement and retention.

Mobile has made accessibility a breeze, and players can play anywhere, anytime through interfaces designed for smaller screens. Live Dealer has bridged the gap between physical and virtual casinos by streaming real-time gameplay with human dealers.

Payment processing has reduced friction with instant deposits and withdrawals through various methods, from traditional banking to cryptocurrencies. Artificial intelligence is improving customer service, fraud detection, and gameplay personalization.

Online Gambling Market: Restraints

Regulatory inconsistency and compliance complexity

Despite the good news, the online gambling industry has many challenges with fragmented regulatory environments and changing compliance requirements across different countries.

Licensing costs and operational requirements vary wildly between markets, making it hard for new operators to enter. Cross-border operations have many legal questions around player eligibility, taxation, and regulatory authority. Advertising restrictions in many markets limit customer acquisition and brand development.

Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements create friction in the player onboarding process, although they are essential for integrity. Operators must navigate all this while keeping competitive offers and a positive user experience to succeed in this crazy market.

Online Gambling Market: Opportunities

Emerging markets and demographic expansion

The online gambling market has big growth opportunities in new regions and among new types of players. Areas like Latin America, Africa, and parts of Asia are seeing more internet access and more explicit rules, making them strong markets to expand into.

Younger generations like Millennials and Gen Z, who are used to digital platforms, offer long-term value as they begin to earn more. There's also a chance to reach more female players since gambling has mostly targeted men. Adapting games to local cultures can attract players who may not respond to Western-style gambling.

The mix of gaming and gambling draws in video game fans who enjoy skill-based betting. As smartphones become common in developing areas, more people can be reached.

Online Gambling Market: Challenges

Market competition and customer acquisition costs

The online gambling industry faces challenges with market saturation in mature markets and increasing customer acquisition costs in a very competitive space. Marketing costs have skyrocketed, with some companies spending over $500 just to get one new user. It’s hard for brands to stand out since many offer similar games from the same providers.

Players often switch platforms for better deals, making it tough to keep them loyal. Some users exploit bonus offers, putting extra financial strain on operators. High affiliate payouts are also cutting into profits.

On top of that, companies must constantly update their platforms, which adds ongoing costs. To succeed in crowded markets, businesses need smart marketing, unique products, and efficient operations.

Online Gambling Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Online Gambling Market |

| Market Size in 2024 | USD 78.77 Billion |

| Market Forecast in 2034 | USD 220.85 Billion |

| Growth Rate | CAGR of 10.86% |

| Number of Pages | 214 |

| Key Companies Covered | Flutter Entertainment plc (Paddy Power Betfair), Entain plc (formerly GVC Holdings), 888 Holdings, Bet365 Group Ltd., William Hill plc, Kindred Group plc, The Stars Group Inc., DraftKings Inc., MGM Resorts International, Caesars Entertainment Corporation, Churchill Downs Incorporated, Betsson AB, LeoVegas AB, Evolution Gaming Group AB, Scientific Games Corporation, Playtech plc, IGT (International Game Technology), BetMGM LLC, Rush Street Interactive, Penn National Gaming, and others. |

| Segments Covered | By Type, By Device, By Component, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Online Gambling Market: Segmentation

The global online gambling market is segmented into type, device, component, end-user, and region.

Based on type, the online gambling market is segregated into sports betting, casino games, poker, lottery, bingo, and others. Sports betting leads the market due to its broad appeal across different demographics, integration with popular sports viewing experiences, and earlier regulatory approval in many jurisdictions compared to other gambling verticals.

Based on devices, the online gambling industry is classified into desktop, mobile, and others. Mobile holds the largest market share due to its convenience, 24/7 accessibility, and the technological evolution of smartphones that can now deliver high-quality gambling experiences comparable to desktop platforms.

Based on components, the online gambling market is divided into hardware, software, and services. Software is expected to lead the market during the forecast period due to its central role in gameplay experience, security, compliance management, and the ongoing shift toward cloud-based delivery models that reduce hardware dependencies.

Based on end-users, the market is segmented into gambling enthusiasts, social exuberants, and others. The gambling enthusiast segment leads the market share due to their higher average spending, more frequent engagement, and greater lifetime value compared to casual or social players.

Online Gambling Market: Regional Analysis

North America to lead the market

North America is the largest online gambling market due to its well-established regulatory framework, high digital adoption, and cultural acceptance of gambling across multiple verticals. 40% of the global market is in North America, with the U.S. being the largest regulated market in the world by revenue and player participation. The North American regulatory approach has clear licensing pathways and consumer protection measures.

The region has an early mover advantage and has developed sophisticated player bases familiar with online gambling products across demographics. Pan-American operators have achieved economies of scale through multi-jurisdiction licenses despite regulatory fragmentation. Strong sports betting cultures, particularly around American football, have driven significant market growth across the continent.

Europe is set to grow significantly.

Europe is growing faster than any other region in the online gambling industry. This growth comes from more countries creating legal gambling frameworks, bringing previously underground gambling into regulated markets.

Europe's strong football culture makes it perfect for sports betting expansion. Media companies are increasingly incorporating gambling content, making it more mainstream. Significant investment is flowing into the sector, funding marketing and new technology. The UK's established gambling market provides a successful model for other countries.

Despite complex regulations and taxes in some places, European gamblers spend more on average than those in different regions. As more European countries approve online gambling, this growth is expected to continue.

Recent Market Developments:

- In February 2025, Flutter Entertainment, an Irish-American multinational sports betting and gambling company, acquired a 56% stake in Brazil's NSX Group, the owner of Betnacional, for $350 million. This acquisition positions Flutter to capitalize on Brazil's rapidly evolving regulatory landscape.

- In December 2024, LeoVegas, an MGM Resorts subsidiary, finalized the acquisition of Tipico's U.S. sportsbook and online casino platforms. This acquisition strengthens MGM's online gambling operations in the rapidly growing U.S. market.

Online Gambling Market: Competitive Analysis

The global online gambling market is led by players like:

- Flutter Entertainment plc (Paddy Power Betfair)

- Entain plc (formerly GVC Holdings)

- 888 Holdings

- Bet365 Group Ltd.

- William Hill plc

- Kindred Group plc

- The Stars Group Inc.

- DraftKings Inc.

- MGM Resorts International

- Caesars Entertainment Corporation

- Churchill Downs Incorporated

- Betsson AB

- LeoVegas AB

- Evolution Gaming Group AB

- Scientific Games Corporation

- Playtech plc

- IGT (International Game Technology)

- BetMGM LLC

- Rush Street Interactive

- Penn National Gaming

The global online gambling market is segmented as follows:

By Type

- Sports Betting

- Casino Games

- Poker

- Lottery

- Bingo

- Others

By Device

- Desktop

- Mobile

- Others

By Component

- Hardware

- Software

- Services

By End-User

- Gambling Enthusiasts

- Social Exuberants

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Online gambling refers to any form of betting, gaming, or wagering conducted over the internet using digital platforms, including sports betting, casino games, poker, lotteries, and other chance-based entertainment that allows players to participate from any location with internet connectivity using computers, smartphones, or other devices.

The online gambling market is expected to be driven by evolving regulatory frameworks legalizing online gambling activities, increasing smartphone and internet penetration, technological advancements enhancing user experiences, integration with mainstream sports and entertainment, and shifting consumer preferences toward convenient at-home entertainment options.

According to our study, the global online gambling market was worth around USD 78.77 billion in 2024 and is predicted to grow to around USD 220.85 billion by 2034.

The CAGR value of the online gambling market is expected to be around 10.86% during 2025-2034.

The global online gambling market will register the highest growth in North America during the forecast period.

Key players in the online gambling market include Flutter Entertainment plc (Paddy Power Betfair), Entain plc (formerly GVC Holdings), 888 Holdings, Bet365 Group Ltd., William Hill plc, Kindred Group plc, The Stars Group Inc., DraftKings Inc., MGM Resorts International, Caesars Entertainment Corporation, Churchill Downs Incorporated, Betsson AB, LeoVegas AB, Evolution Gaming Group AB, Scientific Games Corporation, Playtech plc, IGT (International Game Technology), BetMGM LLC, Rush Street Interactive, and Penn National Gaming.

The report comprehensively analyzes the online gambling market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, regulatory developments, and the evolving consumer behaviors shaping the digital gambling ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed