Oil Mist Separator Market Size, Growth, Global Trends, Forecast 2034

Oil Mist Separator Market By Technology Type (Centrifugal Oil Mist Separators, Electrostatic Oil Mist Separators), By Application (CNC Machining Centers, Coolant and Lubrication Systems, Heat Treatment Processes), By End-User Industry (Metalworking, Automotive, Aerospace, Chemical), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

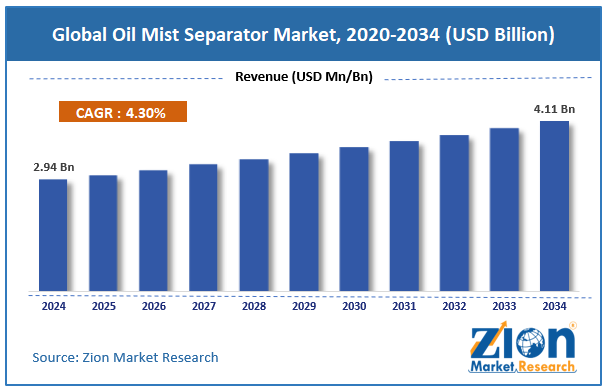

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.94 Billion | USD 4.11 Billion | 4.30% | 2024 |

Oil Mist Separator Industry Perspective:

The global oil mist separator market size was worth around USD 2.94 million in 2024 and is predicted to grow to around USD 4.11 million by 2034, with a compound annual growth rate (CAGR) of roughly 4.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global oil mist separator market is estimated to grow annually at a CAGR of around 4.30% over the forecast period (2025-2034)

- In terms of revenue, the global oil mist separator market size was valued at around USD 2.94 million in 2024 and is projected to reach USD 4.11 million by 2034.

- The oil mist separator market is projected to grow significantly owing to stringent environmental regulations on air emissions, increasing demand for cleaner workplace environments, and technological advancements in separator efficiency.

- Based on technology type, the centrifugal oil mist separators segment is expected to lead the market, while the electrostatic oil mist separators segment is expected to grow considerably.

- Based on application, the CNC machining centers segment is the dominating segment, while the coolant and lubrication systems segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user industry, the metalworking segment is expected to lead the market compared to the automotive segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Oil Mist Separator Market: Overview

An oil mist separator is a device dedicated to removing smoke, oil mist, and fine aerosols from industrial exhaust air, especially in manufacturing environments and machinery. It works by using filters, coalescing methods, or centrifugal force to capture tiny oil droplets, preventing them from being released in the atmosphere or the workplace. The global oil mist separator market is likely to expand rapidly, fueled by increasing metalworking industry activities, a growing focus on worker health and safety, and advancements in industrial automation and smart manufacturing. The rising metalworking industry, comprising stamping, machining, and turning processes, produces substantial oil mist. The worldwide metalworking industry progressed by more than 5% year-on-year, directly driving the demand for OMS systems to ensure clean air in factories and workshops, as per a 2025 report.

Oil mist exposure can cause skin irritation, respiratory issues, and long-term occupational health issues. Industries are progressively investing in OMS systems to safeguard workers, comply with occupational safety norms, and decrease absenteeism, adding to elevated adoption rates. Moreover, Industry 4.0 and automation have led to high-speed CNC machines and automated machining centers, which generate finer oil mist than conventional machines. The need for efficient and automated air filtration solutions has made OMS a vital unit in smart factories.

Despite the growth, the global market is impeded by factors such as maintenance needs and competition from alternative filtration techniques. OMS devices need regular maintenance, comprising cleaning and filter replacement. Improper maintenance may decrease efficiency and raise operational costs, demotivating certain businesses from adopting high-end separators. In some regions, simpler filtration systems or oil recycling techniques are used as cost-effective alternatives to OMS, restricting industry penetration and development.

Nonetheless, the global oil mist separator industry stands to gain from a few key opportunities, such as integration with smart systems and IoT, and retrofitting existing machinery. Smart OMS units embedded with IoT connectivity and sensors enable real-time monitoring, performance optimization, and predictive maintenance, offering opportunities for high-tech system integration in Industry 4.0 arrangements. A majority of industrial facilities seek OMS for older machinery to comply with occupational and environmental safety standards, creating a niche growth category for manufacturers.

Oil Mist Separator Market Dynamics

Growth Drivers

How is increasing focus on workplace safety and health standards boosting the oil mist separator market?

Oil mist exposure can cause respiratory issues and long-term health risks, triggering industries to prioritize employee safety. Regulatory bodies like OSHA in the U.S. recommend oil mist exposure limits to ensure safe workplace surroundings. As per the 2024 survey, nearly 28% of manufacturing plants in the United States were investing in new oil mist separation systems to comply with health standards.

News reports from China highlight initiatives for major automotive plants to install oil mist separators in all hydraulic and CNC systems, emphasizing the importance of workplace safety in fueling the industry. Companies now consider employee health and regulatory compliance as vital factors while choosing oil mist control equipment.

How is the oil mist separator market driven by technological improvements in oil mist separation systems?

Continuous advancement in oil mist separation technology is a key driver of the market. Modern separators now incorporate high-efficiency filtration, energy-saving designs, and automatic drainage, which enhance operational efficiency and reduce maintenance costs.

News from the German manufacturer BEKO Technologies highlights their recent introduction of energy-efficient, compact oil mist separators designed for CNC machinery and small workshops, illustrating how technological advancement is driving industry growth. These advancements make systems more appealing to industrial buyers, impacting the growth of the oil mist separator market.

Restraints

Competition from alternative air filtration technologies unfavorably impacts market progress

The presence of alternative solutions like wet scrubbers, cyclonic separators, and electrostatic precipitators can restrict the adoption of oil mist separators. While these alternatives may not offer the same efficacy for fine mist recovery, they are mostly demanded because of simpler maintenance or lower upfront costs.

Recent industry news shows that some automotive suppliers in the United States are incorporating hybrid filtration systems, assimilating basic separators and wet scrubbers to decrease costs. This competition limits industry expansion by offering manufacturers multiple, at times low-priced alternatives.

Opportunities

How does the demand from the automotive and aerospace sectors open lucrative opportunities for the advancement of the oil mist separator market?

The aerospace and automotive industries continue to expand worldwide, especially with the growth of EVs and advanced aviation manufacturing. These industries need precision machining and generate significant oil mist, creating a continuous need for high-performance separators.

As per industry data 2025, the worldwide EV production is anticipated to progress at a 20% CAGR in the coming 5 years. This eventually increases the demand for oil mist control systems in the manufacturing of electric vehicle components, impacting the growth of the oil mist separator industry. News from Airbus and Tesla facilities shows active deployment of upgraded separators to promise regulatory compliance and operational efficiency.

Challenges

Supply chain disruptions and volatility in industrial production limit the market growth

Industry demand depends on manufacturing output, and supply chain disturbances, recessions, or economic slowdowns may hamper growth. As per the 2024 data, worldwide industrial machinery orders declined by 6% year-on-year in 2023, directly impacting the sales of oil mist separators. Recent news reported that European factories postponed separator installations due to delays in machine tool imports and inflation-led budget restrictions. This volatility creates uncertainty in industry forecasting and capital distribution.

Oil Mist Separator Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oil Mist Separator Market |

| Market Size in 2024 | USD 2.94 Billion |

| Market Forecast in 2034 | USD 4.11 Billion |

| Growth Rate | CAGR of 4.30% |

| Number of Pages | 214 |

| Key Companies Covered | Donaldson Company Inc., Parker Hannifin Corporation, Graco Inc., MANN+HUMMEL GmbH, Eaton Corporation, Hydac International GmbH, Camfil AB, AAF International, Nederman Holding AB, Filtration Group Corporation, Alfa Laval AB, Sullair LLC, Kaeser Kompressoren SE, Atlas Copco AB, Donaldson Torit, and others. |

| Segments Covered | By Technology Type, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Oil Mist Separator Market: Segmentation

The global oil mist separator market is segmented based on technology type, application, end-user industry, and region.

Based on technology type, the global oil mist separator industry is divided into centrifugal oil mist separators and electrostatic oil mist separators. The centrifugal oil mist separators hold a dominating share of the market because of their efficiency in removing large and medium oil droplets from industrial exhaust air. They spin the airflow at high speed, forcing oil particles to separate and collect, which decreases maintenance and promises nonstop operation. Broadly used in automotive, metalworking, and heavy machinery applications, they offer cost-efficiency and reliability.

Based on application, the global oil mist separator market is segmented into CNC machining centers, coolant and lubrication systems, and heat treatment processes. The CNC machining centers segment holds a significant market share due to high-speed cutting, milling, and turning operations, making them the primary application domain. OMS units in these arrangements enhance workplace air quality, promise compliance, and protect equipment from environmental regulations. The rising adoption of automated and high-precision CNC machines in aerospace, automotive, and metalworking industries fuels this demand.

Based on end-user industry, the global market is segmented into metalworking, automotive, aerospace, and chemical. The metalworking segment holds leadership in the market, as processes like grinding, turning, and milling generate significant oil mist. OMS units promise to protect machinery and provide cleaner air, complying with occupational safety and environmental norms. The broader presence of metalworking factories and workshops worldwide fuels strong demand.

Oil Mist Separator Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Oil Mist Separator Market?

Asia Pacific is anticipated to retain its leading role in the global oil mist separator market due to rapid industrialization, high adoption of manufacturing and CNC technologies, and increasing environmental and safety regulations. APAC is witnessing speedy industrial growth, especially in economies like South Korea, China, India, and Japan. The growth of the metalworking, aerospace, and automotive sectors generates substantial oil mist, creating robust demand for OMS systems. The region's industrial growth rate of over 6 percent each year fuels the adoption of OMS. The adoption of automated manufacturing equipment and CNC machining centers is increasing in APAC. High-speed operations produce fine oil mist, demanding advanced separation solutions.

In 2024, APAC accounted for nearly 40% of the worldwide CNC installations, driving the growth of the OMS market. Furthermore, economies in APAC are toughening environmental emission and occupational safety standards, especially in industrial hubs. Compliance with regulations prompts companies to install OMS to decrease workplace risks and air pollution. For instance, China's 2023 revision of industrial emission restrictions restricts the elevated demand for efficient separators.

Europe ranks as the second-leading region in the global oil mist separator industry due to a strong industrial base, stringent environmental regulations, and an emphasis on sustainable and green manufacturing. Europe holds a well-developed industrial sector, comprising automotive, metalworking, and aerospace industries, which produce significant oil mist. Economies like Italy, Germany, and France host many precision manufacturing facilities that need OMS systems.

In 2024, Europe registered for nearly 25-28% of the worldwide industry, denoting robust industrial demand. The European Union enforces stringent environmental and workplace safety standards, like the ISO 14001 certifications and the EU Industrial Emissions Directive. Compliance with these regulations fuels broader adoption of oil mist separators in factories.

Regulatory enforcement has elevated OMS installations by more than 12% between 2022 and 2024. European industries focus on sustainable practices to decrease emissions and enhance air quality. Adoption of energy-efficient and environmentally-friendly OMS solutions complies with corporate sustainability goals. This trend adds to the rising investments in advanced OMS solutions in economies like the Netherlands and Germany.

Oil Mist Separator Market: Competitive Analysis

The leading players in the global oil mist separator market are:

- Donaldson Company Inc.

- Parker Hannifin Corporation

- Graco Inc.

- MANN+HUMMEL GmbH

- Eaton Corporation

- Hydac International GmbH

- Camfil AB

- AAF International

- Nederman Holding AB

- Filtration Group Corporation

- Alfa Laval AB

- Sullair LLC

- Kaeser Kompressoren SE

- Atlas Copco AB

- Donaldson Torit

Oil Mist Separator Market: Key Market Trends

Adoption of smart and IoT-enabled OMS:

Industries are increasingly integrating smart monitoring systems and IoT sensors into OMS units. These systems enable real-time tracking of filter performance, predictive maintenance, and air quality. This trend reduces downtime, improves operational efficiency, and aligns with Industry 4.0 initiatives

Integration with advanced manufacturing equipment:

OMS units are progressively being integrated directly with CNC machines, automated production lines, and coolant systems. This promises effective mist capture at the source, enhancing machinery lifespan and air quality. Producers are emphasizing bundled solutions to draw the attention of high-end industrial clients.

The global oil mist separator market is segmented as follows:

By Technology Type

- Centrifugal Oil Mist Separators

- Electrostatic Oil Mist Separators

By Application

- CNC Machining Centers

- Coolant and Lubrication Systems

- Heat Treatment Processes

By End-User Industry

- Metalworking

- Automotive

- Aerospace

- Chemical

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An oil mist separator is a device dedicated to removing smoke, oil mist, and fine aerosols from industrial exhaust air, especially in manufacturing environments and machinery. It works by using filters, coalescing methods, or centrifugal force to capture tiny oil droplets, preventing them from being released in the atmosphere or the workplace.

The global oil mist separator market is projected to grow due to increasing awareness of occupational health and safety, growing industrialization and manufacturing activities, and rising investments in sustainable and green technologies.

According to study, the global oil mist separator market size was worth around USD 2.94 million in 2024 and is predicted to grow to around USD 4.11 million by 2034.

The CAGR value of the oil mist separator market is expected to be around 4.30% during 2025-2034.

The significant challenges restraining the oil mist separator market include high initial costs, limited awareness in emerging markets, maintenance requirements, space or noise constraints, and competition from alternative filtration methods.

Market trends and consumer preferences in the oil mist separator market are evolving toward energy-efficient, smart, and eco-friendly systems with IoT integration and unified compatibility with automated industrial processes.

Asia Pacific is expected to lead the global oil mist separator market during the forecast period.

China is a major contributor to the global oil mist separator market due to its large-scale manufacturing and industrial activities.

The key players profiled in the global oil mist separator market include Donaldson Company, Inc., Parker Hannifin Corporation, Graco Inc., MANN+HUMMEL GmbH, Eaton Corporation, Hydac International GmbH, Camfil AB, AAF International, Nederman Holding AB, Filtration Group Corporation, Alfa Laval AB, Sullair LLC, Kaeser Kompressoren SE, Atlas Copco AB, and Donaldson Torit.

The report examines key aspects of the oil mist separator market, providing a detailed analysis of current growth factors and restraints, along with future opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed