Assembly Automation Systems Market Size, Share, Growth & Forecast 2034

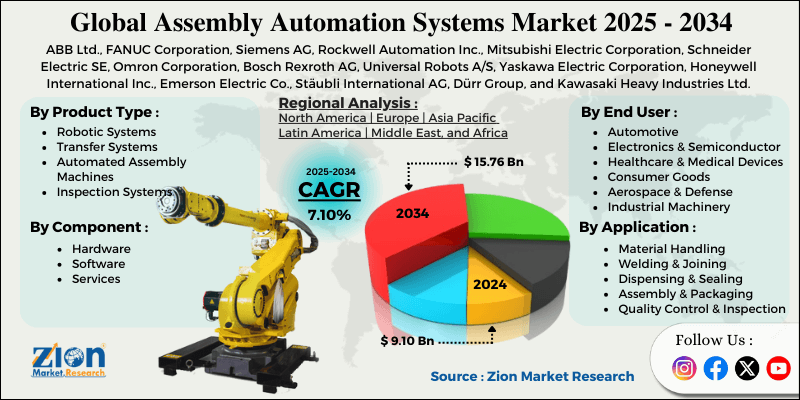

Assembly Automation Systems Market By Product Type (Robotic Systems, Transfer Systems, Automated Assembly Machines, Inspection Systems), By Component (Hardware, Software, Services), By Application (Material Handling, Welding & Joining, Dispensing & Sealing, Assembly & Packaging, Quality Control & Inspection), By End-Use Industry (Automotive, Electronics & Semiconductor, Healthcare & Medical Devices, Consumer Goods, Aerospace & Defense, Industrial Machinery), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

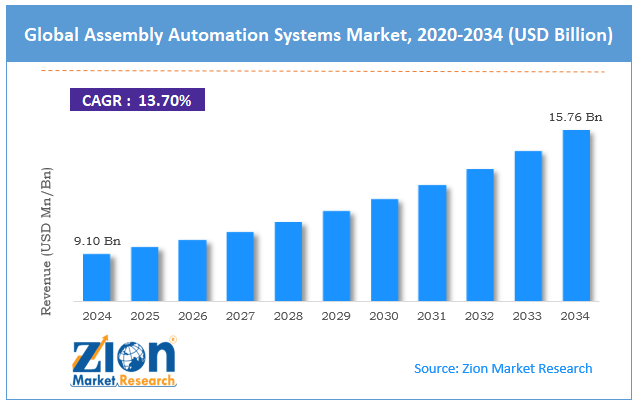

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.10 Billion | USD 15.76 Billion | 7.10% | 2024 |

Assembly Automation Systems Industry Perspective:

The global assembly automation systems market size was approximately USD 9.10 billion in 2024 and is projected to reach around USD 15.76 billion by 2034, with a compound annual growth rate (CAGR) of approximately 7.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global assembly automation systems market is estimated to grow annually at a CAGR of around 7.10% over the forecast period (2025-2034)

- In terms of revenue, the global assembly automation systems market size was valued at around USD 9.10 billion in 2024 and is projected to reach USD 15.76 billion by 2034.

- The assembly automation systems market is projected to grow significantly owing to the growth of smart factories and Industry 4.0, surging demand for improved product quality and consistency, and the adoption of robotics and AI-driven automation.

- Based on product type, the robotic systems segment is expected to lead the market, while the automated assembly machines segment is expected to grow considerably.

- Based on component, the hardware segment dominates the market, while the software segment progresses considerably.

- Based on application, the assembly & packaging segment is the dominant segment, while the material handling segment is projected to witness sizable revenue growth over the forecast period.

- Based on end-use industry, the automotive segment is expected to lead the market compared to the electronics & semiconductor segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Assembly Automation Systems Market: Overview

Assembly automation systems are modernized solutions designed to simplify and enhance manufacturing processes by incorporating conveyors, robotics, machine vision, control systems, and sensors, thereby performing repetitive tasks with accuracy and efficiency. These systems reduce human error, enhance product quality, and lower production costs, while facilitating large-volume and high-speed production in diverse industries. The global assembly automation systems market is poised for significant growth, driven by increasing demand for mass production, rising labor costs and shortages, as well as the adoption of smart manufacturing and Industry 4.0. The growing demand for high-volume production in the electronics, automotive, and consumer goods sectors is driving the adoption of assembly automation systems. Automated solutions assure speed, consistency, and reduced defect rates, which are essential in competitive markets.

Moreover, the global shortage of skilled labor and rising wages are driving manufacturers to adopt automation as a cost-effective alternative. Automated assembly decreases reliance on manual work while promising 24/7 operations. This is particularly important in well-established nations like Japan, the United States, and Germany, where a skilled workforce is in high demand and expensive to acquire.

Furthermore, the incorporation of AI, IoT, and data analytics in assembly automation is transforming industrial production. Smart systems enable real-time monitoring, adaptive manufacturing, and predictive maintenance, thereby driving increased efficacy. This inclination supports global transformation initiatives across various industries.

Nevertheless, the global market faces limitations due to factors such as the complexity of system integration and a lack of skilled workforce. Integrating assembly automation into existing production lines could be challenging and time-consuming. Compatibility issues and customization requirements with legacy systems postpone adoption, discouraging manufacturers with different product portfolios. Similarly, while automation reduces manual labor, it requires a skilled workforce for operation, programming, and maintenance. The scarcity of robotic experts and automation engineers restricts the adoption of these technologies. Training costs also add pressure on manufacturers. Still, the global assembly automation systems industry benefits from several favorable factors, including the integration of ML and AI, as well as the rise of EV manufacturing. AI-based automation allows predictive maintenance, adaptive manufacturing, and self-optimization. Companies that adopt these systems can enhance efficiency and reduce downtime. The AI-based move offers automation providers an opportunity to differentiate their solutions. Additionally, the global EV boom is driving demand for specialized automation solutions in battery assembly, lightweight materials, and electronics. This sector is anticipated to be a significant revenue generator for automation suppliers.

Assembly Automation Systems Market Dynamics

Growth Drivers

How does the expanding electronics and semiconductor industry drive the global assembly automation systems market?

The global electronics and semiconductor industry is experiencing a surge in demand, which is directly driving assembly production. According to SEMI, worldwide semiconductor equipment sales reached USD 107 billion in 2022 and are expected to continue growing despite short-term cyclical fluctuations. Automated assembly is vital for the precision placement of micro-components, consumer electronics production, and chip packaging.

In 2024, Samsung declared investments of $228 billion in new semiconductor fabs, primarily dependent on automated assembly lines. This growth makes the electronics sector a key propeller of assembly automation systems.

How are technological advancements in IoT and AI integration fueling the assembly automation systems market?

The incorporation of IoT, AI, and machine vision into assembly automation systems is transforming flexibility and efficiency. According to McKinsey (2023), AI-based automation is expected to increase productivity in manufacturing by nearly 30% over the coming decade. IoT-enabled assembly systems now allow real-time monitoring, adaptive production flows, and predictive maintenance.

Recent news in 2024 disclosed Siemens's introduction of its 'Industrial Metaverse' project to connect automation systems with digital twins for advanced simulations. This advancement enhances operational efficiency and customization, driving adoption in various industries and contributing to the growth of the assembly automation systems market.

Restraints

Data vulnerabilities and cybersecurity risks unfavorably impact the market progress

The growing connectivity of assembly automation systems presents manufacturers with cybersecurity risks. According to Cybersecurity Ventures (2023), cyberattacks on industrial systems cost the global manufacturing industry more than USD 6 billion annually. Cloud-based automation platforms and IoT-based machinery are especially susceptible to data breaches and ransomware. In 2024, a ransomware attack forced a key European automotive supplier to halt production for several days. The risk of operational disturbance or data theft acts as a key restraint for companies hesitant to adopt complete automated systems.

Opportunities

How does flexible and customized manufacturing demand present favorable prospects for the expansion of the assembly automation systems market?

The rising demand for mass customization is driving manufacturers toward flexible assembly automation systems. According to reports, nearly 30-40% of manufacturers plan to invest in flexible automation by 2025 to meet changing user preferences. The electronics, consumer goods, and automotive industries are adopting modular assembly systems that enable rapid variations of products.

In 2024, Toyota introduced modular robotic cells that can produce multiple EV models on the same production line. This trend presents opportunities for suppliers offering adaptive and scalable automation solutions, which in turn impact the growth of the assembly automation systems industry.

Challenges

Compatibility and integration issues restrict the market growth

Integrating new automation systems with existing production lines and legacy machines presents significant challenges. According to McKinsey reports, nearly 40% of automation projects experience delays due to integration challenges. In 2024, an automotive plant in Germany witnessed months-long delays due to software unsuitability. These issues raise deployment costs and time, and decrease the perceived value of automation solutions.

Assembly Automation Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Assembly Automation Systems Market |

| Market Size in 2024 | USD 9.10 Billion |

| Market Forecast in 2034 | USD 15.76 Billion |

| Growth Rate | CAGR of 7.10% |

| Number of Pages | 213 |

| Key Companies Covered | ABB Ltd., FANUC Corporation, Siemens AG, Rockwell Automation Inc., Mitsubishi Electric Corporation, Schneider Electric SE, Omron Corporation, Bosch Rexroth AG, Universal Robots A/S, Yaskawa Electric Corporation, Honeywell International Inc., Emerson Electric Co., Stäubli International AG, Dürr Group, and Kawasaki Heavy Industries Ltd., and others. |

| Segments Covered | By Product Type, By Component, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Assembly Automation Systems Market: Segmentation

The global assembly automation systems market is segmented based on product type, component, application, end-use industry, and region.

Based on product type, the global assembly automation systems industry is divided into robotic systems, transfer systems, automated assembly machines, and inspection systems. The robotic systems segment holds a dominant share due to its high flexibility and ability to perform multiple tasks in various industries.

On the other hand, the automated assembly machines segment holds the second-leading rank, as they promise high-speed, efficient, and precise production for monotonous tasks.

Based on component, the global market is segmented into hardware, software, and services. The hardware segment holds a leading share, as it forms the core of assembly automation systems, enabling reliable and precise operations.

Conversely, the software segment holds a secondary position, as it fuels monitoring, system control, integration with Industry 4.0, and smart manufacturing solutions.

Based on application, the global assembly automation systems market is segmented into material handling, welding & joining, dispensing & sealing, assembly & packaging, and quality control & inspection. The assembly & packaging segment holds a leadership position, as it accounts for the largest share of automated production processes in industries.

Nonetheless, the material handling segment continues to progress considerably, as it is vital for workflow, the movement of components in automated manufacturing, and logistics.

Based on end-use industry, the global market is segmented into automotive, electronics & semiconductor, healthcare & medical devices, consumer goods, aerospace & defense, and industrial machinery. The automotive segment captures the maximum share due to its high adoption for mass production, complex assembly lines, and precision.

However, the electronics & semiconductor segment captures a second leading share because of the demand for high-precision and high-speed automated assembly in intricate and compact components.

Assembly Automation Systems Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Assembly Automation Systems Market?

The Asia Pacific is projected to maintain its dominant position in the global assembly automation systems market, driven by manufacturing growth, rapid industrialization, the expansion of the automotive industry, and the region's status as a hub for electronics & semiconductor manufacturing. The Asia Pacific region boasts leading manufacturing hubs, including Japan, South Korea, and China, where industrialization is rapidly expanding. The region registered for more than 50% of the worldwide manufacturing output in 2024, fueling massive demand for automation. High-volume production in the electronics, consumer goods, and automotive industries drives the adoption of assembly automation.

Moreover, the automotive industry in the APAC region is among the leading ones globally, with China producing more than 27 million vehicles in 2024. Growing EV production and the increasing demand for advanced automotive electronics necessitate the use of automated assembly systems. This robust automotive base makes the region a leading market for automated and robotic assembly machines. The Asia Pacific region holds a leadership position in semiconductor and electronics production, accounting for approximately 65% of the worldwide semiconductor output. Automation promises high-accuracy assembly and testing of small and intricate components. Economies such as South Korea, Taiwan, and Japan are heavily investing in smart manufacturing and robotics to maintain their competitiveness.

Europe maintains its position as the second-largest region in the global assembly automation systems industry, thanks to its strong manufacturing and automotive base, advanced industrial machinery and electronics sector, and emphasis on smart manufacturing and Industry 4.0. Europe is home to major industrial and automotive manufacturing hubs, including Italy, Germany, and France. The region produced more than 15 million vehicle units in 2024, with advanced assembly lines heavily dependent on automation. High manufacturing standards fuel the demand for automated and robotic assembly machines.

Furthermore, Europe has a robust industrial machinery and electronics industry, which significantly contributes to the region's GDP. Automation is vital for precision assembly, material handling, and testing in these industries. Economies like Switzerland and Germany are forerunners in implementing Industry 4.0 and smart factory technologies. Additionally, European nations actively encourage the adoption of Industry 4.0 through government initiatives, such as Germany's"Industrie 4.0" initiative. Such policies motivate the deployment of assembly systems to enhance efficacy, facilitate flexible production, and enable predictive maintenance. More than 50% of German manufacturing companies have adopted at least one form of industrial automation.

Assembly Automation Systems Market: Competitive Analysis

The leading players in the global assembly automation systems market are:

- ABB Ltd.

- FANUC Corporation

- Siemens AG

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Omron Corporation

- Bosch Rexroth AG

- Universal Robots A/S

- Yaskawa Electric Corporation

- Honeywell International Inc.

- Emerson Electric Co.

- Stäubli International AG

- Dürr Group

- and Kawasaki Heavy Industries Ltd.

Assembly Automation Systems Market: Key Market Trends

Adoption of Collaborative Robots (Cobots):

Cobots that can safely work alongside humans are gaining prominence in the automotive, consumer goods, and electronics industries. They offer low cost, flexibility, and easy deployment compared to conventional industrial robots. Small and medium enterprises are especially leveraging cobots for scalable automation solutions.

Focus on flexible and modular automation:

Industries are moving towards modular assembly automation systems that can be easily reconfigured for diverse products. Flexible systems reduce retooling costs and enable swift adaptation to changing industry demands. This trend supports producers handling different product lines effectively.

The global assembly automation systems market is segmented as follows:

By Product Type

- Robotic Systems

- Transfer Systems

- Automated Assembly Machines

- Inspection Systems

By Component

- Hardware

- Software

- Services

By Application

- Material Handling

- Welding & Joining

- Dispensing & Sealing

- Assembly & Packaging

- Quality Control & Inspection

By End-Use Industry

- Automotive

- Electronics & Semiconductor

- Healthcare & Medical Devices

- Consumer Goods

- Aerospace & Defense

- Industrial Machinery

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Assembly automation systems are modernized solutions designed to simplify and enhance manufacturing processes by incorporating conveyors, robotics, machine vision, control systems, and sensors, thereby performing repetitive tasks with accuracy and efficiency. These systems reduce human error, enhance product quality, and lower production costs, while facilitating large-volume and high-speed production in diverse industries.

The global assembly automation systems market is projected to grow due to increasing demand for efficiency and mass production, the need to reduce production downtime, and the rise of the consumer goods and e-commerce sectors.

According to study, the global assembly automation systems market size was worth around USD 9.10 billion in 2024 and is predicted to grow to around USD 15.76 billion by 2034.

The CAGR value of the assembly automation systems market is expected to be approximately 7.10% from 2025 to 2034.

Market trends and consumer preferences are evolving toward AI-enabled, flexible, and energy-efficient automation systems that improve sustainability and productivity.

Investment and partnership opportunities exist in collaborative robots, AI-driven robotics, smart factory integration, and modular automation across emerging and developed markets.

Asia Pacific is expected to lead the global assembly automation systems market during the forecast period.

The key players profiled in the global assembly automation systems market include ABB Ltd., FANUC Corporation, Siemens AG, Rockwell Automation, Inc., Mitsubishi Electric Corporation, Schneider Electric SE, Omron Corporation, Bosch Rexroth AG, Universal Robots A/S, Yaskawa Electric Corporation, Honeywell International Inc., Emerson Electric Co., Stäubli International AG, Dürr Group, and Kawasaki Heavy Industries, Ltd.

The competitive landscape in the assembly automation systems market is structured around regional and global players focusing on strategic partnerships, innovation, and customized solutions to gain market share.

The report examines key aspects of the assembly automation systems market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed