Multiplex Biomarker Imaging Market Size, Share, & Trends Analysis Report by 2032

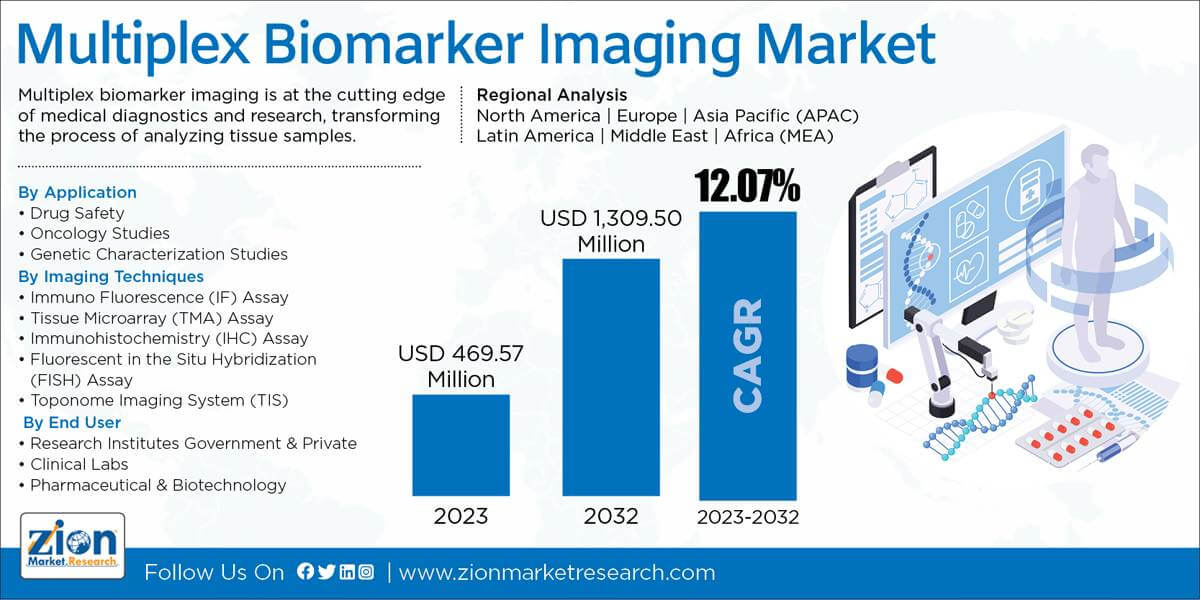

Multiplex Biomarker Imaging Market by Application (Drug Safety, Oncology Studies, and Genetic Characterization Studies), by Imaging Techniques (Immuno Fluorescence (IF) Assay, Tissue Microarray (TMA) Assay, Immunohistochemistry (IHC) Assay, Fluorescent in the Situ Hybridization (FISH) Assay, and Toponome Imaging System (TIS)), and by End-User (Research Institutes Government & Private, Clinical Labs, and Pharmaceutical & Biotechnology): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

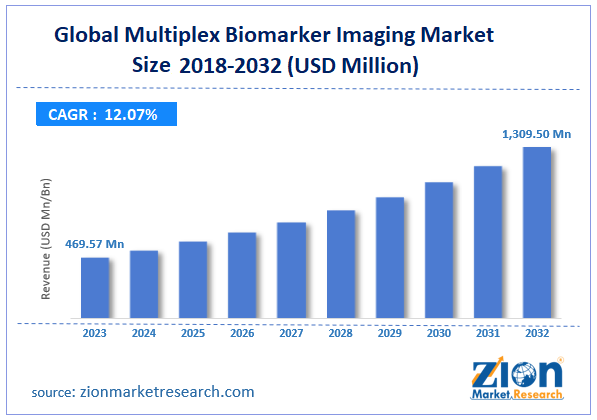

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 469.57 Million | USD 1,309.50 Million | 12.07% | 2023 |

Multiplex Biomarker Imaging Industry Perspective:

The global multiplex biomarker imaging market size was worth around USD 469.57 million in 2023 and is predicted to grow to around USD 1,309.50 million by 2032 with a compound annual growth rate (CAGR) of roughly 12.07% between 2024 and 2032.

The report covers forecast and analysis for the multiplex biomarker imaging market on a global and regional level. The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Million).

Multiplex Biomarker Imaging Market: Overview

Multiplex biomarker imaging is a prominent technique mainly used for the analysis of the correct disease and imaging its characteristics. Moreover, biomarkers are the biological markers used for clinical studies to visualize the exact location and the current stage of the disease. The biomarker has significant use in the healthcare industry; they can be used alone or in combination as an indicator of biological processes and for evaluating & assessing their characteristics. Multiplex biomarker plays an important role in studying complex biological systems by providing analyzed expression of several biomarkers.

As per the World Health Organization, cardiovascular diseases are one of the causes of death worldwide. About 17.5 million people died because of cardiovascular disease representing 31% of all global deaths. Additionally, as per the World Health Organization estimates, worldwide, there were 14 million new cancer cases and 8.8 million deaths resulted due to cancer. Globally, approximately 1 in 6 deaths is because of cancer. Thus, the multiplex biomarker imaging market has vast potential in terms of a large patient pool and an upsurge need for a prominent reagent for diagnosis and analysis. This is estimated to drive the multiplex biomarker imaging market services over the forecast period.

The study includes drivers and restraints for the multiplex biomarker imaging market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the multiplex biomarker imaging market on a global as well as regional level.

In order to give the users of this report a comprehensive view of the multiplex biomarker imaging market, we have included a competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein application, imaging techniques, and end-user segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides a company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

Multiplex Biomarker Imaging Market: Segmentation

The study provides a decisive view of the multiplex biomarker imaging market by segmenting the market based on application, imaging techniques, end-users, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the application, the market is divided into drug safety, oncology studies, and genetic characterization studies.

Based on imaging techniques multiplex biomarker imaging market is categorized into immunofluorescence (IF) assay, tissue microarray (TMA) assay, immunohistochemistry (IHC) assay, fluorescent in the situ hybridization (FISH) assay, and toponome imaging system (TIS).

On the basis of the end user, the multiplex biomarker imaging market is segregated into research institutes government & private, clinical labs, and pharmaceutical & biotechnology.

Multiplex Biomarker Imaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Multiplex Biomarker Imaging Market |

| Market Size in 2023 | USD 469.57 Million |

| Market Forecast in 2032 | USD 1,309.50 Million |

| Growth Rate | CAGR of 12.07% |

| Number of Pages | 210 |

| Key Companies Covered | Thermo Fisher Scientific, PerkinElmer Inc., Bio-Rad Laboratories, Inc., Abcam Plc., US Biomax Inc., Merck KGaA, ToposNomos Ltd., MicroConstants, Inc., Aushon BioSystems Ltd., Ventana Medical Systems, Inc., Leica Biosystems Nussloch GmbH, Illumina Inc., and others. |

| Segments Covered | By Application, By Imaging Techniques, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Multiplex Biomarker Imaging Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa with its further bifurcation into major countries including the U.S., Canada, Germany, France, UK, China, Japan, India, and Brazil. This segmentation includes demand for multiplex biomarker imaging based on individual segments and applications in all regions and countries.

North America is anticipated to be the dominant region in the multiplex biomarker imaging market over the forecast period. Favorable government policies supporting the invasion of new and advanced biomarkers, development in the healthcare infrastructure, and research grants by the government and ruling authorities are expected to propel the market growth in this region. Europe is the second largest market followed by the Asia Pacific. The large healthcare industry due to the large population base in the Asia Pacific region, especially India, China, and Japan is the significant accelerating factor for the growth of the multiplex biomarker imaging market in this region. Therefore, Asia Pacific is anticipated to show the fastest CAGR growth during the forecast period whereas the Latin America market is estimated to grow at a slow to moderate rate during the forecast period. The Middle East and Africa are also expected to cover the prominent market value share in the multiplex biomarker imaging market global market.

Multiplex Biomarker Imaging Market: Competitive Analysis

The global multiplex biomarker imaging market is dominated by players like:

- Thermo Fisher Scientific

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Abcam Plc.

- US Biomax, Inc.

- Merck KGaA

- ToposNomos Ltd.

- MicroConstants, Inc.

- Aushon BioSystems Ltd.

- Ventana Medical Systems, Inc.

- Leica Biosystems Nussloch GmbH

- Illumina, Inc.

This report segments the global multiplex biomarker imaging market as follows:

Global Multiplex Biomarker Imaging Market: By Application

- Drug Safety

- Oncology Studies

- Genetic Characterization Studies

Global Multiplex Biomarker Imaging Market: By Imaging Techniques

- Immuno Fluorescence (IF) Assay

- Tissue Microarray (TMA) Assay

- Immunohistochemistry (IHC) Assay

- Fluorescent in the Situ Hybridization (FISH) Assay

- Toponome Imaging System (TIS)

Global Multiplex Biomarker Imaging Market: By End User

- Research Institutes Government & Private

- Clinical Labs

- Pharmaceutical & Biotechnology

Global Multiplex Biomarker Imaging Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Multiplex biomarker imaging is at the cutting edge of medical diagnostics and research, transforming the process of analyzing tissue samples.

According to a study, the global multiplex biomarker imaging market size was worth around USD 469.57 million in 2023 and is expected to reach USD 1,309.50 million by 2032.

The global multiplex biomarker imaging market is expected to grow at a CAGR of 12.07% during the forecast period.

North America is expected to dominate the multiplex biomarker imaging market over the forecast period.

Leading players in the global multiplex biomarker imaging market include Thermo Fisher Scientific, PerkinElmer Inc., Bio-Rad Laboratories, Inc., Abcam Plc., US Biomax Inc., Merck KGaA, ToposNomos Ltd., MicroConstants, Inc., Aushon BioSystems Ltd., Ventana Medical Systems, Inc., Leica Biosystems Nussloch GmbH, Illumina Inc., among others.

The multiplex biomarker imaging market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed