Motion Sensors Market Size, Share, Analysis, Trends, Growth, 2032

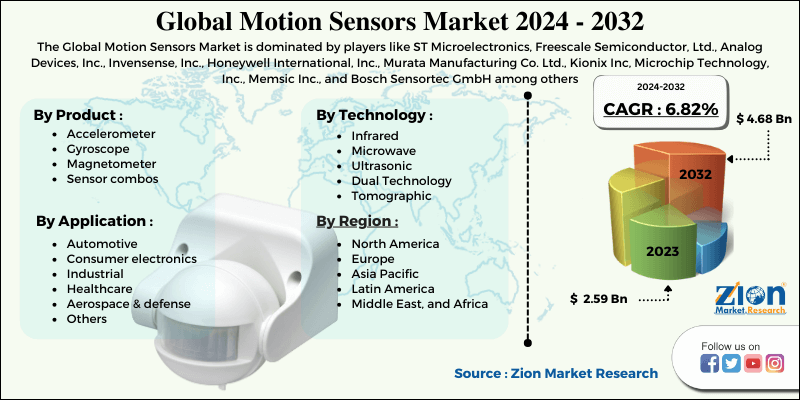

Motion Sensors Market: By Product Type (Accelerometer, Gyroscope, Magnetometer, Sensor Combos), By Technology (Infrared, Microwave, Ultrasonic, Dual Technology, Tomographic), By Application (Automotive, Consumer Electronics, Industrial, Healthcare, Aerospace & Defense, Others), and By Region - Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

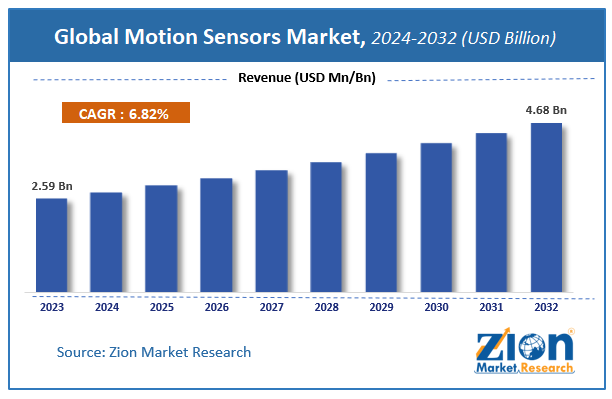

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.59 Billion | USD 4.68 Billion | 6.82% | 2023 |

Motion Sensors Market Insights

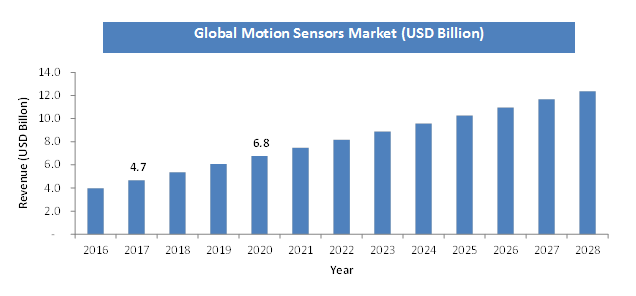

Zion Market Research has published a report on the global Motion Sensors Market, estimating its value at USD 2.59 Billion in 2023, with projections indicating that it will reach USD 4.68 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.82% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Motion Sensors Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Motion Sensors Market: Overview

The onset of the event of smart homes and rise within the number of household applications like automated lighting control and residential control is anticipated to propel the market. Additionally, the proliferation of wearable devices, smartphones, and tablets is probably going to supplement market developments shortly. The growing use of robotics employed for household and commercial applications that incorporate motion sensors and sensing technologies is further expected to impel market growth. The motion sensors market is in its budding stage and over the coming years, it is anticipated to replace manually controlled devices to a large extent. For instance, battery-operated remote controls are now being replaced by gestures and movements without any physical need for devices.

Motion Sensors Market: COVID-19 Impact Analysis

The outbreak of covid 19 affected several global markets. The worldwide market adversely suffering from the pandemic. Also, the worldwide sensor and control industry is facing a severe downfall. The low capital investments have slowed down the entire demand for this market. The availability of the products is on hold in several regions. However, during the covid 19, the need for house security has increased. It's causing a gradual rise within the motion control sensors Industry. The post-pandemic market trends look notable. The surging robotics and automation market are the key factors that positively affect the Motion Sensors Industry.

Motion Sensors Market: Growth Factors

A noteworthy number of applications in household & commercial sectors like energy efficiency security and automatic lighting control are likely to spice up the growth of the worldwide motion sensors market. On the opposite hand, the accessibility of options at a low price is limiting the expansion of the motion sensors market. Moreover, limitations of the accelerometer are negatively affecting the expansion of the motion sensors market. Nevertheless, increasing application in several industries for motion sensors will offer opportunities for the event of the motion sensors market. For instance, in August 2017, Kollmorgen launched the AKM2G, a replacement generation of synchronous servo motors. These motors are capable of offering benefits in conjunction with other devices, thereby boosting the motion sensors market.

Motion Sensors Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Motion Sensors Market |

| Market Size in 2023 | USD 2.59 Billion |

| Market Forecast in 2032 | USD 4.68 Billion |

| Growth Rate | CAGR of 6.82% |

| Number of Pages | 145 |

| Key Companies Covered | ST Microelectronics, Freescale Semiconductor, Ltd., Analog Devices, Inc., Invensense, Inc., Honeywell International, Inc., Murata Manufacturing Co. Ltd., Kionix Inc, Microchip Technology, Inc., Memsic Inc., and Bosch Sensortec GmbH among others |

| Segments Covered | By Product Type, By Technology, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

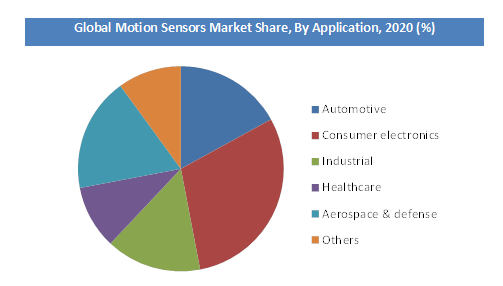

Application Segment Analysis Preview

The consumer electronics segment held the most important share within the market in 2018 due to the increasing demand for multimedia devices with features like motion stabilization and indoor navigation. Furthermore, the emergence of sensor fabrication techniques like MEMS has considerably reduced the dimensions of motion sensors that have enabled them to be deployed in handheld consumer electronics. These devices include mobile phones, portable media players, and gaming consoles.

Product Type Segment Analysis Preview

Based on type, the motion sensors market is split into a gyroscope, accelerometer, sensor combos, and magnetometer. Increasing employment of gyroscopes for image stabilization, high stability, and navigation within the user electronics sector is probably going to extend the event of this segment in the motion sensors market soon. The technologies employed in the motion sensors market are microwave, infrared, dual technology, ultrasonic, and tomographic.

Technology Segment Analysis Preview

The infrared segment dominated the market in 2023. The demand for infrared cameras has grown in recent years due to technological advancements within the field of motion sensors. For instance, a pyroelectric infrared sensor exhibits high accuracy in detecting humans and animals. Moreover, infrared motion sensors are being increasingly adopted for applications like residential security and surveillance. Additionally, their ability to be easily calibrated make them suitable for aerospace and defense also as other applications like healthcare and consumer electronics.

Regional Analysis Preview

Based on region, Europe is probably going to remain the most important area for the motion sensors market within the near future due to the high demand for consumer electronics, luxury vehicles, voice-controlled equipment, and advanced healthcare facilities. Europe is chased by North America. The remainder of the planet and the Asia Pacific are likely to ascertain strong development for the motion sensors market within the future due to an elevation in the requirement for wearable devices & consumer electronics and development in robotics & industrial automation sectors.

Motion Sensors Market: Competitive Landscape

The major players active in motion sensors market are

- ST Microelectronics

- Freescale Semiconductor Ltd.

- Analog Devices Inc.

- Invensense Inc.

- Honeywell International Inc.

- Murata Manufacturing Co. Ltd.

- Kionix Inc

- Microchip Technology Inc.

- Memsic Inc.

- Bosch Sensortec GmbH

- among others.

These players are claimed to bolster the motion sensors market in the years to come.

The global Motion Sensors market is segmented as follows:

By Product Type

- Accelerometer

- Gyroscope

- Magnetometer

- Sensor combos

By Technology

- Infrared

- Microwave

- Ultrasonic

- Dual Technology

- Tomographic

By Application

- Automotive

- Consumer electronics

- Industrial

- Healthcare

- Aerospace & defense

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Motion Sensors market was valued at USD 2.59 Billion in 2023.

The global Motion Sensors market is expected to reach USD 4.68 Billion by 2032, growing at a CAGR of 6.82% between 2024 to 2032.

The major factors that are expected to be driving the market are rising demand for automation in material handling across industries, growing medical automation for reproducibility and accuracy, emerging e-commerce industry, and enhanced productivity enabled by improved supply chain processes.

Regionally, Europe has been leading the worldwide Motion Sensors market and is anticipated to continue in the dominant position in the years to come.

The major players active in the motion sensors market are ST Microelectronics, Freescale Semiconductor, Ltd., Analog Devices, Inc., Invensense, Inc., Honeywell International, Inc., Murata Manufacturing Co. Ltd., Kionix Inc, Microchip Technology, Inc., Memsic Inc., and Bosch Sensortec GmbH among others. These players are claimed to bolster the motion sensors market in the years to come.

List of Contents

Market InsightsOverview COVID-19 Impact AnalysisGrowth Factors Report ScopeApplication Segment Analysis Preview Product Type Segment Analysis Preview Technology Segment Analysis Preview Regional Analysis Preview Competitive LandscapeThe global market is segmented as follows: By Product TypeBy TechnologyBy ApplicationBy RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed