Monoethylene Glycol Market Size, Share, And Growth Report 2032

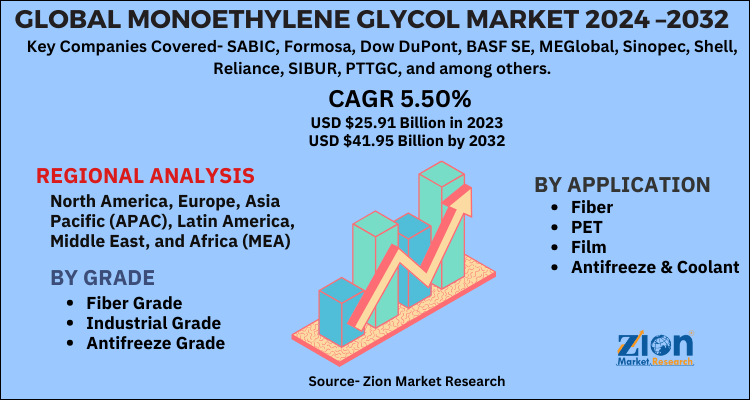

Monoethylene Glycol Market By Grade (Fiber Grade, Industrial Grade, And Antifreeze Grade), By Application (Fiber, PET, Film, Antifreeze & Coolant, And Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.91 Billion | USD 41.95 Billion | 5.50% | 2023 |

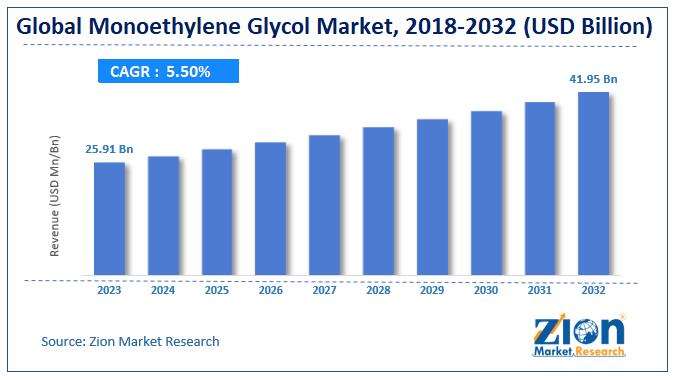

The global monoethylene glycol market size was worth around USD 25.91 billion in 2023 and is predicted to grow to around USD 41.95 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.50% between 2024 and 2032.

The report covers a forecast and an analysis of the monoethylene glycol market on a global and regional level. The study provides historical data for 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion) and volume (Kilotons).

Monoethylene Glycol Market: Overview

Monoethylene glycol is a chemical compound that is prepared and produced by the transitional oxidation reaction of the ethylene compound. The compound is odorless and colorless and has a wide range of industrial applications. Monoethylene glycol is one of the crucial commercially available glycols. The by-products of the chemical compound, such as tri-ethylene and di-ethylene glycol, are obtained from the production process of monoethylene glycol. Monoethylene glycol acts as a crucial element that is utilized in the production of fibers, polyester apparels, fabrics, and resins. Monoethylene glycol is utilized in several end-user industries, such as aircraft, chemical, textile, food, and beverage, etc.

The growing demand for polyester fabrics in the textile industry is anticipated to drive the monoethylene glycol market in the upcoming years. Furthermore, the demand for polyester apparels is continuously growing, owing to the changing lifestyle of the urban population. Additionally, monoethylene glycol is extensively used to produce PET bottles in the food and beverage sector, which is anticipated to further stimulate the monoethylene glycol market globally in the upcoming years. The beneficial features of monoethylene glycol, such as tenacity and durability, make it a key raw material for various industrial applications. It is extensively utilized for the production of fibers, polyester resins, and films. These factors are projected to contribute toward this global market growth in the future. However, the toxicity of chemicals might hamper the monoethylene glycol market on a global scale.

The study includes drivers and restraints for the monoethylene glycol market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the monoethylene glycol market on a global level.

In order to give the users of this report a comprehensive view of the monoethylene glycol market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides a company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launches, agreements, partnerships, collaborations & joint ventures, research & development, technology, and regional expansion of major participants involved in the market on a global and regional basis. Moreover, the study covers price trend analysis and product portfolios of various companies according to regions.

Monoethylene Glycol Market: Segmentation

The study provides a decisive view of the monoethylene glycol market by segmenting the market based on grade, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032

By grade, the global monoethylene glycol market is segmented into the industrial grade, antifreeze grade, and fiber grade.

By application, the monoethylene glycol market is categorized into fiber, PET, film, antifreeze and coolant, and others.

Monoethylene Glycol Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Monoethylene Glycol Market Research Report |

| Market Size in 2023 | USD 25.91 Billion |

| Market Forecast in 2032 | USD 41.95 Billion |

| Growth Rate | CAGR of 5.50% |

| Number of Pages | 110 |

| Key Companies Covered | SABIC, Formosa, Dow DuPont, BASF SE, MEGlobal, Sinopec, Shell, Reliance, SIBUR, PTTGC, and among others. |

| Segments Covered | By Grade, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Monoethylene Glycol Market: Regional Analysis

The regional segmentation includes the historical and forecast demand for North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

By region, Asia Pacific held the largest revenue share of the global monoethylene glycol market in 2018 and is expected to dominate the global market in the upcoming years. This regional growth can be attributed to the rising demand for polyester fabrics and apparels in the textile industry, due to the changing lifestyle of the urban population. Monoethylene glycol is mainly used for the production of polyester fabrics. The European region is expected to provide significant growth opportunities in the global monoethylene glycol market in the future, owing to the increasing sales of pharmaceutical medicines due to the increased production of SUVs. Monoethylene glycol is mainly used to produce antifreeze coolants, which are used for the effective functioning of vehicles.

Monoethylene Glycol Market: Industry Players Analysis

Some key industry players operating in the global monoethylene glycol market include:

- SABIC

- Formosa

- Dow DuPont

- BASF SE

- MEGlobal

- Sinopec

- Shell

- Reliance

- SIBUR

- PTTGC

This report segments the global monoethylene glycol market into:

Global Monoethylene Glycol Market: Grade Analysis

- Fiber Grade

- Industrial Grade

- Antifreeze Grade

Global Monoethylene Glycol Market: Application Analysis

- Fiber

- PET

- Film

- Antifreeze & Coolant

- Others

Global Monoethylene Glycol Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Monoethylene glycol is a chemical compound that is prepared and produced by the transitional oxidation reaction of the ethylene compound.

According to study, the global Monoethylene Glycol Market size was worth around USD 25.91 billion in 2023 and is predicted to grow to around USD 41.95 billion by 2032.

The CAGR value of Monoethylene Glycol Market is expected to be around 5.50% during 2024-2032.

Asia Pacific has been leading the global Monoethylene Glycol Market and is anticipated to continue on the dominant position in the years to come.

The global Monoethylene Glycol Market is led by players like SABIC, Formosa, Dow DuPont, BASF SE, MEGlobal, Sinopec, Shell, Reliance, SIBUR, PTTGC, and among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed