Military Robotics Market Size, Share & Growth Report 2032

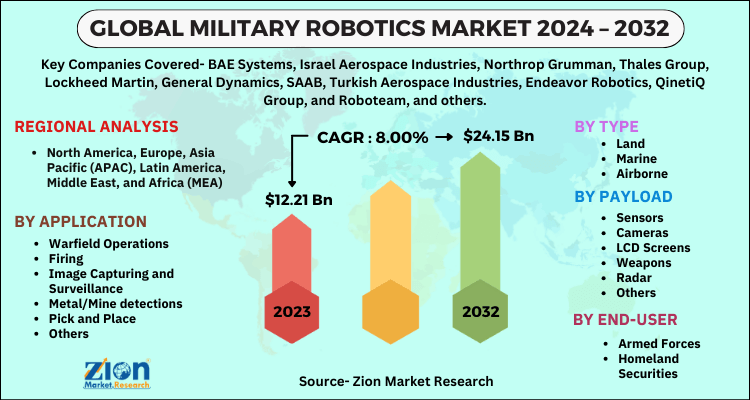

Military Robotics Market By Type (Land, Marine, And Airborne), By Payload (Sensors, Cameras, LCD Screens, Weapons, Radar, And Others), By Application (Warfield Operations, Firing, Image Capturing And Surveillance, Metal/Mine Detections, Pick And Place, And Others), By End-User (Armed Forces And Homeland Securities), And Region: Global Industry Perspective, Comprehensive Analysis, And Forecast, 2024-2032

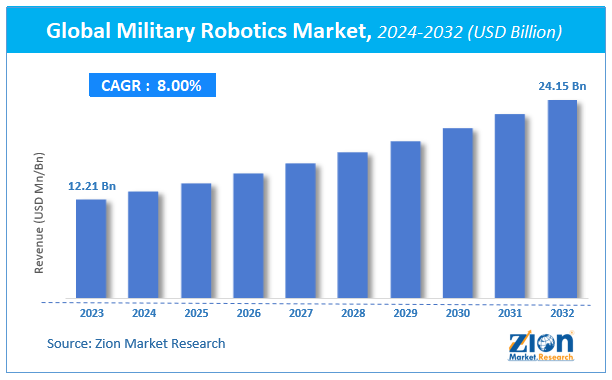

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.21 Billion | USD 24.15 Billion | 8.00% | 2023 |

Military Robotics Industry Perspective

The global military robotics market size was worth around USD 12.21 billion in 2023 and is predicted to grow to around USD 24.15 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.00% between 2024 and 2032.

The report encloses the forecast estimates and historical data for the military robotics market on a global and regional level. The study provides the data from 2018 to 2022 and for the forecast period from 2024 to 2032 based on revenue (USD Billion). The study also provides the impact and descriptive analysis of major drivers, restraints, opportunities, and challenges of the global military robotics market.

The study also offers a market attractiveness analysis and Porter’s Five Forces model analysis to gauge the competitive landscape of major vendors of the global military robotics market. This comprehensive study also provides a detailed analysis and an overview of each segment included in the study.

Military Robotics Market: Overview

Military robots are remote-controlled mobile or autonomous robots. They are intended for various military applications, i.e., from transport to search and rescue and attack. These robots are currently in use, and most of them are under development. The use of military robots is considered to be lifesaving. The foremost advantage of military robots is that they are able to perform various tasks similar to humans without causing any harm to human lives. These robots are easily replaceable at an economical cost, unlike human lives. These robots can sustain damage done by bombs or other weapons, which destroys the human body. Other advantages of human robots include the deactivation of bombs and weapons and putting out fires. Military robots are fortified with various features like a machine gun, which make these medium-sized robots appear to be a small army. Autonomous military systems have become an important part of the modern army, which is expected to increase the demand for military robots and drive the military robotics growth over the forecast time period.

Military Robotics Market: Growth Factors

The increasing demand for military robots for intelligence, surveillance, and reconnaissance (ISR) is expected to fuel the global military robotics market growth over the forecast timeframe. The U.S. Army, Air Force, and Navy have developed various robotic aircrafts, such as unmanned flying vehicles (UAVs). For instance, the ground vehicles can perform various applications, such as they can be used for reconnaissance without endangering human pilots and carry weapons and missiles. These developments regarding military robots are expected to drive the global military robotics market growth over the forecast time period.

Military Robotics Market: Segmentation

The report analyzes the major type, payload, application, end-user, and region of the global military robotics market. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on type, the global military robotics market includes land, marine, and airborne.

On the basis of payload, the market includes radar, cameras, sensors, weapons, LCD screens, and others.

Based on application, the global military robotics market includes firing, pick and place, warfield operations, metal/mine detections, image capturing and surveillance, and others.

By end-user, the global military robotics market is bifurcated into armed forces and homeland securities.

Military Robotics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Military Robotics Market |

| Market Size in 2023 | USD 12.21 Billion |

| Market Forecast in 2032 | USD 24.15 Billion |

| Growth Rate | CAGR of 8.00% |

| Number of Pages | 235 |

| Key Companies Covered | BAE Systems, Israel Aerospace Industries, Northrop Grumman, Thales Group, Lockheed Martin, General Dynamics, SAAB, Turkish Aerospace Industries, Endeavor Robotics, QinetiQ Group, and Roboteam, and others. |

| Segments Covered | By Type, By Payload, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Military Robotics Market: Regional Analysis

The regional segment includes the historic and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America currently dominates the global military robotics market due to the region boasts a strong presence of leading military robotics manufacturers and a continuous flow of technological advancements. North America's involvement in conflicts against terrorism, coupled with the perceived threats it faces, fuels the demand for these technologies.

However, the Asia Pacific region is expected to witness the fastest growth. This can be attributed to the rising defense budgets of developing countries in the region, leading to increased spending on military modernization, including robotics.

Military Robotics Market: Competitive Analysis

The global military robotics market is dominated by players like:

- BAE Systems

- Israel Aerospace Industries

- Northrop Grumman

- Thales Group

- Lockheed Martin

- General Dynamics

- SAAB

- Turkish Aerospace Industries

- Endeavor Robotics

- QinetiQ Group

- Roboteam

This report segments the global military robotics market into:

Global Military Robotics Market: Type Analysis

- Land

- Marine

- Airborne

Global Military Robotics Market: Payload Analysis

- Sensors

- Cameras

- LCD Screens

- Weapons

- Radar

- Others

Global Military Robotics Market: Application Analysis

- Warfield Operations

- Firing

- Image Capturing and Surveillance

- Metal/Mine detections

- Pick and Place

- Others

Global Military Robotics Market: End-User Analysis

- Armed Forces

- Homeland Securities

Global Military Robotics Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Military robots are machines designed for various tasks on the battlefield, from transportation and bomb disposal to reconnaissance and even combat. They can be unmanned (controlled remotely) or semi-autonomous, offering advantages like reduced risk to human soldiers and increased capabilities in dangerous situations.

According to a study, the global military robotics market size was worth around USD 12.21 billion in 2023 and is expected to reach USD 24.15 billion by 2032.

The global military robotics market is expected to grow at a CAGR of 8.00% during the forecast period.

North America is expected to dominate the military robotics market over the forecast period.

Leading players in the global military robotics market include BAE Systems, Israel Aerospace Industries, Northrop Grumman, Thales Group, Lockheed Martin, General Dynamics, SAAB, Turkish Aerospace Industries, Endeavor Robotics, QinetiQ Group, and Roboteam, among others.

The military robotics market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed