Metallic Pigments Market Size, Share, Analysis, Trends, Growth, 2032

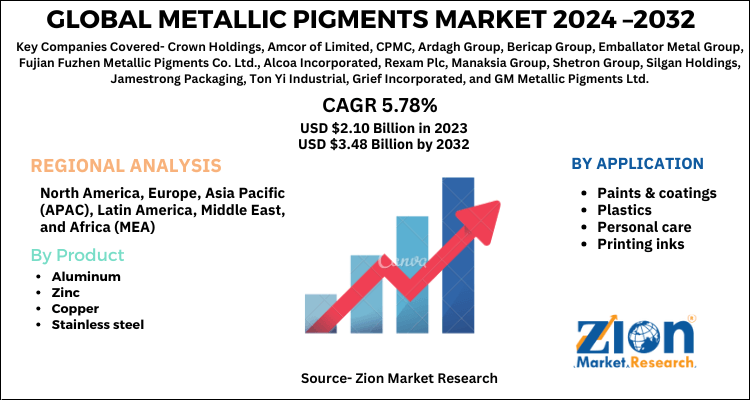

Metallic Pigments Market - By Product (Aluminum, Zinc, Copper, Stainless Steel, Others), By Application (Paints & Coatings, Plastics, Personal Care, Printing Inks, Others), and By Region - Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.10 Billion | USD 3.48 Billion | 5.78% | 2023 |

Metallic Pigments Market Insights

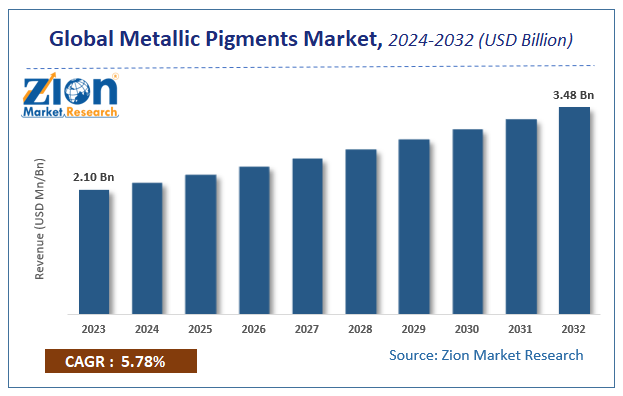

According to a report from Zion Market Research, the global Metallic Pigments Market was valued at USD 2.10 Billion in 2023 and is projected to hit USD 3.48 Billion by 2032, with a compound annual growth rate (CAGR) of 5.78% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Metallic Pigments Market industry over the next decade.

Metallic Pigments Market: Overview

Metallic pigments are used for defending metallic surfaces against corrosion. Stainless steel, aluminum, zinc, and copper pigments offer a particular color shade with which masts, gates, doors, frames, and other equipment or construction parts can be coated effectively. The worldwide metallic pigments market has been seeing vigorous expansion over the previous couple of years on account of growth within the coatings and paints business. The architectural paints and coatings market has developed considerably due to the rising construction activities and infrastructural development in several countries.

Moreover, development within the automotive sector has driven the ornamental paints and coatings market also. Nevertheless, the implementation of strict regulations concerning the utilization of pigments is predicted to hamper the expansion of the metallic pigments market. The introduction of nanotechnology is predicted to get lucrative avenues within the metallic pigments market within the forthcoming years.

Metallic Pigments Market: COVID-19 Impact Analysis

The COVID-19 outbreak has harmed the Metallic Pigments market segment because the demand for Metallic Pigments is linked to the GDP trend and therefore the level of production activity. International response to the rapid disruption to infrastructure, paint & coatings, and personal care industries is ongoing. The significant decrease in the global market size in 2020 is estimated based on the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed based on inputs from various secondary sources and the current data available about the situation.

Metallic Pigments Market: Growth Factors

The rising number of infrastructure projects and the booming automotive sector have majorly impacted the paints & coatings industry which can accelerate metallic pigments market growth. Rising industrialization, changing lifestyle patterns and increase may contribute to rapid construction activities in emerging countries like China, India, Vietnam, Bangladesh, and Indonesia.

Metallic Pigments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Metallic Pigments Market |

| Market Size in 2023 | USD 2.10 Billion |

| Market Forecast in 2032 | USD 3.48 Billion |

| Growth Rate | CAGR of 5.78% |

| Number of Pages | 150 |

| Key Companies Covered | Crown Holdings, Amcor of Limited, CPMC, Ardagh Group, Bericap Group, Emballator Metal Group, Fujian Fuzhen Metallic Pigments Co. Ltd., Alcoa Incorporated, Rexam Plc, Manaksia Group, Shetron Group, Silgan Holdings, Jamestrong Packaging, Ton Yi Industrial, Grief Incorporated, and GM Metallic Pigments Ltd |

| Segments Covered | By Product, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

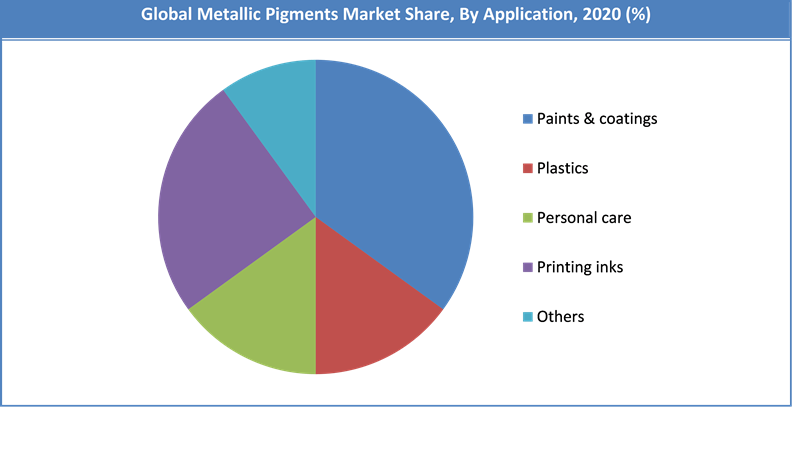

Application Segment Analysis Preview

The metallic pigments market has been bifurcated based on end-user, region, and product. Based on end-user industries, the metallic pigments market is diversified into plastics, paints & coatings, printing inks, personal care, and others. The paints and coatings possessed the biggest market stake in 2023 pursued by the personal care segment on account of the rising fashion trends in budding markets such as Latin America and Asia-Pacific.

To know more about this sample, request a free sample copy.

Product Segment Analysis Preview

Based on product, the metallic pigments market is divided into copper, aluminum, stainless steel, zinc, and others. In 2015, the biggest market share was held by aluminum metallic pigment and is anticipated to expand at the highest CAGR in the years to come. Aluminum pigments are utilized as coloring additives. They offer a silvery metallic finish to the substrate and are widely utilized in automotive coatings. The rising requirement for radiant effects and better sheen is expected to fuel the segment growth in the global metallic pigments market during the forecast period.

Regional Analysis Preview

Geographically, the Asia Pacific market is the fastest-growing region and it's anticipated to be the fastest-growing region in coming years. Budding nations in the Asia Pacific such as India and China are key pigment customers, where the automotive industries are developing at a swift pace since recent years, which, in turn, propels the demand for metallic pigment in the region.

To know more about this sample, REQUEST FOR CUSTOMIZATION.

Metallic Pigments Market: Competitive Landscape

Some of the key players in the market are Crown Holdings, Amcor of Limited, CPMC, Ardagh Group, Bericap Group, Emballator Metal Group, Fujian Fuzhen Metallic Pigments Co. Ltd., Alcoa Incorporated, Rexam Plc, Manaksia Group, Shetron Group, Silgan Holdings, Jamestrong Packaging, Ton Yi Industrial, Grief Incorporated, and GM Metallic Pigments Ltd.

The major players in the metallic pigments market include

- Sudarshan Chemicals

- BASF

- Schlenk Metallic Pigments

- Ferro Corporation & Carlfors Bruk

- Umicore

- Eckhart Pigments

- Asahi Kasei Corporation

- Toyal America Inc.

- Siberline Manufacturing Co.

- Sun Chemical Performance Pigments.

The global Metallic Pigments Market is segmented as follows:

By Product

- Aluminum

- Zinc

- Copper

- Stainless steel

- Others

By Application

- Paints & coatings

- Plastics

- Personal care

- Printing inks

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Metallic Pigments Market were valued at USD 2.10 Billion in 2023.

The global Metallic Pigments Market is expected to reach USD 3.48 Billion by 2032, growing at a CAGR of 5.78% between 2024 to 2032.

Growing disposable income of consumers in Asia Pacific region coupled with the changing lifestyle of consumers is likely to be a major driver for the market. The tremendous growth of end-use industries is anticipated to boost the market over the projected period.

APAC has been leading the worldwide Metallic Pigments Market and is anticipated to continue in the dominant position in the years to come.

Some of the key players in the market are Crown Holdings, Amcor of Limited, CPMC, Ardagh Group, Bericap Group, Emballator Metal Group, Fujian Fuzhen Metallic Pigments Co. Ltd., Alcoa Incorporated, Rexam Plc, Manaksia Group, Shetron Group, Silgan Holdings, Jamestrong Packaging, Ton Yi Industrial, Grief Incorporated, and GM Metallic Pigments Ltd.

List of Contents

Market InsightsOverview COVID-19 Impact Analysis Growth Factors Report ScopeApplication Segment Analysis Preview To know more about this sample,request a free sample copy.Product Segment Analysis PreviewRegional Analysis PreviewTo know more about this sample,REQUEST FOR CUSTOMIZATION.Competitive LandscapeThe major players in the metallic pigments market includeThe global Market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed