Metal Alloy Market Size, Share, Trends, Growth and Forecast 2034

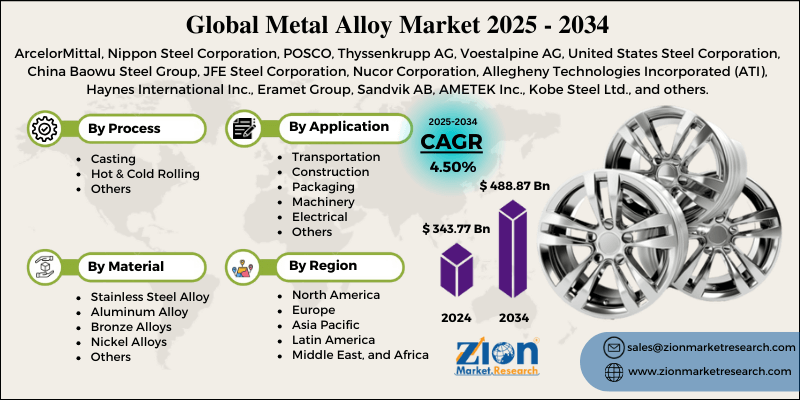

Metal Alloy Market By Process (Casting, Hot & Cold Rolling, and Others), By Material (Stainless Steel Alloy, Aluminum Alloy, Bronze Alloys, Nickel Alloys, and Others), By Application (Transportation, Construction, Packaging, Machinery, Electrical, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

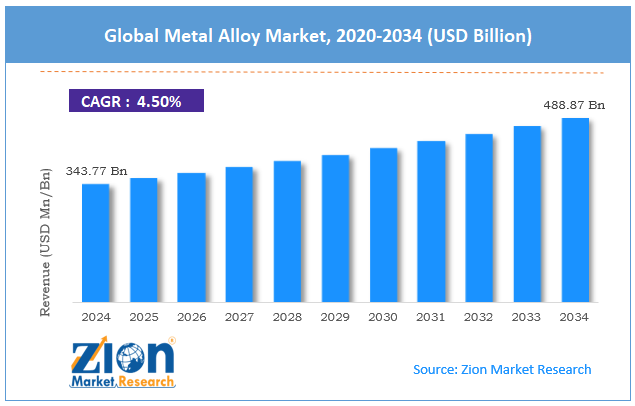

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 343.77 Billion | USD 488.87 Billion | 4.50% | 2024 |

Metal Alloy Industry Perspective:

The global metal alloy market size was approximately USD 343.77 billion in 2024 and is projected to reach around USD 488.87 billion by 2034, with a compound annual growth rate (CAGR) of approximately 4.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global metal alloy market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2025-2034)

- In terms of revenue, the global metal alloy market size was valued at around USD 343.77 billion in 2024 and is projected to reach USD 488.87 billion by 2034.

- The metal alloy market is projected to grow significantly due to the rise of the defense and aerospace sector, increasing applications in electrical and electronic equipment, and a surge in renewable energy projects (solar, wind, nuclear).

- Based on process, the casting segment is expected to lead the market, while the hot & cold rolling segment is expected to grow considerably.

- Based on material, the stainless steel alloy segment is the dominant segment, while the aluminum alloy segment is projected to witness substantial revenue growth over the forecast period.

- Based on application, the transportation segment is expected to lead the market, followed by the construction segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Metal Alloy Market: Overview

Metal alloys are materials composed of blending two or more metallic elements, or occasionally metals with non-metals, to enhance their corrosion resistance, strength, durability, and other properties compared to pure metals. The global metal alloy market is expected to expand rapidly, driven by infrastructure development, urbanization, technological advancements in alloy manufacturing, and the growth of renewable energy and electrification. Rapid infrastructure development, particularly in developing nations such as China and India, drives the demand for alloys, including steel, in the construction sector. Alloys offer load-bearing strength, durability, and corrosion resistance, thereby increasing their suitability for applications such as railways, bridges, pipelines, and skyscrapers.

Moreover, advancements such as nanostructured alloys, powder metallurgy, and additive manufacturing, including 3D printing with alloys, are facilitating the production of lighter, stronger, and more environmentally friendly materials, offering new applications in electronics, medical implants, and energy storage. Additionally, the renewable energy industry is reliant on alloys for wind turbine blades, nuclear reactors, and solar panel frames. Copper alloys are also crucial for electrical conductivity in smart grids and EVs, aiding the clean energy transition.

Despite the growth, the global market is hindered by factors such as environmental regulations, price volatility of raw materials, and complex manufacturing processes. Alloy production requires a substantial amount of energy, particularly in the aluminum and steel industries, leading to high CO2 emissions. Carbon taxation and stringent regulations may increase compliance costs for manufacturers. Aluminum, nickel, and copper prices are volatile due to geopolitical tensions, fluctuating global demand, and disruptions in mining operations. This directly impacts pricing stability and production costs for alloy producers, challenging profitability.

Additionally, advanced alloys often require advanced technologies such as powder metallurgy and vacuum melting, which are costly and limit scalability for mid-sized and small manufacturers. Nonetheless, the global metal alloy industry stands to gain from a few key opportunities, like additive manufacturing with alloys, moving towards green alloys, and rising demand for EVs. Metal 3D printing is transforming medical implants, as well as aerospace and automotive components, offering opportunities for lightweight, customized, and durable alloy applications. The development of eco-friendly smelting processes and low-carbon alloys complies with ESG goals. Companies that use green alloys may gain a competitive advantage in global markets. Furthermore, EV batteries, efficient motors, and lightweight chassis need large volumes of nickel alloys, aluminum, and copper, offering abundant growth opportunities in the coming decade.

Metal Alloy Market: Growth Drivers

How is the growth in additive manufacturing & materials innovation boosting the metal alloy market growth?

Additive manufacturing, also known as AM, has revolutionized the consumption of alloys, particularly in the healthcare industry, aerospace, and industrial tooling. Alloy producers are not investing in atomized powders optimized for 3D printing, which could offer fresh revenue streams. Developing high-entropy alloys, or HEAs, is also gaining prominence, offering optimal ductility, hardness, and corrosion resistance. This convergence of alloy advancements and AM adoption is transforming the metal alloy market with high-value and specialized materials offerings.

How are green alloy initiatives and sustainability pressures fueling the growth of the metal alloy market?

Sustainability is transforming alloy production, with companies under pressure to reduce carbon footprints and raise recycled content. Aluminum production alone accounts for approximately 3% of the worldwide CO2 emissions, underscoring its significance for eco-friendly alloys. Companies like SSAB and Norsk Hydro are pioneering 'green alloys' with renewable hydrogen-based and power processes. Governments in North America and Europe are incentivizing the use of low-carbon materials, driving the adoption of eco-certified alloys. With sustainability now applied in supply chains, eco-friendly alloys are growing as a premium industry segment.

Metal Alloy Market: Restraints

Competition from alternative materials unfavorably impacts the market progress

The rising prominence of alternative materials, such as advanced composites, carbon-fiber-reinforced plastics, and polymers, presents opportunities for reducing alloy consumption. The automotive and aerospace sectors, in particular, are moving towards carbon fiber due to its superior strength-to-weight ratio. Their substitution trend decreases the long-term demand for high-cost specialty alloys in a few applications. As substitutes become more affordable, alloys may lose industry share in major high-performing industries.

Metal Alloy Market: Opportunities

How do recycling initiatives and the circular economy provide advantageous conditions for the development of the metal alloy market?

Growing sustainability mandates are offering opportunities for alloy producers to invest in recycled metal markets. Leading companies, such as Outokumpu and ArcelorMittal, are investing heavily in scrap-based production, aiming to achieve 50-60% recycled content in alloys by 2030. Recycled aluminum needs 95% less energy compared to primary production, increasing its economic appeal. Governments in North America and Europe are implementing policies that promote the use of low-carbon materials. This move ranks recycled alloy production as an environmentally friendly and profitable growth sector, positively impacting the progress of the metal alloy industry.

Metal Alloy Market: Challenges

Dependency on critical raw materials limits the market growth

The alloy market primarily relies on vital minerals such as cobalt, chromium, and nickel, which are concentrated in certain economies. For example, Indonesia accounts for more than 40% of the global nickel supply, which poses risks of export limitations and price manipulation. Supply disturbances from geopolitical tensions, such as the Russia-Ukraine war, have already impacted the nickel and titanium markets. This reliance makes alloy producers susceptible to raw material scarcity and trade restrictions. Without diversification, market risks may create barriers to worldwide production.

Metal Alloy Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Metal Alloy Market |

| Market Size in 2024 | USD 343.77 Billion |

| Market Forecast in 2034 | USD 488.87 Billion |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 214 |

| Key Companies Covered | ArcelorMittal, Nippon Steel Corporation, POSCO, Thyssenkrupp AG, Voestalpine AG, United States Steel Corporation, China Baowu Steel Group, JFE Steel Corporation, Nucor Corporation, Allegheny Technologies Incorporated (ATI), Haynes International Inc., Eramet Group, Sandvik AB, AMETEK Inc., Kobe Steel Ltd., and others. |

| Segments Covered | By Process, By Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Metal Alloy Market: Segmentation

The global metal alloy market is segmented based on process, material, application, and region.

Based on process, the global metal alloy industry is divided into casting, hot & cold rolling, and others. The casting segment holds a leading market share, as it enables the formation of large and complex components at scale, thereby increasing its cost efficiency for mass production. It is broadly applied in automotive engines, heavy machinery components, and aerospace turbine parts due to its durability and strength. By allowing the use of different alloys, such as bronze, aluminum, and steel, casting enables multiple sectors to operate with efficiency and flexibility. Its balance of low cost, design versatility, and scalability helps maintain its leading position.

Based on material, the global metal alloy market is segmented into stainless steel alloy, aluminum alloy, bronze alloys, nickel alloys, and others. The stainless steel alloy segment holds a dominant position in the market due to its optimal corrosion resistance, strength, and versatility across various industries. They are widely used in the automotive, construction, medical device, and consumer goods industries due to their hygienic properties and durability. With growing infrastructure projects in the developing economies and rising demand for high-performance materials, stainless steel alloys lead consumption volumes. Their balance of availability, affordability, and broad applicability sustains their leading position in the industry.

Based on application, the global market is segmented into transportation, construction, packaging, machinery, electrical, and others. The transportation segment holds a dominant position, driven by substantial demand from the marine, aerospace, railway, and automotive industries. Alloys such as steel, aluminum, nickel, and titanium are mainly used to manufacture durable and lightweight components that enhance safety and fuel efficiency. The speedy growth of EVs and expanding air travel are fueling alloy consumption in the market. With a growing focus on performance and sustainability, the transportation industry maintains its leading share worldwide.

Metal Alloy Market: Regional Analysis

What enables the Asia Pacific to have a strong foothold in the global Metal Alloy Market?

The Asia Pacific is expected to maintain its leading position in the global metal alloy market, driven by its rapid industrialization, dominance in transportation and automotive manufacturing, and ample raw material availability and production capacity. The APAC region is the leading consumer of alloys, driven by numerous large-scale infrastructure projects and rapid industrialization. China alone consumes more than 50% of the world's steel and is the leading producer of stainless steel worldwide. Considerable investments in highways, railways, and smart city projects in China, India, and South Asia are anticipated to fuel alloy demand.

Moreover, the region dominates in automotive production, with China producing more than 30 million units in 2023, the highest among other nations worldwide. South Korea, India, and Japan are also major automotive hubs, depending heavily on steel and aluminum alloys. The growth of electric vehicles in China, anticipated to reach 60% of new car sales by 2030, is accelerating demand for alloys.

The APAC region holds substantial reserves of bauxite, iron ore, and nickel, which support the production of alloys on a large scale. China is the leading producer of aluminum worldwide, accounting for approximately 59% of the global output in 2023. The region's integrated supply chains and cost-efficient labor augment its dominance in worldwide alloy exports and production.

Europe ranks as the second-largest region in the global metal alloy industry, driven by its advanced defense and aerospace sectors, emphasis on sustainable construction and infrastructure, and leadership in the green transition and renewable energy sector. Europe is home to leading aerospace players such as Rolls-Royce, Airbus, and Safran, which heavily rely on nickel, aluminum, and titanium alloys. The region accounts for approximately 30% of worldwide aerospace production, increasing the criticality of alloys for aircraft frames and turbines.

Moreover, Europe holds a robust demand for bronze and stainless steel alloys for green buildings, renewable energy infrastructure, and bridges. Economies like the UK, Germany, and France are heavily investing in ecological urbanization, with the European Union distributing EUR 723 billion under the Recovery and Resilience Facility for infrastructure renovation.

Furthermore, Europe leads the clean energy transition, with solar and wind power capacity reaching more than 260 GW in 2023, the largest worldwide. Alloys such as copper, nickel, and aluminum are essential for grids, turbines, and energy storage systems. The European Green Deal, which aims to achieve climate neutrality by 2050, is expected to continue driving demand for alloys in energy-related applications.

Metal Alloy Market: Competitive Analysis

The leading players in the global metal alloy market are:

- ArcelorMittal

- Nippon Steel Corporation

- POSCO

- Thyssenkrupp AG

- Voestalpine AG

- United States Steel Corporation

- China Baowu Steel Group

- JFE Steel Corporation

- Nucor Corporation

- Allegheny Technologies Incorporated (ATI)

- Haynes International Inc.

- Eramet Group

- Sandvik AB

- AMETEK Inc.

- Kobe Steel Ltd.

Metal Alloy Market: Key Market Trends

Shift towards high-strength and lightweight alloys:

Industries such as aerospace and automotive are increasingly adopting titanium, aluminum, and magnesium alloys to achieve low density and reduce weight. Electric vehicles and aircraft demand materials that help balance low density and strength. This trend is fueling R&D in advanced alloy compositions for improved performance.

Integration of shape memory materials and smart alloys:

Smart alloys and shape memory are being used in aerospace actuators, robotics, and biomedical devices for responsive and adaptive applications. For instance, nickel-titanium (NiTi) alloys are extensively used in surgical tools and medical stents. This trend offers novel high-value applications in advanced technology sectors.

The global metal alloy market is segmented as follows:

By Process

- Casting

- Hot & Cold Rolling

- Others

By Material

- Stainless Steel Alloy

- Aluminum Alloy

- Bronze Alloys

- Nickel Alloys

- Others

By Application

- Transportation

- Construction

- Packaging

- Machinery

- Electrical

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Metal alloys are materials composed of blending two or more metallic elements, or occasionally metals with non-metals, to enhance their corrosion resistance, strength, durability, and other properties compared to pure metals.

The global metal alloy market is projected to grow due to industrialization in the developing economies, increasing demand for high-strength and lightweight materials, and advancements in additive manufacturing (3D printing).

According to study, the global metal alloy market size was worth around USD 343.77 billion in 2024 and is predicted to grow to around USD 488.87 billion by 2034.

The CAGR value of the metal alloy market is expected to be approximately 4.50% from 2025 to 2034.

Market trends and consumer preferences are evolving toward high-strength, lightweight, technologically advanced, and sustainable alloys for aerospace, automotive, and renewable energy applications.

Carbon emission standards, stringent environmental regulations, and recycling mandates are shaping the growth of the metal alloy market and influencing production costs.

Significant investment and partnership opportunities exist in additive manufacturing, advanced alloy R&D, sustainable recycling, EV materials, and aerospace-grade alloy production.

Asia Pacific is expected to lead the global metal alloy market during the forecast period.

The key players profiled in the global metal alloy market include ArcelorMittal, Nippon Steel Corporation, POSCO, Thyssenkrupp AG, Voestalpine AG, United States Steel Corporation, China Baowu Steel Group, JFE Steel Corporation, Nucor Corporation, Allegheny Technologies Incorporated (ATI), Haynes International Inc., Eramet Group, Sandvik AB, AMETEK Inc., and Kobe Steel Ltd.

The report examines key aspects of the metal alloy market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed