Medical X-ray Market Size, Share, Trends, Growth 2032

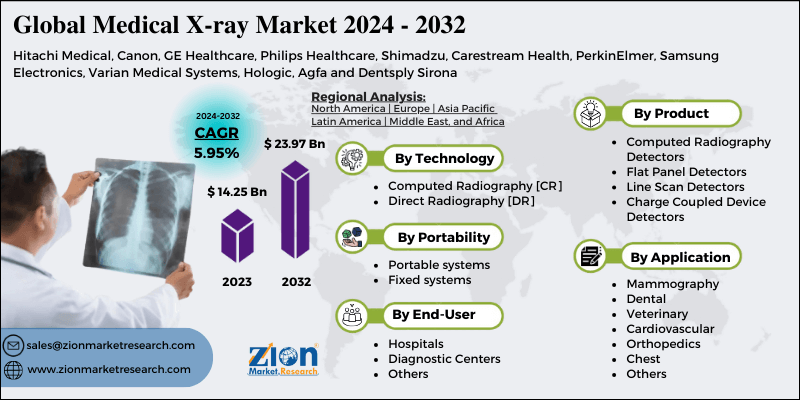

Medical X-ray Market by Product (Computed Radiography Detectors, Flat Panel Detectors, Line Scan Detectors, Charge Coupled Device Detectors [CCD]), by Technology (Computed Radiography [CR], Direct Radiography [DR]), by Portability (Fixed Systems, Portable Systems), by Application (Dental, Veterinary, Mammography, Chest, Cardiovascular, Orthopaedics, Others) and by End Users (Diagnostic Centers, Hospitals and Others), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

| Market Size in 2024 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.25 Billion | USD 23.97 Billion | 5.95% | 2023 |

Medical X-ray Industry Perspective:

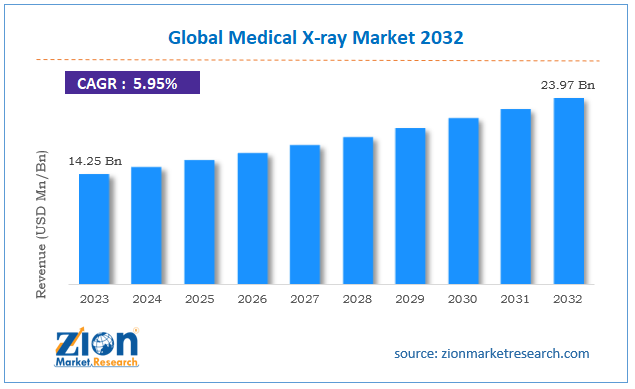

The global medical x-ray market size was worth around USD 14.25 billion in 2023 and is predicted to grow to around USD 23.97 billion by 2032 with a compound annual growth rate (CAGR) of roughly 5.95% between 2024 and 2032.The report covers forecast and analysis for the medical x-ray market on a global and regional level. The study provides historic data of 2018 to 2022 along with a forecast from 2024 to 2032 based revenue (USD Billion).

Key Insights

- As per the analysis shared by our research analyst, the global medical x-ray market is estimated to grow annually at a CAGR of around 5.95% over the forecast period (2024-2032).

- In terms of revenue, the global medical x-ray market size was valued at around USD 14.25 Billion in 2023 and is projected to reach USD 23.97 Billion by 2032.

- The growth of the medical x-ray market is being driven by the increasing prevalence of chronic diseases and demand for accurate diagnostic imaging.

- Based on product, the computed radiography detectors segment is growing at a high rate and is projected to dominate the market.

- On the basis of technology, the computed radiography [CR] segment is projected to swipe the largest market share.

- In terms of portability, the portable systems segment is expected to dominate the market.

- Based on application, the mammography segment is projected to swipe the largest market share.

- In terms of end-user, hospitals segment is expected to dominate the market.

- By region, North Americais expected to dominate the global market during the forecast period.

Medical X-ray Market: Overview

Medical imaging has led to improvements in the diagnosis and treatment of various medical conditions in adults and children. X-ray imaging examination is considered as an important medical tool for a wide range of procedures and examinations. The benefits of medical imaging systems include a noninvasive and painless procedure for disease diagnosis and monitor therapy. It also supports medical and surgical treatment plan and provides guidance for medical personnel as they insert catheters, stents, or other devices inside the body, for the treatment of tumors, or remove blood clots or other blockages. Such factors are expected to witness significant growth for global medical x-ray over the forecast period.

The Radiation Emitting Devices Regulation recommends safety performance. Medicare payment is expected to decrease by 20% in 2017, for providers who submit a claim for examination with analog x-ray under the provision Consolidated Appropriations Act. Furthermore, growing aging population base across the world undertaking x-ray examination are significantly increasing. As elder population are more prone to acquire chronic diseases and will increase demand for medical x-ray in the coming years. However, increased risk of exposure to high radiation among patients and high cost associated with the installation of medical imaging systems may hinder industry growth.

The study includes drivers and restraints for the medical x-ray market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the medical x-ray market on a global level.

In order to give the users of this report a comprehensive view on the medical x-ray market, we have included competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein product segment, technology segment, portability segment, application segment and end-user segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, research & development, technology and regional expansion of major participants involved in the market on the global and regional basis. Moreover, the study covers price trend analysis, the product portfolio of various companies according to the region.

Medical X-ray Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical X-ray Market Research Report |

| Market Size in 2024 | USD 14.25 Billion |

| Market Forecast in 2032 | USD 23.97 Billion |

| Growth Rate | CAGR of 5.95% |

| Number of Pages | 215 |

| Key Companies Covered | Hitachi Medical, Canon, GE Healthcare, Philips Healthcare, Shimadzu, Carestream Health, PerkinElmer, Samsung Electronics, Varian Medical Systems, Hologic, Agfa and Dentsply Sirona |

| Segments Covered | By Product, By Technology, By Portability, By Application, By End-User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical X-ray Market: Segmentation

The study provides a decisive view on the medical x-ray market by segmenting the market based on product, technology, portability, application, end user, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on the product the market is segmented into computed radiography detectors, flat panel detectors, line scan detectors, Charge Coupled Device Detectors [CCD].

On the basis of technology, the market is segmented into Computed Radiography [CR], Direct Radiography [DR]. Based on portability the market is segmented into fixed systems, portable systems.

Based on application the market is segmented as dental, veterinary, mammography, chest, cardiovascular, orthopaedics and others. Based on end users the market is segmented into diagnostic centers, hospitals and others category.

Medical X-ray Market: Regional Analysis

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America and Middle East & Africa with its further bifurcation into major countries including the U.S., Canada, Rest of North America, U.K., Germany, France, Rest of Europe, China, Japan, India, Rest of Asia Pacific, Brazil, Rest of Latin America, and Rest of Middle East and Africa. This segmentation includes demand for medical x-ray market based on product, technology, portability, application and end users in all the regions and countries.

North America held a major revenue share of the global medical x-ray market for in 2023 and the region is anticipated to continue with its regional supremacy over the forecast period. The growth of this regional market is attributed due to the high adoption rate of novel technology and presence of well-established healthcare infrastructure. Asia-Pacific is projected to grow at a significant CAGR, due to rising geriatric population, the high prevalence of chronic diseases that require diagnosis and treatment and increasing unmet medical needs.

Medical X-ray Market: Competitive Analysis

The global Medical X-ray market is dominated by players like:

- Hitachi Medical

- Canon

- GE Healthcare

- Philips Healthcare

- Shimadzu

- Carestream Health,

- PerkinElmer

- Samsung Electronics

- Varian Medical Systems

- Hologic

- Agfa

- Dentsply Sirona

This report segments the global medical x-ray market as follows:

Global Medical X-ray Market: Product Segment Analysis

- Computed Radiography Detectors

- Flat Panel Detectors

- Line Scan Detectors

- Charge Coupled Device Detectors [CCD]

Global Medical X-ray Market: Technology Segment Analysis

- Computed Radiography [CR]

- Direct Radiography [DR]

Global Medical X-ray Market: Portability Segment Analysis

- Portable systems

- Fixed systems

Global Medical X-ray Market: Application Segment Analysis

- Mammography

- Dental

- Veterinary

- Cardiovascular

- Orthopedics

- Chest

- Others

Global Medical X-ray Market: End-User Segment Analysis

- Hospitals

- Diagnostic Centers

- Others

Global Medical X-ray Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

In medicine, medical X-rays, also known as radiography, are frequently used to visualize the internal structures of the body for diagnostic purposes. A form of electromagnetic radiation known as X-rays is utilized in this process to generate intricate images of organs, tissues, and bones. Due to their lesser wavelengths in comparison to visible light, X-rays are capable of penetrating the body and generating images of the latent structures within.

Continuous progress in X-ray technology, exemplified by the creation of computed tomography (CT), fluoroscopy systems, and digital radiography, contributes to enhanced diagnostic capabilities, reduced radiation exposure, and improved imaging quality, thereby propelling market expansion. The rising incidence of diverse medical conditions, including cardiovascular diseases, respiratory disorders, and orthopedic disorders, increases the demand for diagnostic imaging, including X-rays, thereby stimulating market growth.

The global medical x-ray market size was worth around USD 14.25 billion in 2023 and is predicted to grow to around USD 23.97 billion by 2032.

The global medical x-ray market with a compound annual growth rate (CAGR) of roughly 5.95% between 2024 and 2032.

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America and Middle East & Africa with its further bifurcation into major countries including the U.S., Canada, Rest of North America, U.K., Germany, France, Rest of Europe, China, Japan, India, Rest of Asia Pacific, Brazil, Rest of Latin America, and Rest of Middle East and Africa.

The report also includes detailed profiles of end players such as Hitachi Medical, Canon, GE Healthcare, Philips Healthcare, Shimadzu, Carestream Health, PerkinElmer, Samsung Electronics, Varian Medical Systems, Hologic, Agfa and Dentsply Sirona.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed