Medical Ceramics Market Size, Share Report, Analysis, Trends, Growth 2032

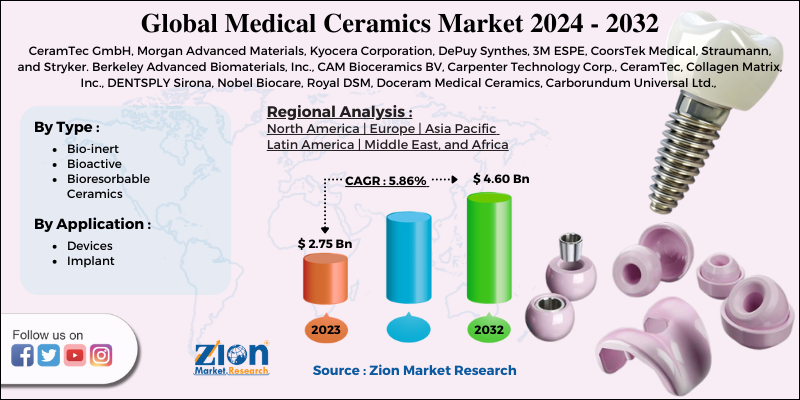

Medical Ceramics Market By Type (Bio-Inert, Bio-Active, & Bio-Resorbable Ceramics), By Application (Devices and Implant), and By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

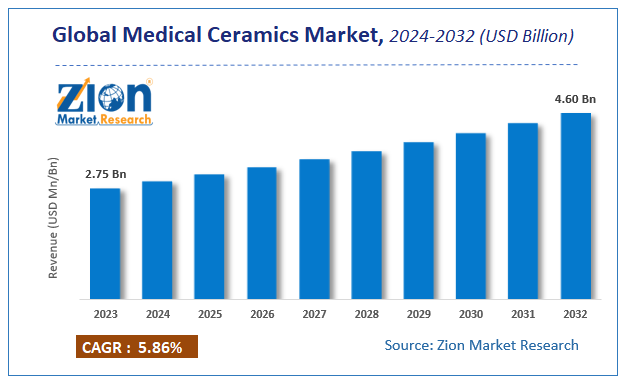

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.75 Billion | USD 4.60 Billion | 5.86% | 2023 |

Medical Ceramics Market Insights

According to a report from Zion Market Research, the global Medical Ceramics Market was valued at USD 2.75 Billion in 2023 and is projected to hit USD 4.60 Billion by 2032, with a compound annual growth rate (CAGR) of 5.86% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Medical Ceramics Market industry over the next decade.

Medical Ceramics Market: Overview

Increasing user revenues and rising requirements for clinical intervention & medical services are a number of the main catalysts for the growth of the medical ceramics market. Rising R&D activities by major players like Kyocera are probably going to spice up the medical ceramics market within the years to return. Furthermore, increasing demand in Europe and North America has resulted in a high penetration of the medical ceramics market in these areas. The transitioning demographics are expected to power the expansion of the medical ceramics market.

Increasing the osteoarthritis population might positively affect the utilization of medical ceramics everywhere on the planet, thereby boosting the medical ceramics market. On the opposite hand, volatility in alumina costs might hinder the event of the worldwide medical ceramics market. Nevertheless, risings hip & knee replacements and implant surgeries are likely to supply lucrative avenues for the expansion of worldwide medical ceramics within the years to return

COVID-19 Impact Analysis:

The global Medical Ceramics market has witnessed a slight decline in growth for the short term due to the lockdown endorsement placed by governments to contain COVID spreading. Several dental events have been postponed and rescheduled due to the COVID-19 pandemic. For instance, KRAKDENT 2020, the largest dental show in Poland and an event that attracts over 15,000 visitors worldwide has been rescheduled. Additionally, the CEO of Straumann Group announced that the COVID-19 outbreak was expected to reduce sales in the Asia Pacific in FY 2020 by at least USD 31 million.

Medical Ceramics Market: Growth Factors

Increasing research activities for the event of novel medical ceramics, growing demand for medical ceramics in plastic surgeries & wound healing applications; the rising number of hip & knee replacement procedures; and therefore, the increasing demand for implantable devices are liable for the many growths of the market during the review period. Increasing investment by market players to take care of their status is about to foster the expansion of the medical ceramics market. For instance in August 2015, CoorsTek Medical announced a multi-million dollar 5-year capital investment deal to support the increasing demand for its ceramic hip replacement components.

Medical Ceramics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Ceramics Market |

| Market Size in 2023 | USD 2.75 Billion |

| Market Forecast in 2032 | USD 4.60 Billion |

| Growth Rate | CAGR of 5.86% |

| Number of Pages | 125 |

| Key Companies Covered | CeramTec GmbH, Morgan Advanced Materials, Kyocera Corporation, DePuy Synthes, 3M ESPE, CoorsTek Medical, Straumann, and Stryker. Berkeley Advanced Biomaterials, Inc., CAM Bioceramics BV, Carpenter Technology Corp., CeramTec, Collagen Matrix, Inc., DENTSPLY Sirona, Nobel Biocare, Royal DSM, Doceram Medical Ceramics, Carborundum Universal Ltd., Sagemax Bioceramics Inc., Jyoti Ceramic Industries Pvt. Ltd., Bone support, Amedica Corporation |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Ceramics Market: Segment Analysis Preview

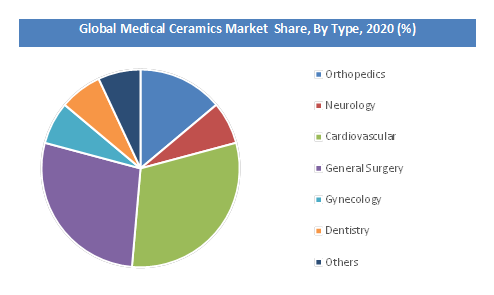

The global medical ceramics market is segmented into types, applications, and regions.

Based on type, the medical ceramics market is divided into bio-inert, bio-active, and bio-resorbable. Alumina-based and zirconia ceramics are divided into bioinert.

Based on the applications division the medical ceramic market can be bifurcated into devices and implants. The orthopedic industry will see fostering development due to the rising trend of surgical intervention by doctors for shoulder, knee, and hip implants at an early phase. Apart from this, increasing usage of zirconium, alumina, and hydroxyapatite due to reduction in wear and tear, better stability, and fewer chances of any dislocation after the operation will power its requirement in the orthopedic industry, thereby power the medical ceramics market.

Medical Ceramics Market: Regional Analysis Preview

Globally, North America is expected to remain the dominant region over the forecast period in 2018. Europe was the second-largest market in 2018. The Asia Pacific is expected to be the fastest-growing and the largest revenue-contributing region in the Medical Ceramics market during the forecast period. Moreover, Latin America is also expected to show noticeable growth in this market in the years to come.

Medical Ceramics Market: Key Players & Competitive Landscape

Key players profiled in the report include -

- CeramTec GmbH

- Morgan Advanced Materials

- Kyocera Corporation

- DePuy Synthes

- 3M ESPE

- CoorsTek Medical

- Straumann

- Stryker.

- Berkeley Advanced Biomaterials

- CAM Bioceramics BV

- Carpenter Technology Corp.

- CeramTec

- Collagen Matrix

- DENTSPLY Sirona

- Nobel Biocare

- Royal DSM

- Doceram Medical Ceramics

- Carborundum Universal Ltd.

- Sagemax Bioceramics Inc.

- Jyoti Ceramic Industries Pvt. Ltd.

- Bone support

- Amedica Corporation.

The global Medical Ceramics Market is segmented as follows:

By Type

- Bio-inert

- Aluminum Oxide

- Zirconia

- Carbon

- Bioactive

- Hydroxyapatite (HAP)

- Glass & Bioglass

- Zirconia Alumina

- Bioresorbable Ceramics

By Application

- Devices

- Implant

- Orthopedic Implants

- Electronic Implants

- Dental Implants

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

.

Table Of Content

Methodology

FrequentlyAsked Questions

Medical Ceramics Market size worth at USD 2.75 Billion in 2023

Medical Ceramics Market size worth at USD 2.75 Billion in 2023 and projected to USD 4.60 Billion by 2032, with a CAGR of around 5.86% between 2024-2032.

Factors such as cost-effectiveness, product innovations, increasing awareness about hospital-acquired infections, rising need for better infection control, growing concerns about patient protection, increasing aging population, and growing stringent regulations for healthcare professionals and patient safety are fueling the growth of the global Medical Ceramics Market.

North America in 2020 ruled the Medical Ceramics Market and was believed to be the highest income-generating area all over the globe.

Key players profiled in the report include CeramTec GmbH, Morgan Advanced Materials, Kyocera Corporation, DePuy Synthes, 3M ESPE, CoorsTek Medical, Straumann, Stryker. Berkeley Advanced Biomaterials, Inc., CAM Bioceramics BV, Carpenter Technology Corp., CeramTec, Collagen Matrix, Inc., DENTSPLY Sirona, Nobel Biocare, Royal DSM, Doceram Medical Ceramics, Carborundum Universal Ltd., Sagemax Bioceramics Inc., Jyoti Ceramic Industries Pvt. Ltd., Bone support, Amedica Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed