Medical Cannabis Packaging Market Size, Share, Trends, Growth 2034

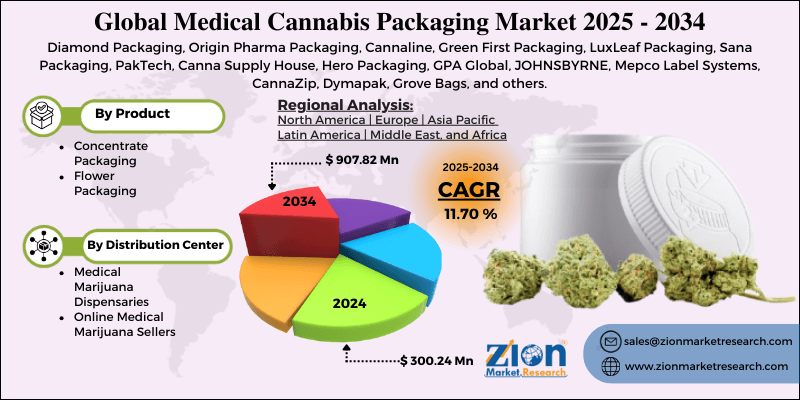

Medical Cannabis Packaging Market By Product (Concentrate Packaging and Flower Packaging), By Distribution Center (Medical Marijuana Dispensaries, and Online Medical Marijuana Sellers), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

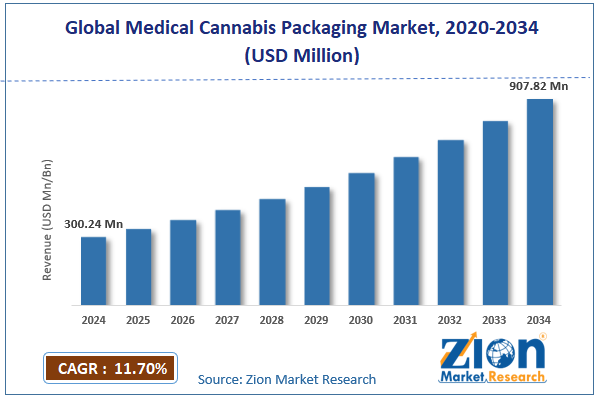

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 300.24 Million | USD 907.82 Million | 11.70% | 2024 |

Medical Cannabis Packaging Industry Perspective:

The global medical cannabis packaging market size was worth around USD 300.24 million in 2024 and is predicted to grow to around USD 907.82 million by 2034 with a compound annual growth rate (CAGR) of roughly 11.70% between 2025 and 2034.

Medical Cannabis Packaging Market: Overview

Medical cannabis packaging refers to specialized packaging solutions designed for storing and protecting cannabis used for medical purposes. The industry consists of a wide range of labels and containers, ensuring longer shelf life and chemical integrity of medical cannabis. In addition to this, demand and innovation in the medical cannabis packaging industry are highly influenced by regulatory requirements. Some of the main parameters of packaging solutions used for medical cannabis include an air-tight seal, child lock features, higher durability, accurate labeling, and other regional regulatory requirements. The most commonly used packaging for medical cannabis is bags, jars, concentrate containers, and pouches. The increasing adoption of medical cannabis in the global healthcare sector is propelling the demand for effective packaging solutions.

In addition to this, rising accessibility to cannabis for medical care, especially through online channels, will further facilitate the market demand rate in the coming years. The presence of stringent regulatory frameworks and the lack of wide-scale acceptance of medical cannabis in major parts of the world may inhibit the industry growth rate during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global medical cannabis packaging market is estimated to grow annually at a CAGR of around 11.70% over the forecast period (2025-2034)

- In terms of revenue, the global medical cannabis packaging market size was valued at around USD 300.24 million in 2024 and is projected to reach USD 907.82 million by 2034.

- The medical cannabis packaging market is projected to grow at a significant rate due to the increasing legal acceptance of medical cannabis worldwide.

- Based on the product, the packaging segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the distribution center, the dispensaries segment is anticipated to command the largest market share.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Medical Cannabis Packaging Market: Growth Drivers

How will increasing legal acceptance of medical cannabis worldwide to drive the medical cannabis packaging market?

The global medical cannabis packaging market is expected to be led by an increasing acceptance of medical cannabis worldwide. Extensive research conducted across the world highlights the effectiveness of medical cannabis, also known as medical marijuana, in managing and treating certain conditions.

For instance, a recent study published on ScienceDirect highlights the effectiveness of improving sleep and reducing pain in patients suffering from chronic pain. As per Mayo Clinic, medical cannabis is used for easing symptoms related to certain conditions such as epilepsy & seizures, Alzheimer’s disease, glaucoma, posttraumatic stress disorder, Crohn’s disease, amyotrophic lateral sclerosis (ALS), muscle spasms & multiple sclerosis, among others. This has led to higher legal acceptance of controlled doses of medical cannabis in the healthcare infrastructure.

In December 2023, the Ukrainian government announced the legalization of medical marijuana in the backdrop of growing stress among its citizens due to the ongoing war with Russia. Canada, on the other hand, legalized medical cannabis in 2018, including cultivation and possession. As more countries and states allow legal transactions related to medical marijuana, the subsequent demand for effective packaging will continue to grow.

Strict government guidelines highlighting packaging requirements to facilitate industry growth

Due to the several risks associated with medical cannabis, the packaging solutions associated with the production and sale of medical marijuana are highly regulated. Governments with legal status for cannabis for medical use have laid down strict and transparent packaging guidelines that must be followed when the product is made available for commercial sale.

For instance, the medical cannabis packaging industry in Canada is regulated by the Cannabis Act and the Cannabis Regulations. Some of the rules in the legal framework require all cannabis products to be packaged in an immediate container that must be child-resistant, translucent, or opaque, have security features, and should not exceed the maximum amount of cannabis, among other guidelines. The existence of a clear and transparent legal structure can help companies in the global medical cannabis packaging market ensure 100% compliance.

Medical Cannabis Packaging Market: Restraints

Limited legal acceptance of medical cannabis to limit market expansion in the future

The global medical cannabis packaging industry is expected to be restricted due to the limited legal acceptance of medical marijuana worldwide. Although some parts of the world have legalized the responsible use of medical cannabis, a large number of countries globally do not promote acceptance of marijuana in healthcare.

Currently, medical cannabis enjoys legal status in a select number of nations. For instance, although medical cannabis is approved in 38 states of the United States, federal law prohibits the use of cannabis for medical purposes. Market players may face difficulties while investing in global expansion during the projection period.

Medical Cannabis Packaging Market: Opportunities

Rising rate of innovation and demand for sustainable packaging to generate growth opportunities

The global medical cannabis packaging market is expected to generate growth opportunities due to the rising rate of innovation in the industry. In recent times, demand for sustainable packaging solutions for medical marijuana has increased, which can open new growth avenues for the industry players. The increasing use of biodegradable or recyclable solutions will help the industry reduce waste and induce a circular economy.

For instance, Brodeur Partners, in a recent event, announced the launch of Calyx Containers. They are 100% recyclable and reduce the overall carbon footprint. The clear glass of Calyx Containers is made using 56% post-consumer recycled material and can be recycled 100% including the cap. Similarly, Sana Packaging offers reclaimed, plant-based, and recyclable materials for producing packaging solutions. In addition to this, the industry is also witnessing an increased rate of integration of smart security features on medical cannabis packaging. These technologies are installed to prevent drug counterfeiting, enable tracking & tracing, and improve compliance.

For instance, in June 2024, MediPharm Labs Corp., a leading pharmaceutical company specializing in precision-based cannabinoids, signed a licensing agreement with Remidose Aerosols. The latter is an advanced cannabis delivery device developer. Through this move, MediPharm has acquired exclusive rights to advanced cannabis products by Remidose.

Medical Cannabis Packaging Market: Challenges

Will the high cost of investment and increasing concerns over counterfeit products challenge the medical cannabis packaging market expansion?

The global medical cannabis packaging industry is expected to be challenged by the high cost of investment associated with developing advanced packaging solutions for medical marijuana. In addition to this, the growing risk of the sale of counterfeit products and its impact on the health of patients may further create growth challenges for the industry players during the forecast period.

Medical Cannabis Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Cannabis Packaging Market |

| Market Size in 2024 | USD 300.24 Million |

| Market Forecast in 2034 | USD 907.82 Million |

| Growth Rate | CAGR of 11.70% |

| Number of Pages | 214 |

| Key Companies Covered | Diamond Packaging, Origin Pharma Packaging, Cannaline, Green First Packaging, LuxLeaf Packaging, Sana Packaging, PakTech, Canna Supply House, Hero Packaging, GPA Global, JOHNSBYRNE, Mepco Label Systems, CannaZip, Dymapak, Grove Bags, and others. |

| Segments Covered | By Product, By Distribution Center, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Cannabis Packaging Market: Segmentation

The global medical cannabis packaging market is segmented based on product, distribution center, and region.

Based on the product, the global market segments are concentrate packaging and flower packaging. In 2024, the highest demand was listed in the concentrate packaging segment. The increasing demand for vap and oils representing concentrated forms of medical cannabis is propelling the segmental revenue. As per market research, around 45% of medical cannabis users prepare concentrated form since it is known to have higher effectiveness as compared to flowers.

Based on the distribution center, the global market divisions are medical marijuana dispensaries and online medical marijuana sellers. In 2024, the highest return on investment was listed in the dispensaries segment, accounting for over 75% of the revenue due to legal constraints. Most countries encourage in-person sales of medical cannabis, thus helping the dispensaries segment grow. However, the increasing acceptance of authorized online channels for medical marijuana may help online distributors generate more revenue.

Medical Cannabis Packaging Market: Regional Analysis

What factors will help Europe register the highest growth rate in the medical cannabis packaging market?

The global medical cannabis packaging market is expected to be led by Europe during the projection period. In recent times, several European countries have legalized the use of medical cannabis, helping the packaging industry thrive. It includes prominent countries such as Greece, Finland, the Netherlands, Italy, Austria, Switzerland, the United Kingdom, Portugal, and Poland, among others.

Furthermore, the growing number of patients across Europe who require medical cannabis will create a higher demand for effective medical cannabis packaging. According to Alzheimer’s Europe, more than 7 million people in the region suffer from Alzheimer’s. Similar statistics are observed for other medical conditions as well, including patients suffering from chronic pain.

Furthermore, recent trends indicate an increasing number of foreign marijuana companies seeking business opportunities in Europe due to lower taxes and less strict regulations. In April 2025, Aurora Cannabis Inc., a Canadian medical cannabis company, launched its medical cannabis concentrates in the UK market. The European market will be highly influenced by the growing demand for sustainable packaging solutions, requiring market players to invest in research & development.

Medical Cannabis Packaging Market: Competitive Analysis

The global medical cannabis packaging market is led by players like:

- Diamond Packaging

- Origin Pharma Packaging

- Cannaline

- Green First Packaging

- LuxLeaf Packaging

- Sana Packaging

- PakTech

- Canna Supply House

- Hero Packaging

- GPA Global

- JOHNSBYRNE

- Mepco Label Systems

- CannaZip

- Dymapak

- Grove Bags

The global medical cannabis packaging market is segmented as follows:

By Product

- Concentrate Packaging

- Flower Packaging

By Distribution Center

- Medical Marijuana Dispensaries

- Online Medical Marijuana Sellers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Medical cannabis packaging refers to specialized packaging solutions designed for storing and protecting cannabis used for medical purposes.

The global medical cannabis packaging market is expected to be led by an increasing acceptance of medical cannabis worldwide.

According to study, the global medical cannabis packaging market size was worth around USD 300.24 million in 2024 and is predicted to grow to around USD 907.82 million by 2034.

The CAGR value of the medical cannabis packaging market is expected to be around 11.70% during 2025-2034.

The global medical cannabis packaging market is expected to be led by Europe during the projection period.

The global medical cannabis packaging market is led by players like Diamond Packaging, Origin Pharma Packaging, Cannaline, Green First Packaging, LuxLeaf Packaging, Sana Packaging, PakTech, Canna Supply House, Hero Packaging, GPA Global, JOHNSBYRNE, Mepco Label Systems, CannaZip, Dymapak, and Grove Bags.

The report explores crucial aspects of the medical cannabis packaging market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed