Medical Aesthetic Devices Market Size, Share, Growth, Trends, and Forecast, 2032

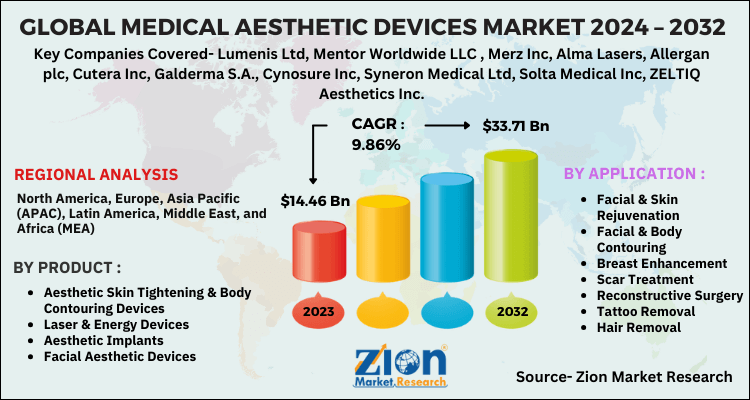

Medical Aesthetic Devices Market: By Product (Aesthetic Laser And Energy Devices, Skin Tightening And Body Contouring Devices, Aesthetic Implants, And Facial Aesthetic Devices) By Application {Facial And Body Contouring, Facial And Skin Rejuvenation, Breast Enhancement, Scar Treatment, Reconstructive Surgery, Tattoo Removal, And Hair Removal)),and Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

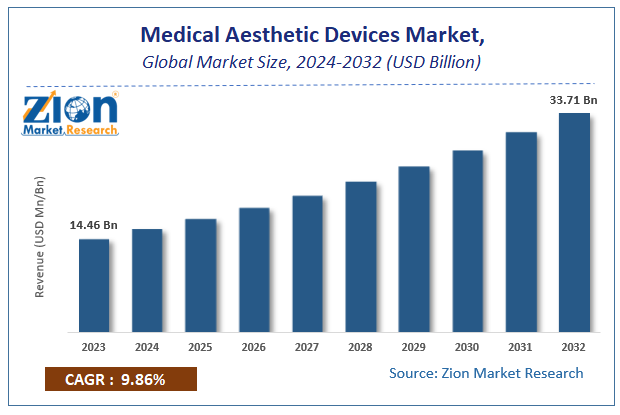

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.46 Billion | USD 33.71 Billion | 9.86% | 2023 |

Medical Aesthetic Devices Market Insights

Zion Market Research has published a report on the global Medical Aesthetic Devices Market, estimating its value at USD 14.46 Billion in 2023, with projections indicating that it will reach USD 33.71 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 9.86% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Medical Aesthetic Devices Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Medical Aesthetic Devices Industry Perspective

Rising acceptance of minimally invasive operations in dermatological applications paired with the rapid increase in population between the age of 30 and 60 are major factors planned to be major demand boosters within the medical aesthetic devices market. This, in return, escalates the demand for dermatological applications in the Asia Pacific market. This is often providing new development chances for the worldwide medical aesthetic devices market. On the opposite hand, the high price of treatment is anticipated to be the main limitation for the medical aesthetic devices market.

Additionally to the present, technological enhancements will offer innovative items and might open up new growth opportunities within the coming years. For instance, in April 2018, Salient Medical Solutions unrolled a new facial skin analysis system that employs skin care photographic imaging tools. The device offers clinical calculations of subsurface and surface facial skin conditions by using digital images techs through PL polarized light, RGB light, and UV spectrum. This launch of the new device has enhanced the event of the medical aesthetic devices market.

Medical aesthetics devices are an inclusive term for specialties that focus on improving cosmetic appearance through the treatment of conditions including scars, skin laxity, wrinkles, moles, liver spots, excess fat, cellulite, unwanted hair, skin discoloration, and spider veins. Laser and energy devices play an important role aesthetic treatment.

Medical Aesthetic Devices Market: Growth Factors

The global Medical Aesthetic Devices market is primarily driven by the expansion of the medical device industry in the Asia Pacific region, especially in China, India and Japan. Another major driving factor is the increasing demand for minimally invasive procedures coupled with technological innovations, increasing obese population, increasing awareness regarding aesthetic procedures and rising adoption of minimally invasive devices.

Additionally, the concern of individuals about their appearance is gradually on an increase, both within the developed and therefore the developing countries. Thus, there's a rise within the number of cosmetic surgeries performed, annually. However, volatile staple prices and strict government regulations implied in this industry are major restraints that will limit the expansion of the market.

The medical aesthetic devices market is anticipated to witness substantial growth in coming years. The market is mainly driven by rapid growth in population between the age of 30 to 60 years and growing adoption of minimally invasive surgeries in dermatological applications. Thus, escalating demand for dermatological applications in Asia Pacific market is offering new growth prospects for the global medical aesthetic devices market. However, the high cost of treatment is expected to hamper the growth of medical aesthetic devices market. Nonetheless, advancement in technology is projected to open up new growth opportunities within the forecast period.

Medical Aesthetic Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medical Aesthetic Devices Market |

| Market Size in 2023 | USD 14.46 Billion |

| Market Forecast in 2032 | USD 33.71 Billion |

| Growth Rate | CAGR of 9.86% |

| Number of Pages | 125 |

| Key Companies Covered | Lumenis Ltd, Mentor Worldwide LLC , Merz Inc, Alma Lasers, Allergan plc, Cutera Inc, Galderma S.A., Cynosure Inc, Syneron Medical Ltd, Solta Medical Inc, ZELTIQ Aesthetics Inc, |

| Segments Covered | By Application, By Product and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medical Aesthetic Devices Market: Segment Analysis

Based on products, medical aesthetic devices market has been segmented into aesthetic skin tightening & body contouring devices, laser & energy devices, aesthetic implants, and facial aesthetic devices. Laser & energy devices were the leading segment and it accounted for over 30% market share of total revenue generated in 2015. Laser & energy devices utilize the combination of energy types in order to provide the most efficient treatment. Thus, this segment is expected to witness strong growth in the next few years. Aesthetic skin tightening & body contouring devices are expected to witness noteworthy growth within the forecast period.

Medical aesthetic devices find widespread applications in various areas such as facial & skin rejuvenation, facial & body contouring, breast enhancement, scar treatment, reconstructive surgery, tattoo removal and hair removal. Facial & body contouring was leading application segment and accounted for a large chunk of market share in 2015. Many people have stubborn pockets of fat that seem impossible to lose even with diet and exercise. Body contouring is able to target these fat areas of patients achieve the desired shape. Scar treatment and tattoo removal are expected to exhibit significant growth in the years to come.

Medical Aesthetic Devices Market: Regional Analysis

The medical aesthetic devices market was led by North America with the share of over 39% in 2020. This area is anticipated to carry on its supremacy in the medical aesthetic devices market in the coming years. The attendance of a huge base of major players in this area paired with technological improvements is anticipated to assist the region to maintain its dominance in the global medical aesthetic devices market in the years to come. Europe was another leading region in the medical aesthetic device market. This development is primarily due to unremitting technological enhancements in the aesthetic device.

Key Market Players & Competitive Landscape

Some of the key players in the Medical Aesthetic Devices market include

- Lumenis Ltd

- Mentor Worldwide LLC

- Merz Inc

- Alma Lasers

- Allergan plc

- Cutera Inc

- Galderma S.A.

- Cynosure Inc

- Syneron Medical Ltd

- Solta Medical Inc

- ZELTIQ Aesthetics Inc

The global Medical Aesthetic Devices Market is segmented as follows:

By Application

- Facial & Skin Rejuvenation

- Facial & Body Contouring

- Breast Enhancement

- Scar Treatment

- Reconstructive Surgery

- Tattoo Removal

- Hair Removal

By Product

- Aesthetic Skin Tightening & Body Contouring Devices

- Laser & Energy Devices

- Aesthetic Implants

- Facial Aesthetic Devices

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Medical Aesthetic Devices Market market size valued at US$ 14.46 Billion in 2023

Medical Aesthetic Devices Market market size valued at US$ 14.46 Billion in 2023, set to reach US$ 33.71 Billion by 2032 at a CAGR of about 9.86% from 2024 to 2032

Certain factors that are driving the market growth include the increasing obese population, increasing awareness regarding aesthetic procedures, rising adoption of minimally invasive devices, and technological advancement in devices.

North America in 2020 ruled the Medical Aesthetic Devices Market and was believed to be the highest income-generating area all over the globe.

Some of the key players in the Medical Aesthetic Devices market include Lumenis Ltd., Mentor Worldwide LLC, Merz, Inc., Alma Lasers, Allergan plc, Cutera, Inc., Galderma S.A., Cynosure, Inc., Syneron Medical Ltd., Solta Medical, Inc., and ZELTIQ Aesthetics, Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed