Malic Acid Market Size, Share, Trends, Growth 2032

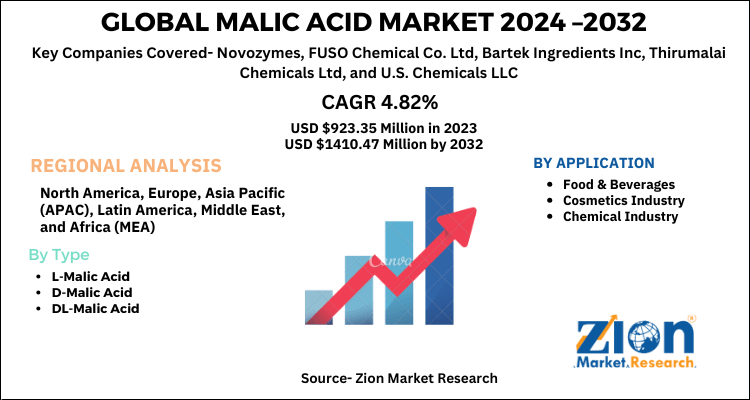

Malic Acid Market By Type (L-Malic Acid, D-Malic Acid And DL-Malic Acid) By Application (Food & Beverages, Chemical Industry, Cosmetics Industry And Other Applications): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

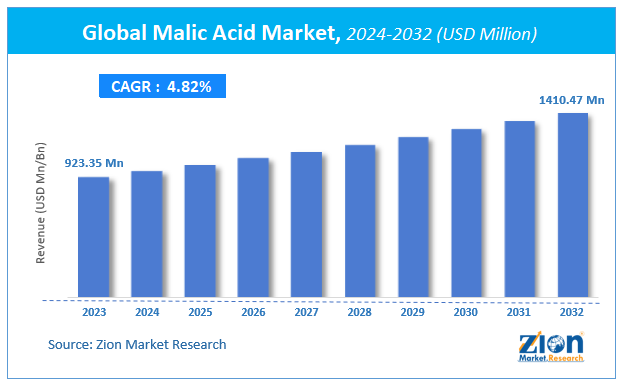

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 923.35 Million | USD 1410.47 Million | 4.82% | 2023 |

Malic Acid Market Insights

According to a report from Zion Market Research, the global Malic Acid Market was valued at USD 923.35 Million in 2023 and is projected to hit USD 1410.47 Million by 2032, with a compound annual growth rate (CAGR) of 4.82% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Malic Acid Market industry over the next decade.

Global Malic Acid Market Size: Overview

The immense need to halt the expansion of micro-organisms and wide product applications across the food & care sector is forecast to reinforce the expansion of the malic acid market within the years ahead. Aside from this, the receiving of approvals from regulatory authorities including EFSA, FDA, and FSSAI is anticipated to spice up the merchandise demand over the years ahead. Furthermore, the persistent requirement for determining and maintaining pH levels within the product will further succor the progress of the malic acid market in the years to return.

Volatility within the staple costs and rampant use of acid as a substitute product for malic acid, however, is probably going to pose a challenge for the worldwide malic acid market within the near future. Nevertheless, the mammoth use of malic acid in medical also as food & beverages sectors will increase the growing popularity of the merchandise among consumers, thereby normalizing the impact of hindrances on the malic acid market, reports the study.

COVID-19 Impact Analysis:

The global Malic acid market size has witnessed a decrease in sales for overall Malic acid products due to the lockdown enforcement placed by governments to contain COVID spreading. People had no option but to remain indoors, so the consumption of products decreased drastically. The restrictions imposed by various nations to contain COVID had stopped production resulting in disruption across the whole supply chain. Recovery is predicted within the last half of the year, provided there's no emergence of another wave of the epidemic, and countries manage to regulate the spread quickly and resume normalcy.

Global Malic Acid Market: Growth Factors

Rising demand from the food and beverage industry to enhance flavor through specialty ingredients is estimated to drive industrial growth over the forecast period. Players across the malic acid market are focusing aggressively on innovation, as well as on including advanced technologies in their existing products. Over the coming years, they are also expected to take up partnerships and mergers and acquisitions as their key strategy for business development which will further boost the growth in the global malic acid market size.

Malic Acid Market: Segment Analysis Preview

The main types available in the malic acid market are L-malic acid, DL-malic acid, and D-malic acid. Among the three, the demand for L-malic acid is relatively higher and the trend is anticipated to remain so over the next few years, notes the research report.

Based on application, the food & beverages segment comprises both non-carbonated and carbonated beverages, including flavored drinks and alcoholic ciders. The segment accounted for the most important market share and is estimated to exhibit a CAGR of 4% in terms of revenue over the projected period. The segment also dominated the worldwide demand due to the increase in consumption of liquid and powdered beverages, alongside surging demand for artificial flavorants in carbonated drinks.

Malic Acid Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Malic Acid Market |

| Market Size in 2023 | USD 923.35 Million |

| Market Forecast in 2032 | USD 1410.47 Million |

| Growth Rate | CAGR of 4.82% |

| Number of Pages | 115 |

| Key Companies Covered | Novozymes, FUSO Chemical Co. Ltd, Bartek Ingredients Inc, Thirumalai Chemicals Ltd, and U.S. Chemicals LLC |

| Segments Covered | By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Malic Acid Market: Regional Analysis Preview

Geographically, Asia Pacific has been leading the worldwide malic acid market and is anticipated to continue in the dominant position in the years to come. For the record, the region contributed more than 40% towards the overall malic acid market share in 2018. The high presence of the food & beverages industry in countries such as India, China, and Malaysia is the main factor behind the dominance of the Asia Pacific malic acid market.

The large number of market players headquartered in the Asia Pacific and the rapidly exploding population base is yet another significant factor that is supporting the growth of the malic acid market in the region.

Malic Acid Market Players & Competitive Landscape

Some of the major companies comprised in the global Malic Acid market are

- Novozymes

- FUSO Chemical Co. Ltd

- Bartek Ingredients Inc

- Thirumalai Chemicals Ltd

- U.S. Chemicals LLC

The global Malic Acid market is segmented as follows:

By Type

- L-Malic Acid

- D-Malic Acid

- DL-Malic Acid

By Applications

- Food & Beverages

- Cosmetics Industry

- Chemical Industry

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Malic Acid Market was valued at USD 923.35 Million in 2023 and is projected to hit USD 1410.47 Million by 2032.

According to a report from Zion Market Research, the global Malic Acid Market a compound annual growth rate (CAGR) of 4.82% during the forecast period 2024-2032.

Rising demand from the food and beverage industry to enhance flavor through specialty ingredients is estimated to drive industrial growth over the forecast period.

Asia Pacific was the leading region for the Malic Acid market in 2018 and it added up to more than 42% share of the global Malic Acid market.

Major players of global Malic Acid market comprise Novozymes, FUSO Chemical Co. Ltd, Bartek Ingredients Inc., Thirumalai Chemicals Ltd, and U.S. Chemicals LLC are some of the key vendors of malic acid across the world.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed