Lubrication Systems Market Size, Share, And Growth Report 2032

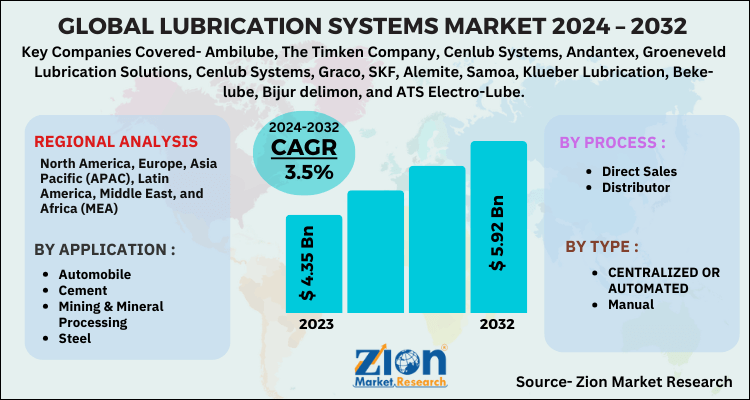

Lubrication Systems Market - By Type (Centralized Or Automated And Manual), By Process (Wet Sump And Dry Sump), And By Application (Automobile, Cement, Mining & Mineral Processing, And Steel): Global Industry Perspective, Comprehensive Analysis, And Forecast, 2024 - 2032

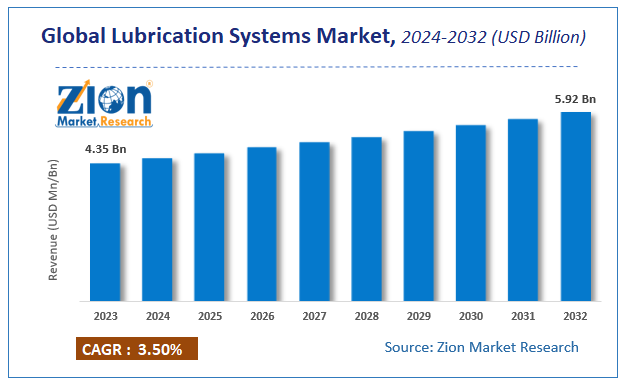

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.35 Billion | USD 5.92 Billion | 3.5% | 2023 |

Lubrication Systems Market Size

According to a report from Zion Market Research, the global Lubrication Systems Market was valued at USD 4.35 Billion in 2023 and is projected to hit USD 5.92 Billion by 2032, with a compound annual growth rate (CAGR) of 3.5% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Lubrication Systems Market industry over the next decade.

Lubrication Systems Market: Overview

The lubrication system is a means where oil, grease, and other lubricants are used between two rubbing surfaces to reduce the friction, heat, and wear. Machines like manufacturing equipment, pumps, turbines, cutting tools, motors, pistons, bearings, cams, chains, vehicles make use of lubrication system to reduce the heat and friction generated; therefore, preventing from getting damaged. The lubricants used in the machines reduce the friction generated between the parts and thus increase the longevity of all the components. Lubrication system benefits in reducing the power consumption due to less friction thus ensuring the safe operation of machinery which, in turn, extends the component life, reduces the maintenance cost, and increases the overall productivity of the system.

Advancement of the novel products which includes synthetic lubricants coupled with the easy availability are the strong factors anticipated to fuel the lubrication systems market growth in upcoming years. In addition to this, growing industrialization and rising automobile sector are also considered to be the major factors driving the lubrication systems market across the globe. Moreover, a rising trend for the automated process leads to the increasing demand for the lubricants which also influences the lubrication systems market during the forecast period. Rapid urbanization also has provoked the market growth. However, lack of awareness among end-user industries regarding the new products can hamper the growth of the market.

Lubrication Systems Market: Growth Factors

Growing necessity for reducing friction between two moving surfaces will promulgate growth of lubrication systems market over upcoming years. In addition to this, breakthroughs in technology resulting in development of many monitoring & controlling tools is predicted to succor lubrication of many of machine parts, thereby driving market trends. Furthermore, lubrication systems help in improving reliability of machines and enhance their performance. Moreover, lubrication system is used for reducing wear & tear of operating equipment. This is projected to create lucrative growth avenues for lubrication systems market in years to come.

Lubrication Systems Market: Segmentation

Based on the type of system, lubrication systems market is bifurcated into centralized or automated and manual.

On the basis of process, the market is bifurcated into the dry sump and wet sump.

Based on the application, the market is bifurcated into automobile, mining & mineral processing, cement, and steel.

Lubrication Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Lubrication Systems Market |

| Market Size in 2023 | USD 4.35 Billion |

| Market Forecast in 2032 | USD 5.92 Billion |

| Growth Rate | CAGR of 3.5% |

| Number of Pages | 177 |

| Key Companies Covered | Ambilube, The Timken Company, Cenlub Systems, Andantex, Groeneveld Lubrication Solutions, Cenlub Systems, Graco, SKF, Alemite, Samoa, Klueber Lubrication, Beke-lube, Bijur delimon, and ATS Electro-Lube |

| Segments Covered | By Process, By Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lubrication Systems Market: Regional Analysis

Asia Pacific To Contribute Majorly Towards Regional Market Share By 2032

Growth of regional market over forecast timespan is owing to increase in use of passenger vehicles in sub-continent. In addition to this, Asia Pacific is largest producer as well as consumer of cement, automotive, and steel. China is major producer of paper and cement. This will contribute majorly towards regional market size in forecasting years. Presence of key manufacturing firms in sub-continent is predicted to make humungous contributions towards growth of lubrication systems market in Asia Pacific zone. Strong infrastructure and rise in per capita income of population in sub-continent will drive regional market trends.

Lubrication Systems Market: Competitive Players

Key players impacting growth of lubrication systems market and profiled in study are:

- Ambilube

- The Timken Company

- Cenlub Systems

- Andantex

- Groeneveld Lubrication Solutions

- Cenlub Systems

- Graco

- SKF

- Alemite

- Samoa

- Klueber Lubrication

- Beke-lube

- Bijur delimon

- ATS Electro-Lube

The global Lubrication Systems Market is segmented as follows:

By Application

- Automobile

- Cement

- Mining & Mineral Processing

- Steel

By Process

- Direct Sales

- Distributor

By Type

- CENTRALIZED OR AUTOMATED

- Manual

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Lubrication systems are mechanisms designed to deliver lubricants, such as oil or grease, to machinery components to reduce friction, wear, and overheating. They are essential in industries like automotive, manufacturing, and aerospace to ensure smooth operation and prolong equipment life.

According to study, the Lubrication Systems Market size was worth around USD 4.35 billion in 2023 and is predicted to grow to around USD 5.92 billion by 2032.

The CAGR value of Lubrication Systems Market is expected to be around 3.5% during 2024-2032.

Asia Pacific has been leading the Lubrication Systems Market and is anticipated to continue on the dominant position in the years to come.

The Lubrication Systems Market is led by players like Ambilube, The Timken Company, Cenlub Systems, Andantex, Groeneveld Lubrication Solutions, Cenlub Systems, Graco, SKF, Alemite, Samoa, Klueber Lubrication, Beke-lube, Bijur delimon, and ATS Electro-Lube.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed