Logistics Insurance Market Size, Share, Analysis, Trends, Growth, 2032

Logistics Insurance Market By Industry (Transportation, Marine, Aviation and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.71 Billion | USD 2.65 Billion | 5% | 2023 |

Logistics Insurance Market Insights

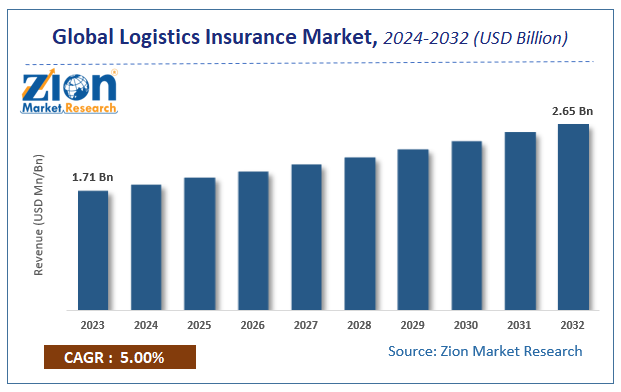

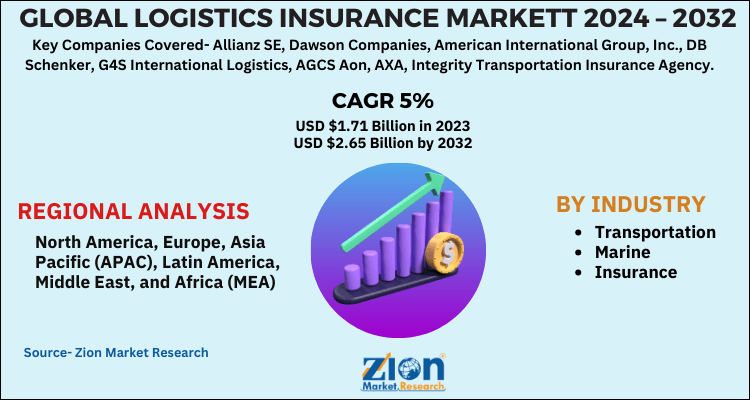

Zion Market Research has published a report on the global Logistics Insurance Market, estimating its value at USD 1.71 Billion in 2023, with projections indicating that it will reach USD 2.65 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Logistics Insurance Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Logistics Insurance Market: Overview

Logistics insurance protects businesses against damage or loss caused by disruptions in the logistics chain. In exchange for a premium, logistics insurance promises compensation in the event of damage/injury/loss. This is a type of risk management.

Logistics Insurance Market: COVID-19 Impact Analysis

The impact of covid on the logistics insurance market is less severe as compared to other markets. Since the outbreak of the virus, the Logistics market did see a dip, yet the loss is not much substance. Due to the disruptions in logistics hubs and trade routes, it is evident to see disruptions in operations too. Mobile-based technologies though showed some respite to the logistic insurers as they may function in areas hit by covid-19, but if the service remains offshore, they may have limited or no access to work remotely.

Logistics Insurance Market: Growth Factors

The rapid growth of the transportation industry in emerging countries has been fueled by increased foreign direct investment; the establishment of free trade zones and increased globalization are a few of the major factors boosting market growth. The use of digital technologies allows the company to capitalize on new opportunities for higher premiums, increased governance, better risk selection, and improved customer experience. Insurers all over the world are implementing newer technologies and embracing the cloud- and mobile-based technologies to improve their services.

Logistics Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Logistics Insurance Market |

| Market Size in 2023 | USD 1.71 Billion |

| Market Forecast in 2032 | USD 2.65 Billion |

| Growth Rate | CAGR of 5% |

| Number of Pages | 120 |

| Key Companies Covered | Allianz SE, Dawson Companies, American International Group, Inc., DB Schenker, G4S International Logistics, AGCS Aon, AXA, Integrity Transportation Insurance Agency, Liberty Mutual Insurance, Marsh, |

| Segments Covered | By Industry and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industry Segment Analysis Preview

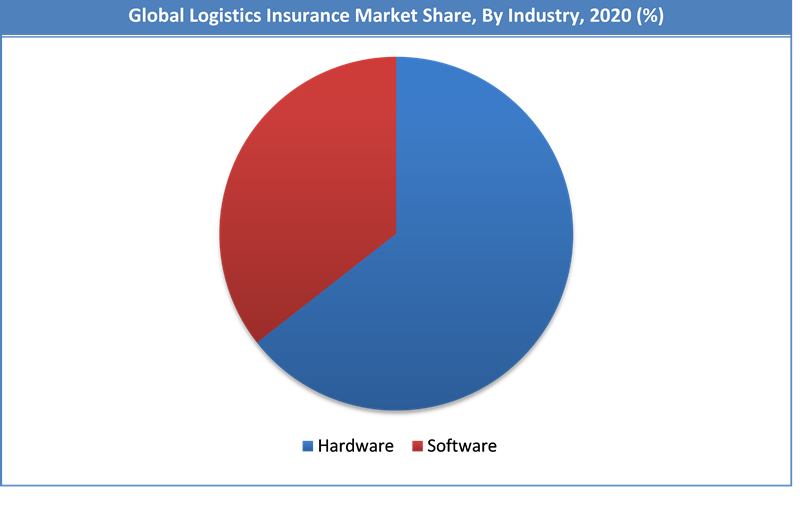

The Industry segment is growing at a CAGR of XX% in 2020. The marine sector dominated the segment in 2020 and is expected to follow the same trend during the forecast period. This is attributed to the rapid growth in port development in emerging countries. The contribution of cargo holders has increased as the deductible and premium value of vessels have been reduced. Because of the risk associated with water transportation, the latter is the most important of the four modes of transportation, which are road, air, rail, and water. This is due to a variety of natural occurrences such as storms, pirates, and so on. The global logistics insurance market has been divided into transportation, marine, aviation, and others.

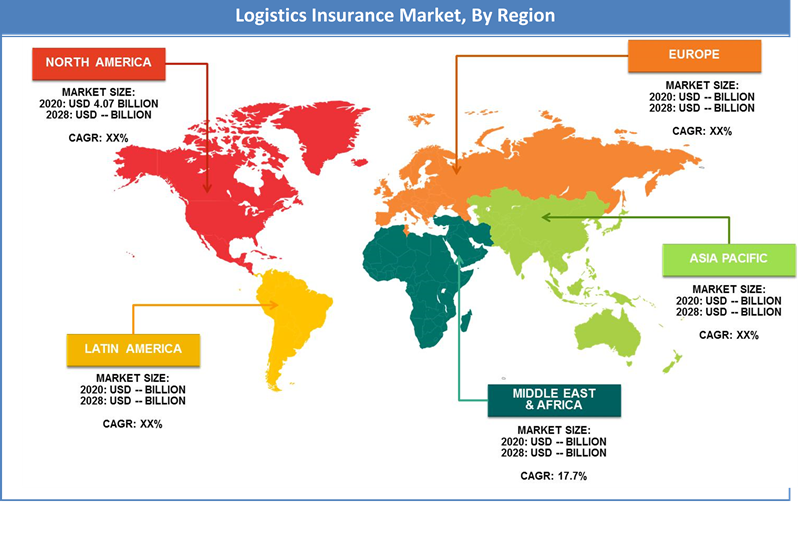

Logistics Insurance Market: Regional Analysis Preview

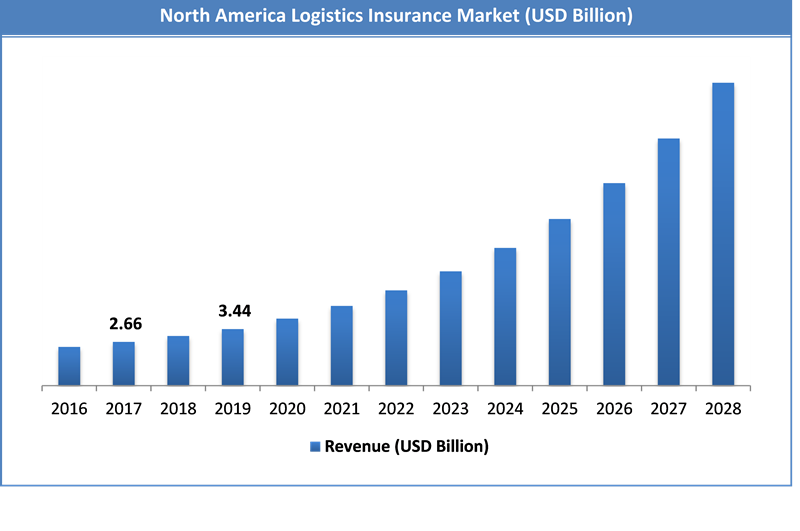

Europe accounted for a share of around 34% in 2020. Europe accounted for a sizable portion and grew to become one of the industry's most influential markets. The presence of established Logistics Infrastructure players along with the rise in digital insurance is the primary factor bolstering the region's dominance. The region is also likely to stimulate growth by automating regulatory compliance. Government regulatory initiatives play an important role in determining the price of policies, which should have an impact on the industry as a driver.

Rapid market growth is expected in the Asia Pacific as a result of the growing logistics development in emerging economies such as China and India, which will likely offer many opportunities for the logistics insurance market. Developing countries, such as Korea, India, Japan, and China, have made steady progress in recent years, with promising growth prospects in the Asia-Pacific region. The region's increasing infrastructure expenditure is expected to drive growth during the forecast period.

Logistics Insurance Market: Key Players & Competitive Landscape

Some of the key players in the logistics insurance market are:

- Allianz SE

- Dawson Companies

- American International Group, Inc.

- DB Schenker

- G4S International Logistics

- AGCS Aon

- AXA

- Integrity Transportation Insurance Agency

- Liberty Mutual Insurance

- Marsh

The logistics insurance market is segmented as follows:

By Industry

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The logistics insurance market size was valued at USD 1.71 Billion in 2023.

The logistics insurance market size is expected to reach USD 2.65 Billion by 2032, growing at a CAGR of 5% between 2024 to 2032.

The rapid growth of the transportation industry in emerging countries has been fueled by increased foreign direct investment, the establishment of free trade zones, and increased globalization. Logistics hubs and trade routes are slowly shifting toward the emerging market. Privatization of the transportation industry has accelerated growth in China, Turkey, and India.

Europe accounted for a share of around 34% in 2023. Europe accounted for a sizable portion and grew to become one of the industry's most influential markets. The presence of established Logistics Infrastructure players along with the rise of digital insurance are the primary factors bolstering the region's dominance.

Some of key players in Logistics Insurance market are llianz SE, Dawson Companies, American International Group, Inc., DB Schenker, G4S International Logistics, AGCS Aon, AXA, Integrity Transportation Insurance Agency, Liberty Mutual Insurance and Marsh among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed