Liquidation Service Market Size, Share, Trends, Growth & Forecast 2034

Liquidation Service Market By Service Type (Legal Services, Accounting Services, Consulting Services, and Others), By Organization Size (Small & Medium-sized Enterprises (SMEs) and Large Enterprises), By Industry Vertical (Retail, Manufacturing, BFSI, Healthcare, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 35 Billion | USD 73 Billion | 9.4% | 2024 |

Liquidation Service Industry Perspective:

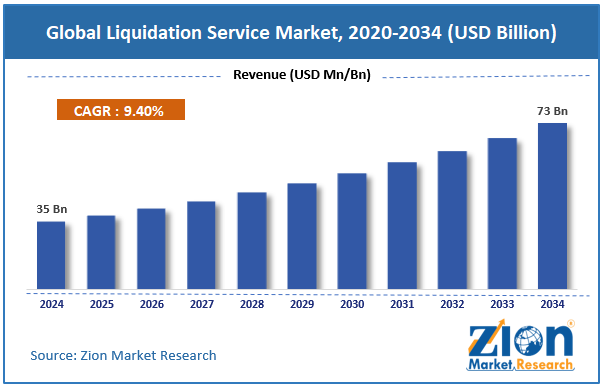

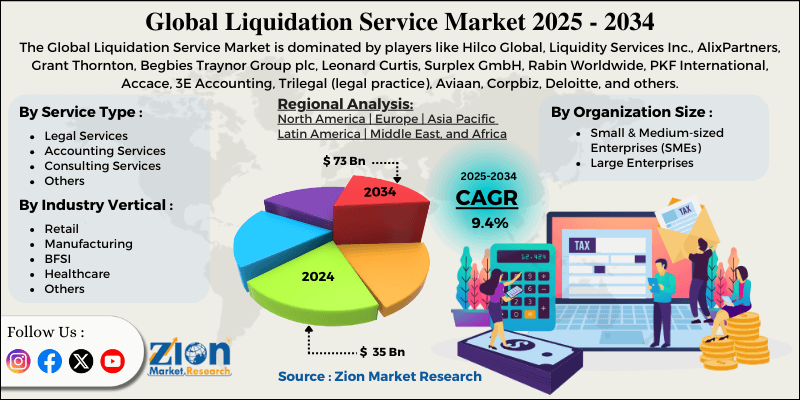

The global liquidation service market size was worth around USD 35 billion in 2024 and is predicted to grow to around USD 73 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.4% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global liquidation service market is estimated to grow annually at a CAGR of around 9.4% over the forecast period (2025-2034).

- In terms of revenue, the global liquidation service market size was valued at around USD 35 billion in 2024 and is projected to reach USD 73 billion by 2034.

- Growing complexity of business operations is expected to drive the liquidation service market over the forecast period.

- Based on the service type, the legal services segment is expected to capture the largest market share over the projected period.

- Based on the organization size, the large enterprises segment is expected to capture the largest market share over the projected period.

- Based on the industry vertical, the retail segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Liquidation Service Market: Overview

Liquidation services involve trained insolvency specialists or specialized companies helping a business lawfully shut down. This entails disposing of assets, paying off obligations, and distributing any excess funds to shareholders. The first step is to hire a liquidator, who will find, value, and liquidate the company's assets to create a liquidation estate. First, debtors with and without security get paid. After that, any surplus funds are distributed to shareholders. Companies House in the UK and the National Company Law Tribunal (NCLT) in India are two examples of government entities that no longer maintain records of businesses after their debts are paid. This means that the company is no longer legally recognized. This meticulous approach ensures that the law is respected, even when people want to, which often means seeking court approval. Liquidation services are essential for preventing losses in bankruptcy situations, as they help creditors ensure the process is conducted correctly and in the correct order.

Liquidation Service Market Dynamics

Growth Drivers

Why do the rising global business insolvencies drive the liquidation service market growth?

The liquidation service market is directly affected by the rise in worldwide corporate bankruptcies. This is because more companies are having to officially close their doors, collect debts, and sell off their assets through formal liquidation procedures. When a business goes bankrupt due to financial problems, excessive debt, a bad economy, or operational issues, it needs to hire liquidation service providers to evaluate its assets, conduct auctions or sales, address creditor claims, and ensure compliance with the rules.

More businesses are going bankrupt, especially small and medium-sized businesses, retailers, manufacturers, and businesses that operate across borders. This means there is always a need for expert liquidation skills to recover the most money from assets and ensure the business closes smoothly. As more businesses go out of business worldwide, more assets are put into liquidation. Creditors seek faster, more transparent recovery processes, and businesses increasingly rely on professional liquidation services. One of the most essential structural drivers in the global liquidation service market is the rising number of corporate failures, which are directly related to the expansion of bankruptcy.

Restraints

Difficulty in asset valuation & market volatility are impeding the market growth

Problems with valuing assets and market volatility make it hard for the liquidation service industry to thrive. This is because they make it harder to price distressed assets accurately, leading to longer delays, fewer bidders, and higher costs for liquidators handling complex estates. Incomplete records, machinery, and intangibles that quickly lose value, and the lack of clear methods for valuing specialist assets like intellectual property or bespoke equipment, lead to subjective, disputed assessments that delay auctions and realizations.

Legal issues, such as ownership conflicts or regulatory inspections under frameworks like IBBI, make processes more complex and increase the risk of lawsuits, which puts a strain on provider resources. These problems make it harder to recover money and turn a profit, which in turn makes it harder to enter the market, even though more businesses are going bankrupt.

Also, changing conditions make it harder to determine the fair market value of something by shifting the supply-demand balance. This makes it hard for buyers to buy "as-is" without warranties. When things are uncertain, low prices for stressed assets in fields like construction make bidders tired after failed rounds, and economic problems make operational problems like shipping and storage worse. This makes it harder for service providers to grow, as it reduces the ability to generate income from assets and increases financial risks for professionals.

Opportunities

Does the expansion of e-commerce, retail, & inventory liquidation present an opportunity for the liquidation service industry growth?

The growth of e-commerce, retail, and inventory liquidation opportunities is driving the liquidation services market by increasing the volume of excess, returned, and unsold goods that need to be disposed of and sold quickly. The rapid increase in online shopping and high return rates (approximately 22% of transactions) has led to a large number of goods being returned by customers and to overstock, necessitating specialized liquidation services to recover value and free up warehouse space.

As a result, platforms like B-Stock and BULQ have been created. These platforms enable large-scale liquidation auctions and bulk sales, helping sellers swiftly sell their goods and make money. Retailers also use liquidation services to save on storage costs, make room on shelves and in warehouses for new products that align with customer demand, and avoid losing money on old stock. Advanced inventory analytics and management tools can identify items that aren't selling well early on, enabling them to be disposed of quickly and limiting their financial impact. As inventory and consumer behavior become more complex, the liquidation sector's role in ensuring that retail and e-commerce run smoothly grows.

Challenges

Will the fragmented market and competitive pressures pose a major challenge to the liquidation service market expansion?

The liquidation services market is struggling to grow due to fragmented marketplaces and competitive pressures. This is because many small and large companies compete with each other, leading to price wars, lower profits, and barriers to new companies scaling up quickly. The liquidation services industry is very fragmented, with thousands of small businesses competing with specialist companies and consulting firms. This makes it hard to develop a strong brand or dominate the market. This leads to intense price competition, which often lowers profit margins and makes it hard for smaller suppliers to invest in technology, infrastructure, or regional development.

Also, new technology-driven platforms that offer faster and cheaper liquidation services hurt current businesses. To stay on top of the market, these businesses have to come up with new ideas and set themselves apart by offering better, faster service and greater knowledge. Companies also have to deal with different rules and compliance standards in other places, which makes operations more complicated and expensive when there is competition. These things can slow growth by making it harder to access resources and by reducing the reasons to grow or come up with new ideas.

Liquidation Service Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Liquidation Service Market |

| Market Size in 2024 | USD 35 Billion |

| Market Forecast in 2034 | USD 73 Billion |

| Growth Rate | CAGR of 9.4% |

| Number of Pages | 213 |

| Key Companies Covered | Hilco Global, Liquidity Services Inc., AlixPartners, Grant Thornton, Begbies Traynor Group plc, Leonard Curtis, Surplex GmbH, Rabin Worldwide, PKF International, Accace, 3E Accounting, Trilegal (legal practice), Aviaan, Corpbiz, Deloitte, and others. |

| Segments Covered | By Service Type, By Organization Size, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Liquidation Service Market: Segmentation

The global liquidation service industry is segmented based on service type, organization size, industry vertical, and region.

Based on the service type, the global liquidation service market is bifurcated into legal services, accounting services, consulting services, and others. The legal services segment is expected to dominate the market. Legal services drive revenue growth in the liquidation service market by providing essential compliance, dispute resolution, and regulatory navigation support amid rising insolvencies and complex asset distributions.

Based on organization size, the global liquidation service industry is bifurcated into Small & Medium-sized Enterprises (SMEs) and large enterprises. The large enterprises segment holds the major market share. Large companies are responsible for expanding the liquidation services industry because they have substantial assets and need comprehensive, specialized support during restructurings, divestitures, and insolvencies.

Based on the industry vertical, the global liquidation service market is divided into retail, manufacturing, BFSI, healthcare, and others. The retail segment is expected to dominate the market over the forecast period. Retail is the main driver of revenue growth in the liquidation service business. Store closings, high return rates, and migrations to e-commerce create significant excess inventory that must be disposed of by professionals to maximize returns and improve cash flow.

Liquidation Service Market: Regional Analysis

Why does North America dominate the liquidation service market over the projected period?

The North America region is expected to dominate the liquidation service market. The regional market is growing strongly because more businesses are going bankrupt, companies are restructuring on a massive scale, and companies are under more financial stress as interest rates and inflation rise. The region's mature business sector, particularly in retail, manufacturing, technology, and real estate, has seen a higher number of bankruptcies. This has led to a greater need for structured liquidation services, including asset appraisal, auctioning, and settlement with creditors.

In addition, North America has a well-developed legal and regulatory framework for insolvency. For instance, the Chapter 7 and Chapter 11 processes in the United States require professional liquidation support and give advisory firms, auction houses, and asset recovery specialists steady business. The proliferation of e-commerce returns, retail overstocks, and excess inventory has driven growth in the liquidation ecosystem, leading to the rise of digital liquidation platforms and B2B auction markets.

As a result, North America remains one of the most significant and fastest-growing regions in the Liquidation Service Market. This is due to economic cycles, restructuring trends, and a technologically advanced environment for getting rid of assets.

Liquidation Service Market: Competitive Analysis

The global liquidation service market is dominated by players like:

- Hilco Global

- Liquidity Services Inc.

- AlixPartners

- Grant Thornton

- Begbies Traynor Group plc

- Leonard Curtis

- Surplex GmbH

- Rabin Worldwide

- PKF International

- Accace

- 3E Accounting

- Trilegal (legal practice)

- Aviaan

- Corpbiz

- Deloitte

The global liquidation service market is segmented as follows:

By Service Type

- Legal Services

- Accounting Services

- Consulting Services

- Others

By Organization Size

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- Retail

- Manufacturing

- BFSI

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Liquidation services involve trained insolvency specialists or specialized companies helping a business lawfully shut down. This entails disposing of assets, paying off obligations, and distributing any excess funds to shareholders.

Rising global business insolvencies are driving the Liquidation Service Market by increasing the number of companies requiring formal asset disposal, creditor settlement, and structured business closure.

A key challenge for the liquidation service market is the difficulty in accurately valuing diverse assets amid market volatility, which leads to unpredictable recovery outcomes, reduces stakeholder confidence, and complicates the liquidation process.

Based on the industry vertical, the retail segment is expected to dominate the liquidation service market growth during the projected period.

The increased corporate restructuring, mergers & acquisitions pose a major impact factor for the liquidation service industry's growth over the projected period.

Several regulatory and environmental factors significantly influence the Liquidation Service Market, shaping both demand and operational complexity. Regulatory environments—such as insolvency and bankruptcy laws, creditor-protection frameworks, tax regulations, and court-mandated liquidation processes—play a central role, as businesses undergoing insolvency must comply with strict legal procedures that often require professional liquidation services.

To stay competitive, stakeholders should embrace digital tools, strengthen regulatory expertise, specialize in high-demand sectors, expand global partnerships, adopt eco-friendly practices, and deliver fast, transparent, value-driven liquidation solutions.

According to the report, the global liquidation service market size was worth around USD 35 billion in 2024 and is predicted to grow to around USD 73 billion by 2034.

The global liquidation service market is expected to grow at a CAGR of 9.4% during the forecast period.

The global liquidation service industry growth is expected to be led by North America over the forecast period.

The global liquidation service market is dominated by players like Hilco Global, Liquidity Services, Inc., AlixPartners, Grant Thornton, Begbies Traynor Group plc, Leonard Curtis, Surplex GmbH, Rabin Worldwide, PKF International, Accace, 3E Accounting, Trilegal (legal practice), Aviaan, Corpbiz, and Deloitte, among others.

The liquidation service market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed