LINE OF CREDIT (LOCs) Market Size, Growth, Global Trends, Forecast 2034

LINE OF CREDIT (LOCs) Market By Borrower Type (Corporations/Non-financial Firms, Small & Medium Enterprises (SMEs), and Consumers/Households), By Credit Facility Structure (Revolving Credit Lines, Non-revolving Lines, and Standby Lines/Contingent Facilities), By Channel (Traditional Banks and Financial Institutions, Fintech, and Embedded Finance), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

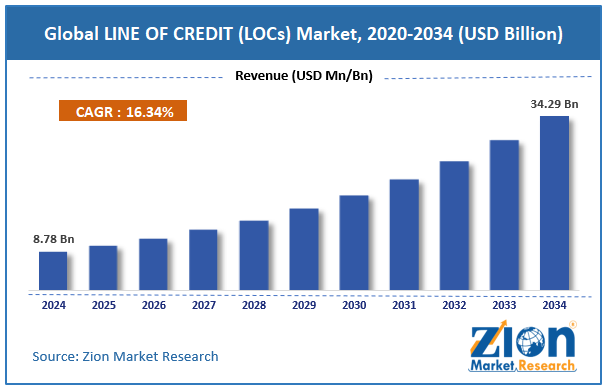

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.78 Billion | USD 34.29 Billion | 16.34% | 2024 |

LINE OF CREDIT (LOCs) Industry Perspective:

The global LINE OF CREDIT (LOCs) market size was worth around USD 8.78 billion in 2024 and is predicted to grow to around USD 34.29 billion by 2034 with a compound annual growth rate (CAGR) of roughly 16.34% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global LINE OF CREDIT (LOCs) market is estimated to grow annually at a CAGR of around 16.34% over the forecast period (2025-2034).

- In terms of revenue, the global LINE OF CREDIT (LOCs) market size was valued at around USD 8.78 billion in 2024 and is projected to reach USD 34.29 billion by 2034.

- The increasing demand from SMEs is expected to drive the LINE OF CREDIT (LOCs) market over the forecast period.

- Based on the borrower type, the corporations/non-financial firms segment is expected to capture the largest market share over the projected period.

- Based on the credit facility structure, the revolving credit lines segment is expected to capture the largest market share over the projected period.

- Based on the channel, the traditional banks and financial institutions capture the largest market share in 2024.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

LINE OF CREDIT (LOCs) Market: Overview

A Line of Credit (LOC) is a flexible way for banks or other financial institutions to lend money to consumers or businesses. It lets them borrow money up to a certain amount. The best thing about a Line of Credit (LOC) is that the borrower can access money whenever needed, rather than having to obtain a large amount all at once, as is the case with a standard loan. Interest is charged only on the amount borrowed, not the whole credit limit. As long as the Line of Credit is open, borrowers can take out, return, and redraw money up to the agreed-upon limit. During the draw term, the borrower can use or repay money from a LOC multiple times, much like with a revolving credit account. There are two types of Line of Credit (LOCs): secured LOCs, which are backed by assets such as real estate or vehicles, and typically have lower interest rates, and unsecured LOCs, which don't require collateral and consequently have higher interest rates. They can get a personal Line of Credit, a business Line of Credit, or a home equity Line of Credit (HELOC). Line of Credit (LOCs) give consumers flexibility and control over borrowing and repayment, which can help them manage spending that remains constant or fluctuates.

LINE OF CREDIT (LOCs) Market Dynamics

Growth Drivers

Why does working-capital/liquidity management needs drive the Line of Credit market growth?

The Lines of Credit (LOC) market is evolving as businesses need to manage their cash flow and working capital effectively. These financial services provide businesses with quick and easy access to the funds they need to pay their invoices and manage fluctuations in their cash flow. Companies can use Line of Credit (LOCs) to obtain funds when needed to cover expenses such as rent, payroll, inventory, or other unexpected business obligations. This flexibility is also beneficial in fields where demand fluctuates with the seasons or costs are difficult to predict. Quick, on-demand financing is crucial for capitalizing on new business opportunities or addressing unexpected financial needs, as it can help with both ongoing operations and cash flow requirements that arise unexpectedly.

Small and medium-sized firms (SMEs) can also get working capital through lines of credit (LOCs). This enables companies to take advantage of supplier discounts, swiftly replenish their shelves, and manage delays in receiving payments and paying bills, all of which make their businesses more flexible and efficient.

Restraints

Why do the credit risk/borrower quality constraints hinder the Line of Credit market growth?

Credit risk and borrower quality limits exacerbate the Line of Credit (LOC) market by increasing the likelihood that borrowers will default and lenders will incur losses. This makes lending conditions stricter, making it harder for people to obtain credit. Lenders assume the risk that borrowers will not repay the money they borrow from their lines of credit, especially when lines of credit allow borrowers to borrow money repeatedly up to a certain maximum. As the borrower's financial health or creditworthiness deteriorates, this risk increases, making banks less willing to extend or renew credit lines.

Also, the borrower's credit score often affects the availability and terms of the LOC. If a person has a poor credit score or their financial situation is uncertain, they may be required to pay higher interest rates, have lower credit limits, or even be denied a loan. This makes it more challenging for businesses to expand in high-risk regions.

Opportunities

How does the rising partnership among the key market players offer a potential opportunity for the Line of Credit industry growth?

The rising partnership among the key market players is expected to offer a potential opportunity to the LINE OF CREDIT (LOCs) industry. For instance, in September 2025, Axis Bank and Freecharge have teamed up to offer India's first gold-backed credit line, which can be used through the Unified Payments Interface (UPI). The project aims to make working capital and short-term loans easier, more digital, and more available for micro, small, and medium-sized enterprises (MSMEs), merchants, and self-employed people.

Customers can utilize the "Credit on UPI with Gold Loans" offering to receive a digital overdraft by using their gold as collateral. It only charges interest on the amount used, which makes it a relatively inexpensive way to borrow money. Once they are signed up, clients can make and receive payments in real-time through UPI or the Freecharge platform, eliminating the need to visit a branch. The National Payments Corporation of India (NPCI) has set up a new structure that allows for protected credit lines on UPI. This new idea fits with that framework. The goal of the recommendations is to encourage digital lending by adding credit to payment systems that people already use.

Challenges

Substitution by alternative financing poses a major challenge to market expansion

Changes in structure and new methods of generating revenue make it more challenging for the Line of Credit (LOC) sector to develop, as they complicate the market and divert demand away from traditional Line of Credit (LOCs). Businesses are turning to alternative sources of funding, such as trade credit, bond issuances, marketplace lending, and loans from fintech companies, as it becomes more complex or more expensive to obtain traditional bank credit. These options frequently come with faster processing, more flexible terms, and workflows that start with digital. When banks make it harder to get loans, businesses can employ bonds or securitized debt instruments instead of relying on bank-provided Line of Credit (LOCs).

Fintech platforms leverage AI and cloud technologies to streamline underwriting and loan maintenance processes. This makes them more desirable to both small enterprises and individuals. Alternative financing is expanding into sectors that banks have traditionally avoided, such as serving customers with thin credit files and providing services integrated into accounting and e-commerce platforms. This makes the LOC market share even smaller.

LINE OF CREDIT (LOCs) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | LINE OF CREDIT (LOCs) Market |

| Market Size in 2024 | USD 8.78 Billion |

| Market Forecast in 2034 | USD 34.29 Billion |

| Growth Rate | CAGR of 16.34% |

| Number of Pages | 213 |

| Key Companies Covered | JPMorgan, BofA Securities (Bank of America), Citi, Wells Fargo, Goldman Sachs, Barclays, BNP Paribas, Crédit Agricole CIB, Société Générale (SG CIB), Deutsche Bank, RBC Capital Markets, MUFG, Mizuho, SMBC (Sumitomo Mitsui Financial Group), HSBC, and others. |

| Segments Covered | By Borrower Type, By Credit Facility Structure, By Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

LINE OF CREDIT (LOCs) Market: Segmentation

The global LINE OF CREDIT (LOCs) industry is segmented based on borrower type, credit facility structure, channel, and region.

Based on the borrower type, the global LINE OF CREDIT (LOCs) market is bifurcated into corporations/non-financial firms, Small & Medium Enterprises (SMEs), and consumers/households. The corporations/non-financial firms segment is expected to capture the largest market share over the projected period. Lines of Credit (LOCs) help businesses manage their cash flow efficiently by covering short-term operational needs, including inventory buildup, payroll, and unplanned expenses. This flexibility enables businesses to avoid disruptions, capitalize on timely opportunities, and maintain seamless operations, ultimately leading to increased revenue generation.

Based on the credit facility structure, the global LINE OF CREDIT (LOCs) industry is bifurcated into revolving credit lines, non-revolving lines, and standby lines/contingent facilities. The revolving credit lines segment holds the major market share. Revolving credit lines provide businesses with a pre-approved maximum credit limit, enabling them to borrow, repay, and borrow again as needed without the need for reapplication. This continued access allows for swift reactions to operational needs, seasonal swings, or unforeseen expenses, supporting continuous revenue-generating business activities.

Based on the channel, the global LINE OF CREDIT (LOCs) market is bifurcated into traditional banks and financial institutions, fintech, and embedded finance. The traditional banks and financial institutions segment is expected to dominate the market over the forecast period. Financial institutions generate revenue by offering Lines of Credit (LOCs) to a diverse range of borrowers, including non-financial firms and private credit vehicles. Increased lending commitments and the use of revolving credit lines directly contribute to interest income growth.

Line of Credit (LOCs) Market: Regional Analysis

Why does North America dominate the Line of Credit market over the projected period?

The North America region is expected to dominate the LINE OF CREDIT (LOCs) market. As e-commerce and trade between the US, Canada, and Mexico grow, so does the need for working capital and built-in payment options. As a result, LOC is used more frequently to finance inventory and supply chain needs.

In addition, banks and fintechs in North America are utilizing digital platforms, blockchain, and real-time payment systems to offer credit products more quickly, securely, and easily. This attracts more clients to Line of Credit (LOCs) and increases income. Companies are also increasingly utilizing structured finance solutions that incorporate asset tokenization and funding that aligns with environmental, social, and governance (ESG) criteria, in addition to traditional revolving credit lines. This variety expands the market and income base for LOC suppliers.

LINE OF CREDIT (LOCs) Market: Competitive Analysis

The global LINE OF CREDIT (LOCs) market is dominated by players like:

- JPMorgan

- BofA Securities (Bank of America)

- Citi

- Wells Fargo

- Goldman Sachs

- Barclays

- BNP Paribas

- Crédit Agricole CIB

- Société Générale (SG CIB)

- Deutsche Bank

- RBC Capital Markets

- MUFG

- Mizuho

- SMBC (Sumitomo Mitsui Financial Group)

- HSBC

The global LINE OF CREDIT (LOCs) market is segmented as follows:

By Borrower Type

- Corporations/Non-financial Firms

- Small & Medium Enterprises (SMEs)

- Consumers/Households

By Credit Facility Structure

- Revolving Credit Lines

- Non-revolving Lines

- Standby Lines/Contingent Facilities

By Channel

- Traditional Banks and Financial Institutions

- Fintech

- Embedded Finance

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A Line of Credit (LOC) is a flexible way for banks or other financial institutions to lend money to consumers or businesses. It lets them borrow money up to a certain amount.

The LINE OF CREDIT (LOCs) market is being driven by several factors such as working-capital/liquidity management needs, global trade & cross-border expansion, structural banking/regulatory dynamics, rise of SMEs, and working-capital requirements, among others.

The credit risk/borrower quality constraints pose a significant challenge to the LINE OF CREDIT (LOCs) industry's growth.

Based on the channel, the traditional banks and financial institutions segment is expected to dominate the LINE OF CREDIT (LOCs) market growth during the projected period.

The increasing partnership and advancement in technology pose a major impact factor for the LINE OF CREDIT (LOCs) industry's growth over the projected period.

According to the report, the global LINE OF CREDIT (LOCs) market size was worth around USD 8.78 billion in 2024 and is predicted to grow to around USD 34.29 billion by 2034.

The global LINE OF CREDIT (LOCs) market is expected to grow at a CAGR of 16.34% during the forecast period.

The global LINE OF CREDIT (LOCs) industry growth is expected to be driven by the North America region. It is currently the world’s highest-revenue-generating market, thanks to the presence of major players and growing product innovation.

The global LINE OF CREDIT (LOCs) market is dominated by players like JPMorgan, BofA Securities (Bank of America), Citi, Wells Fargo, Goldman Sachs, Barclays, BNP Paribas, Crédit Agricole CIB, Société Générale (SG CIB), Deutsche Bank, RBC Capital Markets, MUFG, Mizuho, SMBC (Sumitomo Mitsui Financial Group), and HSBC, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed