Letter Of Credit Confirmation Market Size, Share, Trends, Growth and Forecast 2034

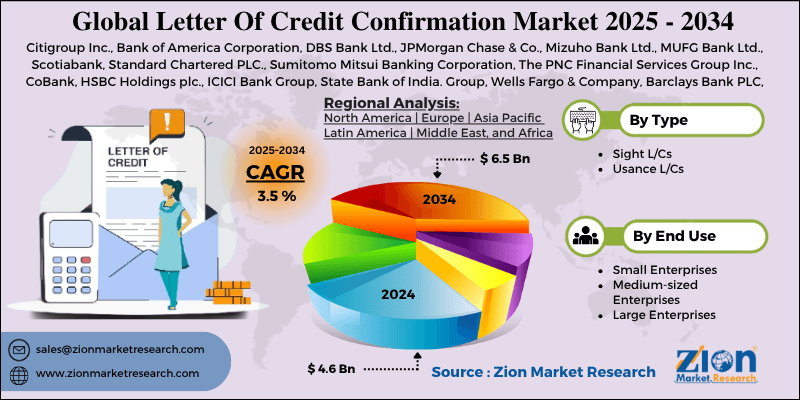

Letter Of Credit Confirmation Market By Type (Sight L/Cs and Usance L/Cs), By End-User (Small Enterprises, Medium-sized Enterprises, and Large Enterprises), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.6 Billion | USD 6.5 Billion | 19.8% | 2024 |

Letter Of Credit Confirmation Industry Perspective:

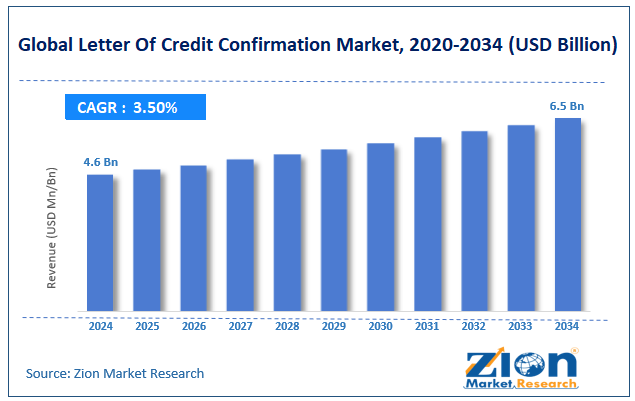

The global letter of credit confirmation market size was worth around USD 4.6 billion in 2024 and is predicted to grow to around USD 6.5 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.5% between 2025 and 2034.

Letter Of Credit Confirmation Market: Overview

A Letter of Credit (LC) confirmation is a guarantee added to the promise made by the issuing bank (generally in the importer's nation) by a second bank, usually in the exporter's country. It guarantees the exporter that they will be paid even if the importer or the issuing bank does not carry out the LC's conditions.

A number of factors, such as the expansion of international trade, currency exchange rate volatility, an increase in bank failures and defaults, and many more, influence the market. Consequently, the market expansion is hampered by the high price of LC confirmation services and their restricted availability in high-risk areas.

Key Insights

- As per the analysis shared by our research analyst, the global letter of credit confirmation market is estimated to grow annually at a CAGR of around 3.5% over the forecast period (2025-2034).

- In terms of revenue, the global letter of credit confirmation market size was valued at around USD 4.6 billion in 2024 and is projected to reach USD 6.5 billion by 2034.

- The growing global trade is expected to drive the letter of credit confirmation market over the forecast period.

- Based on the type, the Sight L/Cs segment is expected to hold the largest market share over the forecast period.

- Based on the end-user, the large enterprises segment is expected to dominate the market expansion over the projected period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Letter Of Credit Confirmation Market: Growth Drivers

Increasing global trade drives market growth

The increasing volume of international trade is the primary factor driving the expansion of the Letter of Credit Confirmation Industry. As companies grow internationally, they need reliable and secure ways to make foreign transactions easier.

A Letter of Credit Confirmation lowers the risk for both importers and exporters by guaranteeing payment. The market has grown overall as a result of the spike in demand for Letter of Credit Confirmation services. For instance, according to the most recent Global Trade Update by UN Trade and Development (UNCTAD), global trade reached a record $33 trillion in 2024, growing 3.7% ($1.2 trillion).

Letter Of Credit Confirmation Market: Restraints

Rising fraud and cyberattacks hinder market growth

The letter of credit is confirmed online, and the transaction between the bank that issues the credit and the bank that receives it involves many middlemen from all over the world. This ultimately leads to fraud and cyberattacks on the online trading mechanism's network, causing data loss, trade information loss, and massive trade volumes.

Furthermore, one of the main problems impeding the market's expansion for credit confirmation letters is the provision of false and fraudulent underlying documents by importers and exporters in the sector. Therefore, the letter of credit confirmation market is severely constrained by the above-described problem.

Letter Of Credit Confirmation Market: Opportunities

Rising agreement among the key market players offers a lucrative opportunity for market growth

The growing number of agreements among the key market players is expected to flourish the letter of credit confirmation market during the forecast period.

For instance, in September 2023, a US$ 10 million Letter of Credit (LC) Confirmation Facility was signed by Rabitabank and the International Islamic Trade Finance Corporation (ITFC) to address the trade finance requirements of the private sector, especially those of SME clients, and to support the development of Sharia-compliant trade financing options in Azerbaijan. Dr. Aydin Huseynov, the chairman of Rabitabank's management board, and Eng. Hani Salem Sonbol, the CEO of ITFC, signed this agreement.

The Bank will be able to provide trade finance solutions and support the growth of Islamic finance in Azerbaijan thanks to the facility. The signed facility is acknowledged as the first LC Confirmation line that ITFC has extended to commercial banks in Azerbaijan. This initiative is also in line with ITFC's Private Sector Strategy, which places a strong emphasis on fostering bank partnerships to support small and medium-sized businesses and the private sector in member countries, as well as expanding the LC Confirmation business.

Letter Of Credit Confirmation Market: Challenges

Limited awareness among SMEs poses a major challenge to market expansion

Many small and medium-sized businesses are unaware of the advantages and features of confirmed letters of credit. This disparity in understanding could limit their capacity to expand their markets and participate in international trade. Educational programs are essential to raising awareness and promoting acceptance among these businesses. Thus, the limited awareness among SMEs poses a major challenge for the letter of credit confirmation market expansion.

Letter Of Credit Confirmation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Letter Of Credit Confirmation Market |

| Market Size in 2024 | USD 4.6 Billion |

| Market Forecast in 2034 | USD 6.5 Billion |

| Growth Rate | CAGR of 3.5% |

| Number of Pages | 214 |

| Key Companies Covered | Citigroup Inc., Bank of America Corporation, DBS Bank Ltd., JPMorgan Chase & Co., Mizuho Bank Ltd., MUFG Bank Ltd., Scotiabank, Standard Chartered PLC., Sumitomo Mitsui Banking Corporation, The PNC Financial Services Group Inc., CoBank, HSBC Holdings plc., ICICI Bank Group, State Bank of India. Group, Wells Fargo & Company, Barclays Bank PLC, BNP Paribas SA, and others. |

| Segments Covered | By Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Letter Of Credit Confirmation Market: Segmentation

The global letter of credit confirmation industry is segmented based on type, end-user, and region.

Based on the type, the global market is bifurcated into Sight L/Cs and Usance L/Cs. The Sight L/Cs segment is expected to hold the largest market share over the forecast period. A sight letter of credit certifies that goods and services were paid for in an overseas business transaction. The market's certifying banks receive the payment, which is then provided to financial institutions so they may complete the required paperwork.

Businesses that provide the letter of credit are also obligated to pay the agreed-upon amount of money as soon as the terms of the letter are met. Payments made via sight letters of credit normally take three business days or 72 hours to process. One must have the required documentation, such as evidence of shipment and delivery of the buyer's purchased products, in order to finish payment by sight letter of credit.

Dealers in the industry make extensive use of sight payment systems since they offer the benefits of quick and easy payments. The issuing and confirming institutions are developing instant payment options for letter of credit confirmation that are becoming important market trends. Furthermore, sight payments make it possible to pay the supplier as soon as the items are delivered, which promotes market growth.

Based on the end user, the global letter of credit confirmation industry is bifurcated into small enterprises, medium-sized enterprises, and large enterprises. The large enterprises segment is expected to dominate the market over the projected period. With 500 or more workers, large enterprises are massive, corporately managed companies.

For their needs, these large companies usually depend on customized trade finance solutions. These large companies also receive import loans, invoice financing, shipping guarantees, supply chain financing, letter of credit issuance and confirmation, and other comparable trade finance services. The biggest consumers of letter of credit services in recent years have been large organizations from a variety of industries, such as healthcare, media & technology, electricity & utilities, and others.

Large businesses in these sectors generate high levels of revenue and engage in substantial commerce. It is therefore expected that the issuing and confirming banks would present an alluring opportunity for creating goods and services and making customized offerings in this field.

Letter Of Credit Confirmation Market: Regional Analysis

Asia Pacific dominates the market over the projected period

The Asia Pacific is expected to dominate the global letter of credit confirmation market during the projected period. Asia-Pacific's issuing and confirming banks are maintaining their focus on the future growth of trade finance services in the region while also pursuing further expansion.

Additionally, with the region's evolving legal landscape and rising economies, traders are expanding their businesses. Consequently, these dealers have emerged as crucial market drivers for the confirmation of letters of credit. During that period, it is expected that letter of credit services will continue to be the most popular, as local merchants still depend on them.

Letter Of Credit Confirmation Market: Competitive Analysis

The global letter of credit confirmation market is dominated by players like:

- Citigroup Inc.

- Bank of America Corporation

- DBS Bank Ltd.

- JPMorgan Chase & Co.

- Mizuho Bank Ltd.

- MUFG Bank Ltd.

- Scotiabank

- Standard Chartered PLC.

- Sumitomo Mitsui Banking Corporation

- The PNC Financial Services Group Inc.

- CoBank

- HSBC Holdings plc.

- ICICI Bank Group

- State Bank of India. Group

- Wells Fargo & Company

- Barclays Bank PLC

- BNP Paribas SA

The global letter of credit confirmation market is segmented as follows:

By Type

- Sight L/Cs

- Usance L/Cs

By End User

- Small Enterprises

- Medium-sized Enterprises

- Large Enterprises

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A Letter of Credit (LC) confirmation is a guarantee added to the promise made by the issuing bank (generally in the importer's nation) by a second bank, usually in the exporter's country.

A number of factors, such as the expansion of international trade, currency exchange rate volatility, an increase in bank failures and defaults, and many more, influence the letter of credit confirmation market.

According to the report, the global letter of credit confirmation market size was worth around USD 4.6 billion in 2024 and is predicted to grow to around USD 6.5 billion by 2034.

The global letter of credit confirmation market is expected to grow at a CAGR of 3.5% during the forecast period.

The global letter of credit confirmation market growth is expected to be driven by the Asia Pacific region. It is currently the world’s highest revenue-generating market due to the increasing trade and growing economies.

The global letter of credit confirmation market is dominated by players like Citigroup Inc., Bank of America Corporation, DBS Bank Ltd., JPMorgan Chase & Co., Mizuho Bank Ltd., MUFG Bank Ltd., Scotiabank, Standard Chartered PLC., Sumitomo Mitsui Banking Corporation, The PNC Financial Services Group Inc., CoBank, HSBC Holdings plc., ICICI Bank Group, State Bank of India. Group, Wells Fargo & Company, Barclays Bank PLC, and BNP Paribas SA, among others.

The letter of credit confirmation market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed