Laboratory Freezers Market Size Share, Growth Report 2032

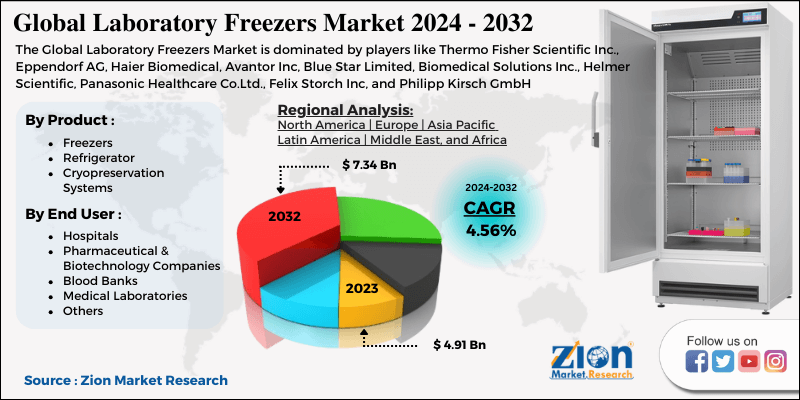

Laboratory Freezers Market By Product (Freezers, Refrigerator And Cryopreservation Systems), By End User (Blood Banks, Hospitals, Pharmaceutical & Biotechnology Companies, Medical Laboratories Others) And By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

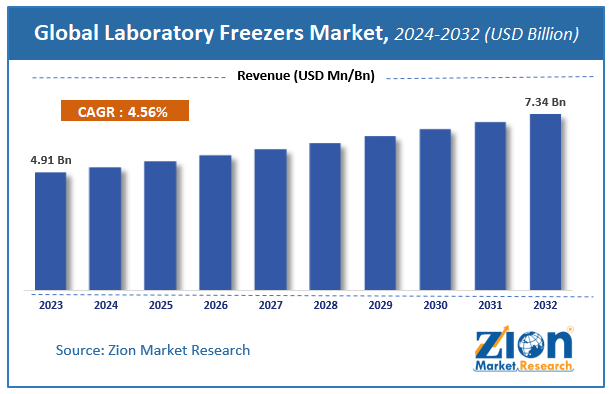

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.91 Billion | USD 7.34 Billion | 4.56% | 2023 |

Laboratory Freezers Market Insights

Zion Market Research has published a report on the global Laboratory Freezers Market, estimating its value at USD 4.91 Billion in 2023, with projections indicating that it will reach USD 7.34 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 4.56% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Laboratory Freezers Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Laboratory freezers are refrigerated cabinets that operate at very low temperatures for storing biological samples and volatile laboratory reagents at the temperature range between -40oC to 10oC temperature. The functional use of these refrigerator cabinets is to store and keep biological samples like blood, tissues, serums, vaccines, enzymes, and others in intact and viable condition. The laboratory refrigerators are used in hospitals, blood banks, laboratories, research, and academic institutes and industries.

The laboratory freezers market is witnessing an increase in demand owing to increasing organ transplants and growing demand for blood and blood components. The rising technological advancements are leading to new product launches.

The market is witnessing an emerging trend for increased demand for vaccine storage laboratory freezers, owing to the rise in demand for vaccines.

Laboratory Freezers Market Growth Factors

The laboratory freezers market is majorly driven by increasing organ transplants across the globe. In addition to this, there is an extensive demand for blood and blood components for the patients under treatment in the hospitals. The industries of pharmaceutical and biotechnology and other industries dealing with biological samples contribute to steady demand for laboratory freezers to ensure viability, safe storage, and transport of biological samples. The increasing prevalence of target diseases like blood cancer, leukemia, hemophilia, sickle cell anemia, and lymphoma are contributing to the need for demand of blood. This is demand for blood is contributing to blood storage laboratory freezers.

The rising awareness for blood donation is leading to the greater demand for laboratory freezers from blood banks. The government initiatives for technological advancements of medical devices are anticipated to drive market growth. The growing vaccination drives across the globe are estimated to bolster the market demand for laboratory freezers in the forecast period.

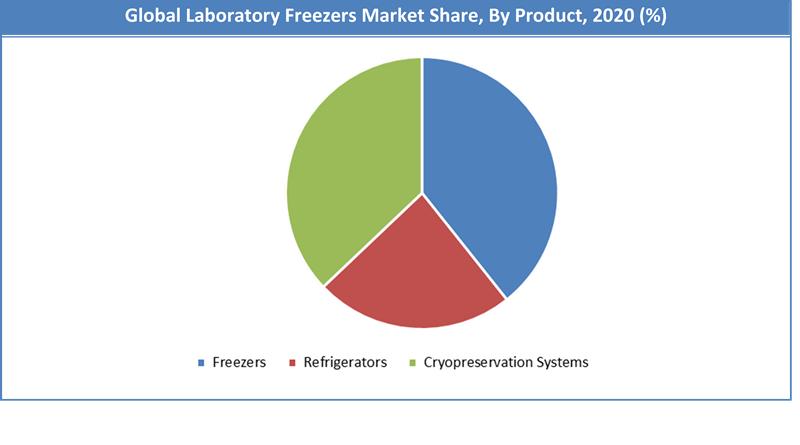

Product Segment Analysis Preview

The laboratory freezers segment held a share of around 38.68% in 2020. This is attributable to an increase in the utilization of laboratory freezers in end-user industries like pharmaceutical and biotechnology companies, academic and clinical research institutes, and hospitals. The increasing prevalence of infectious diseases is leading to an upsurge in research and development activities for the discovery and development of drugs, vaccines, and other treatment modes. The rise in clinical diagnosis had created a demand for freezers for storage and collection of samples. The emerging technological advancements are anticipated to grow the market demand.

End Use Segment Analysis Preview

The blood banks segment will grow at a CAGR of over 5.8% from 2021 to 2028. This is attributable to the rising prevalence of blood-related disorders like blood cancer, leukemia, hemophilia, sickle cell anemia, lymphoma, and many more. The increased demand for blood storage is driving the segment growth. The rising awareness about blood donation and government initiatives for blood donation campaigns have boosted the utilization of laboratory freezers in this segment. The growing need to keep blood and other blood components in viable condition is estimated to bolster the growth of the blood bank segment in the forecast period.

Laboratory Freezers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Laboratory Freezers Market |

| Market Size in 2023 | USD 4.91 Billion |

| Market Forecast in 2032 | USD 7.34 Billion |

| Growth Rate | CAGR of 4.56% |

| Number of Pages | 178 |

| Key Companies Covered | Thermo Fisher Scientific Inc., Eppendorf AG, Haier Biomedical, Avantor Inc, Blue Star Limited, Biomedical Solutions Inc., Helmer Scientific, Panasonic Healthcare Co.Ltd., Felix Storch Inc, and Philipp Kirsch GmbH |

| Segments Covered | By Product, By End User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

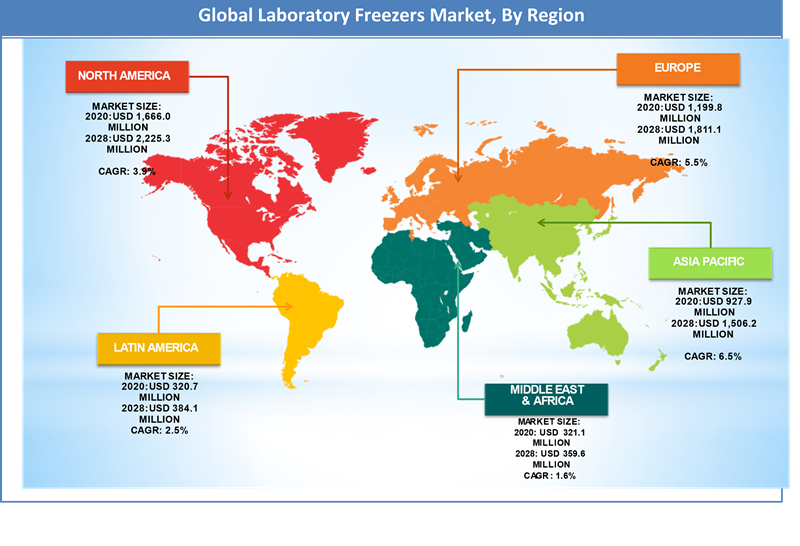

Laboratory Freezers Market Regional Analysis

The North American region held a share of 37.56% in 2020. This is attributable to the presence of top laboratory freezers manufacturers in the region. The region is witnessing an increase in the number of organ transplants leading to demand laboratory freezers. In addition to this, increasing expenditure on R&D activities in U.S. and Canada is contributing to the higher demand for laboratory freezers in the region. The increasing investments in the pharmaceutical and biotechnology industry and healthcare industry are driving the market demand in this region. The presence of advanced healthcare infrastructure and development activities by the government to increase the number of hospitals in the region is estimated to drive the market demand in the North American region.

Request Free SampleThe Asia Pacific region is projected to grow at a CAGR of 6.5% over the forecast period. This surge is the due presence of a large patient population and exponential growth of the population. The region is showing an increase in demand for laboratory freezers owing to rising government funding for the development of healthcare infrastructure. The rapid surge in investments in the pharmaceutical, biotechnology, and healthcare industry along with the surge in research and development activities are contributing to the higher demand for laboratory freezers in this region. The rise in the adoption of cell preservation and cryopreservation techniques is estimated to boost the market demand in the forecast period.

Request Free SampleThe Asia Pacific region is projected to grow at a CAGR of 6.5% over the forecast period. This surge is the due presence of a large patient population and exponential growth of the population. The region is showing an increase in demand for laboratory freezers owing to rising government funding for the development of healthcare infrastructure. The rapid surge in investments in the pharmaceutical, biotechnology, and healthcare industry along with the surge in research and development activities are contributing to the higher demand for laboratory freezers in this region. The rise in the adoption of cell preservation and cryopreservation techniques is estimated to boost the market demand in the forecast period.

Laboratory Freezers Market Key Market Players & Competitive Landscape

Some of the key players in laboratory freezers are:

- Thermo Fisher Scientific Inc.

- Eppendorf AG

- Haier Biomedical

- Avantor Inc

- Blue Star Limited

- Biomedical Solutions Inc

- Helmer Scientific

- Panasonic Healthcare Co.Ltd.

- Felix Storch Inc

- Philipp Kirsch GmbH

These market players are focusing on integrating new technologies with their existing models of laboratory freezers. Product innovation and development are the key focus for the manufacturers. The vendors are focusing on the production of laboratory freezers for vaccine storage owing to the extensive implementation of vaccination drives across the globe.

Ex. In March 2021, Helmer Scientific one of the top laboratory freezer manufacturing company announced to launch of GX Solutions Laboratory and Plasma Freezers for sample and vaccine storage.

The global laboratory freezers market is segmented as follows:

By Product

- Freezers

- Ultra-Low-Temperature Freezers

- Laboratory Freezers

- Plasma Freezers

- Enzyme Freezers

- Explosion-Proof Freezers

- Flammable Material Freezers.

- Refrigerator

- Blood Bank Refrigerators

- Chromatography Refrigerators

- Explosion-Proof Refrigerators

- Flammable Material Refrigerators

- Laboratory Refrigerators

- Pharmacy Refrigerators.

- Cryopreservation Systems

By End User

- Hospitals

- Pharmaceutical & Biotechnology Companies

- Blood Banks

- Medical Laboratories

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global laboratory freezers market was valued at US$ 4.91 Billion in 2023.

Laboratory Freezers Market size valued at US$ 4.91 Billion in 2023, set to reach US$ 7.34 Billion by 2032 at a CAGR of about 4.56% from 2024 to 2032.

The Global laboratory freezers market is expected to reach US$ 7.34 Billion by 2032 at a CAGR of about 4.56% from 2024 to 2032.

Some of the key factors driving the Global laboratory freezers market growth increasing organ transplants and growing demand for blood and blood components across the globe.

North America region held a substantial share of the laboratory freezers market in 2023. This is attributable to presence of top laboratory freezers manufacturers in the region. The increasing investments in the pharmaceutical and biotechnology industry and healthcare industry are driving the market demand in this region.

Some of the major companies operating in the laboratory freezers market are Thermo Fisher Scientific, Inc., Eppendorf AG, Haier Biomedical, Avantor Inc, Blue Star Limited, Biomedical Solutions Inc., Helmer Scientific, Panasonic Healthcare Co. Ltd., Felix Storch, Inc, and Philipp Kirsch GmbH.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed