Laboratory Filtration Market Size, Share, Growth, Forecast 2032

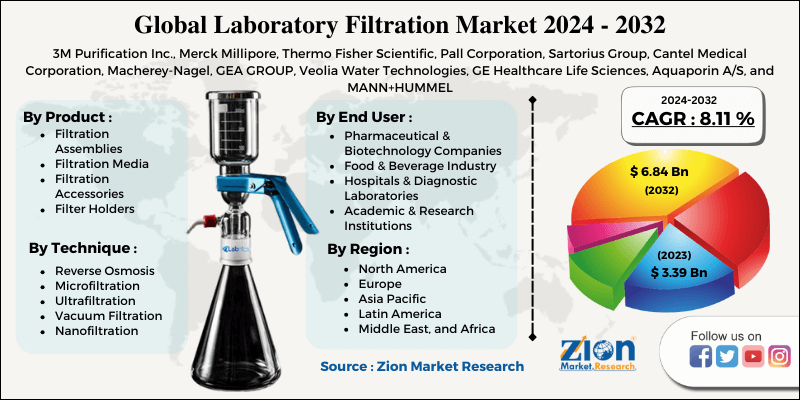

Laboratory Filtration Market By Product (Filtration Assemblies, Filtration Media, Filtration Accessories), By Technique (Reverse Osmosis, Micro-Filtration, Ultra-Filtration, Vacuum Filtration, Nano-Filtration And Others), By End User (Pharmaceutical & Biotechnology Companies, Food & Beverage Industry, Hospitals & Diagnostic Laboratories, Academic & Research Institutions And Others) And By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032-

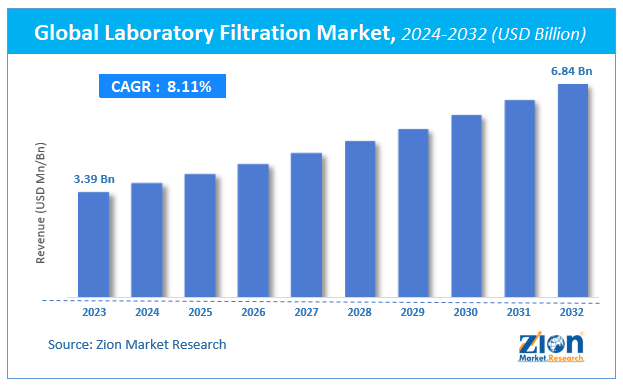

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.39 Billion | USD 6.84 Billion | 8.11% | 2023 |

Laboratory Filtration Market Insights

Zion Market Research has published a report on the global Laboratory Filtration Market, estimating its value at USD 3.39 Billion in 2023, with projections indicating that it will reach USD 6.84 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 8.11% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Laboratory Filtration Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Laboratory Filtration Market Overview

Laboratory filtration is a mechanical technique of sterilization used to separate solid particles from gases or liquids for the purification of biomolecules. Laboratory filtration products have a wide range of applications in various fields such as drug discovery, new drug development, microbial analysis, virus and pathogen removal, and research laboratories. In the last two decades, the market has witnessed a significant upsurge owing to the development of new technology. The technological development has transformed laboratory filtration techniques from simple osmosis to nano-filtration and micro-filtration techniques. The laboratory filtration market is being empowered by rising investments in research and developments by developing economies across the globe.

The extensive use of micro-filtration techniques for API and enzyme sterilization is emerging as a trend in the laboratory filtration market.

COVID-19 Impact Analysis

The sudden outbreak of covid-19 has significantly impacted all the industries across the globe. The market faced disruptions in supply and distribution chains in the earlier days, COVID-19 the outbreak for short period. But the overall laboratory filtration industry is positively impacted by the covid-19 pandemic. The upsurge in demand for covid-19 vaccine and rising research and development activities across the globe had boosted the market growth. The increasing investments by governments of major economies across the globe had led to the growth of the pharmaceutical industry. The rising focus towards the developments of new drugs and treatment methods for covid-19 and prevailing diseases has led to an increase in demand for laboratory filtration products.

The leading market players are ensuring the safety of employees at production facilities. Companies are ensuring the implementation of safety regulations like social distance and hygiene maintenance to avoid the spread of covid-19 infections. Companies are also focusing on strengthening their distribution channels across the globe.

Laboratory Filtration Market Growth Factors

The laboratory filtration market is primarily driven is prevailing applications of filtration techniques in the biopharmaceutical and pharmaceutical industries and the rise in research and development activities across the globe. The rising demand for more efficient laboratory filtration products with improved capacity and efficiency is leading to technological advancement and product development in the market. These developments of new filtration products and techniques are contributing to the market demand for laboratory filtration products.

In addition to this, increasing demand for the purified products from the end-users is fueling the market demand. The rising demand for developing large biomolecules, drug discovery, and development are boosting the market demand for laboratory filtration products. The food and beverages industries are contributing to market demand, owing to the need for the separation of solid particles from liquid and to ensure food safety.

The upsurge in the demand for high-efficiency filtration products in downstream processing and demand for cost-effective filtration techniques is estimated to drive the market demand in the forecast period.

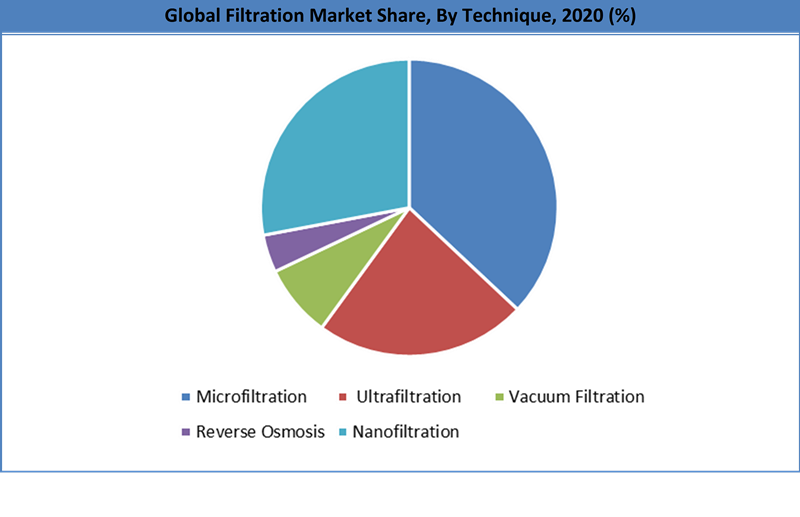

Technique Segment Analysis Preview

The micro-filtration segment held a share of around 37.01% in 2020. This growth is attributable to benefits offered by the technique like high separation efficiency, easy operation, and no requirement for additional solvents. The extending R&D activities in the pharmaceutical and biotechnology industry and increasing applications of microfiltration techniques in the food and beverages industry are reinforcing the growth of this segment. The microfiltration technique is also increasingly used as pretreatment for ultra-filtration and reverse osmosis techniques. The Ultrafiltration technique segment is estimated to be the fastest-growing segment in the forecast period. This growth is attributable to advantages over other techniques such as low energy consumption, serene handling, and gentle product treatment.

End Use Industry Segment Analysis Preview

The pharmaceutical and biotechnology companies’ segment will grow at a CAGR of over 9% from 2024-2032. This is attributable to the increasing use of filtration products by pharmaceutical and biotechnology companies. The governments of leading economies are investing in R&D activities to strengthen their healthcare and pharmaceutical industry. This has led to an upsurge in activities like clinical research, new drug development and developing new treatment methods. The stringent government regulations for the quality of pharmaceutical products are contributing to market growth.

The pharmaceutical and biotechnology product manufacturers install laboratory filters in their production facilities to get sterile and defect-free end products. The rising demand for safe and contamination-free products by the end-users is driving the market demand for laboratory filtration products in this segment.

Laboratory Filtration Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Laboratory Filtration Market |

| Market Size in 2023 | USD 3.39 Billion |

| Market Forecast in 2032 | USD 6.84 Billion |

| Growth Rate | CAGR of 8.11% |

| Number of Pages | 146 |

| Key Companies Covered | 3M Purification Inc., Merck Millipore, Thermo Fisher Scientific, Pall Corporation, Sartorius Group, Cantel Medical Corporation, Macherey-Nagel, GEA GROUP, Veolia Water Technologies, GE Healthcare Life Sciences, Aquaporin A/S, and MANN+HUMMEL. |

| Segments Covered | By Product, By Technique, By End User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

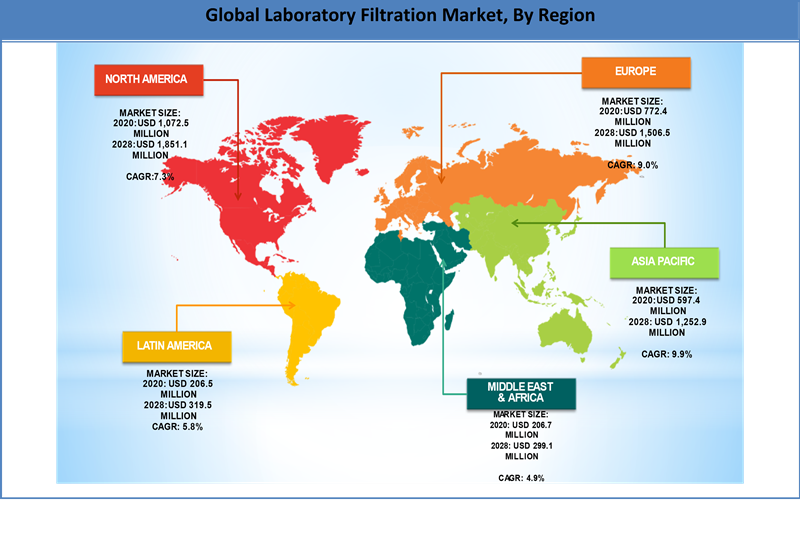

Laboratory Filtration Market Regional Analysis

The North American region held a share of 37.56% in 2020. This is attributable to the presence of leading laboratory filtration manufacturers and well-established laboratories in the region. U.S. is contributing to market growth in the North American region due to the existence of well-established market players like 3M Purification Inc., Merck Millipore, Sartorius Group, Thermo Fisher Scientific, and more along with rising government funding in research and development. The region is witnessing growth due to growing industrialization, development of new laboratory filtration products due to technological advancements. This is leading to a rise in the adoption of laboratory filtration products. The increase in demand from end-user industries like pharmaceutical and biotechnology companies, hospitals and diagnostic centers, and research centers are anticipated to bolster the market growth in the North American region.

The Asia Pacific region is estimated to grow at a CAGR of 9.9% over the forecast period. This surge is due to the focus of leading pharmaceutical and biotechnology manufacturers to set up new production facilities in the region. The healthcare, pharmaceutical, food, and beverage industries in this region are focusing on the efficient production of quality products. The countries like India and Japan are estimated to be the fastest-growing markets for laboratory filtration due to the growing pharmaceutical industry. The stringent government regulations for the quality of products used in the manufacturing of pharmaceutical products are driving the market demand in the APAC region. The increasing adoption of new technology and laboratory filtration products in the manufacturing process are anticipated to grow the market in the forecast period.

Laboratory Filtration Market Key Market Players & Competitive Landscape

Some of the key players in the automated sortation system market are:

- 3M Purification Inc.

- Merck Millipore

- Thermo Fisher Scientific

- Pall Corporation

- Sartorius Group

- Cantel Medical Corporation

- Macherey-Nagel

- GEA GROUP

- Veolia Water Technologies

- GE Healthcare Life Sciences

- Aquaporin A/S

- MANN+HUMMEL

The leading laboratory filtration product manufacturers are focusing on strategies like business expansion, developing efficient supply and distribution channels in growing market segments. In addition to this, companies are focusing on the expansion of product portfolios by mergers and acquisitions, partnerships, and collaborations.

EX. 1) In July 2021, Veolia Water Technologies have signed agreements with many distributors to strengthen their distribution channels in countries across the Asia-Pacific region.

2) 3M Company is focusing on business expansion in the Asia-Pacific region, In February 2020, Company had introduced a new store in Jammu, India.

The global laboratory filtration market is segmented as follows:

By Product

- Filtration Assemblies

- Reverse Osmosis Assemblies

- Microfiltration Assemblies

- Ultrafiltration Assemblies

- Nano Filtration

- Vacuum Filtration Assemblies

- Others

- Filtration Media

- Membrane Filters

- Filter Papers

- Filtration Microplates

- Syringeless Filters

- Syringe Filters

- Capsule Filters

- Others

- Filtration Accessories

- Filter Holders

- Filter Flasks

- Filter Funnels

- Dispensers

- Cartridges

- Filter Housings

- Vacuum Pumps

- Seals

- Others

By Technique

- Reverse Osmosis

- Microfiltration

- Ultrafiltration

- Vacuum Filtration

- Nanofiltration

By End User

- Pharmaceutical & Biotechnology Companies

- Food & Beverage Industry

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutions

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Laboratory Filtration Market market size valued at US$ 3.39 Billion in 2023

Laboratory Filtration Market market size valued at US$ 3.39 Billion in 2023, set to reach US$ 6.84 Billion by 2032 at a CAGR of about 8.11% from 2024 to 2032.

Some of the key factors driving the Global laboratory filtration market growth are applications of filtration techniques in the biopharmaceutical and pharmaceutical industries and the rise in research and development activities across the globe.

North America region held a substantial share of the laboratory filtration market in 2020. This is attributable to the presence of major players such as 3M Purification Inc., Merck Millipore, Sartorius Group, Thermo Fisher Scientific, GE Healthcare among others. Asia Pacific region is projected to grow at a significant rate owing the focus of leading pharmaceutical and biotechnology manufacturers to set up new production facilities in the region.

Some of the major companies operating in the laboratory filtration market are 3M Purification Inc., Merck Millipore, Thermo Fisher Scientific, Pall Corporation, Sartorius Group, Cantel Medical Corporation, Macherey-Nagel, GEA GROUP, Veolia Water Technologies, GE Healthcare Life Sciences, Aquaporin A/S and MANN+HUMMEL.

List of Contents

Market InsightsMarket OverviewCOVID-19 Impact AnalysisMarket Growth FactorsTechnique Segment Analysis PreviewEnd Use Industry Segment Analysis PreviewReport ScopeMarket Regional AnalysisMarket Key Market Players Competitive LandscapeThe global laboratory filtration market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed