Global Laboratory Equipment Services Market Size, Share, Growth Analysis Report - Forecast 2034

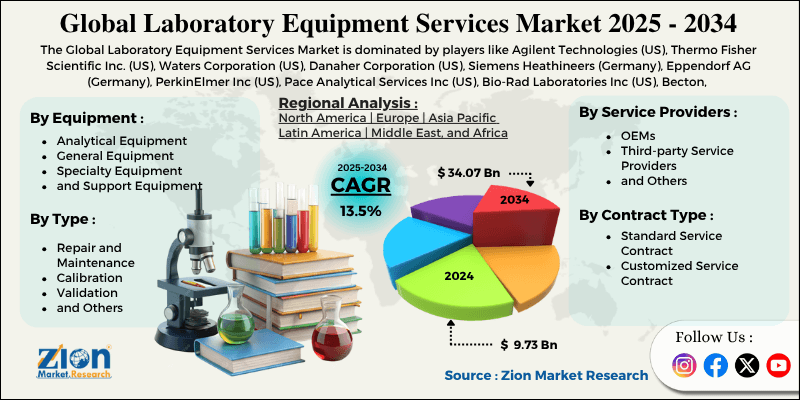

Laboratory Equipment Services Market By Equipment Type (Analytical Equipment, General Equipment, Specialty Equipment, and Support Equipment), By Type (Repair and Maintenance, Calibration, Validation, and Others), Service Providers (OEMs, Third-party Service Providers, and Others), Contract Type (Standard Service Contract and Customized Service Contract), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

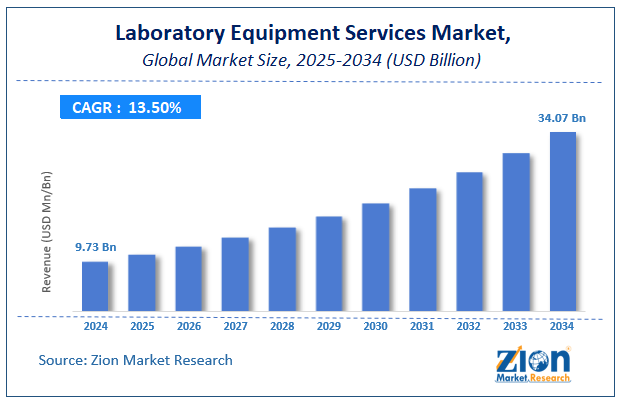

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.73 Billion | USD 34.07 Billion | 13.5% | 2024 |

Laboratory Equipment Services Market: Industry Perspective

The global laboratory equipment services market size was worth around USD 9.73 Billion in 2024 and is predicted to grow to around USD 34.07 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 13.5% between 2025 and 2034. The report analyzes the global laboratory equipment services market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the laboratory equipment services industry.

Laboratory Equipment Services Market: Overview

Laboratory equipment services are anticipated to see an increase in demand over the forecast period as the focus on healthcare bolsters and there is an increase in research and development activities across the world. The increasing spending on healthcare research activity will spawn demand for Laboratory Equipment Services over the forecast period.

The increasing prevalence of chronic diseases has bolstered the demand for effective diagnostic and treatment services, and this is also expected to boost demand for Laboratory Equipment Services over the forecast period. Rising focus on healthcare, increasing healthcare expenditure, and spending are other factors that will influence Laboratory Equipment Services' market growth through 2028.

However, high service costs are expected to be a major restraining factor for the Laboratory Equipment Services market growth in the long run. The shift from lab-based diagnosis to home-based/POC testing is also anticipated to hamper the market potential.

Key Insights

- As per the analysis shared by our research analyst, the global laboratory equipment services market is estimated to grow annually at a CAGR of around 13.5% over the forecast period (2025-2034).

- Regarding revenue, the global laboratory equipment services market size was valued at around USD 9.73 Billion in 2024 and is projected to reach USD 34.07 Billion by 2034.

- The laboratory equipment services market is projected to grow at a significant rate due to rising research and development activities, increasing demand for maintenance and calibration of lab instruments, advancements in laboratory technologies, and the growing need for compliance with regulatory standards in healthcare and research sectors.

- Based on Equipment Type, the Analytical Equipment segment is expected to lead the global market.

- On the basis of Type, the Repair and Maintenance segment is growing at a high rate and will continue to dominate the global market.

- Based on the Service Providers, the OEMs segment is projected to swipe the largest market share.

- By Contract Type, the Standard Service Contract segment is expected to dominate the global market.

- Based on region, Asia Pacific is predicted to dominate the global market during the forecast period.

Laboratory Equipment Services Market: Growth Drivers

Rising Research Activity to Boost Laboratory Equipment Services Market Growth

Focus on healthcare has bolstered across the world and this has increased research and development activity, which is majorly driving the Laboratory Equipment Services marketplace. The rising prevalence of chronic diseases and rising demand for diagnosis and treatment are other factors that will be influencing the Laboratory Equipment Services market growth over the forecast period.

Laboratory Equipment Services Market: Restraints

High Cost of Service to Restrict Market Growth

Laboratory Equipment Services are costlier now that advanced technologies are being integrated to increase productivity and efficiency. Increasing costs of laboratory equipment are expected to hamper the global Laboratory Equipment Services market growth over the forecast period. This factor is anticipated to have a major adverse impact on the Laboratory Equipment Services market potential in the developing region.

Global Laboratory Equipment Services Market: Segmentation

The global laboratory equipment services market is segmented based on equipment type, type, service providers, contract type, and region.

By equipment type, the market is divided into analytical equipment, general equipment, specialty equipment, and support equipment. The analytical equipment segment is expected to hold a dominant outlook over the forecast period in the global Laboratory Equipment Services marketplace. The high cost of this sensitive equipment and rising demand are expected to be prominent trends driving Laboratory Equipment Services market potential through 2028.

Based on type, the global laboratory equipment services market is divided into repair and maintenance, calibration, validation, and others.

In terms of service providers, the global laboratory equipment services market is categorized into OEMs, third-party service providers, and others.

By contract type, the laboratory equipment services market is segmented into standard service contracts and customized service contracts. The standard service contract segment is expected to have a bright outlook over the forecast period.

Laboratory Equipment Services Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Laboratory Equipment Services Market |

| Market Size in 2024 | USD 9.73 Billion |

| Market Forecast in 2034 | USD 34.07 Billion |

| Growth Rate | CAGR of 13.5% |

| Number of Pages | 185 |

| Key Companies Covered | Agilent Technologies (US), Thermo Fisher Scientific Inc. (US), Waters Corporation (US), Danaher Corporation (US), Siemens Heathineers (Germany), Eppendorf AG (Germany), PerkinElmer Inc (US), Pace Analytical Services Inc (US), Bio-Rad Laboratories Inc (US), Becton, Dickinson and Company (US), and others. |

| Segments Covered | By Equipment Type, By Type, By Service Providers, By Contract Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Laboratory Equipment Services Market: Regional Analysis

Asia Pacific region leads the global Laboratory Equipment Services market in terms of growth and is estimated to rise at the fastest CAGR through 2028. Increasing focus on healthcare is anticipated to further foster demand for research and development activities and subsequently drive the Laboratory Equipment Services market potential over the forecast period. India and China are expected to be the most prominent markets in this region through 2028

The market for Laboratory Equipment Services in North America is expected to hold a dominant outlook over the forecast period. Owing to the presence of key pharmaceutical and biotechnology companies and increasing focus on research in the healthcare sector in this region is expected to further bolster the demand for Laboratory Equipment Services in this region through 2028. The United States is expected to be a highly lucrative market for Laboratory Equipment Services over the forecast period in this region.

Recent Developments

- In 2018 – Agilent an analytical instrumentation manufacturing organization announced the opening of its new logistics hub in Shanghai which is aimed at increasing the speed of delivery of its products in China.

The global laboratory equipment services market is dominated by players like:

- Agilent Technologies (US)

- Thermo Fisher Scientific Inc. (US)

- Waters Corporation (US)

- Danaher Corporation (US)

- Siemens Heathineers (Germany)

- Eppendorf AG (Germany)

- PerkinElmer Inc (US)

- Pace Analytical Services Inc (US)

- Bio-Rad Laboratories Inc (US)

- Becton

- Dickinson and Company (US)

The global laboratory equipment services market is segmented as follows:

By Equipment Type

- Analytical Equipment

- General Equipment

- Specialty Equipment

- and Support Equipment

By Type

- Repair and Maintenance

- Calibration

- Validation

- and Others

By Service Providers

- OEMs

- Third-party Service Providers

- and Others

By Contract Type

- Standard Service Contract

- Customized Service Contract

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Laboratory equipment services refer to the maintenance, calibration, repair, and installation of lab instruments to ensure accurate and reliable performance. These services help extend equipment lifespan, maintain compliance with standards, and support smooth laboratory operations.

The Global laboratory equipment services market is expected to grow due to increasing complexity and sophistication of laboratory equipment, the rising need for regulatory compliance, and the growing focus on maximizing equipment uptime and operational efficiency.

According to a study, the Global laboratory equipment services market size was worth around USD 9.73 Billion in 2024 and is expected to reach USD 34.07 Billion by 2034.

The Global laboratory equipment services market is expected to grow at a CAGR of 13.5% during the forecast period.

Asia Pacific is expected to dominate the laboratory equipment services market over the forecast period.

Leading players in the Global laboratory equipment services market include Agilent Technologies (US), Thermo Fisher Scientific Inc. (US), Waters Corporation (US), Danaher Corporation (US), Siemens Heathineers (Germany), Eppendorf AG (Germany), PerkinElmer Inc (US), Pace Analytical Services Inc (US), Bio-Rad Laboratories Inc (US), Becton, Dickinson and Company (US), among others.

The report explores crucial aspects of the laboratory equipment services market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed