Global Kosher Salt Market Size, Share, Growth Analysis Report - Forecast 2034

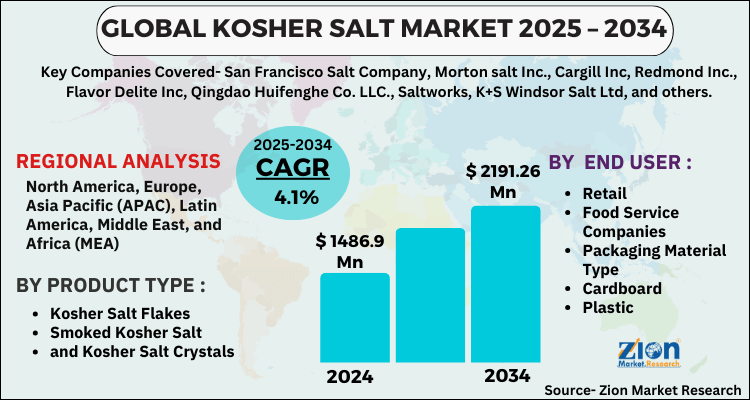

Kosher Salt Market By Product Type (Kosher Salt Flakes, Smoked Kosher Salt, and Kosher Salt Crystals), By End User (Retail, Food Service Companies, Packaging Material Type, Cardboard, Plastic, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

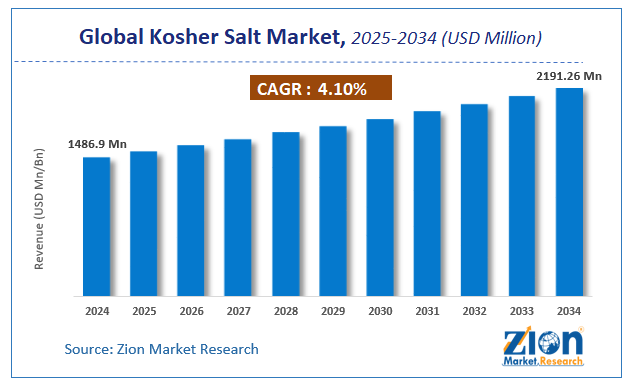

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1486.9 Million | USD 2191.26 Million | 4.1% | 2024 |

Kosher Salt Market Size

The global kosher salt market size was worth around USD 1486.9 Million in 2024 and is predicted to grow to around USD 2191.26 Million by 2034 with a compound annual growth rate (CAGR) of roughly 4.1% between 2025 and 2034.

The report analyzes the global kosher salt market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the kosher salt industry.

Kosher Salt Market: Overview

Kosher salt is an edible salt with big granules. It is named after the koshering of meat. Except for the iodine, which is also found in regular salt, it contains no additions. The global demand for kosher salt is predicted to rise due to a variety of factors such as increased acceptance, higher absorption rate, growing health awareness, and convenience of usage. Moreover, an increase in meat consumption is expected to raise the demand for kosher globally, opening up new business potential. One of the primary factors driving the growth of the kosher salt market is the increased demand for natural ingredients and nutritious cuisine around the world. The rise in the acceptance of kosher salt, which is thought to be attributable to the lack of chemical-tasting dextrose and iodine, as well as the coarse texture, which makes it easier to estimate the amount of salt to be used in cooking, is driving market expansion. The usage of salt as a blood pressure reducer due to its decreased sodium content, as well as the rising shift away from standard synthetic food ingredients and toward more organic alternatives, all, have an impact on the market.

Additionally, changes in lifestyle, higher absorption rates, increased health awareness, and increased acceptance all have a favorable impact on the kosher salt business. Further, research and development initiatives, as well as an increase in demand for organic components, provide profitable prospects to market participants during the projection period.

Key Insights

- As per the analysis shared by our research analyst, the global kosher salt market is estimated to grow annually at a CAGR of around 4.1% over the forecast period (2025-2034).

- Regarding revenue, the global kosher salt market size was valued at around USD 1486.9 Million in 2024 and is projected to reach USD 2191.26 Million by 2034.

- The kosher salt market is projected to grow at a significant rate due to increasing health-conscious consumers and rising kosher food certifications.

- Based on Product Type, the Kosher Salt Flakes segment is expected to lead the global market.

- On the basis of End User, the Retail segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Kosher Salt Market: Driver

The need for natural ingredients and healthy food is projected to drive the global kosher salt market. Due to its big granular texture, kosher salt has half the salting strength of conventional table salt and is easier to handle for cooks. Another element boosting the market is the growing use of kosher salts in traditional cuisines and by professional chefs in luxury hotels. Kosher salt also gives retailers with a bigger profit margin. In the foreseeable future, the increased demand for kosher foods is likely to fuel the market for kosher salts. These variables are critical in driving the kosher salt market. During the forecast period, advanced technology and scientific breakthroughs will boost the growth of the kosher salt market.

Kosher Salt Market: Restraint

The Kosher salt's low solubility is predicted to stymie market growth. The rising frequency of iodine deficiency is expected to pose a challenge to the kosher salt industry throughout the forecast period. Kosher salt, unlike other varieties of salt, is entirely composed of sodium chloride. It typically lacks trace minerals, iodine, and anti-clumping or anti-caking compounds. Sodium overload is linked to high blood pressure, osteoporosis, kidney stones, and other health problems. This factor may stifle market expansion.

Kosher Salt Market: Segmentation Analysis

The Kosher Salt Market is segregated based on Product Type and End User.

By Product Type, the market is classified into Kosher Salt Flakes, Smoked Kosher Salt, and Kosher Salt Crystals. The Smoked Kosher Salt segment is estimated to grow rapidly in the forecast period. The growth is attributable to an increase in the smokey food trend and an increase in the consumption of grilled foods. Kosher salt crystals are the most popular type of kosher salt and are broadly used as culinary salt by professional chefs around the world. Moreover, many chefs prefer kosher salt as table salt as it dissolves more easily than other salts and possesses a tasty flavor. Smoked kosher salt is the second important segment, showing a significant growth due to its high consumption in food preparation to add flame-grilled smokiness to a dish.

By End User, the market is classified into Retail, Food Service Companies, Packaging Material Type, Cardboard, Plastic, and Others. The growing Food Service Companies industry is expected to drive up demand for kosher salt even more. The number of food chains and restaurants is growing, as is the number of new meals created by chefs. The necessity for salt is unmistakable in the development of this sector. Advances in the packaging industry to provide better quality storage facilities for kosher salt to keep it fit for use for a longer period of time are also projected to boost the market's growth.

Kosher Salt Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Kosher Salt Market |

| Market Size in 2024 | USD 1486.9 Million |

| Market Forecast in 2034 | USD 2191.26 Million |

| Growth Rate | CAGR of 4.1% |

| Number of Pages | 165 |

| Key Companies Covered | San Francisco Salt Company, Morton salt Inc., Cargill Inc, Redmond Inc., Flavor Delite Inc, Qingdao Huifenghe Co. LLC., Saltworks, K+S Windsor Salt Ltd, and others. |

| Segments Covered | By Product Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Kosher Salt Market: Regional Landscape

North America dominates the kosher salt market because of the presence of a sophisticated network of hotels and restaurants, as well as the region's consumers' desire for a better lifestyle. Due to the huge number of participants in this market, the American region is expected to hold a significant share of this market. Additionally, the high meat consumption in this region is expected to have an impact on the sales of kosher meat in this region. Furthermore, the growing awareness of the health benefits of utilizing kosher salt over regular salt is driving up the market even further.

The Asia-Pacific area is predicted to develop significantly during the forecast period, owing to increased awareness of and access to kosher salt, as well as a readiness to shift long-held habits in the region. Rapid urbanization, combined with increased incomes, is prompting people to seek out healthier alternatives in order to maintain their health. Furthermore, food demand is rising in developing countries such as India and China. During the anticipated period, home use of kosher salt will be at its peak.

Kosher Salt Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the kosher salt market on a global and regional basis.

The global kosher salt market is dominated by players like:

- San Francisco Salt Company

- Morton salt Inc.

- Cargill Inc

- Redmond Inc.

- Flavor Delite Inc

- Qingdao Huifenghe Co. LLC.

- Saltworks

- K+S Windsor Salt Ltd

The global kosher salt market is segmented as follows;

By Product Type

- Kosher Salt Flakes

- Smoked Kosher Salt

- and Kosher Salt Crystals

By End User

- Retail

- Food Service Companies

- Packaging Material Type

- Cardboard

- Plastic

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global kosher salt market is expected to grow due to increasing consumer preference for premium and additive-free salts in cooking and food processing applications.

According to a study, the global kosher salt market size was worth around USD 1486.9 Million in 2024 and is expected to reach USD 2191.26 Million by 2034.

The global kosher salt market is expected to grow at a CAGR of 4.1% during the forecast period.

North America is expected to dominate the kosher salt market over the forecast period.

Leading players in the global kosher salt market include San Francisco Salt Company, Morton salt Inc., Cargill Inc, Redmond Inc., Flavor Delite Inc, Qingdao Huifenghe Co. LLC., Saltworks, K+S Windsor Salt Ltd, among others.

The report explores crucial aspects of the kosher salt market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed