Keytruda Market Size, Share, Growth, Global Trends, Forecast 2034

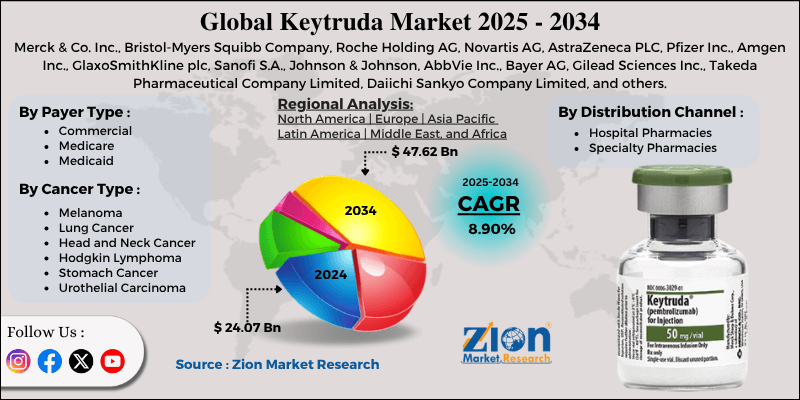

Keytruda Market By Payer Type (Commercial, Medicare, Medicaid), By Cancer Type (Melanoma, Lung Cancer, Head and Neck Cancer, Hodgkin Lymphoma, Stomach Cancer, Urothelial Carcinoma), By Distribution Channel (Hospital Pharmacies, Specialty Pharmacies), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

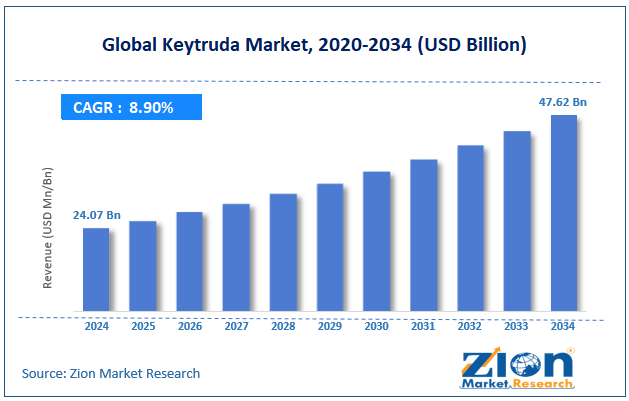

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 24.07 Billion | USD 47.62 Billion | 8.90% | 2024 |

Keytruda Industry Perspective:

The global Keytruda market size was worth around USD 24.07 billion in 2024 and is predicted to grow to around USD 47.62 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.90% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global Keytruda market is estimated to grow annually at a CAGR of around 8.90% over the forecast period (2025-2034)

- In terms of revenue, the global Keytruda market size was valued at around USD 24.07 billion in 2024 and is projected to reach USD 47.62 billion by 2034.

- The Keytruda market is projected to grow significantly due to the increasing adoption of immunotherapy treatments, rising investment in oncology research and development, and strategic collaborations and partnerships by Merck & Co.

- Based on payer type, the commercial segment is expected to lead the market, while the medicare segment is expected to grow considerably.

- Based on cancer type, the lung cancer segment is the dominating segment, while the melanoma segment is projected to witness sizeable revenue over the forecast period.

- Based on the distribution channel, the hospital pharmacies segment is expected to lead the market compared to the specialty pharmacies segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Keytruda Market: Overview

Keytruda (pembrolizumab) is an immunotherapy drug developed by Merck & Co. that works by blocking the PD-1 receptor, helping the immune system identify and attack cancer cells more efficiently. It is approved for treating different cancers, including lung, head & neck, melanoma, colorectal, and bladder cancers. The global Keytruda market is projected to witness substantial growth driven by increasing cases of cancer worldwide, expanding therapeutic indications, and improvements in immunotherapy research. The growing cases of cancers like melanoma, lung, and head & neck have fueled elevated demand for effective therapies like Keytruda. Cancer cases are anticipated to reach 30 million every year by 2040, according to the WHO. This burgeoning patient base boosts the worldwide adoption of Keytruda in oncology centers.

Keytruda has gained multiple EMA and FDA approvals for more than 30 cancer indications, comprising rare tumor types. Continuous label growth improves its clinical reach and revenue potential. This broad therapeutic coverage strengthens Merck's competitive benefit in the immuno-oncology domain. Moreover, ongoing research on PD-1 inhibitors and combination immunotherapies improves Keytruda’s clinical outcomes. Trials comprising Keytruda with targeted therapy, chemotherapy, and other immune checkpoint inhibitors show better survival rates. This scientific progress accelerates its incorporation into mainstream cancer care.

Although drivers exist, the global market faces challenges such as competition from other immunotherapies, as well as adverse effects and safety concerns. Keytruda experiences intense competition from drugs like Roche’s Tecentriq and Bristol Myers Squibb’s Opdivo. These opponents offer comparable efficiency and are also growing into multiple indications. This industry competition pressures pricing and erodes industry share. Despite its benefits, Keytruda may cause severe immune-related side effects like colitis, endocrinopathies, and pneumonitis. These side effects usually lead to therapy discontinuation. Safety concerns reduce patient willingness and physician preference in a few cases.

Even so, the global Keytruda industry is well-positioned due to the emergence of biomarker-based therapies and rising focus on combination therapies. Personalized medicine is growing, with biomarkers like MSI-H and PD-L1 guiding treatment selection. Keytruda’s efficiency in biomarker-based therapies ranks it as the highly preferred choice in precision oncology. This trend will improve treatment success rates and patient satisfaction. Keytruda’s incorporation with targeted therapy, chemotherapy, and radiation offers synergistic advantages. Combination regimens are gaining prominence in oncology pipelines across the globe. This approach will widen its indications and patient applicability in the near future.

Keytruda Market Dynamics

Growth Drivers

How is the Keytruda market driven by competitive landscape, patent life, and biosimilar/biologic threats?

Keytruda’s industry outlook is strongly associated with legal protection and exclusivity. At the same time, Merck historically maintained settlements and patent portfolios that postponed interchangeable biosimilars, biosimilar/genetic entrants to the PD-L1/PD-1 space, and alternative checkpoint inhibitors create long-term competitive pressure. Competition is not only from biosimilars but also from opponent anti-PD-1/PD-L1 and next-gen immunotherapies, which may offer equivalent or enhanced safety. This could fragment industry share and lead to price erosion in tendering environments. Patent expirations, litigation, and settlement outcomes – usually reported in company filings and press releases, hence materially impact predictions, as do regulatory sanctions for biosimilar monoclonal antibodies.

How are strong commercial performance, pricing dynamics, and revenue scale considerably fueling the Keytruda market?

Commercial uptake has been buoyed by Keytruda’s early mover benefit in PD-1 therapy and Merck's extensive commercial infrastructure, resulting in multi-billion dollar annual revenues in recent years. High list prices per course in several markets and more prolonged treatment durations in adjuvant settings raise aggregate revenue per patient than with short-course cytotoxics. Financial performance has, in turn, supported investments, heavy marketing in real-world evidence generation, and payer engagement that withstands utilization. Nonetheless, price pressure, cost-containment policies, and value-based contracting continue to be key variables in some regions. Hence, these price dynamics and revenue scale propel the growth of the Keytruda market.

Restraints

Adverse effects and safety concerns negatively impact the market progress

Immune-related adverse effects (irAEs) are majorly seen with Keytruda, comprising pneumonitis, hepatitis, colitis, and endocrinopathies, which may need hospitalization or therapy discontinuation. Safety concerns restrict prescribing in comorbid or frail patients, limiting the eligible population. Managing these ill-effects increases treatment costs and healthcare resource utilization, particularly in middle and low-income economies. Physicians usually need specialized monitoring, which may slow adoption in community clinics. Recent clinical reports in 2023-2024 underscored rare but severe immune-related myocarditis cases, highlighting ongoing safety vigilance.

Opportunities

How does the growth in combination therapy and pipeline expansion offer advantageous conditions for the development of the Keytruda market?

Keytruda is the backbone in several combination trials with targeted agents, chemotherapy, and novel immunotherapies. Positive Phase II/III results may increase indications and raise per-patient treatment duration. Merck holds more than 1000 ongoing trials in different cancers worldwide, presenting significant pipeline potential. These combinations also create opportunities in the Keytruda industry for label extensions in hard-to-treat or rare cancers. Strategic associations with biotech companies augment clinical development and commercial reach, especially in immuno-oncology niches.

Challenges

Regulatory complexity and delayed approvals limit the market growth

Worldwide regulatory pathways vary, and extra data requirements may delay approval for new indications. Agencies progressively demand long-term outcome data and post-marketing surveillance before granting full approvals. In a few Latin American and Asian economies, regulatory reviews have postponed NSCLC label growth or adjuvant therapy approvals. These delays restrict revenue growth and decrease early mover benefits. Navigating a different regulatory landscape needs significant investment in regulatory and clinical affairs teams.

Keytruda Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Keytruda Market |

| Market Size in 2024 | USD 24.07 Billion |

| Market Forecast in 2034 | USD 47.62 Billion |

| Growth Rate | CAGR of 8.90% |

| Number of Pages | 216 |

| Key Companies Covered | Merck & Co. Inc., Bristol-Myers Squibb Company, Roche Holding AG, Novartis AG, AstraZeneca PLC, Pfizer Inc., Amgen Inc., GlaxoSmithKline plc, Sanofi S.A., Johnson & Johnson, AbbVie Inc., Bayer AG, Gilead Sciences Inc., Takeda Pharmaceutical Company Limited, Daiichi Sankyo Company Limited, and others. |

| Segments Covered | By Payer Type, By Cancer Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Keytruda Market: Segmentation

The global Keytruda market is segmented based on payer type, cancer type, distribution channel, and region.

Based on payer type, the global Keytruda industry is divided into commercial, Medicare, and Medicaid. The commercial insurance segment holds a leading market share since it offers extensive coverage for high-cost immunotherapies. Patients with private insurance can access advanced treatments easily, promising wider adoption. Private health plans and employers actively reimburse Keytruda, increasing its significance as the key revenue source. This segment also benefits from fewer limitations than public insurance programs.

Based on cancer type, the global Keytruda market is segmented into melanoma, lung cancer, head and neck cancer, Hodgkin lymphoma, stomach cancer, and urothelial carcinoma. The lung cancer segment holds a dominating share of the market owing to its burgeoning worldwide cases and mortality rate. Keytruda is approved for small-cell lung cancer and non-small cell lung cancer (NSCLC) in some instances, fueling remarkable adoption. Strong clinical evidence shows enhanced response and survival rates, increasing the demand for it. The combination of high cases and proven efficacy makes lung cancer the leading cause among others.

Based on distribution channel, the global market is segmented into hospital pharmacies and specialty pharmacies. The hospital pharmacies segment registered a substantial share of the market since a majority of cancer treatments are administered in hospitals under oncologist supervision. They offer patient monitoring and controlled infusion services, assuring safety during immunotherapy. Hospitals also facilitate access and reimbursement for high-priced therapies. This central role in treatment delivery secures hospital pharmacies as the leading segment.

Keytruda Market: Regional Analysis

What gives North America a competitive edge in the global Keytruda Market?

North America is likely to sustain its leadership in the Keytruda market due to supportive reimbursement policies, early regulatory approvals, and advanced healthcare infrastructure. The United States healthcare system provides strong insurance coverage for high-priced oncology drugs, comprising Medicaid, Medicare, and other commercial plans. A majority of patients can access Keytruda with insurance support, decreasing financial obstacles. This reimbursement infrastructure majorly fuels uptake and industry revenue. Keytruda has gained several FDA approvals for multiple cancer indications earlier than other drugs in its class. The United States' amplified route enables quick patient access to immunotherapy. Early industry entry boosts brand presence and strengthens regional dominance.

Furthermore, North America holds high-class hospitals, infusion facilities, and oncology centers capable of administering immunotherapies. Advanced infrastructure promises safer and broader delivery of Keytruda to patients. The presence of specialized oncologists further backs high adoption rates.

Europe continues to secure the second-highest share in the keytruda industry owing to substantial cancer burden, strong healthcare infrastructure, and supportive reimbursement policies. Europe registers more than 4.4 million novel cancer cases every year, with head & neck, melanoma, and lung cancers leading, as per the European Cancer Information System (ECIS). These burgeoning cases propel the demand for advanced immunotherapies like Keytruda. Rising patient pool promises steady industry growth on the continent.

Moreover, European nations, especially France, Germany, and the UK, hold well-established oncology centers and hospitals capable of administering complex therapies. Advanced infusion and diagnostic facilities support broader and safer use of Keytruda. The infrastructure enables unified adoption of immunotherapy in both regional and urban centers. Several European nations offer substantial reimbursement for high-priced oncology drugs through national health services or private insurance. For instance, Germany's statutory health insurance encompasses approved immunotherapies, decreasing patient financial burden. These policies improve accessibility and fuel the industry's growth.

Keytruda Market: Competitive Analysis

The leading players in the global Keytruda market are:

- Merck & Co. Inc.

- Bristol-Myers Squibb Company

- Roche Holding AG

- Novartis AG

- AstraZeneca PLC

- Pfizer Inc.

- Amgen Inc.

- GlaxoSmithKline plc

- Sanofi S.A.

- Johnson & Johnson

- AbbVie Inc.

- Bayer AG

- Gilead Sciences Inc.

- Takeda Pharmaceutical Company Limited

- Daiichi Sankyo Company Limited

Keytruda Market: Key Market Trends

Growth in biomarker-driven treatments:

The use of biomarkers like MSI-H and PD-L1 is guiding patient selection for Keytruda therapy. Precision medicine promises high efficiency and decreases unnecessary exposure for non-responders. The adoption of biomarker-based protocols is augmenting the industry growth, mainly in the developed regions.

Expansion of combination therapies:

Keytruda is progressively used in combination with targeted therapy, chemotherapy, and other immunotherapies. Clinical studies show that combination regimens can enhance response rates and overall survival across multiple cancer types. This trend is expanding Keytruda's indications and reinforcing its industry rank.

Digital health and remote monitoring integration

Healthcare providers are progressively using telemedicine and digital tools to monitor Keytruda patients remotely. AI-driven platforms track treatment responses and adverse effects in real-time. This incorporation improves patient outcomes, adherence, and overall treatment efficiency.

The global Keytruda market is segmented as follows:

By Payer Type

- Commercial

- Medicare

- Medicaid

By Cancer Type

- Melanoma

- Lung Cancer

- Head and Neck Cancer

- Hodgkin Lymphoma

- Stomach Cancer

- Urothelial Carcinoma

By Distribution Channel

- Hospital Pharmacies

- Specialty Pharmacies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Keytruda (pembrolizumab) is an immunotherapy drug developed by Merck & Co. that works by blocking the PD-1 receptor, helping the immune system identify and attack cancer cells more efficiently. It is approved for treating different cancers, including lung, head & neck, melanoma, colorectal, and bladder cancers.

The global Keytruda market is projected to grow due to rising global cancer prevalence, increasing demand for personalized and targeted cancer therapies, and technological advancements in biomarker testing and diagnostics.

According to study, the global Keytruda market size was worth around USD 24.07 billion in 2024 and is predicted to grow to around USD 47.62 billion by 2034.

The CAGR value of the Keytruda market is expected to be around 8.90% during 2025-2034.

Emerging trends in the Keytruda market include combination therapies, early-stage cancer applications, biomarker-driven precision medicine, novel formulation innovations, and AI-based patient monitoring.

The Keytruda value chain includes clinical trials, research & development, manufacturing, marketing & distribution, regulatory approval, and patient administration.

North America is expected to lead the global Keytruda market during the forecast period.

The key players profiled in the global Keytruda market include Merck & Co., Inc., Bristol-Myers Squibb Company, Roche Holding AG, Novartis AG, AstraZeneca PLC, Pfizer Inc., Amgen Inc., GlaxoSmithKline plc, Sanofi S.A., Johnson & Johnson, AbbVie Inc., Bayer AG, Gilead Sciences, Inc., Takeda Pharmaceutical Company Limited, and Daiichi Sankyo Company, Limited.

Leading players are adopting strategies like acquisitions, market expansion, R&D collaborations, strategic partnerships, and patient support programs to strengthen their Keytruda presence.

The report examines key aspects of the Keytruda market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed