Global Isoprenol Market Size, Share, Growth Analysis Report - Forecast 2034

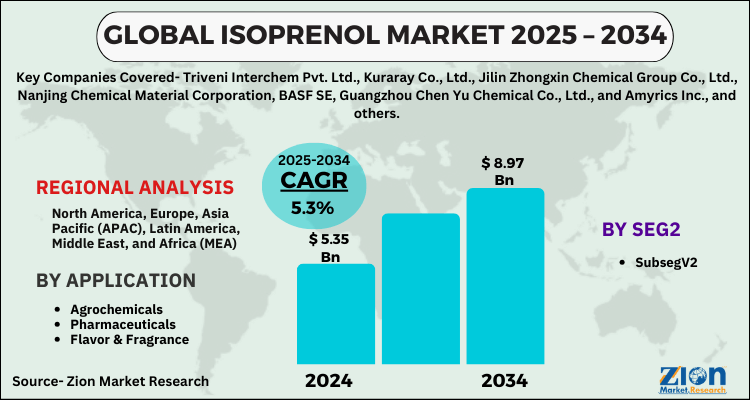

Isoprenol Market By Application (Agrochemicals, Pharmaceuticals, Flavor & Fragrance, and Polymers), By Seg2 (Subseg2), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

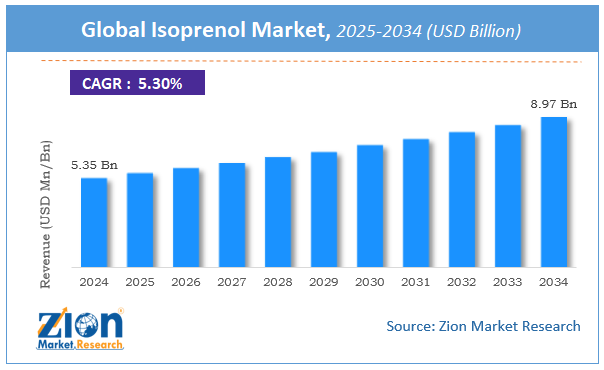

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.35 Billion | USD 8.97 Billion | 5.3% | 2024 |

Isoprenol Market Size

The global isoprenol market size was worth around USD 5.35 Billion in 2024 and is predicted to grow to around USD 8.97 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.3% between 2025 and 2034.

The report analyzes the global isoprenol market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the isoprenol industry.

Global Isoprenol Market: Overview

Isoprenol is a light yellow to a colorless liquid. It is also referred as 3-methyl-3-butene-1-ol. Isoprenol is manufactured industrially as an intermediate to prenol (3-methyl-3-butene-1-ol). It is mainly used as a building block for aromatic chemicals and for pharmaceutical active ingredients. Moreover, it also finds use in the production of dyes, solvents, and paints. Isoprenol is widely used in agrochemicals for producing insecticides and pesticides. Isoprenol has many advantages such as durability, high water reduction, and low dosage. It is also used for protection from corrosion of steel and is environmentally friendly in nature.

The isoprenol market is primarily driven by strong demand from agrochemical and pharmaceutical industry. Rising demand for aromatic chemicals for use in perfumes is also expected to boost the demand for isoprenol, thus driving the global isoprenol market in the forecast period. Isoprenol also finds use in the production of dyes, solvents, and paints. Thus, developing paints and coatings sector is one of the major driving factors for the growth of the isoprenol market. In addition, the growth in the construction industry due to the rapid urbanization in the emerging countries is likely to fuel the demand for isoprenol. This, in turn, is anticipated to be the main driving factor for the increase in worldwide isoprenol market in the coming years. However, stringent environmental regulations may hamper the market growth.

It is a hemiterpene alcohol and is referred by name 3-methylbut-3-en-1-ol. The compound is produced in factories as an intermediary to 3-methylbut-2-en-1-ol. The product is manufactured due to reaction taking place between isobutene and formaldehyde. Moreover, isoprenol is light yellow liquid and it offers myriad benefits including high water reduction, low dosage, and longevity. Furthermore, the chemical compound is utilized for protecting steel from getting corroded. Additionally, the compound is a key building block for aromatic chemicals. Apart from this, the compound plays a key role of pharmaceutical active constituents.

Key Insights

- As per the analysis shared by our research analyst, the global isoprenol market is estimated to grow annually at a CAGR of around 5.3% over the forecast period (2025-2034).

- Regarding revenue, the global isoprenol market size was valued at around USD 5.35 Billion in 2024 and is projected to reach USD 8.97 Billion by 2034.

- The isoprenol market is projected to grow at a significant rate due to rising demand in pharmaceuticals, agrochemicals, and flavoring agents.

- Based on Application, the Agrochemicals segment is expected to lead the global market.

- On the basis of Seg2, the SubsegK2 segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Furthermore, isoprenol finds massive application in agrochemicals. In addition to this, the compound finds huge application as raw material for manufacturing super plasticizer from polycarbonate. Massive need for high quality isoprenol across myriad end-use sectors will drive market trends.

Isoprenol Market: Growth Drivers

Thriving pharmaceutical sector and rise in use of aromatic chemicals in perfumes has driven product penetration in pharmaceutical & specialty chemicals industries, thereby driving market growth. In addition to this, a prominent increase in use of isoprenyl in paints & coatings industry will boost expansion of isoprenol industry. Increment in construction activities owing to swift urbanization in emerging economies will translate into humungous expansion of isoprenol industry. Rapid expansion of chemical sector is projected to open new vistas of growth for isoprenol market.

Furthermore, surging cases of crop infestation, launching of new farming techniques, and rise in demand for agrochemicals to improve crop yield will increase growth of isoprenol market. In addition to this, need for reducing crop loss is anticipated to generate new growth avenues for isoprenol industry in ensuing years. Huge rise in crude oil costs and surge in GHG emissions arising due to increase in its use will produce large demand for isoprenol. Preference for biofuels will further drive business growth. Rapidly expanding emulsifier market will favorably impact isoprenol market progress owing to product application in cosmetics & personal care items, cleansing items, and food & beverages.

Isoprenol Market: Segmentation Analysis

The global isoprenol market is segmented based on Purity, Application, End-Use Industry, and region.

Based on Purity, the global isoprenol market is divided into ≥98%, <98%.

On the basis of Application, the global isoprenol market is bifurcated into Agrochemicals, Fragrances, Pharmaceuticals, Food Additives, Others.

By End-Use Industry, the global isoprenol market is split into Agriculture, Cosmetics & Personal Care, Pharmaceutical, Food & Beverage, Chemicals.

Isoprenol Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Isoprenol Market |

| Market Size in 2024 | USD 5.35 Billion |

| Market Forecast in 2034 | USD 8.97 Billion |

| Growth Rate | CAGR of 5.3% |

| Number of Pages | 180 |

| Key Companies Covered | Triveni Interchem Pvt. Ltd., Kuraray Co., Ltd., Jilin Zhongxin Chemical Group Co., Ltd., Nanjing Chemical Material Corporation, BASF SE, Guangzhou Chen Yu Chemical Co., Ltd., and Amyrics Inc., and others. |

| Segments Covered | By Application, By Seg2, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Isoprenol Market: Regional Analysis

Europe To Dominate Isoprenol Industry In 2025-2034

Growth of European market over forecasting timeline is subject to humungous demand for isoprenol in European countries such as Germany. Furthermore, rise in use of product in pharmaceutical, aroma chemicals, and agrochemicals in country will proliferate regional market size. Additionally, aroma chemicals are utilized in fragrance & flavor constituents in European countries. The product is also used as intermediate chemical for making adhesives that are extensively used in vehicles, electrical & electronics, and construction. Increase in research & development ventures pertaining to producing of green products for minimizing carbon emissions will drive regional market penetration.

Isoprenol Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the isoprenol market on a global and regional basis.

The global isoprenol market is dominated by players like:

- Triveni Interchem Pvt. Ltd.

- Kuraray Co.

- Ltd.

- Jilin Zhongxin Chemical Group Co.

- Ltd.

- Nanjing Chemical Material Corporation

- BASF SE

- Guangzhou Chen Yu Chemical Co.

- Ltd.

- and Amyrics Inc.

The global isoprenol market is segmented as follows;

By Application

- Agrochemicals

- Pharmaceuticals

- Flavor & Fragrance

- and Polymers

By Seg2

- SubsegV2

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed