IoT in Defense Market Size, Share Report, Analysis, Trends, Growth, 2034

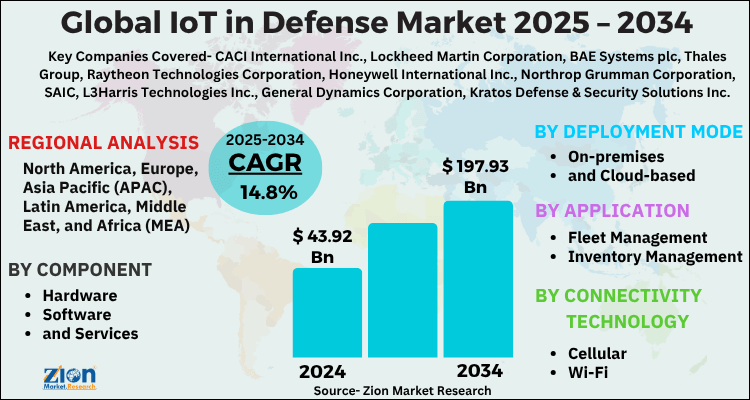

IoT in Defense Market By Components (Hardware, Software, And Services), By Connectivity Technology (Cellular, Wi-Fi, Satellite Communication, and Radio Frequency), By Deployment Mode (On-premises and Cloud-based), By Application (fleet management, inventory management, equipment maintenance, security, and others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 43.92 Billion | USD 197.93 Billion | 14.8% | 2024 |

IoT in Defense Market: Industry Perspective

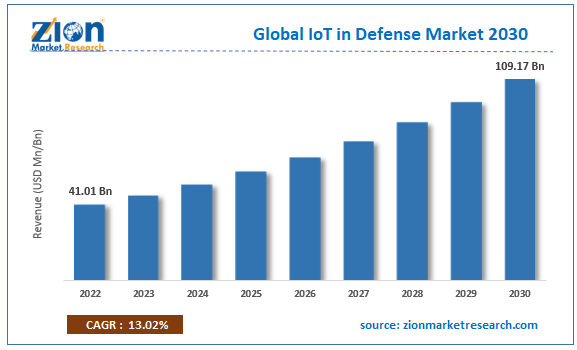

The global IoT in defense market size was worth around USD 43.92 billion in 2024 and is predicted to grow to around USD 197.93 billion by 2034 with a compound annual growth rate (CAGR) of roughly 14.8% between 2025 and 2034. The report analyzes the global IoT in defense market's drivers, restraints/challenges, and the effect they have on the demand during the projection period. In addition, the report explores emerging opportunities in the IoT in defense industry.

IoT in Defense Market: Overview

IoT technology is known as the Internet of Things. It refers to the use of advanced technological tools such as software, sensors, and communication devices to connect several systems capable of exchanging information and data through the internet. IoT is driven by concepts of computer science engineering, communication technology, and electronics, as these components form the main pillar of using IoT in several end-user applications, including the growing defense sector.

The changing national security needs of developing and developed countries have created a need for integrating sophisticated and functional technologies to maintain and optimally use defense equipment. IoT in defense allows countries to undertake intelligent warfare by facilitating modern battle operations that are a result of the efficient integration of human knowledge and technological capabilities of IoT devices. Physical objects used by defense units are embedded with sensors and other equipment that allow each object to communicate with other defense objects. Some of the most commonly collected and exchanged data consist of heart rate, fingerprints, face, and facial expression.

Key Insights

- As per the analysis shared by our research analyst, the global IoT in defense market is estimated to grow annually at a CAGR of around 14.8% over the forecast period (2025-2034).

- Regarding revenue, the global IoT in defense market size was valued at around USD 43.92 billion in 2024 and is projected to reach USD 197.93 billion by 2034.

- The IoT in defense market is projected to grow at a significant rate due to the growing need for enhanced situational awareness, surveillance, and real-time data in modern warfare.

- Based on the Component, the Hardware segment is expected to lead the global market.

- On the basis of Connectivity Technology, the Cellular segment is growing at a high rate and will continue to dominate the global market.

- Based on the Deployment Mode, the On-premises segment is projected to swipe the largest market share.

- By Application, the Fleet Management segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

IoT in Defense Market: Growth Drivers

Rising applications in fleet and ammunition management to drive market growth

The global IoT in defense market is projected to grow owing to the increasing application of Internet of Things technology in defense fleet and ammunition management. With the constant addition of new defense equipment and other technologies, security agencies are starting to invest in intelligent tools that help them maintain a large fleet of multi-billion-dollar weapons and gear. This helps the agencies stay prepared in case of a sudden need for weapon deployment.

Fleet management is crucial for controlling costs and optimizing the utilization of resources. The changing global order and increasing social-political tensions between cross-border territories have resulted in more countries ramping up their defense investments to ensure national security. Regional governments are either collaborating with transcontinental suppliers of weapons for new equipment or investing in domestic research & development. In August 2022, the United States announced its approval to make a sales deal with the Middle Eastern countries of Saudi Arabia and the United Arab Emirates to help the latter countries counteract the defense activities of Iran. The deal is worth more than USD 5 billion

Growing demand for advanced defense warheads to propel further sales

The changing global defense ecosystems have pushed weapon manufacturers and suppliers to invest in intense research and innovation. Key defense equipment manufacturers are using advanced technologies such as the Internet of Things, Artificial Intelligence, and Machine Learning to build highly effective military gear. The annual report of Lockheed Martin, the world’s largest manufacturer of defense machinery, suggested that the company spends nearly USD 3.4 billion in independent research and development.

IoT in Defense Market: Restraints

Threats posed by cyber attackers to restrict market growth

The global IoT in defense market growth is projected to be restricted owing to the increasing threats posed by cyber criminals, including terrorist groups and digital hijackers. Research indicates that 2022 was considered a critical point in cybersecurity, mainly due to the growing penetration of Internet of Things technology. Although defense equipment cannot be easily hacked, the increasing proliferation of IoT increases the risk of cyberattacks. In April 2023, multiple reports emerged detailing China’s investment in building cyber weapons that can hijack the enemy’s satellite. In such situations, IoT systems create more vulnerabilities.

IoT in Defense Market: Opportunities

Growing collaboration between technology companies and weapons manufacturers creates growth opportunities

The IoT in the defense industry growth may be further propelled by the increasing collaboration between technology companies and leading manufacturers of modern-age, highly advanced military weapons or defense tools. In October 2022, Lockheed Martin announced its partnership with Red Hat Inc. The companies aim to leverage Artificial Intelligence (AI) technologies to help the former improve its military platform services. Lockheed Martin has already adopted the cutting-edge technology Red Hat Device Edge. On the other hand, in April 2023, India and the US announced bilateral trade deals for the manufacturing of sophisticated and modern military armaments.

Rising development of affordable IoT solutions opens new expansion windows

The rising demand for IoT solutions in the defense sector has resulted in higher initiatives to control the overall cost of IoT technologies. Developing more cost-effective alternatives will allow emerging countries to invest in IoT in their national defense strategies. In September 2023, Swisscom, a Europe-based telecommunication company, launched Enea Aptilo Connectivity Control Service (IoT CCS). The new tool is more affordable and efficient for projects using a lesser number of devices. Such innovations are likely to attract more buyers from the military, army, and naval defense units.

IoT in Defense Market: Challenges

Political turmoil surrounding defense dealings may challenge market expansion

The global IoT in defense market growth trend is likely to be challenged by the increasing political turmoil that surrounds all forms of defense dealings or undertakings. National defense is an extremely sensitive industry and it is subject to strict guidelines that regulate trade in military equipment and associated technologies. However, it also leads to more challenges for industry players since they have to navigate through a complex web of governing policies.

IoT in Defense Market: Segmentation

The global IoT in defense market is segmented based on components, connectivity technology, deployment mode, application, and region.

In terms of components, the global IoT in defense market is divided into hardware, software, and services. The hardware segment is growing at a high rate and is projected to dominate the global market.

Based on connectivity technology, the IoT in defense industry segments are cellular, wi-fi, satellite communication, and radio frequency. In 2024, the highest growth was observed in the cellular segment as a result of the greater availability of cellular networks and the changing landscape around machine-to-machine (M2M) technology. Increasing investments in the 5G network are expected to broaden the growth prospects of IoT in defense and rapid communication is a critical aspect for security weapons. The global 5G industry is currently valued at less than USD 100 billion, but it has the potential to cross USD 1 trillion by the end of 2030 as end-consumer needs are growing exponentially.

By deployment mode, the global IoT in defense market is divided into on-premises and cloud-based. The on-premises segment is expected to dominate the global market during the forecast period.

Based on application, the IoT in defense industry is divided into fleet management, inventory management, equipment maintenance, security, and others. In 2024, the highest growth was registered in the fleet management segment due to the growing need to ensure optimum utilization of the defense equipment fleet. The use of IoT allows security units to stay prepared in case of an urgent event and mobilize ammunition that is best suited for the incoming situation. Increasing defense equipment drills have also been a crucial driver for the segment. In 2021, the US states held more than 100 drills near China’s border, as per reports.

IoT in Defense Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | IoT in Defense Market |

| Market Size in 2024 | USD 43.92 Billion |

| Market Forecast in 2034 | USD 197.93 Billion |

| Growth Rate | CAGR of 14.8% |

| Number of Pages | 210 |

| Key Companies Covered | CACI International Inc., Lockheed Martin Corporation, BAE Systems plc, Thales Group, Raytheon Technologies Corporation, Honeywell International Inc., Northrop Grumman Corporation, SAIC, L3Harris Technologies Inc., General Dynamics Corporation, Kratos Defense & Security Solutions Inc., Siemens AG, Boeing Company, Leidos Holdings Inc., Cisco Systems Inc., and others., and others. |

| Segments Covered | By Component, By Connectivity Technology, By Deployment Mode, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

IoT in Defense Market: Regional Analysis

North America will lead with the highest growth rate

The global IoT in defense market will be dominated by North America. The US is currently the largest exporter of arms and ammunition. It also tops the ranks in terms of countries with superior-grade defense equipment. Over the years, the US has managed to hold its position owing to constant research and development. The country has some of the largest manufacturers of defense weapons such as Lockheed Martin which is currently worth USD 104 billion. Furthermore, it also has a large presence of IoT developers which allows both units to undertake seamless collaboration for further proliferation of IoT in defense equipment. The increasing collaboration between the US and other countries for the supply of world-class warheads is likely to boost regional revenue. In August 2023, the US sanctioned arms sales worth USD 500 million to Taiwan as tensions with China continued to grow. Europe on the other hand, is projected to grow steadily. France will lead the regional revenue during the forecast period.

IoT in Defense Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the IoT in defense market on a global and regional basis.

The global IoT in defense market is led by players like:

- CACI International Inc.

- Lockheed Martin Corporation

- BAE Systems plc

- Thales Group

- Raytheon Technologies Corporation

- Honeywell International Inc.

- Northrop Grumman Corporation

- SAIC

- L3Harris Technologies Inc.

- General Dynamics Corporation

- Kratos Defense & Security Solutions Inc.

- Siemens AG

- Boeing Company

- Leidos Holdings Inc.

- Cisco Systems Inc.

The global IoT in defense market is segmented as follows:

By Components

- Hardware

- Software

- Services

By Connectivity Technology

- Cellular

- Wi-Fi

- Satellite Communication

- Radio Frequency

By Deployment Mode

- On-premises

- Cloud-based

By Application

- Fleet Management

- Inventory Management

- Equipment Maintenance

- Security

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

IoT in defense allows countries to undertake intelligent warfare by facilitating modern battle operations that are a result of the efficient integration of human knowledge and technological capabilities of IoT devices.

The global IoT in defense market is expected to grow due to growing need for enhanced situational awareness, surveillance, and real-time data in modern warfare.

According to a study, the global IoT in defense market size was worth around USD 43.92 Billion in 2024 and is expected to reach USD 197.93 Billion by 2034.

The global IoT in defense market is expected to grow at a CAGR of 14.8% during the forecast period.

North America is expected to dominate the IoT in defense market over the forecast period.

Leading players in the global IoT in defense market include CACI International Inc., Lockheed Martin Corporation, BAE Systems plc, Thales Group, Raytheon Technologies Corporation, Honeywell International Inc., Northrop Grumman Corporation, SAIC, L3Harris Technologies Inc., General Dynamics Corporation, Kratos Defense & Security Solutions Inc., Siemens AG, Boeing Company, Leidos Holdings Inc., Cisco Systems Inc., and others., among others.

The report explores crucial aspects of the IoT in defense market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed