Intravenous Immunoglobulin Market Size, Share, And Growth Report 2032

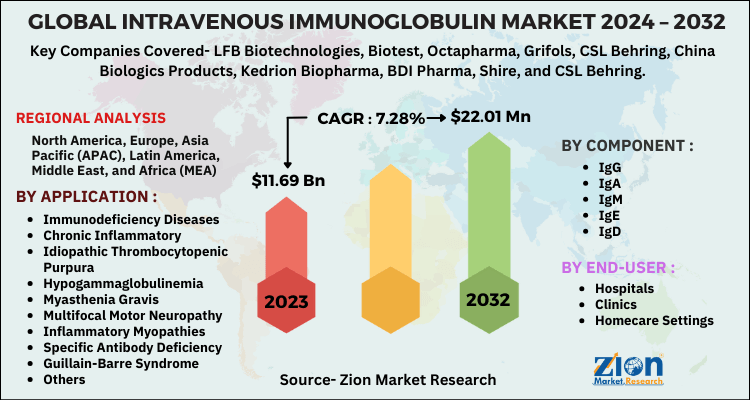

Intravenous Immunoglobulin Market by Component (IgG, IgA, IgM, IgE, and IgD), by Application (Immunodeficiency Diseases, Chronic Inflammatory Demyelinating Polyneuropathy, Myasthenia Gravis, Idiopathic Thrombocytopenic Purpura, Hypogammaglobulinemia, Multifocal Motor Neuropathy, Inflammatory Myopathies, Specific Antibody Deficiency, Guillain-Barre Syndrome, and Others), by End-User (Hospitals, Clinics, and Homecare Settings), and By Region - Global And Regional Industry Overview, market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

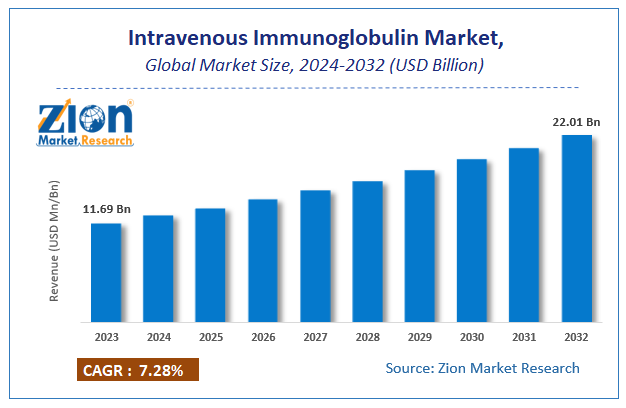

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 11.69 Billion | USD 22.01 Billion | 7.28% | 2023 |

Intravenous Immunoglobulin Market: Size

The global Intravenous Immunoglobulin Market size was worth around USD 11.69 billion in 2023 and is predicted to grow to around USD 22.01 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.28% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the Intravenous Immunoglobulin Market on a global and regional level.

Intravenous Immunoglobulin Market: Overview

Intravenous immunoglobulin is a blood product that is prepared from the serum of about 1,000 to 10,000 donors per batch. This type of treatment is used for treating patients with antibody deficiencies. For this purpose, IVIG is used at a replacement dose of 200–400 mg/kg body weight, which is given approximately for about 3-weeks. Immunoglobulins are glycoproteins that are often produced in the blood plasma, which respond to antigens present in the body. They are obtained from the blood via fractionation and are purified for various applications.

Significant rise in the global geriatric population, increase in the number of hemophilic patients, improved technology for high production of intravenous immunoglobulin, and enhancements in the purification techniques are the major factors fueling the global intravenous immunoglobulin market. Moreover, the increasing government initiatives for treating hemophilic patients and rising cases of CIDP and hypogammaglobulinemia are also fueling the market. However, strict government regulations pertaining to intravenous immunoglobulin usage due to its harmful side-effects may hinder the market globally. Alternatively, growing per capita disposable income of people across the world, rising active role of distributors, developing advanced healthcare facilities, and increasing awareness among people are some other factors further fueling the intravenous immunoglobulin market globally.

Intravenous Immunoglobulin Market: Segmentation

The study provides a decisive view of the intravenous immunoglobulin market by component, application, end-user, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on component, the intravenous immunoglobulin market includes IgM, IgA, IgE, IgD, and IgG.

By application, the market includes immunodeficiency diseases, Guillain-Barre syndrome, hypogammaglobulinemia, multifocal motor neuropathy, CIDP (chronic inflammatory demyelinating polyneuropathy), thrombocytopenic purpura, specific antibody deficiency, inflammatory myopathies, myasthenia gravis, and others.

Based on end-user, the market for intravenous immunoglobulin comprises hospitals, homecare settings, and clinics.

Intravenous Immunoglobulin Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Intravenous Immunoglobulin Market |

| Market Size in 2023 | USD 11.69 Billion |

| Market Forecast in 2032 | USD 22.01 Billion |

| Growth Rate | CAGR of 7.28% |

| Number of Pages | 110 |

| Key Companies Covered | LFB Biotechnologies, Biotest, Octapharma, Grifols, CSL Behring, China Biologics Products, Kedrion Biopharma, BDI Pharma, Shire, and CSL Behring |

| Segments Covered | By Product Type, By Application and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Intravenous Immunoglobulin Market: Regional Analysis

The regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America is likely to dominate the global intravenous immunoglobulin market, owing to the early introduction of highly developed techniques, increasing hemophilic patients due to changing lifestyle patterns, and rising disposable income of the regional population. The Asia Pacific region is anticipated to show a high rate of growth in the upcoming years, owing to the rising investments and funding by private organizations, active participation of online and offline distribution networks, increasing population, growing establishments of health clinics and hospitals in India and China, and rising number of patients suffering from hemophilic diseases.

Intravenous Immunoglobulin Market: Competitive Players

Some major players of the global intravenous immunoglobulin market are:

- LFB Biotechnologies

- Biotest

- Octapharma

- Grifols

- CSL Behring

- China Biologics Products

- Kedrion Biopharma

- BDI Pharma

- Shire

- CSL Behring

The Global Intravenous Immunoglobulin Market is segmented as follows:

Global Intravenous Immunoglobulin Market: Component Analysis

- IgG

- IgA

- IgM

- IgE

- IgD

Global Intravenous Immunoglobulin Market: Application Analysis

- Immunodeficiency Diseases

- Chronic Inflammatory Demyelinating Polyneuropathy (CIDP)

- Idiopathic Thrombocytopenic Purpura

- Hypogammaglobulinemia

- Myasthenia Gravis

- Multifocal Motor Neuropathy

- Inflammatory Myopathies

- Specific Antibody Deficiency

- Guillain-Barre Syndrome

- Others

Global Intravenous Immunoglobulin Market: End-User Analysis

- Hospitals

- Clinics

- Homecare Settings

Global Intravenous Immunoglobulin Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Immunoglobulins are glycoproteins that are often produced in the blood plasma, which respond to antigens present in the body. Intravenous immunoglobulin is a blood product that is prepared from the serum of about 1,000 to 10,000 donors per batch.

According to study, the Intravenous Immunoglobulin Market size was worth around USD 11.69 billion in 2023 and is predicted to grow to around USD 22.01 billion by 2032.

The CAGR value of Intravenous Immunoglobulin Market is expected to be around 7.28% during 2024-2032.

North America has been leading the Intravenous Immunoglobulin Market and is anticipated to continue on the dominant position in the years to come.

The Intravenous Immunoglobulin Market is led by players like LFB Biotechnologies, Biotest, Octapharma, Grifols, CSL Behring, China Biologics Products, Kedrion Biopharma, BDI Pharma, Shire, and CSL Behring.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed