Insurance Agency Portal Market Size, Share, Trends, Growth & Forecast 2034

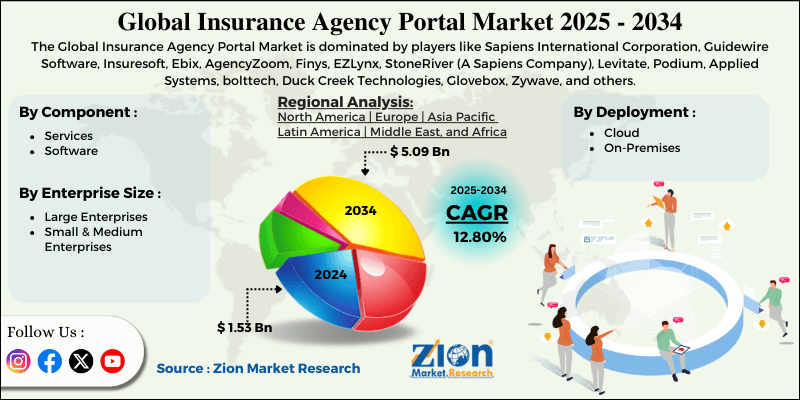

Insurance Agency Portal Market By Component (Services and Software), By Deployment (Cloud and On-Premises), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

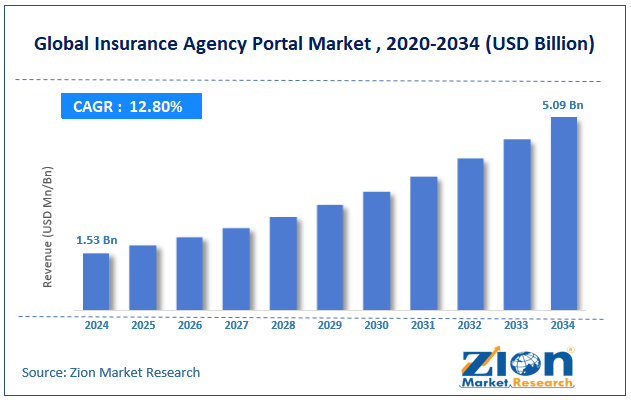

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.53 Billion | USD 5.09 Billion | 12.80% | 2024 |

Insurance Agency Portal Industry Perspective:

The global insurance agency portal market size was worth around USD 1.53 billion in 2024 and is predicted to grow to around USD 5.09 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.80% between 2025 and 2034.

Insurance Agency Portal Market: Overview

An insurance agency portal is a digital platform designed for professionals in the insurance sector to manage their businesses. It is primarily designed to assist insurance agents and brokers in performing their job roles and ensuring smooth business operations. Insurance agency portals are used for business activities such as policy management, insurance quotes, and customer relationship management. According to market analysis, the growing rate of digitization in the finance industry, including the insurance sector, is fueling demand for efficient insurance agency portals. In addition to this, the growing number of insurance seekers among the ordinary population, along with increased demand for business-based insurance schemes, is further propelling market revenue.

Some of the key advantages of incorporating digital tools in managing insurance policies and customers include higher efficiency, reduced risk of errors, enhanced collaboration, and improved customer relationships. During the projection period, advancements in portal technology, such as the integration of Artificial Intelligence (AI) features and the rising expansion of Software-as-Service (SaaS) in the technology sector, will further create new growth opportunities for the market players. However, increasing risks of cyber-attacks and digital crimes may impede market expansion in the long run.

Key Insights:

- As per the analysis shared by our research analyst, the global insurance agency portal market is estimated to grow annually at a CAGR of around 12.80% over the forecast period (2025-2034)

- In terms of revenue, the global insurance agency portal market size was valued at around USD 1.53 billion in 2024 and is projected to reach USD 5.09 billion by 2034.

- The insurance agency portal market is projected to grow at a significant rate due to the growing number of insurance seekers worldwide.

- Based on the component, the software segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the enterprise size, the larger enterprise segment is anticipated to command the largest market share.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Insurance Agency Portal Market: Growth Drivers

Growing number of insurance seekers worldwide to encourage higher adoption of digital assisting tools

The global insurance agency portal market is expected to benefit from the growing number of insurance seekers worldwide. As the client data of insurance brokers or agents grows, they are more likely to invest in digital tools such as insurance agency portals to better manage their tasks. Growing awareness of the numerous benefits of insurance policies, along with the increased disposable income of the general population, is propelling demand for effective insurance policies. According to recent findings, around 9% of China’s population holds a life insurance policy.

Similarly, in the UK, around 30.0% of the population has invested in policies related to life insurance. In addition to this, the extensive availability of different types of insurance policies has further encouraged increased adoption among the ordinary population. The wide range of options promotes inclusivity as insurance companies offer policies depending on the regional demographic, income level, and future needs.

Moreover, businesses worldwide are opting for comprehensive insurance plans as business risks continue to rise. Changing global trading relationships, rising geopolitical tensions, and war situations have put businesses at heavy risk, and efficient insurance policies are an excellent way of mitigating or minimizing damages caused by such vulnerabilities.

Will risk management and regulatory requirements encourage increased demand for the insurance agency portal market?

The global insurance industry is one of the world’s most strictly regulated sectors due to the large volumes of stakeholders it affects and the overall sensitive nature of the market. The ever-evolving government regulations concerning the insurance sector have encouraged further adoption of digital portals explicitly designed for insurance brokers and agents. These tools can assist insurance companies in achieving timely and 100% compliance, preventing any form of penalties.

On the other hand, the global insurance agency portal market further benefits from the growing necessity in the insurance industry to mitigate any form of monetary or non-monetary risks.

Insurance Agency Portal Market: Restraints

How will the growing rate of cybercrime and digital theft limit the revenue of the insurance agency portal market?

The global insurance agency portal industry is expected to be restricted due to risks associated with growing cybercrimes worldwide. Since digital portals primarily operate through the Internet, they are vulnerable to cyber-attacks and digital crimes. In October 2024, Star Health Insurance, one of India’s leading health insurers, became a victim of a massive data breach affecting more than 31 million of its customers. Similar attacks have been reported worldwide. The ongoing technological sophistication reported in malware and computer viruses will further discourage the higher adoption of digital portals among insurance companies.

Insurance Agency Portal Market: Opportunities

Does increased integration of next-generation technologies in portals create new growth opportunities for the insurance agency portal industry?

The global insurance agency portal market is expected to experience new growth opportunities as market players provide high-performance and comprehensive tools to portal seekers. Developers of digital tools for insurance agencies are increasingly focusing on enhancing security features, providing real-time assistance, and assisting insurance brokers in meeting the increasing demand for personalized policies.

In August 2024, RSA Insurance, a leading insurer in the UK region, announced the launch of a new and improved broker and customer claims portal. The company is the first organization in the UK to implement the Guidewire Cloud solution. The claims portal delivers a scalable and secure cloud environment for its customers.

In February 2025, Sapiens International Corporation announced the launch of Sapiens UnderwritingPro v14. It is the latest version of the company’s automated underwriting and new business case management platform designed for life & annuities insurers. The tool is equipped with AI features for better performance.

Additionally, the rising proliferation of cloud-based positions will further create demand for insurance agency portals, according to market analysis. The ongoing advancements in SaaS models, allowing greater flexibility to end-users of advanced platforms, could prove beneficial for companies developing insurance agency portals.

Insurance Agency Portal Market: Challenges

Integration with existing systems and employee training-related concerns remain key challenges

The global insurance agency portal industry is expected to face challenges related to the smooth integration of the solution with the existing infrastructure of a business. In addition to this, incorporating insurance agency portals in businesses will require companies to invest in training their workforce, which can be time-consuming. Businesses may also record hesitancy among employees toward technology-related changes.

Insurance Agency Portal Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insurance Agency Portal Market |

| Market Size in 2024 | USD 1.53 Billion |

| Market Forecast in 2034 | USD 5.09 Billion |

| Growth Rate | CAGR of 12.80% |

| Number of Pages | 214 |

| Key Companies Covered | Sapiens International Corporation, Guidewire Software, Insuresoft, Ebix, AgencyZoom, Finys, EZLynx, StoneRiver (A Sapiens Company), Levitate, Podium, Applied Systems, bolttech, Duck Creek Technologies, Glovebox, Zywave, and others. |

| Segments Covered | By Component, By Deployment, By Enterprise Size, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Insurance Agency Portal Market: Segmentation

The global insurance agency portal market is segmented based on component, deployment, enterprise size, and region.

Based on the components, the global market segments are services and software. In 2024, the highest revenue was recorded in the software segment. It is the primary component of the tool and hence generated significant investment. In addition to this, the rising technological advancements, such as AI integration and compatibility with modern cloud computing tools, will further improve segmental revenue in the future. The average cost of an enterprise-level portal can range between USD 155,000 and USD 550,000.

Based on deployment, the global insurance agency portal industry is divided into cloud and on-premises.

Based on the enterprise size, the global market divisions are large enterprises and small & medium enterprises. In 2024, the larger enterprises segment dominated the market. Such companies generally employ an extensive number of brokers with a sales force reaching more than 100,000 employees and dealing with multiple clients across the globe. In addition to this, they have higher disposable funds that can be allotted to expensive insurance agency portals, further helping the segment thrive.

Insurance Agency Portal Market: Regional Analysis

What factors help Europe emerge as a crucial player in the insurance agency portal market?

The global insurance agency portal market is anticipated to be led by Europe during the forecast period. The primary reason for regional dominance is the presence of a structurally evolving regulatory environment inciting customers and business interests. For instance, the increasing penetration of AI across industries was influential in the launch of the European Artificial Intelligence Act (EU AI Act), which came into existence on 1 August 2024.

According to the latest reports, the European Union is expected to finalize the Code of Practice by 2 May 2025. It will enable insurance companies in the region to gain a deeper understanding of the act. A major segment of the initiative will require companies integrating AI systems in insurance companies across European nations to be subject to strict legal frameworks to ensure that their workforce has sufficient AI literacy by February 2025.

In addition to this, the growing rate of digital technology adoption among regional players will further facilitate higher revenue in Europe. In October 2020, Beazley, a British insurance company, announced the launch of a global broker portal focusing on the growing digital healthcare sector.

Insurance Agency Portal Market: Competitive Analysis

The global insurance agency portal market is led by players like:

- Sapiens International Corporation

- Guidewire Software

- Insuresoft

- Ebix

- AgencyZoom

- Finys

- EZLynx

- StoneRiver (A Sapiens Company)

- Levitate

- Podium

- Applied Systems

- bolttech

- Duck Creek Technologies

- Glovebox

- Zywave

The global insurance agency portal market is segmented as follows:

By Component

- Services

- Software

By Deployment

- Cloud

- On-Premises

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An insurance agency portal is a digital platform designed for professionals in the insurance sector to manage their businesses.

The global insurance agency portal market is expected to benefit from the growing number of insurance seekers worldwide.

According to study, the global insurance agency portal market size was worth around USD 1.53 billion in 2024 and is predicted to grow to around USD 5.09 billion by 2034.

The CAGR value of the insurance agency portal market is expected to be around 12.80% during 2025-2034.

The global insurance agency portal market is anticipated to be led by Europe during the forecast period.

The global insurance agency portal market is led by players like Sapiens International Corporation, Guidewire Software, Insuresoft, Ebix, AgencyZoom, Finys, EZLynx, StoneRiver (A Sapiens Company), Levitate, Podium, Applied Systems, bolttech, Duck Creek Technologies, Glovebox, and Zywave.

The report explores crucial aspects of the insurance agency portal market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed