Industrial Tubes Market Size, Share, Trends, Growth 2032

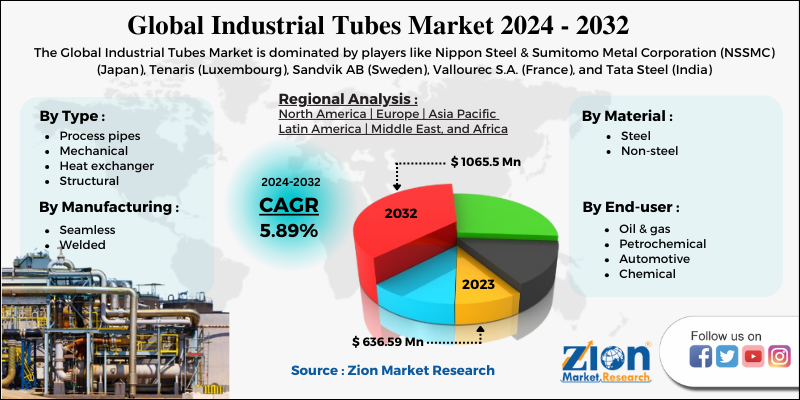

Industrial Tubes Market By Type (Process pipes, mechanical, heat exchanger, structural), By Material (Steel, Non-steel), By Manufacturing (Seamless, Welded), By End user (Oil & gas, Petrochemical, Automotive, Chemical)- Global Industry Perspective Comprehensive Analysis and Forecast, 2024 - 2032

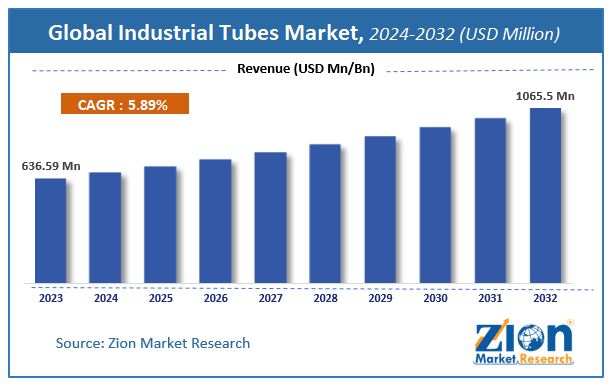

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 636.59 Million | USD 1065.5 Million | 5.89% | 2023 |

Industrial Tubes Market Insights

According to a report from Zion Market Research, the global Industrial Tubes Market was valued at USD 636.59 Million in 2023 and is projected to hit USD 1065.5 Million by 2032, with a compound annual growth rate (CAGR) of 5.89% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Industrial Tubes industry over the next decade.

Global Industrial Tubes Market: Overview

Industrial tubes are manufactured from steel and have the ability to proficiently handle the tough conditions experienced in the oil & gas reservoirs from which hydrogen sulfide, carbon dioxide emissions, and other compounds are ejected. Industrial tubes are commonly used for applications like coiled tubing and pipe tracing systems in process utilities. The operational efficiencies of production facilities are affected by growing energy loss issues in different industries, especially those located in colder areas. The implementation of a heat tracing device in plants is therefore expected to be promoted, thus providing an impetus for the growth of the demand for industrial pipes over the forecast period.

Global Industrial Tubes Market: Growth Factors

The rise in the number of activities witnessed across the global petrochemical and chemical sectors are the vital aspects stimulating the industrial tubes market trends. Furthermore, the thriving energy & power sector is also catapulting the sales of industrial tubes across the globe. Furthermore, the massive use of the product in oil & gas, chemical, automotive, construction, and petrochemical sectors will further increase the global market penetration rate. This, in turn, will amplify the scope of the business space in the coming decade.

Flourishing these industries will help the industrial tube market reach scalable heights. In addition, the high durability of steel tubes along with their outstanding rust resistance, weldability, and chemical property resulting in their massive use will drive the industrial tubes market size. With the growing trend toward the manufacturing of eco-friendly products and as a part of corporate social responsibility, manufacturers are trying to manufacture eco-friendly industrial tubes, thereby augmenting the scope of the business over the next decade.

Global Industrial Tubes Market: Segmentation

The global industrial tube market can be classified based on type, material, manufacturing, and end-user.

Based on the type, the market is sectored into process pipes, mechanical, heat exchanger, and structural.

On the basis on material, the market is segmented into steel and non-steel.

On the basis of manufacturing, the industrial tube market is classified into seamless and welded.

Based on the end –user, the market is divided into oil & gas, petrochemical, automotive, and chemical.

Industrial Tubes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Tubes Market |

| Market Size in 2023 | USD 636.59 Million |

| Market Forecast in 2032 | USD 1065.5 Million |

| Growth Rate | CAGR of 5.89% |

| Number of Pages | 110 |

| Key Companies Covered | Nippon Steel & Sumitomo Metal Corporation (NSSMC) (Japan), Tenaris (Luxembourg), Sandvik AB (Sweden), Vallourec S.A. (France), and Tata Steel (India) |

| Segments Covered | By Type, By Material, By Manufacturing, By End-User And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Industrial Tubes Market: Regional Analysis

Based on regions, the global industrial tubes market can be divided into five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Asia Pacific market is likely to contribute majorly towards the market share during the estimated timespans. The region's most densely populated regions comprising of China and India and these countries are rapidly experiencing large production of petrochemicals, specialty chemicals, and other chemicals with enhanced use of chemical goods. In addition, automobile production is also expected to grow significantly with the rise in the disposable income of the middle-class population. The industrial tubes market is, therefore, expected to experience a positive growth trend in the automotive industry. The thriving construction sector is also expected to witness moderate demand for industrial tubes with the growth in the commercial infrastructure in key regions. With the increase in APAC’s natural gas demand, the market in the region is likely to touch new growth horizons in the near future.

Massive product demand in the United States of America and economies of scale in the manufacturing of industrial tubes in the country will drive the growth of the industrial tubes market in North America. Additionally, Europe, LATAM, and the MEA markets have huge growth potential and will elevate the growth trajectory of the global industrial tubes market in the coming decade.

Global Industrial Tubes Market: Competitive Players

Some of the key players in the industrial tubes market are

- Nippon Steel & Sumitomo Metal Corporation (NSSMC) (Japan)

- Tenaris (Luxembourg)

- Sandvik AB (Sweden)

- Vallourec S.A. (France)

- Tata Steel (India)

The report segments the Global Industrial Tubes market as follows:

Global Industrial Tubes Market: Type Segment Analysis

- Process pipes

- Mechanical

- Heat exchanger

- Structural

Global Industrial Tubes Market: Material Segment Analysis

- Steel

- Non-steel

Global Industrial Tubes Market: Manufacturing Segment Analysis

- Seamless

- Welded

Global Industrial Tubes Market: End-user Segment Analysis

- Oil & gas

- Petrochemical

- Automotive

- Chemical

Global Industrial Tubes Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of The Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial tubes are hollow cylindrical structures that are intended for industrial use and are constructed from a variety of materials, including metal, plastic, and rubber. They fulfil a variety of functions, such as the transportation of fluids, gases, and substances, as well as the provision of structural support and protection for components in a variety of machinery and systems.

The demand for industrial tubes that are both durable and efficient is on the rise as a result of the ongoing development of infrastructure, which includes transportation, utilities, and energy initiatives.

According to a report from Zion Market Research, the global Industrial Tubes Market was valued at USD 636.59 Million in 2023 and is projected to hit USD 1065.5 Million by 2032.

According to a report from Zion Market Research, the global Industrial Tubes Market a compound annual growth rate (CAGR) of 5.89% during the forecast period 2024-2032.

Massive product demand in the United States of America and economies of scale in the manufacturing of industrial tubes in the country will drive the growth of the industrial tubes market in North America. Additionally, Europe, LATAM, and the MEA markets have huge growth potential and will elevate the growth trajectory of the global industrial tubes market in the coming decade.

Some of the key players in the industrial tubes market are Nippon Steel & Sumitomo Metal Corporation (NSSMC) (Japan), Tenaris (Luxembourg), Sandvik AB (Sweden), Vallourec S.A. (France), and Tata Steel (India).

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed