Industrial Rubber Product Market Size, Share, Trends, Growth and Forecast 2034

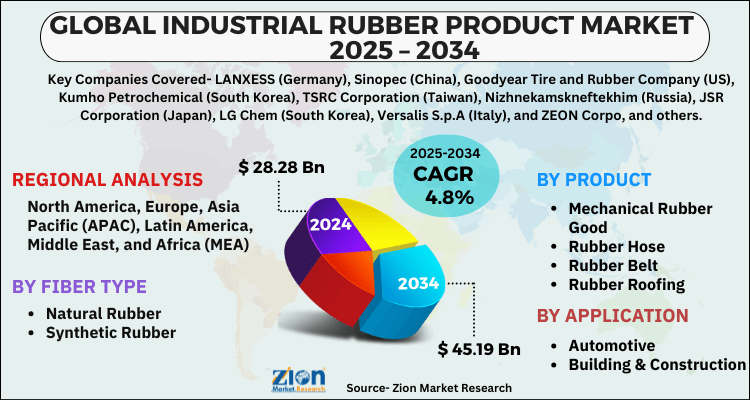

Industrial Rubber Product Market By Type (Natural Rubber, Synthetic Rubber), By Product (Mechanical Rubber Goods, Rubber Hose, Rubber Belt, Rubber Roofing, Others), By Application (Automotive, Building & Construction, Industrial Manufacturing, Polymer Modification, Wire & Cable, Electrical & Electronics, Bitumen Modification, Coating, Sealant, & Adhesive, Medical & Healthcare, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

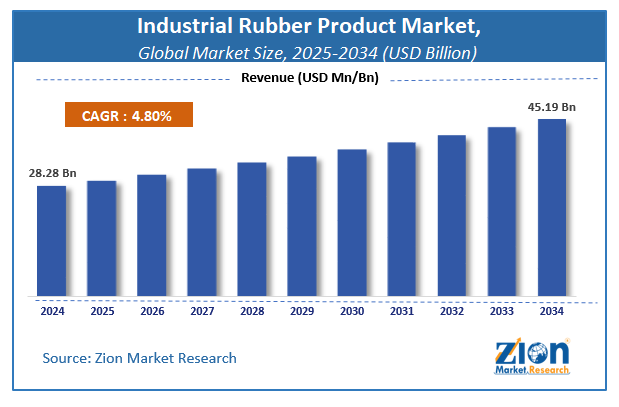

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 28.28 Billion | USD 45.19 Billion | 4.8% | 2024 |

Industrial Rubber Product Industry Perspective:

The global industrial rubber product market size was worth around USD 28.28 Billion in 2024 and is estimated to grow to about USD 45.19 Billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.8% between 2025 and 2034. The report analyzes the industrial rubber product market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the industrial rubber product market.

Industrial rubber product Market: Overview

Industrial rubbers are materials used in almost all industry verticals due to their versatile scope of application in the modern industrial infrastructure. Industry verticals such as automotive, construction, manufacturing, etc. are prime industries that deploy industrial rubber product use on a massive scale. Increasing demand from the automotive industry, rising scope of application, rapid industrialization, and increasing production of synthetic rubber are prominent trends propelling market growth through 2028. Increasing strict regulations and government mandates are expected to restrain industrial rubber product market growth.

A rubber product deals with the transformation of elastomers into the useful products such as rubber mats, automobile tires, and others. Rubbers used in the industrial products are naturally produced or sometimes it is the combination of complex chemical compounds. Rubber offers significant characteristics such as elongations, abrasion resistance, tear resistance, and tensile strength. Moreover, rubber is water resistant owing to which it is widely used for chemical tubing, rainwear, diving equipment, and others. Rubber products are used in various industrial applications and rubber product industry is considered to be the significant resource-based industry sector.

Rapidly increasing automotive industry coupled with technological advancement in the industries is majorly responsible for propelling the growth of industrial rubber product market. Moreover, rising demand for the high-performance tires, tire adhesive, and sealing products are anticipated to add on to the growth of the industrial rubber market across the globe. The use of industrial rubber is dominated by the product rubber tire. The compulsion of rubber safety shoes in the industries and accessories is also the major factor driving the industrial rubber product market. In addition to this, for power transmission in the motor, a special rubber is used and other rubber products such as a spinning belt, V-belt, timing belt, and others are used at a large scale. Therefore, operational utilization is also considered as a key factor which is positively influencing the growth of the market. However, stringent regulations issued by the government due to ecological concerns may restrain the growth of the market in upcoming years.

To know more about this report, Request a FREE sample copy

Key Insights

- As per the analysis shared by our research analyst, the global industrial rubber product market is estimated to grow annually at a CAGR of around 4.8% over the forecast period (2025-2034).

- Regarding revenue, the global industrial rubber product market size was valued at around USD 28.28 Billion in 2024 and is projected to reach USD 45.19 Billion by 2034.

- The industrial rubber product market is projected to grow at a significant rate due to rising demand in automotive and construction sectors, increasing applications in manufacturing and heavy industries, advancements in rubber processing technologies, and growing emphasis on sustainability and high-performance materials.

- Based on Type, the Natural Rubber segment is expected to lead the global market.

- On the basis of Product, the Mechanical Rubber Goods segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Automotive segment is projected to swipe the largest market share.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Industrial rubber product Market: Growth Drivers

Increasing demand from Automotive Industry Vertical

Rubber has a massive scope of application in the automotive industry as it is used in making gaskets, seals, and belts as well. Rising automobile production and increasing use of rubber in multiple components are expected to make this industry a major end use vertical for the industrial rubber product market growth over the forecast period. The industrial rubber product market is expected to be majorly driven by this industry through 2028

Industrial rubber product Market: Restraints

Adverse Impact on Environment

Industrial rubber products have proven to be really toxic and harmful to the environment and the increasing focus on sustainability on a global level is anticipated to restrain the use and production of industrial rubber product over the forecast period. The disposal of rubber products creates a major waste hazard and is also often highly toxic not only to humans but also to the environment. Stringent government mandates to reduce waste and conserve the environment are expected to constrain industrial rubber product market potential through 2028

Global Industrial rubber product Market: Segmentation

The global industrial rubber product market is segregated based on product, type, application, and region.

By Type, the market is divided into synthetic rubber and natural rubber. The synthetic rubber segment is expected to lead the market and emerge as a highly lucrative segment over the forecast period. The use of synthetic rubber in large quantities in multiple industries is expected to boost the demand for this segment. Especially this segment will be driven by rising use from the automotive sector. Its better abrasion-resistant quality makes it a good substitute for natural rubber.

By Application, the industrial rubber product market is segmented into automotive, building & construction, industrial manufacturing, polymer modification, wire & cable, electrical & electronics, bitumen modification, coating, sealant, & adhesive, medical & healthcare, others. The rising production of automotive is expected to boost industrial rubber product market growth as it is the major end use vertical.

Recent Developments

- In September 2017 – PJSC Nizhnekamskneftekhim announced the start of production of concentrated formaldehyde at a new plant and this is expected to be a step to boost production of isoprene. The plant has a capacity of 100,000 tons per year.

Regional Landscape

Asia Pacific region leads the global industrial rubber product market in terms of revenue and volume share owing to high industrial activity and the presence of key industrial rubber product end use industry verticals. The low cost of manufacturing in this region is expected to propel industrial rubber product market growth. High demand from China and India is expected to be a prominent trend as these emerging economies see rising investments in the industrial sector and supportive government initiatives are projected to bolster the market potential as well.

The market for industrial rubber products in North America is expected to exhibit a positive outlook owing to an increase in international trade activities and a developing industrial sector for growing demand. Increasing automotive production is also expected to favor market potential in this region. The United States and Canada are expected to be major markets for industrial rubber product in this region.

Industrial Rubber Product Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Rubber Product Market |

| Market Size in 2024 | USD 28.28 Billion |

| Market Forecast in 2034 | USD 45.19 Billion |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 190 |

| Key Companies Covered | LANXESS (Germany), Sinopec (China), Goodyear Tire and Rubber Company (US), Kumho Petrochemical (South Korea), TSRC Corporation (Taiwan), Nizhnekamskneftekhim (Russia), JSR Corporation (Japan), LG Chem (South Korea), Versalis S.p.A (Italy), and ZEON Corpo, and others. |

| Segments Covered | By Type, By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the industrial rubber product market on a global and regional basis.

Some of the main competitors dominating the global industrial rubber product market include -

- LANXESS (Germany)

- Sinopec (China)

- Goodyear Tire and Rubber Company (US)

- Kumho Petrochemical (South Korea)

- TSRC Corporation (Taiwan)

- Nizhnekamskneftekhim (Russia)

- JSR Corporation (Japan)

- LG Chem (South Korea)

- Versalis S.p.A. (Italy)

- ZEON Corpo.

Global industrial rubber product market is segmented as follows:

By Fiber Type

- Natural Rubber

- Synthetic Rubber

By Product

- Mechanical Rubber Good

- Rubber Hose

- Rubber Belt

- Rubber Roofing

- Others

By Application

- Automotive

- Building & Construction

- Industrial Manufacturing

- Polymer Modification

- Wire & Cable

- Electrical & Electronics

- Bitumen Modification

- Coating, Sealant, & Adhesive

- Medical & Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial rubber products are items made from natural or synthetic rubber that are used in industrial settings for a wide range of applications. These products are valued for their flexibility, durability, resistance to wear, heat, chemicals, and weather, making them essential in many manufacturing and mechanical processes.

The global industrial rubber product market is expected to grow due to increasing demand from various end-use industries like automotive, manufacturing, construction, and oil & gas, coupled with the need for durable and high-performance rubber components.

According to a study, the global industrial rubber product market size was worth around USD 28.28 Billion in 2024 and is expected to reach USD 45.19 Billion by 2034.

The global industrial rubber product market is expected to grow at a CAGR of 4.8% during the forecast period.

Asia-Pacific is expected to dominate the industrial rubber product market over the forecast period.

Leading players in the global industrial rubber product market include LANXESS (Germany), Sinopec (China), Goodyear Tire and Rubber Company (US), Kumho Petrochemical (South Korea), TSRC Corporation (Taiwan), Nizhnekamskneftekhim (Russia), JSR Corporation (Japan), LG Chem (South Korea), Versalis S.p.A (Italy), and ZEON Corpo, among others.

The report explores crucial aspects of the industrial rubber product market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

Recent Developments: In September 2017 – PJSC Nizhnekamskneftekhim announced the start of production of concentrated formaldehyde at a new plant and this is expected to be a step to boost production of isoprene. The plant has a capacity of 100,000 tons per year.

List of Contents

Industry Perspective:Industrial rubber product OverviewTo know more about this report, Request a FREE sample copyKey InsightsIndustrial rubber product Growth DriversIndustrial rubber product RestraintsGlobal Industrial rubber product SegmentationRecent DevelopmentsRegional LandscapeReport Scope Competitive Landscape Global industrial rubber product market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed